|

All Signs Point to Your House Selling Quickly This Year

Current real estate conditions are creating great opportunities for sellers. Let's connect to discuss why you should expect your house to sell quickly in today's market. #TopGranbyRealtor #StephenSimard #RealBrokerLLC

0 Comments

WSOURCE:KCM

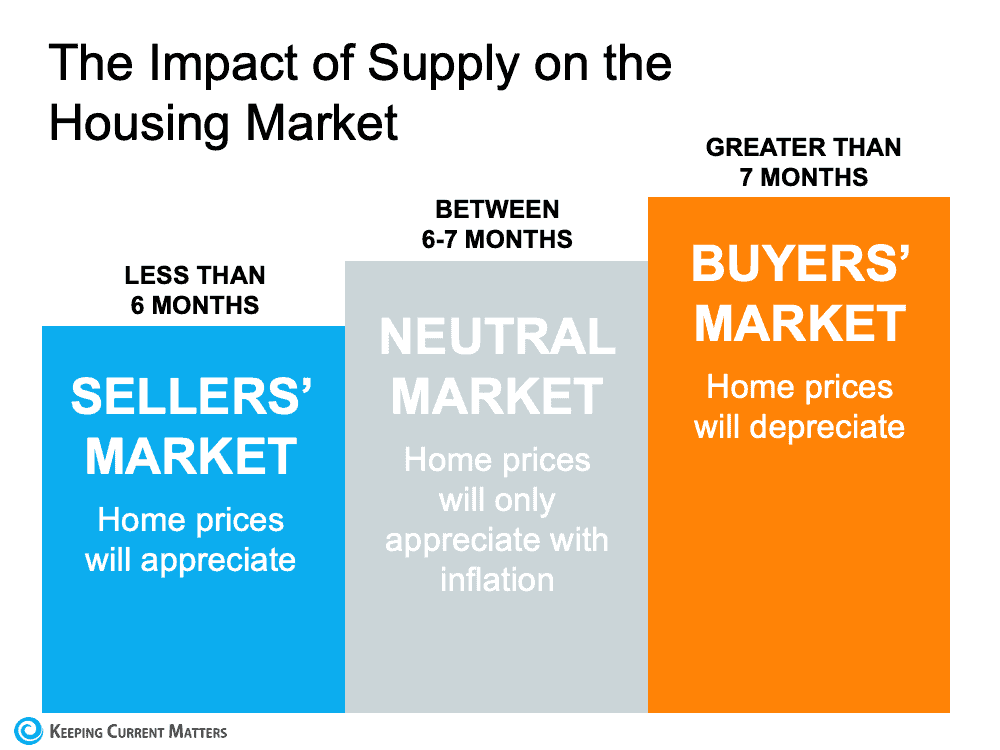

#GranbyRealtor #StephenSimard As we near the end of the year, more homeowners are realizing the benefits of today’s sellers’ market. Record-breaking home price appreciation, growing equity, low inventory, and competitive mortgage rates are motivating homeowners to make a move that addresses their changing lifestyles. In fact, recent data from realtor.com shows a larger share of homeowners are planning to list their houses this winter. So, that means more homes are about to hit the market, which will lead to more choices for buyers too. According to George Ratiu, Manager of Economic Research at realtor.com: “The pandemic has delayed plans for many Americans, and homeowners looking to move on to the next stage of life are no exception. Recent survey data suggests the majority of prospective sellers are actively preparing to enter the market this winter.” If you’re thinking of waiting until the spring to sell your house, know that your neighbors may be one step ahead of you by selling this winter. If you want to stand out from the crowd, this holiday season is the best time to make sure your house is available for buyers. Here’s why. Sellers Are Still Firmly in the Driver’s Seat Historically, a 6-month supply of homes for sale is needed for a normal or neutral market. That level ensures there are enough homes available for active buyers (see graph below): The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows the inventory of houses for sale sits at a 2.4-month supply. This is well below a neutral market.

What Does That Mean for You? When the supply of homes for sale is as low as it is today, it’s much harder for buyers to find homes to purchase. This drives up competition among buyers, who then submit increasingly competitive offers to win out against others in the home search process. As this happens, prices rise and your leverage as a seller rises too, putting you in the best position to negotiate a contract that meets your ideal terms. And while the low housing supply we’re facing won’t be solved overnight, sellers this season should move quickly to maximize their potential. As the data shows, with more prospective sellers planning to list their homes this winter, selling sooner rather than later helps your house rise to the top of a holiday buyer’s wish list so you can close the best possible deal. Bottom Line Selling your house over the next few weeks gives you the best chance to be in front of buyers competing for homes while the number of houses for sale is still low. Connect with a local real estate advisor today to discuss how you can benefit from today’s sellers’ market. SOURCE:KCM #ForSellers #HousingMarketUpdates #Move-UpBuyers #Pricing #SellingMyths #SimardRealtyGroup #RealBrokerLLC Some Highlights

SOURCE:KCM #ForBuyers #ForSellers #Infographics #SimardRealtyGroup #RealBrokerLLC Even in today’s competitive sellers’ market, first-time homebuyers are finding ways to win. The latest data from NAR shows the percent of first-time buyers is increasing. Are you looking to buy your first home? Comment with any challenges you’re facing in today’s market so we can work to overcome them together.

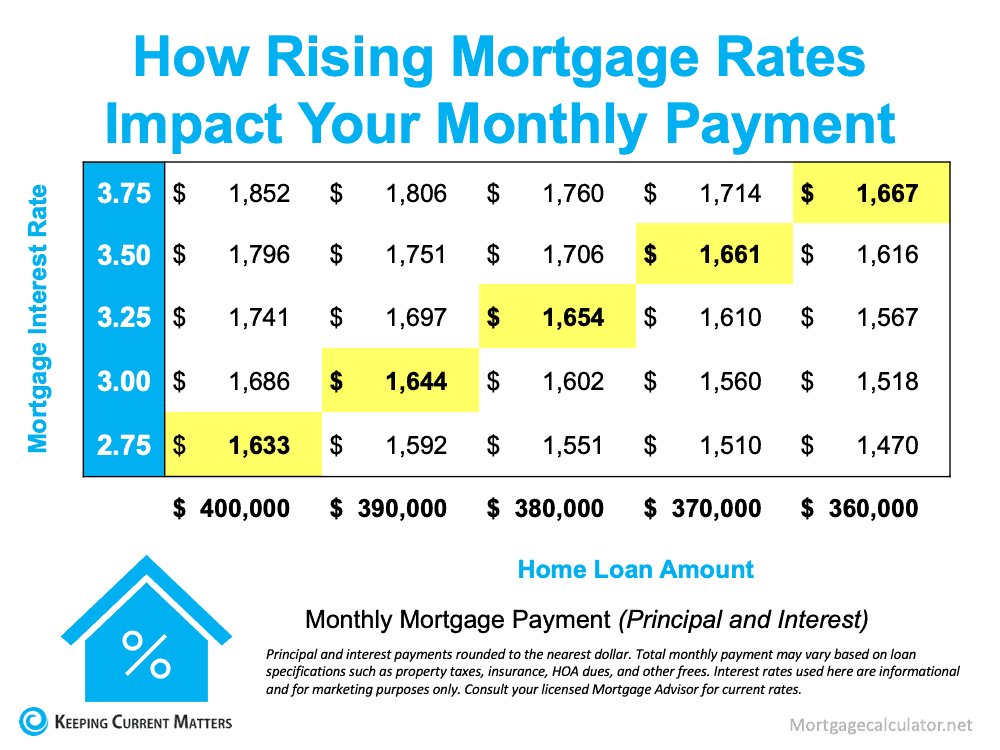

#firsttimehomebuyer #homeownership #teamwork #realestate #homesweethome #househunting #homegoals #houseshopping #housegoals #starterhome #dreamhome #keepingcurrentmatters Last week, the average 30-year fixed mortgage rate from Freddie Mac inched up to 3.1%, and experts project rates will continue rising through 2022: “The 30-year fixed-rate mortgage was 2.9% in the third quarter of 2021. We forecast mortgage rates to increase slightly through the remainder of the year and reach 3.0%, rising to 3.5% for full year 2022.” If you’re thinking of buying a home, here are a few things to keep in mind so you can succeed even as mortgage rates rise. Taking Time Off Can Be Costly Mortgage rates play a significant role in your home search. As rates go up, your monthly mortgage payment increases if you’re buying a home, directly affecting how much you can afford. And even the smallest increase can have a large impact on your monthly payment (see chart below): With mortgage rates on the rise, you’ve likely seen your purchasing power impacted already. Instead of waiting and hoping rates will fall, today’s rates should motivate you to purchase now before rates increase more.

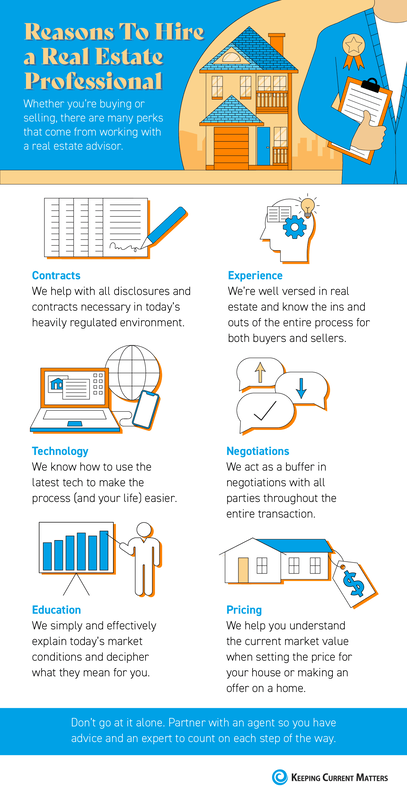

Smart Buyers Can Succeed by Planning Ahead You can use your newfound motivation to energize your search and plan your next steps accordingly so you’re prepared to act no matter what happens with mortgage rates. One way to do that: take rising rates into consideration as part of your budget. Danielle Hale, Chief Economist at realtor.com, puts it best, saying: “Smart buyers should consider calculating a monthly payment not only at today’s rates, but also at rates that are a bit higher so that they won’t be derailed by a sudden upward move. . . .” You should also be ready to act when you find the home that meets your needs. That means getting pre-approved with a lender so there won’t be any delays when the time arrives. The best way to prepare is to work with a trusted real estate advisor now. An agent can connect you with a lender, help you adjust your search based on your budget, and be ready to act quickly when it’s time to make an offer. Bottom Line Serious buyers should approach rising rates as a motivating factor to buy sooner, not a reason to wait. Waiting will cost you more in the long run. Work with a real estate professional to understand your budget and how you can be prepared to buy your home before rates climb higher. SOURCE:KCM #BuyingMyths #FirstTimeHomeBuyers #ForBuyers #InterestRates #Move-UpBuyers #SimardRealtyGroup #RealBrokerLLC Working from home and in need of more space? You’re not alone. Many of today’s homebuyers are deciding to move up to a space that better fits their needs. If you weren’t limited by space, how would you design your ideal #homeoffice? Comment with your answers, and let’s discuss how we can make your dream home office a reality.

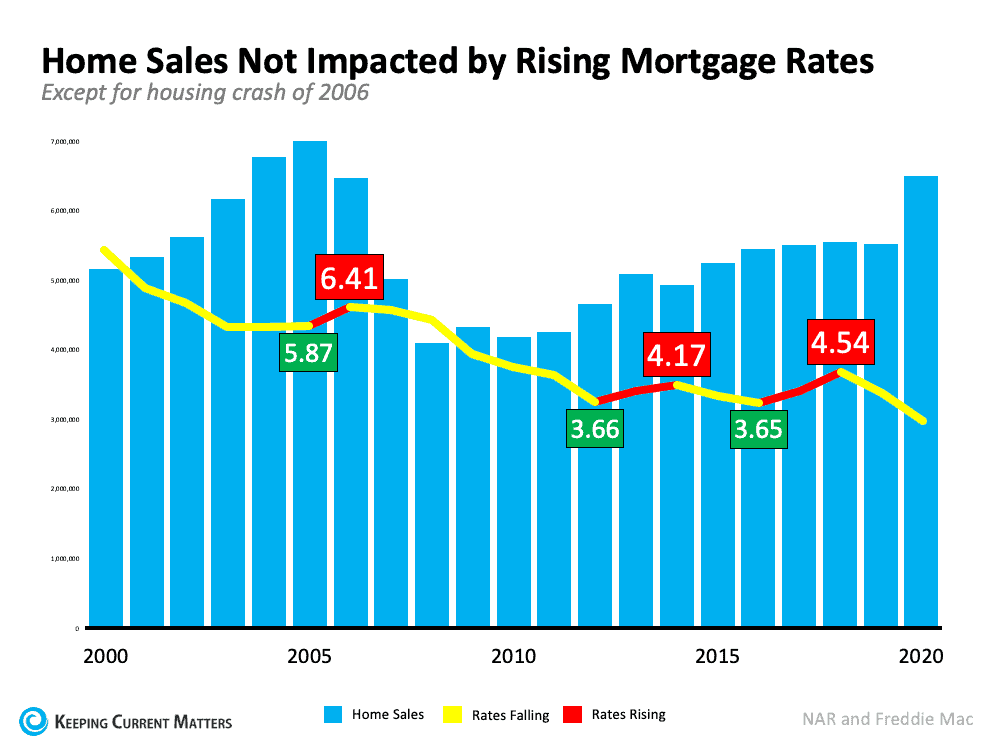

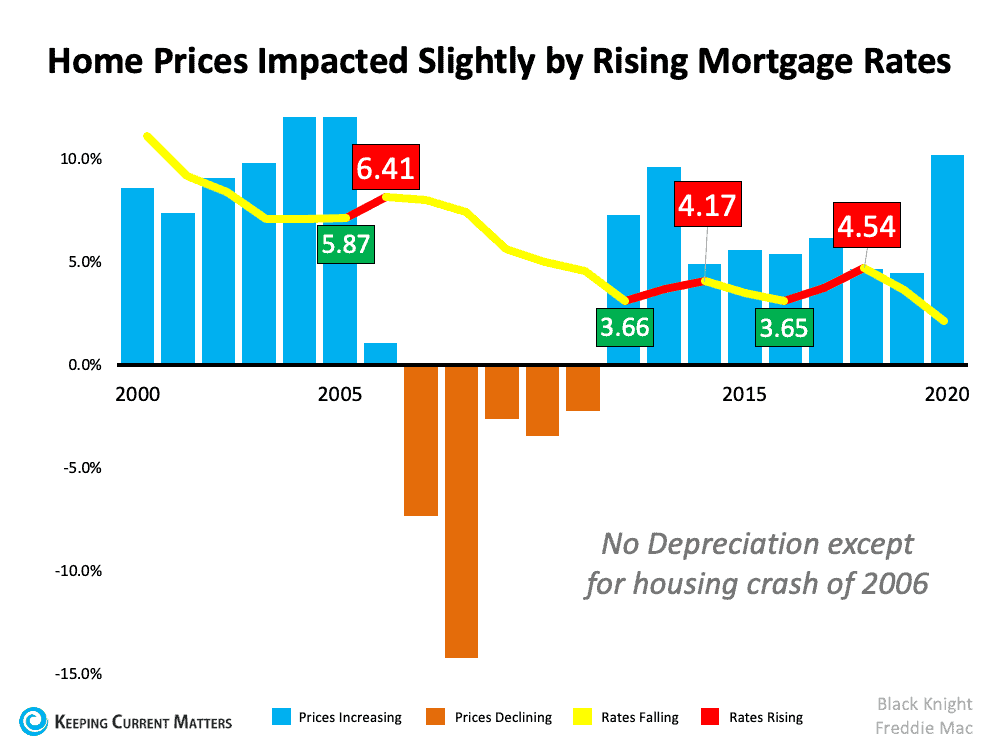

#workfromhome #remotework #homeshopping #houseshopping #motivation #mindset #inspiredaily #dreamhome #firsttimehomebuyer #opportunity #housingmarket #househunting #makememove #realestateinfo #keepingcurrentmatters There are a lot of questions right now regarding the real estate market as we head into 2022. The forbearance program is coming to an end and mortgage rates are beginning to rise. With all of this uncertainty, anyone with a megaphone – from the mainstream media to a lone blogger – has realized that bad news sells. Unfortunately, we’ll continue to see a rash of troublesome headlines over the next few months. To make sure you aren’t paralyzed by a headline, turn to reliable resources for a look at what to expect from the housing market next year. There are already alarmist headlines starting to appear. Here are two recent topics you may have seen in the news. 1. Foreclosures Are Spiking Today There are a number of headlines circulating that call out the rising foreclosures in today’s real estate market. Those stories focus on an overly narrow view on that topic: the current volume of foreclosures compared to 2020. They emphasize that we’re seeing far more foreclosures this year compared to last. That seems rather daunting. However, though it’s true foreclosures have been up over the 2020 numbers, it’s important to realize that there were virtually no foreclosures last year because of the forbearance plan. If we compare this September to September of 2019 (the last normal year), foreclosures were down 70% according to ATTOM. Even Rick Sharga, an Executive Vice President of the firm that issued the report referenced in the above article, says: “As expected, now that the moratorium has been over for three months, foreclosure activity continues to increase. But it’s increasing at a slower rate, and it appears that most of the activity is primarily on vacant and abandoned properties, or loans in foreclosure prior to the pandemic.” Homeowners who have been impacted by the pandemic are not generally the ones being burdened right now. That’s because the forbearance program has worked. Ali Haralson, President of Auction.com, explains that the program has done a remarkable job: “The tsunami of foreclosures many feared in the early days of the pandemic has not materialized thanks in large part to the swift and decisive foreclosure protections put in place by government policymakers and the mortgage servicing industry.” And the government is still making sure homeowners have every opportunity to stay in their homes. Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB), issued this statement just last week: Failures by mortgage servicers and regulators worsened the impact of the economic crisis a decade ago. Regulators have learned their lesson, and we will be scrutinizing servicers to ensure they are doing all they can to help homeowners and follow the law.” 2. Rising Mortgage Rates Will Slow the Housing Market nother topic that’s generating frequent headlines is the rise in mortgage rates. Some people are expressing concern that rising rates will negatively impact the housing market by causing home sales to dramatically decline. The resulting headlines are raising unneeded alarm bells. To counteract those headlines, we need to take a look at what history tells us. Looking at data over the last 20 years, there’s no evidence that an increase in rates dramatically forces sales to come to a halt. Nor does home price appreciation come to a screeching stop. Let’s look at home sales first: The last three times rates increased (shown in the graph above in red), sales (depicted in blue in the graph) remained rather consistent. It’s true that sales fell rather dramatically from 2007 through 2010, but mortgage rates were also falling at the time. The next two instances showed no meaningful drop in sales. Now, let’s take a look at home price appreciation (see graph below): Again, we see that a rise in rates didn’t cause prices to depreciate. Outside of the years following the crash, prices continued to appreciate, just at a slower rate.

Bottom Line There’s a lot of misinformation out there. If you want the best advice on what’s happening in the current housing market, contact your local real estate agent. SOURCE:KCM #DistressedProperties #ForBuyers #ForSellers #Foreclosures, #HousingMarketUpdates #InterestRates #Pricing #SimardRealtyGroup #RealBrokerLLC

Source : KCM

#GranbyRealtor #StephenSimard our equity is a powerful tool that can help you achieve your goals as a homeowner. And chances are, your equity grew substantially over the past year. According to the latest Equity Insights Report from CoreLogic, homeowners gained an average of $51,500 in equity over the past year.

If you’re looking for the best ways to use your growing equity, here are four options: 1. Use Your Equity To Buy a Home That Fits Your Needs If you’re finding you no longer have the space you need, it might be time to move into a larger home. Or, it’s possible you have too much space and would like something smaller. No matter the situation, consider using your equity to power a move into a home that fits your changing lifestyle. Moving into a larger home can provide extra space for remote work or loved ones. Downsizing, on the other hand, may mean saving time and money by caring for a smaller home. 2. Move to the Location of Your Dreams If the size of your home isn’t a challenge but your current location is, it could be time to relocate to a new area. Maybe you enjoy vacationing in the mountains, at the beach, or another area, and you’re dreaming of living there year-round. Or perhaps the distance between you and your loved ones is greater than you’d like, and you want to close the gap. No matter what, your home equity can fuel your move to the location where you really want to live. 3. Start a New Business If you’re not ready to move into a new home, you can use your equity to invest in a new business venture. As the U.S. Small Business Administration Office of Advocacy says: “There is an estimate of 31.7 million small business owners in the United States, many of them started their business with the equity they had in their home.” While it’s not recommended that homeowners use their equity for unnecessary spending, leveraging your equity to start a business that you’re passionate about can potentially grow your nest egg further. 4. Fund an Education Whether you have a loved one preparing to head off to college or you’re planning to go back to school yourself, the thought of paying for higher education can be daunting. In either situation, using a portion of your growing equity can help with those costs, so you can make an investment in someone’s future. Bottom Line Your equity can help you achieve your goals. If you’re unsure how much equity you have in your home, connect with a trusted real estate advisor so you can start planning your next move. SOURCE:KCM #ForSellers #Move-UpBuyers #SimardRealtyGroup #RealBrokerLLC |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed