|

Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Along with Freddie Mac, Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors are all calling for mortgage rates to continue to rise over the next four quarters.

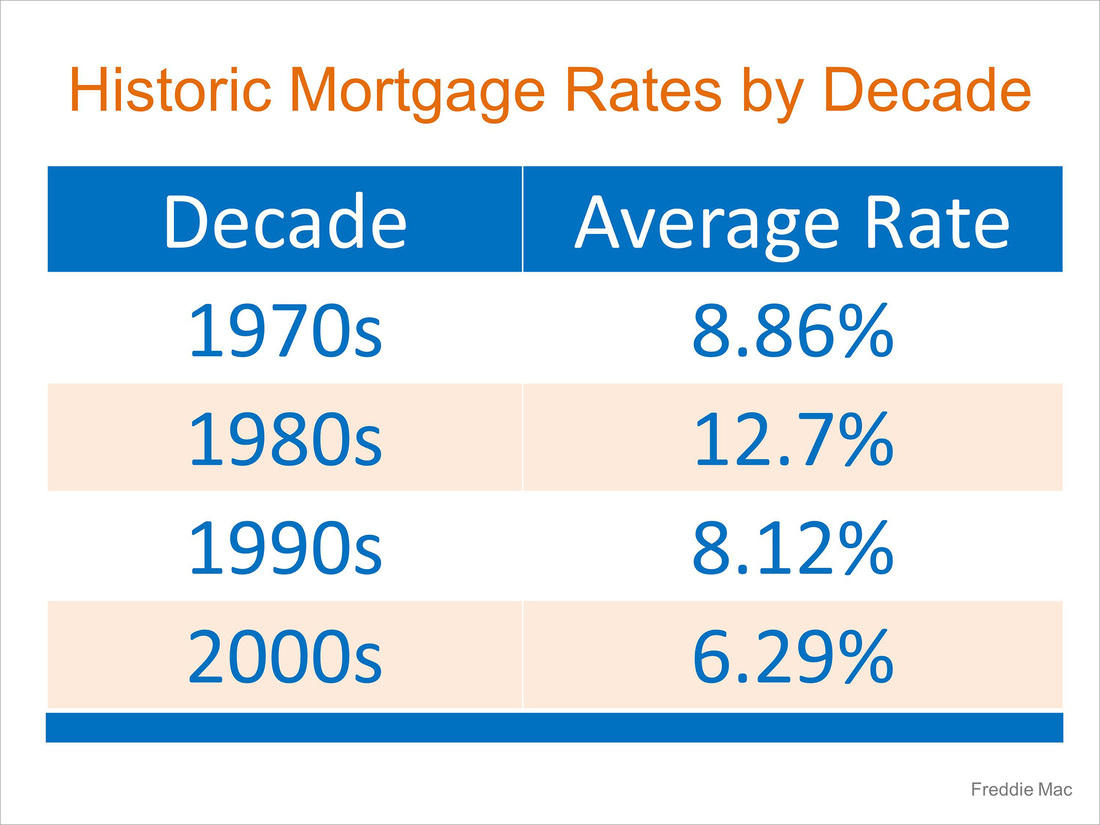

This has caused some purchasers to lament the fact they may no longer be able to get a rate less than 4%. However, we must realize that current rates are still at historic lows. Bottom Line Though you may have missed getting the lowest mortgage rate ever offered, you can still get a better interest rate than your older brother or sister did ten years ago; a lower rate than your parents did twenty years ago and a better rate than your grandparents did forty years ago. Below is a chart showing the average mortgage interest rate over the last several decades. Ready to find your home? Start here source KCM

0 Comments

5 Reasons to Hire a Real Estate Professional When Buying & Selling in Connecticut and Massachusetts11/28/2016  Whether you are buying or selling a home, it can be quite an adventurous journey; you need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened, due to the projections of higher mortgage interest rates & home prices as the market continues to pick up steam. 1. What do you do with all this paperwork?Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true Real Estate Professional is an expert in their market and can guide you through the stacks of paperwork necessary to make your dream a reality. 2. Ok, so you found your dream house, now what?According to the Orlando Regional REALTOR Association, there are over 230 possible actions that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to make sure that you acquire your dream? 3. Are you a good negotiator?So maybe you’re not convinced that you need an agent to sell your home. However, after looking at the list of parties that you need to be prepared to negotiate with, you’ll realize the value in selecting a Real Estate Professional. From the buyer (who wants the best deal possible), to the home inspection companies, to the appraiser, there are at least 11 different people that you will have to be knowledgeable with and answer to, during the process. 4. What is the home you’re buying/selling really worth?It is important for your home to be priced correctly from the start to attract the right buyers and shorten the time that it’s on the market. You need someone who is not emotionally connected to your home to give you the truth as to your home’s value. According to the National Association of REALTORS, “the typical FSBO home sold for $185,000 compared to $245,000 among agent-assisted home sales.” Get the most out of your transaction by hiring a professional. 5. Do you know what’s really going on in the market?There is so much information out there on the news and the internet about home sales, prices, and mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively price your home correctly at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a lowball offer? Dave Ramsey, the financial guru, advises: “When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.” Hiring an agent who has their finger on the pulse of the market will make your buying or selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear. Bottom LineYou wouldn’t replace the engine in your car without a trusted mechanic. Why would you make one of the most important financial decisions of your life without hiring a Real Estate Professional? Are you looking for the perfect country retreat, an equestrian property, a mini estate, a gentlemans farm? Look no further, this is it! Amazing setting with so many possibilities. The special property consists of just over 35 acres, a post and beam cape cod style home with 2,600 sq ft of living space, 4 working fireplaces including a beehive oven, a stone patio area, 2 new chimneys, an over-sized 2 car garage, original wide board flooring, exposed beams, family room with cathedral ceiling, and the charm of many original period details.

Text 20322 to 25678 for more info on this listing straight to your phone! Or simply click on this link for the virtual tour: http://48robertsvilleroad.thebestlisting.com/ #NewPrice #SellingCT #ExpRealty #JoinExpRealty #SimardRealtyGroup People across the country are beginning to think about what their life will look like next year. It happens every fall; we ponder whether we should relocate to a different part of the country to find better year-round weather, or perhaps move across the state for better job opportunities. Homeowners in this situation must consider whether they should sell their house now or wait.

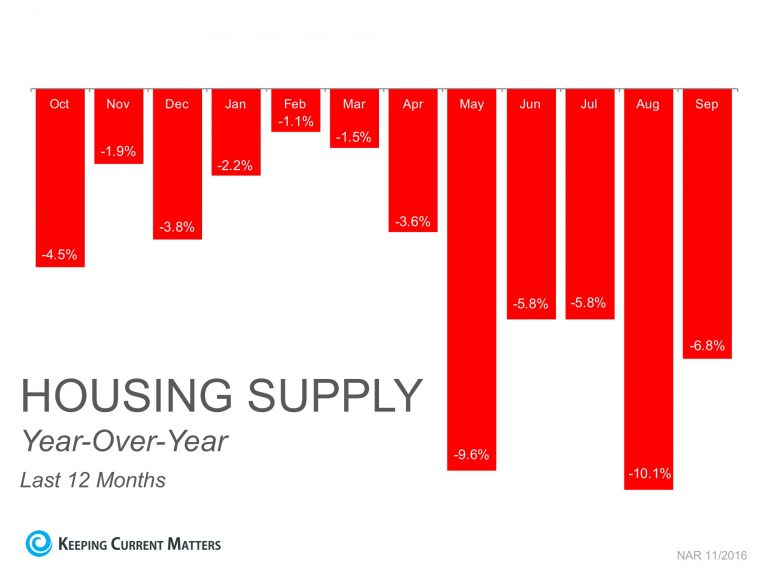

If you are one of these potential sellers, here are five important reasons to sell now instead of in the dead of winter. 1. Demand Is Strong The latest Realtors’ Confidence Index from the National Association of Realtors (NAR) shows that buyer demand remains very strong throughout the vast majority of the country. These buyers are ready, willing and able to purchase… and are in the market right now! Take advantage of the buyer activity currently in the market. 2. There Is Less Competition Now According to NAR’s latest Existing Home Sales Report, the supply of homes for sale is still under the 6-month supply that is needed for a normal housing market (which is 4.5-months). This means, in most areas, there are not enough homes for sale to satisfy the number of buyers in that market. This is good news for home prices. However, additional inventory is about to come to market. There is a pent-up desire for many homeowners to move, as they were unable to sell over the last few years because of a negative equity situation. Homeowners are now seeing a return to positive equity as real estate values have increased over the last two years. Many of these homes will be coming to the market soon. Also, as builders regain confidence in the market, new construction of single-family homes is projected to continue to increase, reaching historic levels in 2017. Last month’s new home sales numbers show that many buyers who have not been able to find their dream homes within the existing inventory have turned to new construction to fulfill their needs. The choices buyers have will continue to increase. Don’t wait until all this other inventory of homes comes to market before you sell. 3. The Process Will Be Quicker Fannie Mae announced that they anticipate an acceleration in home sales that will surpass 2007's pace. As the market heats up, banks will be inundated with loan inquiries causing closing timelines to lengthen. Selling now will make the process quicker & simpler. 4. There Will Never Be a Better Time to Move Up If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by 5.2% over the next year, according to CoreLogic. If you are moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. According to Freddie Mac’s latest report, you can also lock-in your 30-year housing expense with an interest rate around 3.57% right now. Interest rates are projected to increase moderately over the next 12 months. Even a small increase in rate will have a big impact on your housing cost. 5. It’s Time to Move On with Your Life Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should? Only you know the answers to the questions above. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to move on and start living the life you desire. That is what is truly important. SOURCE KCM #SellNow #ForSellers #ExpRealty #JoinExpRealty #SimardRealtyGroup Some Highlights:

Source KCM #Infographic #ForSellers #SimardRealtyGroup Stephen Simard has been named one of Connecticut’s outstanding real estate agents with fewer than 7% awarded.

Five Star Professional partnered with Connecticut magazine to recognize a select group of Connecticut area real estate agents who provide quality services to their clients. Stephen Simard will be featured, along with other award winners, in a special section of the November issue. It is an honor to be selected as a Five Star Real Estate Agent this year. A special thanks to my clients for recommending me, and favorably evaluating my services. Clients are the reason I do what I do. It is extremely rewarding to know that I am making a difference and helping them achieve their Real Estate goals, Stephen Simard, Exp Realty. The Five Star Real Estate Agent award program is the largest and most widely published real estate agent award program in North America. Agents are measured using an objective, in-depth research methodology with significant focus on customer feedback and overall satisfaction. Five Star Professionals research is extensive, with more than 10 million consumers, peers and other stakeholders contacted each year. We are relentless in our efforts to identify those professionals with the utmost standard of excellence, Jonathan Wesser, Research Director, Five Star Professional. About the research process: Now entering its 13th year, Five Star Professional conducts in-depth, market-specific research in more than 45 markets across the United States and Canada to identify premium service professionals. Five Star Professional contacts thousands of recent homebuyers to identify award candidates. Phone, mail and online respondents rate their real estate agent on 10 satisfaction criteria. Candidates with a qualifying client satisfaction rating move on to be evaluated on objective criteria such as experience, and production levels. #FiveStarPro #ThankYouClients #SimardRealtyGroup Multigenerational homes are coming back in a big way! In the 1950s, about 21%, or 32.2 million Americans shared a roof with their grown children or parents. According to a recent Pew Research Center report, the number of multigenerational homes dropped to as low as 12% in 1980 but has shot back up to 19%, roughly 60.6 million people, as recently as 2014.

Multigenerational households typically occur when adult children (over the age of 25) either choose to, or need to, remain living in their parent’s home, and then have children of their own. These households also occur when grandparents join their adult children and grandchildren in their home. According to the National Association of Realtors’ (NAR) 2016 Profile of Home Buyers and Sellers, 11% of home buyers purchased multigenerational homes last year. The top 3 reasons for purchasing this type of home were:

Donna Butts, Executive Director of Generations United, points out that, “As the face of America is changing, so are family structures. It shouldn’t be a taboo or looked down upon if grown children are living with their families or older adults are living with their grown children.” For a long time, nuclear families (a couple and their dependent children) became the accepted norm, but John Graham, co-author of “Together Again: A Creative Guide to Successful Multigenerational Living,” says, “We’re getting back to the way human beings have always lived in – extended families.” This shift can be attributed to several social changes over the decades. Growing racial and ethnic diversity in the U.S. population helps explain some of the rise in multigenerational living. The Asian and Hispanic populations are more likely to live in multigenerational family households and these two groups are growing rapidly. Additionally, women are a bit more likely to live in multigenerational conditions than are their male counterparts (20% vs. 18%, respectively). Last but not least, basic economics. Carmen Multhauf, co-author of the book “Generational Housing: Myth or Mastery for Real Estate,” brings to light the fact that rents and home prices have been skyrocketing in recent years. She says that, “The younger generations have not been able to save,” and often struggle to get good-paying jobs. Bottom Line Multigenerational households are making a comeback. While it is a shift from the more common nuclear home, these households might be the answer that many families are looking for as home prices continue to rise in response to a lack of housing inventory. SOURCE KCM #HomeOwners #Multigenerational #SimardRealtyGroup When it comes to buying a home, whether it is your first time or your fifth, it is always important to know all the facts. With the large number of mortgage programs available that allow buyers to purchase a home with a down payment below 20%, you can never have Too Much Information (TMI) about Private Mortgage Insurance (PMI). What is Private Mortgage Insurance (PMI)? Freddie Mac defines PMI as: “An insurance policy that protects the lender if you are unable to pay your mortgage. It's a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment.” As the borrower, you pay the monthly premiums for the insurance policy, and the lender is the beneficiary. Freddie Mac goes on to explain that: “The cost of PMI varies based on your loan-to-value ratio – the amount you owe on your mortgage compared to its value – and credit score, but you can expect to pay between $30 and $70 per month for every $100,000 borrowed.” According to the National Association of Realtors, the average down payment for all buyers last year was 10%. For first-time buyers, that number dropped to 6%, while repeat buyers put down 14% (no doubt aided by the sale of their home). This just goes to show that for a large number of buyers last year, PMI did not stop them from buying their dream homes. Here’s an example of the cost of a mortgage on a $200,000 home with a 5% down payment & PMI, compared to a 20% down payment without PMI: The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:

“It's no doubt an added cost, but it's enabling you to buy now and begin building equity versus waiting 5 to 10 years to build enough savings for a 20% down payment.” Bottom Line If you have questions about if you should buy now or wait until you’ve saved a larger down payment, meet with a professional in your area who can explain your market’s conditions and help you make the best decision for you and your family. SOURCE KCM #ForBuyers #MoveUpBuyers #SimardRealtyGroup The housing crisis is finally in the rearview mirror as the real estate market moves down the road to a complete recovery. Home values are up, home sales are up, and distressed sales (foreclosures & short sales) are at their lowest mark in over 8 years. This has been, and will continue to be, a great year for real estate.

However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. According to the National Association of Realtors (NAR), buyer traffic and demand continues to be the strongest it has been in years. The supply of homes for sale has not kept up with this demand and has driven prices up in many areas as buyers compete for their dream home. Traditionally, the winter months create a natural slowdown in the market. Jonathan Smoke, Chief Economist at realtor.com, points to low interest rates as one of the many reasons why buyers are still out in force looking for a home of their own. “Overall, the fundamental trends we have been seeing all year remain solidly in place as we enter the traditionally slower sales season, and pent-up demand remains substantial as buyers seek to get a home under contract while rates remain so low.” NAR’s Chief Economist, Lawrence Yun, points out that the inventory shortage we are currently experiencing isn’t a new challenge by any means: "Inventory has been extremely tight all year and is unlikely to improve now that the seasonal decline in listings is about to kick in. Unfortunately, there won't be much relief from new home construction, which continues to be grossly inadequate in relation to demand." Bottom Line Healthy labor markets and job growth have created more and more buyers who are not just ready and willing to buy but are also able to. If you are debating whether or not to put your home on the market this year, now is the time to take advantage of the demand in the market. Source KCM #ForSellers #HousingMarketUpdate #SimardRealtyGroup Every year at this time, many homeowners decide to wait until after the holidays to put their homes on the market for the first time, while others who already have their homes on the market decide to take them off until after the holidays. Here are six great reasons not to wait:

6. The supply of listings increases substantially after the holidays. Also, in many parts of the country, new construction will continue to surge reaching new heights in 2017, which will lessen the demand for your house.

Bottom Line Waiting until after the holidays to sell your home probably doesn't make sense. SOURCE KCM #HousingSupply #ForSellers #SimardRealtyGroup |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed