|

Starting your journey to buy or sell a home can be scary if you aren’t familiar with everything that needs to happen! That’s why you need a trusted advisor to lead you through the whole process. One that will educate you, help you get the best price for your home or make the best offer, and will lead you through the process with confidence! Let's get together today!

0 Comments

A considerable number of potential buyers shy away from jumping into the real estate market due to their uncertainties about the buying process. A specific cause for concern tends to be mortgage qualification.

For many, the mortgage process can be scary, but it doesn’t have to be! In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and good credit history. Throughout the entire home buying process, you will interact with many different professionals who will all perform necessary roles. These professionals are also valuable resources for you. Once you’re ready to apply, here are 5 easy steps that Freddie Mac suggests to follow:

Bottom Line Do your research, reach out to professionals, stick to your budget, and be sure that you are ready to take on the financial responsibilities of becoming a homeowner. SOURCE KCM #FirstTimeHomeBuyers #ForBuyers #SimardRealtyGroup #eXpRealty

There are many misconceptions out there when it comes to qualifying for a home loan. Whether it's down payment or credit, let's get together today so I can walk you through the process. You may be surprised to find out that you already qualify today!

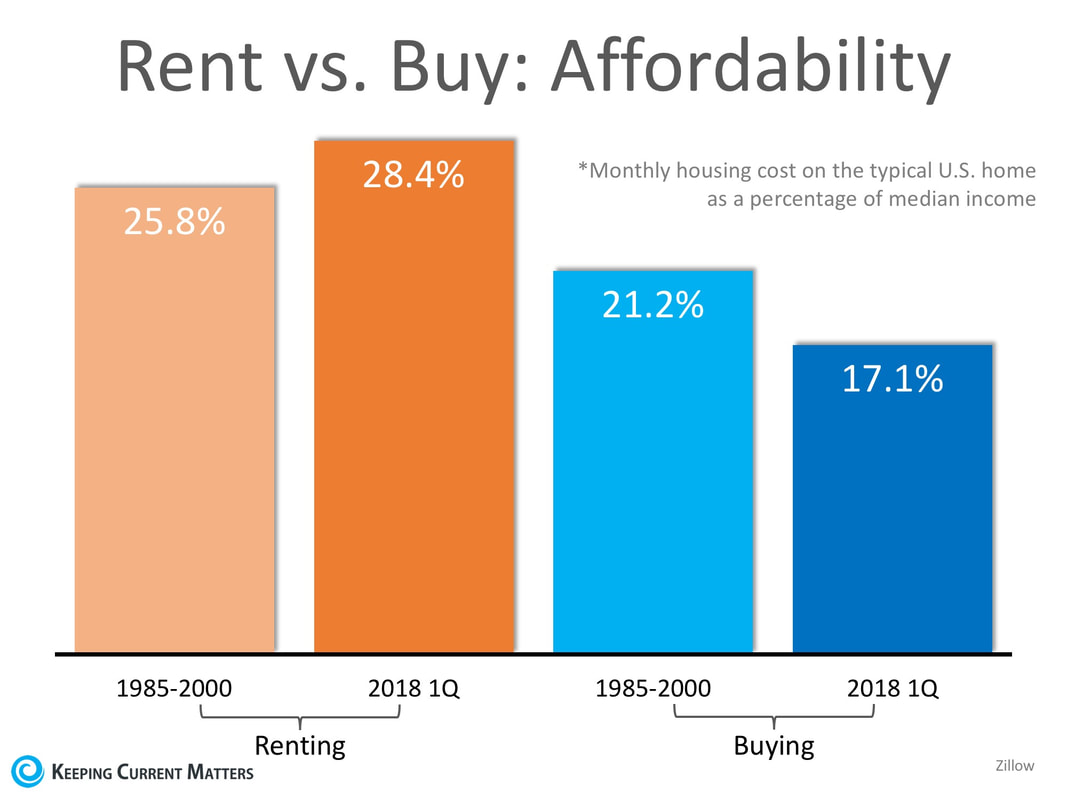

Chances are if you are renting you are spending too much of your income on your monthly housing expense. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their rent or mortgage payment. This percentage allows the household to save money for the future while comfortably covering other expenses. According to new data released from ApartmentList.com, 49.5 million renters in the United States were cost-burdened in 2017, meaning they spent more than 30% of their monthly incomes on rent. This accounts for nearly half of all renter households in the country and is up 3.1 million from 2007. When a household is cost-burdened by their monthly housing expense, they are not as easily able to save money for the future. This is a big factor for many renters who dream of owning their own homes someday. But there is hope for those who are able to save at least a 3% down payment! The percentage of income needed in the US to buy a home is significantly less than renting at 17.1%! The chart below compares the historic percentage of income needed to rent and buy from 1985-2000 to the first quarter of 2018. As you can see, the cost of renting has climbed above historic numbers while the cost of buying dropped over the same period of time. Bottom LineIf you are one of the many renters who is spending too much of their monthly income on rent, consider saving money by getting a roommate, moving into a less expensive apartment, or even moving in with family. These are all ways to save for a down payment so that you can put your housing costs to work for you!

SOURCE KCM #DownPayments #RentVSBuy #SimardRealtyGroup #eXpRealty With home prices on the rise and buyer demand still strong, some sellers may be tempted to try and sell their homes on their own without using the services of a real estate professional.

Real estate agents are trained and experienced in negotiation and, in most cases, the seller is not. Sellers must realize that their ability to negotiate will determine whether or not they get the best deal for themselves and their families. Here is a list of just some of the people with whom the seller must be prepared to negotiate with if they decide to For Sale by Owner (FSBO):

Bottom Line The percentage of sellers who have hired real estate agents to sell their homes has increased steadily over the last 20 years. Meet with a professional in your local market to see the difference that he or she can make in easing the selling process for you. SOURCE KCM #ForSellers #FSBO's #SimardRealtyGroup #eXpRealty Some Highlights:

Many potential homebuyers believe that they need a 20% down payment and a 780 FICO® score to qualify to buy a home which stops many of them from even trying! Here are some facts:

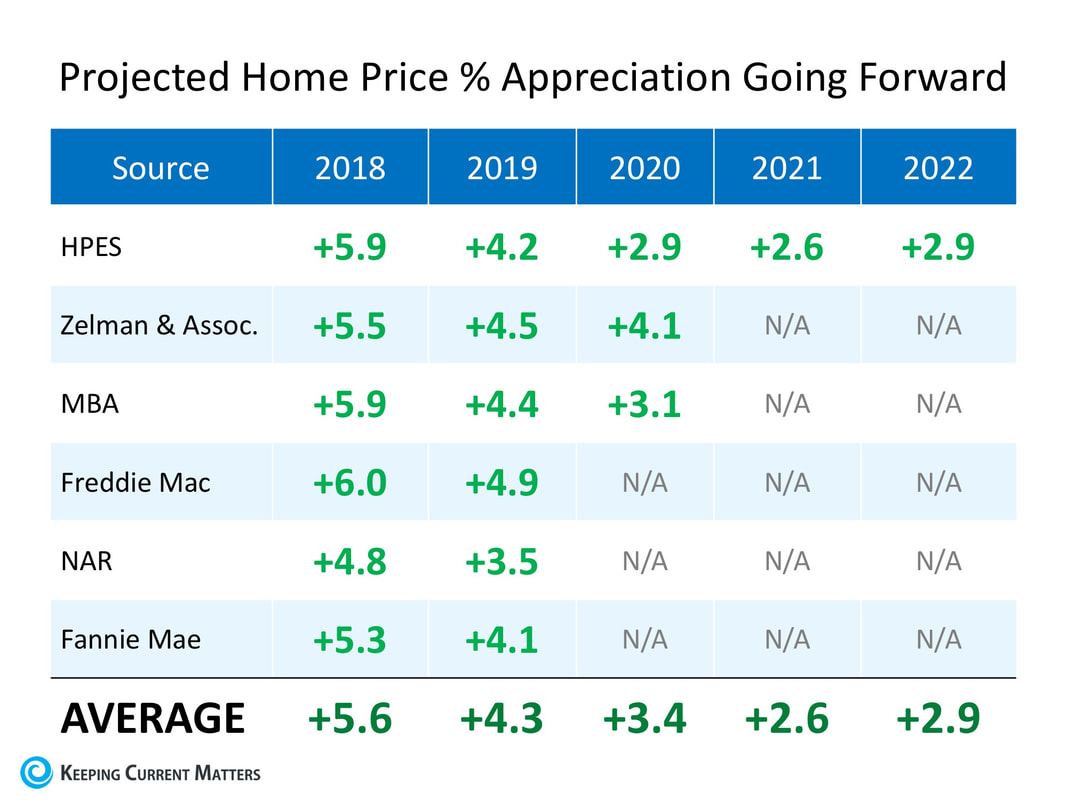

SOURCE KCM #BuyingMyths #Infographics #SimardRealtyGroup #eXpRealty There are many questions about where home prices will be next year as well as where they may be headed over the next several years to come. We have gathered the most reliable sources to help answer these questions: The Home Price Expectation Survey – A survey of over 100 market analysts, real estate experts, and economists conducted by Pulsenomics each quarter. Zelman & Associates – The firm leverages unparalleled housing market expertise, extensive surveys of industry executives, and rigorous financial analysis to deliver proprietary research and advice to leading global institutional investors and senior-level company executives. Mortgage Bankers Association (MBA) – As the leading advocate for the real estate finance industry, the MBA enables members to successfully deliver fair, sustainable, and responsible real estate financing within ever-changing business environments. Freddie Mac – An organization whose mission is to provide liquidity, stability, and affordability to the U.S. housing market in all economic conditions extending to all communities from coast to coast. The National Association of Realtors (NAR) – The largest association of real estate professionals in the world. Fannie Mae – A leading source of financing for mortgage lenders, providing access to affordable mortgage financing in all markets always. Here are their projections of prices going forward: Bottom LineEvery source sees home prices continuing to appreciate – just at lower percentages as we move through the next several years.

SOURCE KCM #ForBuyers #ForSellers #Pricing #SimardRealtyGroup #eXpRealty According to a new study from Urban Institute, there are over 19 million millennials in 31 cities who are not only ready and willing to become homeowners, but are able to as well!

Now that the largest generation since baby boomers has aged into prime homebuying age, there will no doubt be an uptick in the national homeownership rate. The study from Urban Institute revealed that nearly a quarter of this generation has the credit and income needed to purchase a home. Surprisingly, the largest share of mortgage-ready millennials lives in expensive coastal cities. These cities often attract highly skilled workers who demand higher salaries for their expertise. So, what’s holding these mortgage-ready millennials back from buying? Myths About Down Payment Requirements! Most of the millennials surveyed for the study believe that they need at least a 15% down payment in order to buy a home when, in reality, the median down payment in the US in 2017 was just 5%, and many programs are available for even lower down payments! The study goes on to point out that: “Despite limited awareness, every state has programs that provide grants and loans to make homeownership more attainable, with average assistance in various states ranging from $2,436 to $21,171.” Bottom Line With so many young families now able to buy a home in today’s market, the demand for housing will continue for years to come. If you are one of the many millennials who have questions about their ability to buy in today’s market, sit with a local real estate professional who can assist you along your journey! SOURCE KCM #DownPayment #ForBuyers #SimardRealtyGroup #eXpRealty Lately, there have been many headlines circulating about whether or not there is an “affordability issue forming in the housing market.”

If you are considering selling your current house and moving up to the home of your dreams, but are unsure whether or not to believe what you’re seeing in the news, let’s look at the results of the latest Housing Affordability Report from the National Association of Realtors (NAR). According to NAR: “A value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that a family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

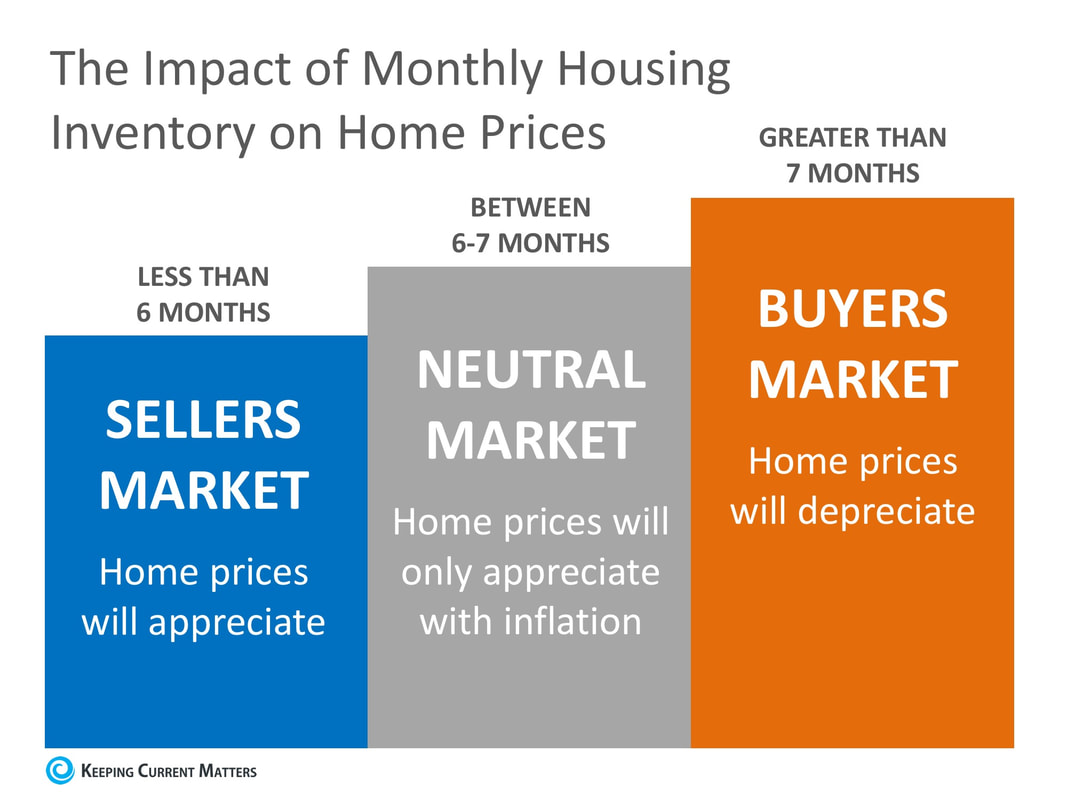

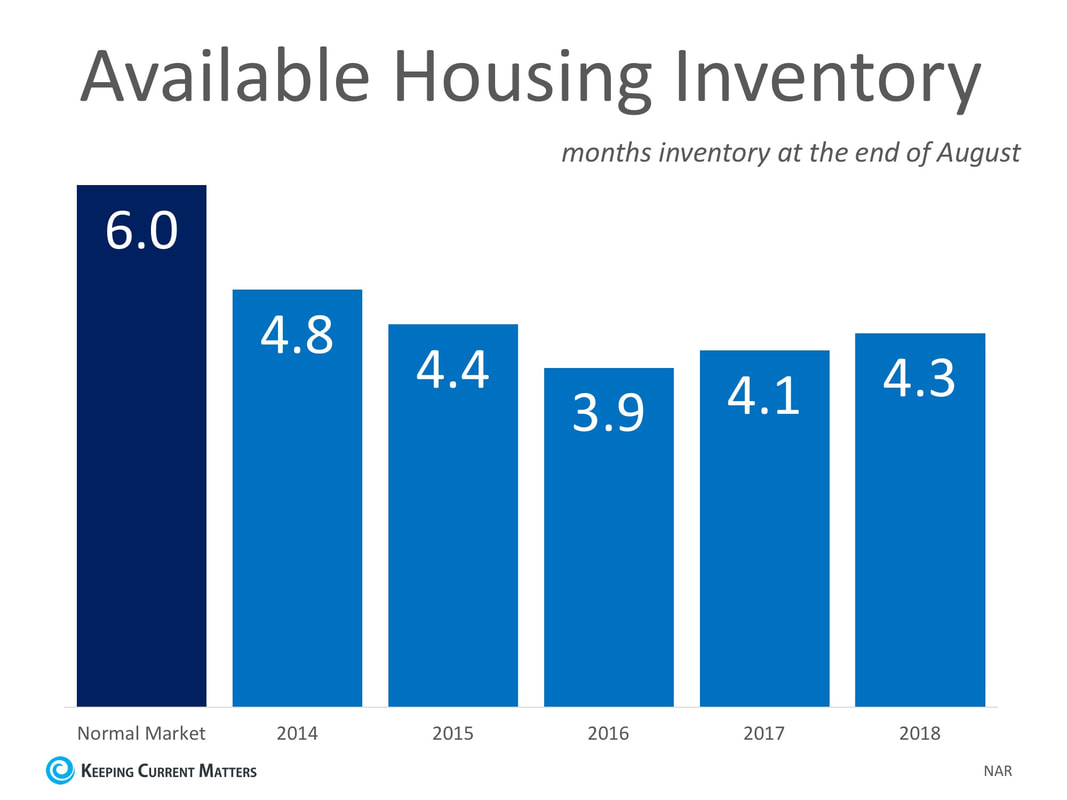

One big factor in determining affordability each month is the interest rate available at the time of calculation. In August 2017, the 30-year fixed rate mortgage interest rate was 4.19%. This August, the rate rose to 4.78%! With an index reading of 141.2, housing remains affordable in the U.S. Regionally, affordability is up in three out of four regions. The Northeast had the biggest gain at 6.2%. The South had an increase of 2.4% followed by the West with a slight increase of 0.1%. The Midwest had the only dip in affordability at 4.8%. Despite month-over-month changes, the most affordable region remains the Midwest, with an index value of 175.7. The West remains the least affordable region at 101.2. For comparison, the index was 146.7 in the South, and 151.2 in the Northeast. Bottom Line If you are thinking of selling your home, contact a local real estate professional who can help you understand the affordability conditions in your marketplace. SOURCE KCM #ForBuyers #RentVSBuy #SimardRealtyGroup #eXpRealty There are many unsubstantiated theories about what is happening with home prices. From those who are worried that prices are falling (data shows this is untrue), to those who are concerned that prices are again approaching boom peaks because of “irrational exuberance” (this is also untrue as prices are not at peak levels when they are adjusted for inflation), there seems to be no shortage of opinion. However, the increase in prices is easily explained by the theory of supply & demand. Whenever there is a limited supply of an item that is in high demand, prices increase. It is that simple. In real estate, it takes a six-month supply of existing salable inventory to maintain pricing stability. In most housing markets, anything less than six months will cause home values to appreciate and anything greater than seven months will cause prices to depreciate (see chart below). According to the Existing Home Sales Report from the National Association of Realtors (NAR), the monthly inventory of homes for sale has been below six months for the last five years (see chart below). Bottom Line

If buyer demand continues to outpace the current supply of existing homes for sale, prices will continue to appreciate. Nothing nefarious is taking place. It is simply the theory of supply & demand working as it should. #BuyingMyths #Pricing #RealEstate #SimardRealtyGroup #eXpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed