|

Here are five reasons listing your home for sale this summer makes sense.

1. Demand Is Strong The latest Buyer Traffic Report from the National Association of Realtors (NAR) shows that buyer demand remains very strong throughout the vast majority of the country. These buyers are ready, willing and able to purchase…and are in the market right now! More often than not, multiple buyers are competing with each other to buy the same home. Take advantage of the buyer activity currently in the market. 2. There Is Less Competition Now Housing inventory has declined year-over-year for the last 35 months and is still under the 6-month supply needed for a normal housing market. This means that, in the majority of the country, there are not enough homes for sale to satisfy the number of buyers in the market. This is good news for homeowners who have gained equity as their home values have increased. However, additional inventory could be coming to the market soon. Historically, the average number of years a homeowner stayed in his or her home was six, but that number has hovered between nine and ten years since 2011. There is a pent-up desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. As home values continue to appreciate, more and more homeowners will be given the freedom to move. The choices buyers have will continue to increase. Don’t wait until this other inventory comes to market before you decide to sell. 3. The Process Will Be Quicker Today’s competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. This makes the entire selling process much faster and much simpler as buyers know exactly what they can afford before home shopping. According to Ellie Mae’s latest Origination Insights Report, the average time it took to close a loan was 41 days. 4. There Will Never Be a Better Time to Move Up If your next move will be into a premium or luxury home, now is the time to move up! The inventory of homes for sale at these higher price ranges has forced these markets into a buyer’s market. This means that if you are planning on selling a starter or trade-up home, your home will sell quickly, AND you’ll be able to find a premium home to call your own! Prices are projected to appreciate by 5.2% over the next year, according to CoreLogic. If you are moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. 5. It’s Time to Move on With Your Life Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should? Only you know the answers to the questions above. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to move on and start living the life you desire. That is what is truly important. SOURCE KCM #ForSellers #ForBuyers #SimardRealtyGroup #eXpRealty

0 Comments

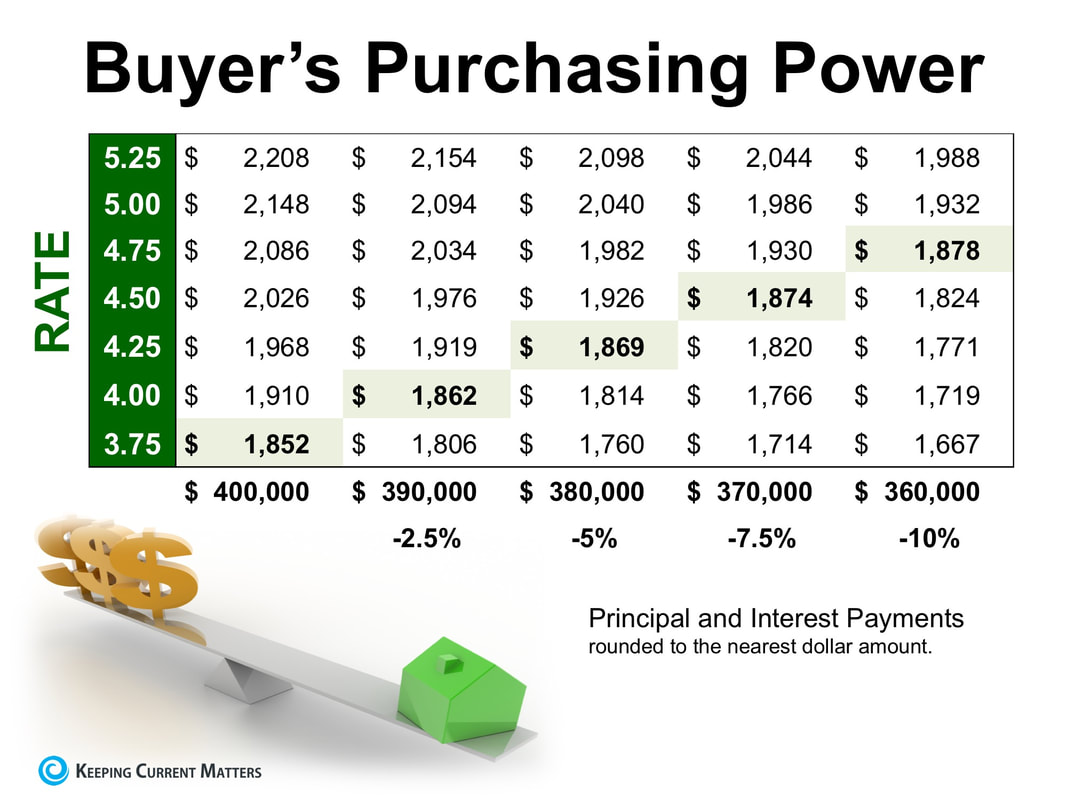

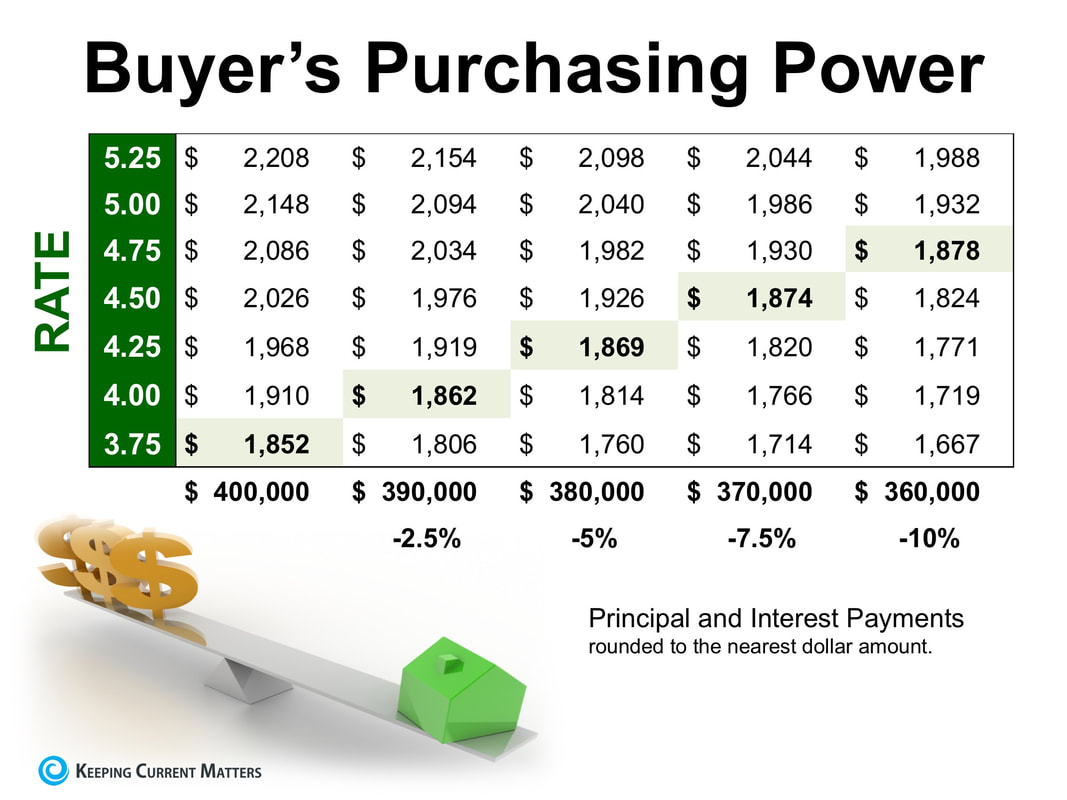

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.61%, which is still near record lows in comparison to recent history! The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power. Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house you can afford to buy will decrease if you plan to stay within a certain monthly housing budget. The chart below shows the impact that rising interest rates would have if you planned to purchase a home within the national median price range while keeping your principal and interest payments between $1,850-$1,900 a month. With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5% (in this example, $10,000). Experts predict that mortgage rates will be closer to 5% by this time next year.

Act now to get the most house for your hard-earned money. SOURCE KCM #FirstTimeHomeBuyers #SimardRealtyGroup #eXpRealty In this extremely hot real estate market, some homeowners might consider selling their homes on their own which is known as a For Sale by Owner (FSBO). They rationalize that they don’t need a real estate agent and believe that they can save the fee for the services a real estate agent offers.

However, a study by Collateral Analytics reveals that FSBOs don’t actually save anything, and in some cases may be costing themselves more, by not listing with an agent. In the study, they analyzed home sales in a variety of markets. The data showed that: “FSBOs tend to sell for lower prices than comparable home sales, and in many cases below the average differential represented by the prevailing commission rate.” (emphasis added) Why would FSBOs net less money than if they had used an agent? The study makes several suggestions:

Conclusions from the study:

Bottom Line As Dave Ramsey, America’s trusted voice on money, explains: “Research has shown that, between mistakes, lack of negotiating skills, pricing errors and general exposure on the market, you’ll cost yourself more than the real estate commission…You’ll come out slightly better and with a lot less hassle if you use a top-shelf agent. SOURCE KCM #ForSellers #FSBO #SimardRealtyGroup #eXpRealty Price Improvement for 24 Whitman Dr, Granby CT now at 💲295k!

Come home 🏡 to this spacious Colonial set in Granby's desired Poet's Corner. Enjoy the versatile floor plan with over 2400 sq ft and even more in the finished lower level. 🚪 Check out this link for more info:⬇️⬇️ http://24whitmandr.thebestlisting.com/ #PriceReduced #Granby #SimardRealtyGroup #eXpRealty Interest rates for a 30-year fixed rate mortgage have climbed from 3.95% in the first week of January up to 4.61% last week, which marks a 7-year high according to Freddie Mac. The current pace of acceleration has been fueled by many factors.

Sam Khater, Freddie Mac’s Chief Economist, had this to say: “Healthy consumer spending and higher commodity prices spooked bond markets and led to higher mortgage rates over the past week. Not only are buyers facing higher borrowing costs, gas prices are currently at four-year highs just as we enter the important peak home sales season.” But what do gas prices have to do with interest rates? Investopedia explains the relationship like this: “The price of oil and inflation are often seen as being connected in a cause-and-effect relationship. As oil prices move up or down, inflation follows in the same direction.” You may have noticed that filling your gas tank has become substantially more expensive in recent months. The average national gas price has climbed nearly $0.50 from the beginning of the year, leading to the highest price for Memorial Day weekend since 2014. As rates go up, your purchasing power goes down, but don’t worry; rates are still well below the averages we’ve seen over the last four decades. “Freddie Mac said this year’s higher rates have not yet caused much of a ripple in the strong demand levels for buying a home seen in most markets, but inflationary pressures and the prospect of rates approaching 5 percent could begin to hit the psyche of some prospective buyers.” Buying sooner rather than later will help lock in a lower rate than waiting, as the experts believe rates will continue to climb. Even a small increase in interest rates can have a big impact on your monthly housing cost. Bottom Line If you are planning on buying a home this year, keep an eye on gas prices the next time you’re at the pump. If you start to feel a big jump in price, know that rates are probably on their way up too. SOURCE KCM #ForBuyers #InterestRates #SimardRealtyGroup #eXpRealty According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.61%, which is still near record lows in comparison to recent history! The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power. Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house you can afford to buy will decrease if you plan to stay within a certain monthly housing budget. The chart below shows the impact that rising interest rates would have if you planned to purchase a home within the national median price range while keeping your principal and interest payments between $1,850-$1,900 a month. With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5% (in this example, $10,000). Experts predict that mortgage rates will be closer to 5% by this time next year.

Act now to get the most house for your hard-earned money. SOURCE KCM #ForBuyers #InterestRates #SimardRealtyGroup #eXpRealty Recently released data from the National Association of Realtors (NAR) suggests that a now is a great time to sell your home. The concept of ‘supply & demand’ reveals that the best price for an item is realized when the supply of that item is low and the demand for that item is high.

Let’s see how this applies to the current residential real estate market. SUPPLY It is no secret that the supply of homes for sale has been far below the number needed to sustain a normal market for over a year at this point. A normal market requires six months of housing inventory to meet the demand. The latest report from NAR revealed that there is currently only a 3.6-month supply of houses on the market. Supply is currently very low! DEMAND A report that was just released tells us that demand is very strong. The most recent Foot Traffic Report(which sheds light on the number of buyers who are actually out looking at homes) disclosed that “foot traffic grew 10.5 points to 52.4 in March as the new season approaches.” Demand is currently very high! Bottom Line Waiting to sell will only increase the competition between you and all of the other sellers putting their houses on the market later this summer. If you are debating whether or not to list your home, contact a local real estate professional who can explain the conditions in your market. SOURCE KCM #SupplyandDemand #Selling #Buying #SimardRealtyGroup #eXpRealty Congrats to our buyers! 🎉

Click link to view more photos and info of this property: https://www.zillow.com/homedetails/387-Ripley-Hill-Rd-Coventry-CT-06238/58992354_zpid/ #UnderContract #Coventry #SimardRealtyGroup #eXpRealty Some Highlights:

SOURCE KCM #ForBuyers #Millennials #SimardRealtyGroup #eXpRealty Congrats to our buyers! 🏡🏡🍷🍷

Check out this link for more info on this property: http://stephensimard.ct.exprealty.com/property/162-170080049-30-Pine-Street-Hartland-CT-06027 #UnderContract #Hartland #SimardRealtyGroup #eXpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed