|

Who’s driving the greatest amount of demand in today’s housing market? #Millennials.

If you’re part of this generation and thinking about buying a home, today’s housing market is full of opportunities. DM me your questions about the real estate process so you can make your move with confidence. #millennials #largestgeneration #americandream #motivation #mindset #inspiredaily #dreamhome #homesweethome #firsttimehomebuyer #opportunity #housingmarket #househunting #homegoals #houseshopping #housegoals #keepingcurrentmatters

0 Comments

Some Highlights

SOURCE KCM #BuyingMyths #Pricing #Infographics #MoveUpBuyers #SimardRealtyGroup #joinRealBroker The economic principles of #supplyanddemand are driving today’s rising home prices. We simply haven’t built enough homes over the last 10 years to keep up with demand. That means more buyer competition for today’s limited housing supply. DM me so we can talk about how your home could sell for a great price in today’s market.

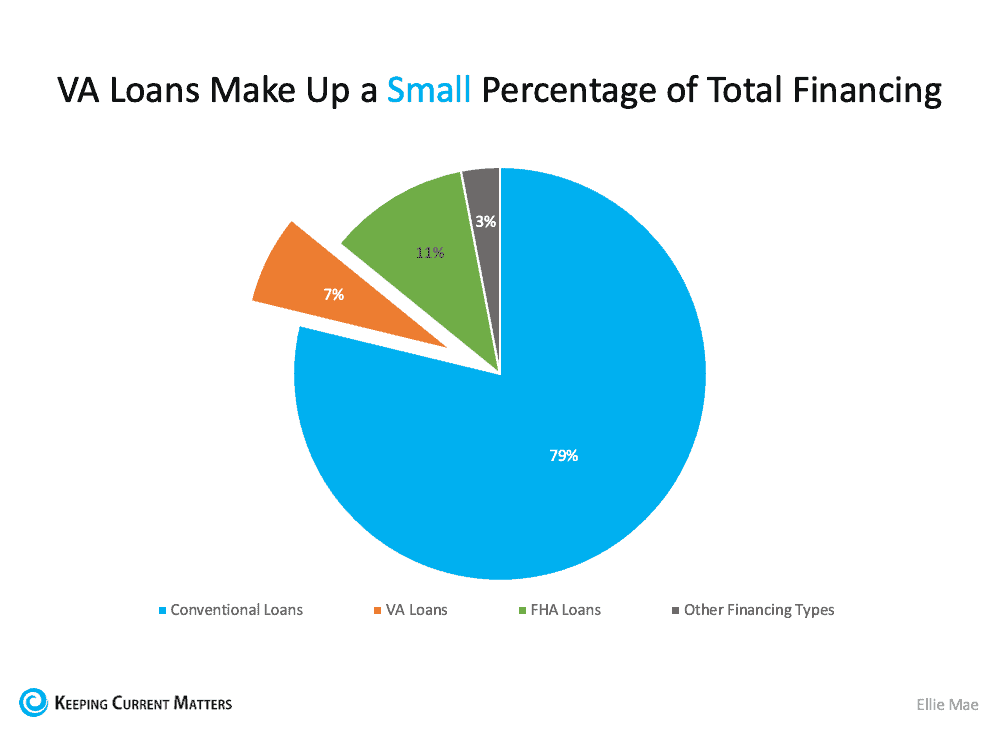

#supplyanddemand #economics101 #sellingfast #sellyourhouse #realestategoals #justsold #motivation #mindset #inspiredaily #dreamhome #homesweethome #hustle #realestatestats #realestateinfo #instarealestate #keepingcurrentmatters Some veterans are finding it difficult to obtain a home in today’s market. According to the National Association of Realtors (NAR): “Conventional conforming mortgages (mortgages that conform to guidelines set by Fannie Mae and Freddie Mac), accounted for 74% of mortgages obtained by homebuyers in May 2021, an increase from about 65% during 2018 through 2019…The share of VA-guaranteed loans has also decreased to 7% in May 2021 from about 10% in past years.” Recent data in the latest Origination Insight Report from Ellie Mae sheds light on the continuation of this trend. Below, we can see just how small of a share of total financing VA loans made up in June of 2021, according to that Ellie Mae report: The drop in VA loan usage can be attributed to the difficulties veterans continue to face when buying a home. The NAR article elaborates:

“It is extremely difficult for FHA/VA buyers to get accepted in a multiple offer situation. They are on the bottom of the hierarchy.” One contributing factor is that buyers with VA loans can’t waive certain contingencies. However, just because a certain contingency must be present for a particular buyer doesn’t mean that buyer’s offer shouldn’t be considered. What Should Sellers Do To Help Create a Level Playing Field? As a seller, it’s important to consider every offer in front of you regardless of loan type. If you’re selecting an offer because some contingencies are waived, keep in mind that it doesn’t always mean the offer is what’s best for you. Buyers who can’t waive specific contingencies may adjust other terms in their offer to make it more appealing to sellers. This may depend on several factors, including their loan type and location, but a motivated buyer and their agent will do everything they can to present an offer that’s as appealing to you as possible. Ultimately, you should make sure you take time to really understand the terms of their offer and see the big picture. Working with a driven buyer who’s motivated to purchase your house may provide a better opportunity for you to reach your overall best option and what’s most important to you. Bottom Line If you’re selling your house, work closely with your agent to make sure you understand the terms of all offers so you can give each one fair consideration, including those buyers using a VA loan. Our veterans sacrifice so much for our country. They’ve earned our gratitude and should have the same opportunity to obtain the home of their dreams. SOURCE KCM #ForSellers #MoveUpBuyers #SimardRealtyGroup #RealBrokerLLC With forbearance plans about to come to an end, many are concerned the housing market will experience a wave of foreclosures like what happened after the housing bubble 15 years ago. Here are four reasons why that won’t happen.

1. There are fewer homeowners in trouble this time After the last housing crash, about 9.3 million households lost their home to a foreclosure, short sale, or because they simply gave it back to the bank. As stay-at-home orders were issued early last year, the overwhelming fear was the pandemic would decimate the housing industry in a similar way. Many experts projected 30% of all mortgage holders would enter the forbearance program. Only 8.5% actually did, and that number is now down to 3.5%. As of last Friday, the total number of mortgages still in forbearance stood at 1,863,000. That’s definitely a large number, but nowhere near 9.3 million. 2. Most of the 1.86M in forbearance have enough equity to sell their home Of the 1.86 million homeowners currently in forbearance, 87% have at least 10% equity in their homes. The 10% equity number is important because it enables homeowners to sell their houses and pay the related expenses instead of facing the hit on their credit that a foreclosure or short sale would create. The remaining 13% might not all have the option to sell, so if the entire 13% of the 1.86M homes went into foreclosure, that would total 241,800 mortgages. To give that number context, here are the annual foreclosure numbers of the three years leading up to the pandemic:

3. The current market can absorb any listings coming to the market When foreclosures hit the market in 2008, there was an excess supply of homes for sale. The situation is exactly the opposite today. In 2008, there was a 9-month supply of listings for sale. Today, that number stands at less than 3 months of inventory on the market. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains when addressing potential foreclosures emerging from the forbearance program: “Any foreclosure increases will likely be quickly absorbed by the market. It will not lead to any price declines.” 4. Those in power will do whatever is necessary to prevent a wave of foreclosures Just last Friday, the White House released a fact sheet explaining how homeowners with government-backed mortgages will be given further options to enable them to keep their homes when exiting forbearance. Here are two examples mentioned in the release:

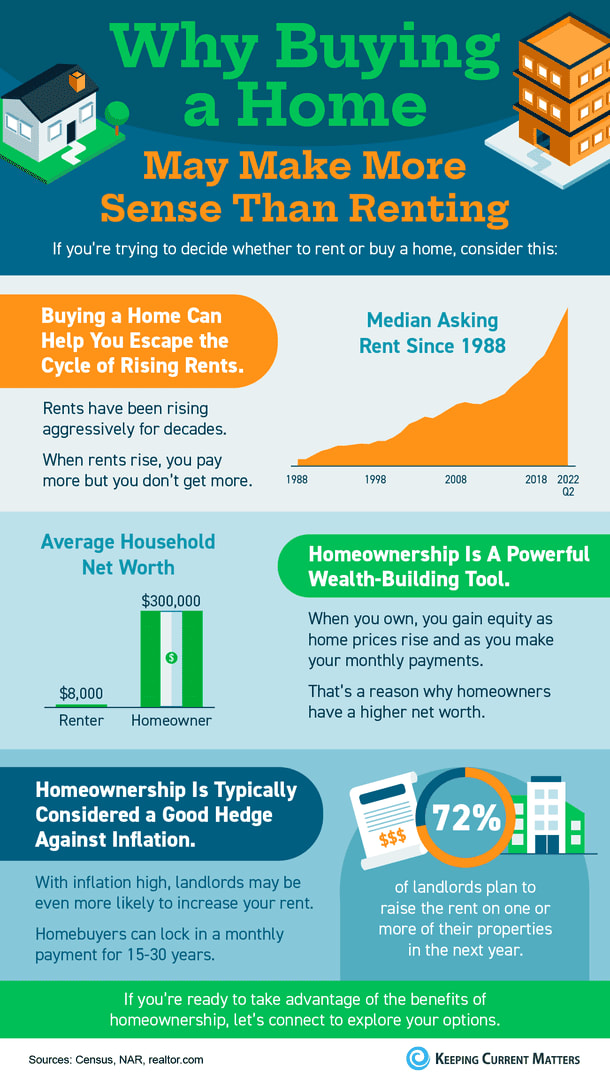

When evaluating the four reasons above, it’s clear there won’t be a flood of foreclosures coming to the market as the forbearance program winds down. Bottom Line As Ivy Zelman, founder of the major housing market analytical firm Zelman & Associates, notes: “The likelihood of us having a foreclosure crisis again is about zero percent.” SOURCE KCM #DistressedProperties #Pricing #ShortSales #SimardRealtyGroup #RealBrokerLLC With rental prices rising, there's a chance you'll be paying more in rent soon (if you aren't already). When you rent, you face rising, unpredictable expenses every year. When you buy, your mortgage payments remain consistent year to year. DM me today if you’re ready to go from renting to owning your own home.

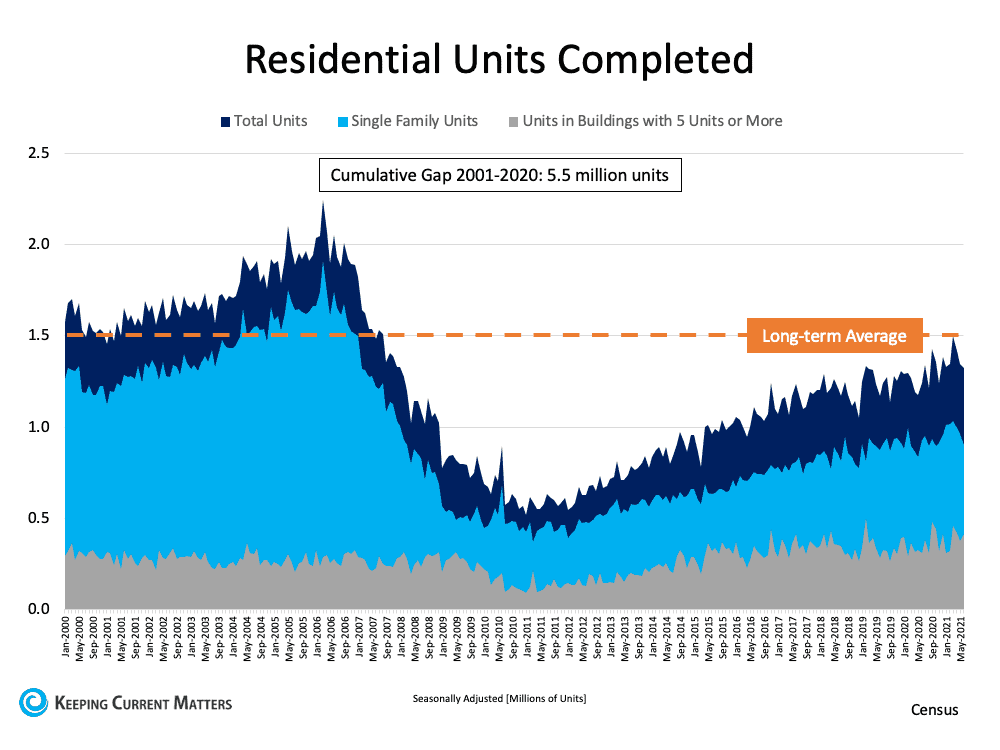

SOURCE: KCM #risingrents #breakfree #rentvsbuy #firsttimehomebuyer #opportunity #housingmarket #househunting #makememove #homegoals #starterhome #dreamhome #motivation #mindset #realestateinfo #keepingcurrentmatters One of the hottest topics of conversation in today’s real estate market is the shortage of available homes. Simply put, there are many more potential buyers than there are homes for sale. As a seller, you’ve likely heard that low supply is good news for you. It means your house will get more attention, and likely, more offers. But as life begins to return to normal, you may be wondering if that’s something that will change. While it may be tempting to blame the pandemic for the current inventory shortage, the pandemic can’t take all the credit. While it did make some sellers hold off on listing their houses over the past year, the truth is the low supply of homes was years in the making. Let’s take a look at the root cause and what the future holds to uncover why now is still a great time to sell. Where Did the Shortage Come From? It’s not just today’s high buyer demand. Our low supply goes hand-in-hand with the number of new homes built over the past decades. According to Sam Khater, VP and Chief Economist at Freddie Mac: “The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes.” Data in a recent report from the National Association of Realtors (NAR) tells the same story. New home construction has been lagging behind the norm for quite some time. Historically, builders completed an average of 1.5 million new housing units per year. However, since the housing bubble in 2008, the level of new home construction has fallen off (see graph below): The same NAR report elaborates on the impact of this below-average pace of construction:

“. . . the underbuilding gap in the U.S. totaled more than 5.5 million housing units in the last 20 years.” “Looking ahead, in order to fill an underbuilding gap of approximately 5.5 million housing units during the next 10 years, while accounting for historical growth, new construction would need to accelerate to a pace that is well above the current trend, to more than 2 million housing units per year. . . .” That means if we build even more new houses than the norm every year, it’ll still take a decade to close the underbuilding gap contributing to today’s supply-and-demand mix. Does that mean today’s ultimate sellers’ market is here to stay? We’re already starting to see an increase in new home construction, which is great news. But newly built homes can’t bridge the supply gap we’re facing right now on their own. In the State of the Nation’s Housing 2021 Report, the Joint Center for Housing Studies of Harvard University (JCHS) says: “…Although part of the answer to the nation’s housing shortage, new construction can only do so much to ease short-term supply constraints. To meet today’s strong demand, more existing single-family homes must come on the market.” Early Indicators Show More Existing-Home Inventory Is on Its Way When we look at existing homes, the latest reports signal that housing supply is growing gradually month-over-month. This uptick in existing homes for sale shows things are beginning to shift. Based on recent data, Odeta Kushi, Deputy Chief Economist at First American, has this to say: “It looks like existing inventory is starting to inch up, which is good news for a housing market parched for more supply.” Lawrence Yun, Chief Economist at NAR, echoes that sentiment: “As the inventory is beginning to pick up ever so modestly, we are still facing a housing shortage, but we may have turned a corner.” So, what does all of this mean for you? Just because life is starting to return to normal, it doesn’t mean you missed out on the best time to sell. It’s not too late to take advantage of today’s sellers’ market and use rising equity and low interest rates to make your next move. Bottom Line It’s still a great time to sell. Even though housing supply is starting to trend up, it’s still hovering near historic lows. Talk to a trusted real estate professional about how you can list your house now and use the inventory shortage to get the best possible terms for you. SOURCE KCM #ForSellers #NewConstruction #SellingMyths #SimardRealtyGroup #RealBrokerLLC

Owning your home provides many benefits, including stability, safety, and personal pride. Let's connect if you're dreaming of homeownership this year

SOURCE: KCM #TopGranbyRealtor #StephenSimard #RealBrokerLLC #GranbyRealEstate #GranbyConnecticut #FindyourGranbyhome #Newhomesforsale #SimardRealtyGroup #Granbyhomesforsale #JoinRealBrokerLLC #Simsburyhomes If you’re a prospective buyer or seller, it’s important to understand the current real estate market conditions and how they affect you. The Counselors of Real Estate (CRE) just released its Top Ten Issues Affecting Real Estate report. Here are three hot topics from the list and how they impact today’s housing market.

Technology Acceleration and Innovation The past year ushered in many changes to the real estate industry, especially when it comes to technology. The CRE report elaborates on this: “Lockdown-driven changes in our work, in the economy, in social structures, and in our personal behavior have pushed our reluctance aside. The acceleration and adoption of technology during the pandemic has impacted everything, and real estate is no exception.” For real estate, innovations like digital documentation, virtual tours, and video chat enable agents to connect with clients no matter their location. These options are ideal for prospective buyers and sellers who aren’t local to the area or those that need the added flexibility signing documents online or doing virtual tours provide. That’s why many trusted real estate advisors will continue to use these technologies moving forward to best serve their clients. Remote Work and Mobility Working from home became the reality for many individuals during the pandemic, and the latest list from the CRE identified remote work and mobility as an important influence on the real estate market. As the report notes: “…the pandemic universally caused a movement away from urban cores, particularly for those with higher incomes who could afford to move and for lower-income individuals seeking lower costs of living. Most of these relocations remained within their original region—84%—and, while some are returning, it is unknown as to the permanence of these movements or whether they represent a true urban exodus.” With the added mobility remote work offers, where people are moving and where they can ultimately purchase a home is less dependent on a physical office location. This newfound flexibility is giving remote workers the opportunity to move to more affordable areas and buy more home for their money. Housing Supply and Affordability Finally, the limited supply of houses for sale and the related affordability challenges also makes CRE’s list of key factors this year: “According to the National Association of Realtors®, the state of America’s housing inventory is dire, with a chronic shortage of affordable and available homes needed to support the nation’s population.” There is good news. Homes are still more affordable than they have been historically thanks to today’s low mortgage rates. And while housing supply is still low, we’re seeing steady increases in the number of homes coming to market, which gives hope to homebuyers. As the supply of homes for sale improves, buyers will have more options. Bottom Line New technology, remote work, housing supply, and home affordability are key factors in the housing market right now for both buyers and sellers. Connect with your trusted real estate advisor to better understand how these topics can impact the buying and selling process for you. SOURCE KCM #ForBuyers #HousinsMarketUpdate #SimardRealtyGroup #RealBrokerLLC Some Highlights

SOURCE KCM #ForBuyers #Infographics #ForSellers #SimardRealtyGroup #RealBrokerLLC |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed