|

Even in today's ultimate sellers' market, it's key to have an expert guide when you sell your house. Let's connect to optimize your home sale this summer.

#TopGranbyRealtor #StephenSimard #RealBrokerLLC #GranbyRealEstate #GranbyConnecticut #FindyourGranbyhome #Newhomesforsale #SimardRealtyGroup #Granbyhomesforsale #JoinRealBrokerLLC #Simsburyhomes

0 Comments

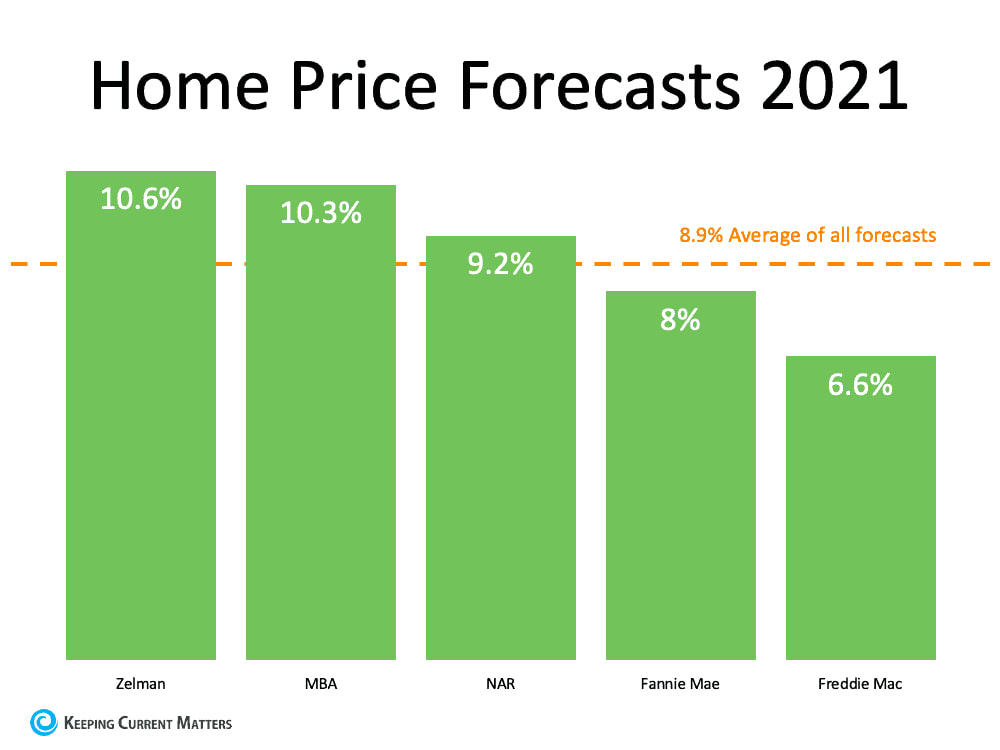

As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off a robust housing market in the first half of 2021, but what does the forecast tell us about what’s on the horizon? Mortgage Rates Will Likely Increase, but Remain Low Many experts are projecting a rise in interest rates. The latest Quarterly Forecast from Freddie Mac states: “We forecast that mortgage rates will continue to rise through the end of next year. We estimate the 30-year fixed mortgage rate will average 3.4% in the fourth quarter of 2021, rising to 3.8% in the fourth quarter of 2022.” However, even as mortgage rates rise, the anticipated increase is expected to be modest at most, and still well below historical averages. Rates remaining low is good news for homebuyers who are looking to maximize their purchasing power. The same report from Freddie Mac goes on to say: “While higher mortgage rates will help slow the pace of home sales and moderate house price growth, we expect overall housing market activity will remain robust. Our forecast has total home sales, the sum of new and existing home sales, at 7.1 million in 2021….” Home Price Appreciation Will Continue, but Price Growth Will Likely Slow Joe Seydl, Senior Markets Economist at J.P. Morgan, projects home prices to continue rising as well, indicating buyers interested in purchasing a home should do so sooner rather than later. Waiting for rates or home prices to fall may not be wise: “Homebuyers—interest rates are still historically low, though they are inching up. Housing prices have spiked during the last six-to-nine months, but we don’t expect them to fall soon, and we believe they are more likely to keep rising. If you are looking to purchase a new home, conditions now may be better than 12 months hence.” Other experts remain optimistic about home prices, too. The graph below highlights 2021 home price forecasts from multiple industry leaders: Inventory Remains a Challenge, but There’s Reason To Be Optimistic

Home prices are rising, but they should moderate as more housing inventory comes to market. George Ratiu, Senior Economist at realtor.com, notes there are signs that we may see the current inventory challenges lessen, slowing the fast-paced home price appreciation and creating more choices for buyers: “We have seen more new listings this year compared with 2020 in 11 of the last 13 weeks. The influx of new sellers over the last couple of months has been especially helpful in slowing price gains.” New home starts are also showing signs of improvement, which further bolsters hopes of more options coming to market. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), writes: “As an indicator of the economic impact of housing, there are now 652,000 single-family homes under construction. This is 28% higher than a year ago.” Finally, while it may not fundamentally change the market conditions we’re currently experiencing, another reason to be optimistic more homes might come to market: our improving economy. Mark Fleming, Chief Economist at First American, notes: “A growing economy in the summer months has multiple implications for the housing market. Growing consumer confidence, a stronger labor market, and higher wages bode well for housing demand. While a growing economy and improving public health conditions may also spur hesitant existing owners to list their homes for sale, it’s unlikely to significantly ease the super sellers’ market conditions.” Bottom Line As we look at the forecast for prices, interest rates, inventory, and home sales, experts remain optimistic about what’s on the horizon for the second half of 2021. Contact your trusted real estate advisor to discuss how to navigate the market together in the coming months. SOURCE KCM #ForBuyers #InterestRates #Pricing #SimardRealtyGroup #RealBrokerLLC The average monthly rent rose 5.5% in the last 12 months alone. On the other hand, monthly costs naturally stay relatively steady for homeowners. Purchasing a home helps you secure a consistent monthly payment, free from rent hikes. DM me if you have questions about transitioning from a renter to a homeowner.

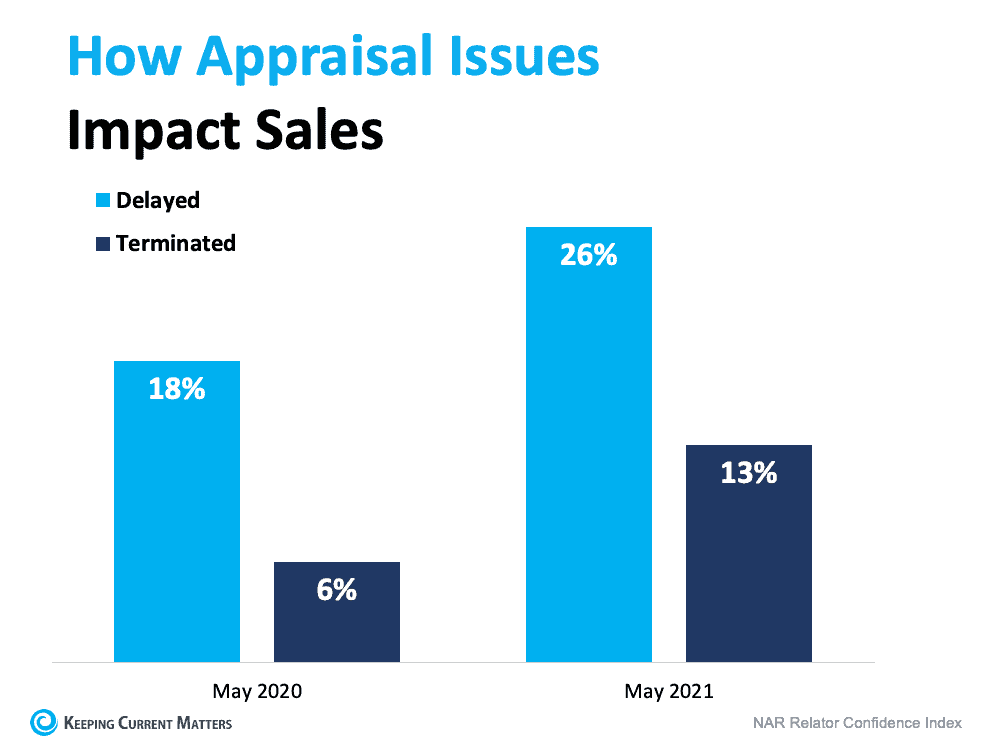

#rentvsbuy #risingrent #rentcosts #stoprenting #homeownership #buyahome #homeowner #expertanswers #stayinformed #staycurrent #powerfuldecisions #confidentdecisions #realestate #realestatetipsandadvice #keepingcurrentmatters In today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association of Realtors (NAR). Shawn Telford, Chief Appraiser at CoreLogic, elaborates: “The frequency of buyers being willing to pay more than the market data supports is increasing.” While this is great news for today’s sellers, it can be tricky to navigate if the price of your contract doesn’t match up with the appraisal for the house. It’s called an appraisal gap, and it’s happening more in today’s market than the norm. According to recent data from CoreLogic, 19% of homes had their appraised value come in below the contract price in April of this year. That’s more than double the percentage in each of the two previous Aprils. The chart below uses the latest insights from NAR’s Realtors Confidence Index to showcase how often an issue with an appraisal slowed or stalled the momentum of a house sale in May of this year compared to May of last year. If an appraisal comes in below the contract price, the buyer’s lender won’t loan them more than the house’s appraised value. That means there’s going to be a gap between the amount of loan the buyer can secure and the contract price on the house.

In this situation, both the buyer and seller have a vested interest in making sure the sale moves forward with little to no delay. The seller will want to make sure the deal closes, and the buyer won’t want to risk losing the home. That’s why it’s common for sellers to ask the buyer to make up the difference themselves in today’s competitive market. Bottom Line Whether you’re buying or selling, your real estate agent is your ally. They’re with you throughout the process and are there to help you navigate the unexpected, including potential appraisal gaps. SOURCE KCM #BuyingMyths #DownPayments #Pricing #SimardRealtyGroup #joinRealBrokerLLC

This National Homeownership Month, take time to appreciate everything owning your home has to offer. Let's connect if you're ready to become a homeowner this year.

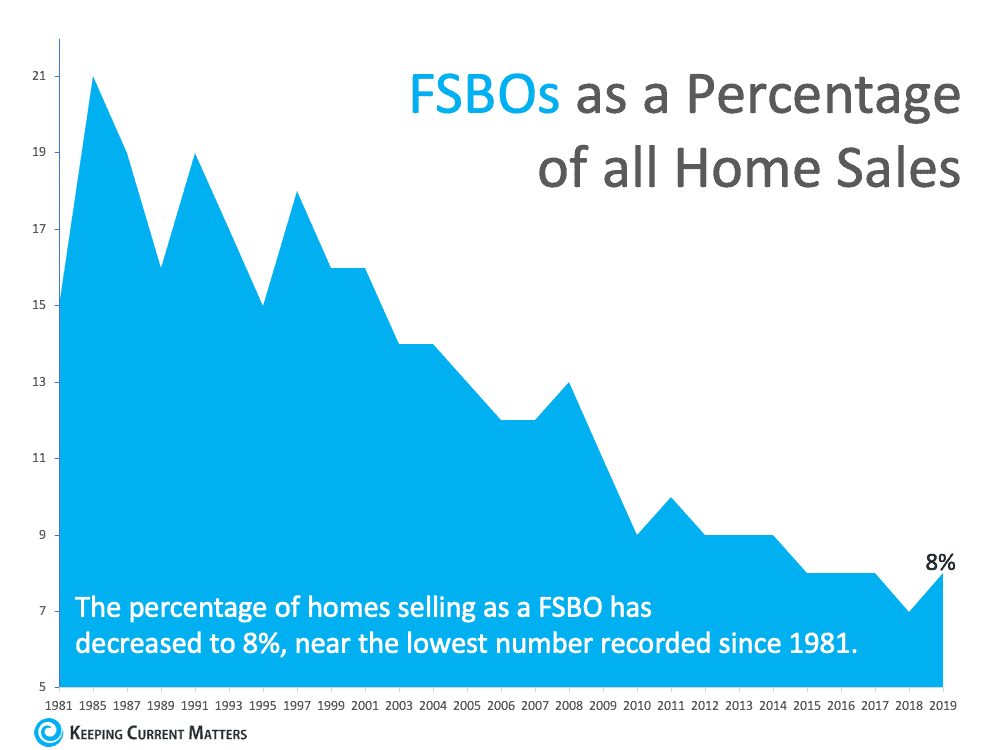

#TopGranbyRealtor #StephenSimard #RealBrokerLLC #GranbyRealEstate #GranbyConnecticut #FindyourGranbyhome #Newhomesforsale #SimardRealtyGroup #Granbyhomesforsale #JoinRealBrokerLLC #Simsburyhomes Selling a house is a time-consuming process – especially if you decide to do it on your own, known as a For Sale By Owner (FSBO). From conducting market research to reviewing legal documents, handling negotiations, and more, it’s an involved and highly detailed process that requires a lot of expertise to navigate effectively. That’s one of the reasons why the percentage of people selling their own house has declined from 19% to 8% (See graph below): To help you understand just how much time and effort it takes to sell on your own, here’s a look at a few of the things you need to think about before putting that “For Sale” sign up in your yard.

1. Making a Good First Impression While it may sound simple, there are a lot of proven best practices to consider when prepping a house for sale.

If you do this work on your own, you may invest capital and many hours into the wrong things. Your time is money – don’t waste it. An agent can help steer you in the right direction based on current market conditions to save you time and effort. Since we’re in a hot sellers’ market, you don’t want to delay listing your house by focusing on things that won’t change your bottom line. These market conditions may not last, so lean on an agent to capitalize on today’s low inventory while you can. 2. Pricing It Right Real estate professionals have mission-critical information on what sells and how to maximize your profit. They’re experienced when it comes to looking at recent comparable homes that have sold in your area and understanding what price is right for your neighborhood. They use that data to price your house appropriately, maximizing your return. In a FSBO, you’re operating without this expertise, so you’ll have to do your own homework on how to set a price that’s appropriate for your area and the condition of your home. Even with your own research, you may not find the most up-to-date information and could risk setting a price that’s inaccurate or unrealistic. If you price your house too high, you could turn buyers away before they’re even in the front door, or run into problems when it comes time for the appraisal. 3. Maximizing Your Buyer Pool (and Profit) Contrary to popular belief, FSBOs may actually net less profit than sellers who use an agent. One of the factors that can drive profit up is effective exposure. Simply put, real estate professionals can get your house in front of more buyers via their social media followers, agency resources, and proven sales strategies. The more buyers that view a home, the more likely a bidding war becomes. According to the National Association of Realtors (NAR), the average house for sale today gets 5 offers. Using an agent to boost your exposure may help boost your sale price too. 4. Navigating Negotiations When it comes to selling your house as a FSBO, you’ll have to handle all of the negotiations. Here are just a few of the people you’ll work with:

As part of their training, agents are taught how to negotiate every aspect of the real estate transaction and how to mediate potential snags that may pop up. When appraisals come in low and in countless other situations, they know what levers to pull, how to address the buyer and seller emotions that come with it, and when to ask for second opinions. Navigating all of this on your own takes time –a lot of it. 5. Juggling Legal Documentation Speaking of time, consider how much free time you have to review the fine print. Just in terms of documentation, more disclosures and regulations are now mandatory. That means the stack of legal documents you need to handle as the seller is growing. It can be hard to know and truly understand all the terms and requirements. Instead of going at it alone, use an agent as your shield and advisor to help you avoid potential legal missteps. Bottom Line Selling your house on your own is a lot of responsibility. It’s time consuming and requires an immense amount of effort and expertise. Before you decide to sell your house yourself, connect with a local real estate professional to discuss your options and learn more about how they can make sure you get the most out of the sale. SOURCE KCM #SellingMyths #Pricing #FSBOs #SimardRealtyGroup #RealBrokerLLC Some Highlights

SOURCE KCM #Pricing #InterestBuyers #Infographics #SimardRealtyGroup #RealBrokerLLC The pandemic created a tremendous interest in vacation homes across the country. Throughout the last year, many people purchased second homes as a safe getaway from the challenges of the health crisis. With many professionals working from home and many students taking classes remotely, it made sense to see a migration away from cities and into counties with more vacation destinations.

The 2021 Vacation Home Counties Report from the National Association of Realtors (NAR) shows that this increase in vacation home sales continues in 2021. The report examines sales in counties where “vacant seasonal, occasional, or recreational use housing account for at least 20% of the housing stock” and compares that data to the overall residential market. Their findings show:

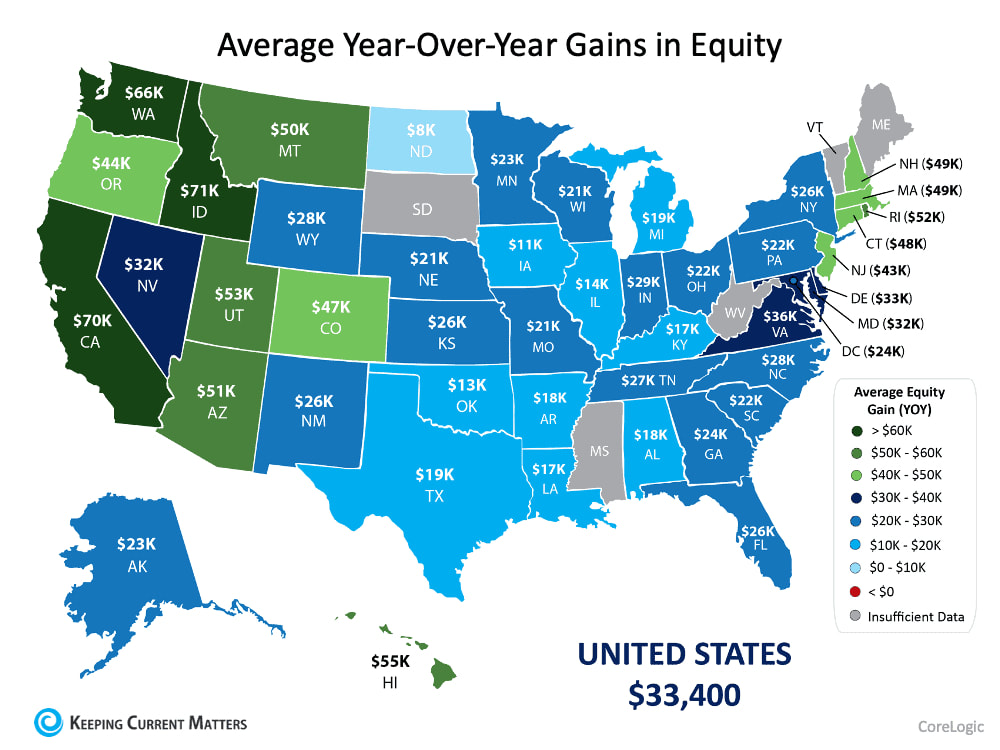

This coincides with data released by Zelman & Associates on the increase in sales of second homes throughout the country last year. As the data above shows, there is still high demand for second getaway homes in 2021 even as the pandemic winds down. While we may see a rise in second-home sellers as life returns to normal, ongoing low supply and high demand will continue to provide those sellers with a good return on their investment. Bottom Line If you’re one of the many people who purchased a vacation home during the pandemic, you’re likely wondering what this means for you. If you’re considering selling that home as life returns to normal, you have options. There are still plenty of buyers in the market. If, on the other hand, you want to keep your second home, enjoy it! Current market conditions show that it’s a good ongoing investment. SOURCE KCM #LuxuryMarket #SellingMyths #Pricing #SimardRealtyGroup #RealBrokerLLC In the last 12 months, the average homeowner gained approximately $33,400 in equity. If you’re a homeowner, that’s a huge increase in not only your net worth, but the power you have to win big when you sell your house. DM me to learn more about how to leverage your #homeequity this year.

#equity #networth #expertanswers #homepriceappreciation #REgoals #realestate #homevalues #homeownership #homebuying #realestategoals #realestatetips #realestatelife #realestatemarket #realestateexperts #keepingcurrentmatters Building financial wealth and stability remains one of the top reasons Americans choose to own a home, and as a homeowner, your wealth often grows without you even realizing it. In a recent paper published by the Urban Institute, Home Ownership is Affordable Housing, author Mike Loftin illustrates how homeowners increase their equity and their wealth simply by making monthly mortgage payments: “The principal portion that reduces the loan balance builds the homeowner’s equity. In doing so, the principal payments behave like an automatic savings account. The principal payment is not money going out; it is money staying in.” But home equity – the difference between the value of your home and what you currently owe – isn’t just built through your monthly principal payments. Home price appreciation plays a vital role in growing your equity and, ultimately, your wealth. As Freddie Mac explains: “Homeownership has cemented its role as part of the American Dream, providing families with a place that is their own and an avenue for building wealth over time. This ‘wealth’ is built, in large part, through the creation of equity…Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.” Homeowners Continue To See Equity Increase CoreLogic recently published their latest Homeowner Equity Insights Report, and it shows continued growth in equity amidst record home price appreciation. The report provides several key takeaways, all of which point to rising wealth for homeowners:

Equity Provides Homeowners with Flexibility

In addition to being a critical tool in building wealth, a homeowner’s equity also provides significant flexibility. When you sell your house, the accumulated equity comes back to you in the sale. Recent increases in home equity coupled with record-low mortgage rates mean it could be the perfect time for homeowners looking to make a move. Mark Fleming, Chief Economist at First American, notes: “Existing homeowners today are sitting on record amounts of equity. As homeowners gain equity in their homes, the temptation grows to list their current home for sale and use the equity to purchase a larger or more attractive home.” Increasing equity also helps families facing challenges brought on by the pandemic. Frank Martell, President and CEO of CoreLogic, explains in the recent Homeowner Equity Insights Report: “Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic. These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market, especially for older homeowners and baby boomers who’ve experienced years of price appreciation.” Bottom Line Home equity has always been a powerful wealth-building tool, and homeowners continue to see their financial stability increase. Contact a local real estate professional today to better understand how much equity you have in your current home or if you’re ready to take the next step in building your savings as a homeowner. SOURCE KCM #Pricing #ForSellers #Buyers #SimardRealtyGroup #RealBrokerLLC |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed