|

Selling your house is no simple task. And when you sell on your own – known as a FSBO (or For Sale by Owner) – you’re responsible for handling some of the more difficult aspects of the process without the expert guidance you need.

The 2021 Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) surveys homeowners who recently sold their house on their own and asks what difficulties they faced. Those sellers say some of the biggest headaches are prepping their house for sale, pricing it right, and handling the required paperwork. Working with an agent is the best way to ensure you have an expert on your side to guide you at every turn. Agents have the skills and knowledge that are essential to navigating each step with ease, efficiency, and accuracy. Here are just a few things a real estate agent will do to make sure you get the most out of your sale. 1. Make the Best First Impression Selling your house requires a significant amount of time and effort. Doing it right takes expertise and an understanding of today’s buyers. Your agent knows the answers to common questions, such as:

Your time and money are important, and you don’t want to waste either one focusing on the wrong things. A real estate advisor relies on their experience to answer these questions and more, allowing you to make the right investments to prep your house before you list. 2. Maximize Your Buyer Pool – and Your Sale Today, the average home is getting 3.6 offers per sale according to recent data from NAR. That’s great news if you’re planning to sell, since the more offers you receive, the more likely you are to sell your house in a bidding war, and for a higher price. Real estate agents have an assortment of tools at their disposal, like social media followers and agency resources, that will ensure your house is viewed by the most buyers. Without access to these tools and your agent’s marketing expertise, your buyer pool – and your home’s selling potential – is limited. 3. Understand the Documentation, Including the Fine Print Today, when a house is sold, more disclosures and regulations are mandatory, meaning the number of legal documents to juggle is growing. It’s hard to understand all the requirements and fine print (especially if you’re not an expert). That’s why your advisor is an invaluable guide. Your agent knows exactly what needs to happen, what all the paperwork means, and can work through it efficiently. They’ll help you review the documentation and avoid any costly missteps that could happen if you tackle it on your own. 4. Act as Your Expert Negotiator If you sell without an agent, you’ll also be solely responsible for all negotiations. That means you have to coordinate with:

Instead of going toe-to-toe with all these parties alone, lean on an expert. Your agent relies on experience and training to make the right moves throughout the negotiation. They’ll know what levers to pull, how to address each individual concern, and when you may want to get a second opinion. When you sell your house yourself, you’ll need to be prepared to have these conversations on your own. 5. Price It Right Real estate professionals have the expertise to price your house accurately and competitively. To do so, they compare your house to recently sold homes in your area and factor in the current condition of your house. These factors are key to making sure your house is priced to move quickly and get you the maximum return on your investment. When you sell as a FSBO, you’re operating without this advantage. That could cost you in the long run if you price your house too high or too low. Bottom Line There’s a lot that goes into selling your house, and it takes time, effort, and expertise to truly maximize your sale. Instead of tackling it alone, reach out to a trusted real estate advisor to make sure you have an expert on your side. SOURCE:KCM #ForSellers #FSBOs #SellingMyths #SimardRealtyGroup #RealBrokerLLC

0 Comments

As we move into 2022, both buyers and sellers are wondering, what’s next? Will there be more homes available to buy? Will prices keep climbing? How high will mortgage rates go? For the answer to those questions and more, we turn to the experts. Here’s a look at what they say we can expect in 2022.

Odeta Kushi, Deputy Chief Economist, First American: “Consensus forecasts put rates at about 3.7% by the end of next year. So, that’s still historically low, but certainly higher than they are today.” Danielle Hale, Chief Economist, realtor.com: “Affordability will increasingly be a challenge as interest rates and prices rise, but remote work may expand search areas and enable younger buyers to find their first homes sooner than they might have otherwise. And with more than 45 million millennials within the prime first-time buying ages of 26-35 heading into 2022, we expect the market to remain competitive.” Lawrence Yun, Chief Economist, National Association of Realtors (NAR): “With more housing inventory to hit the market, the intense multiple offers will start to ease. Home prices will continue to rise but at a slower pace.” George Ratiu, Manager of Economic Research, realtor.com: “We also expect a growing number of homeowners to bring properties to market, taking some pressure off high prices and offering buyers more options.” Mark Fleming, Chief Economist, First American: “Strong demographic demand will continue to act as the wind in the housing market’s sails.” What Does This Mean for Buyers? Hope is on the horizon for 2022. You should see your options grow as more homes are listed and some of the peak intensity of buyer competition starts to ease. Just remember, rising rates and prices are a great motivator for you to find the home of your dreams sooner rather than later so you can buy while today’s affordability is still in your favor. What Does This Mean for Sellers? Make no mistake – this sellers’ market will remain in 2022 as home prices are projected to continue climbing, just at a more moderate pace. Selling your house while buyer demand is so high will truly put you in the driver’s seat. But don’t wait too long. With more listings projected to become available, your ideal window of opportunity to stand out from the crowd won’t last forever. Work with an agent who knows your local market and current inventory conditions to ensure you have the support you need to make an educated and informed decision about selling in the coming year. Bottom Line If you’re thinking of buying or selling, 2022 may be your year. Partner with a real estate professional to discuss your goals and the unique opportunities you have in today’s housing market. SOURCE:KCM #ForBuyers #ForSellers #HousingMarketUpdates #InterestRates #Pricing #SimardRealtyGroup #RealBrokerLLC

SOURCE:KCM

#SimardRealtyGroup #RealBrokerLLC As a buyer in a sellers’ market, sometimes it can feel like you’re stuck between a rock and a hard place. When you’re ready to make an offer on a home, remember these five easy tips to help you rise above the competition.

1. Know Your Budget Knowing your budget and what you can afford is critical to your success as a homebuyer. The best way to understand your numbers is to work with a lender so you can get pre-approved for a loan. As Freddie Mac puts it: “This pre-approval allows you to look for a home with greater confidence and demonstrates to the seller that you are a serious buyer.” Showing sellers you’re serious can give you a competitive edge, and it helps you act quickly when you’ve found your perfect home. 2. Be Ready To Move Fast Homes are selling quickly in today’s competitive housing market. According to the Existing Home Sales Report from the National Association of Realtors (NAR): “Eighty-three percent of homes sold in November 2021 were on the market for less than a month.” When houses are selling this fast, staying on top of the market and moving quickly are key. Your agent can help you put together and submit your best offer as soon as you find the home you want to buy. 3. Lean on a Real Estate Professional No matter what the housing market looks like, rely on a trusted real estate advisor. As Freddie Mac also notes: “The success of your homebuying journey largely depends on the company you keep. . . . Be sure to select experienced, trusted professionals who will help you make informed decisions and avoid any pitfalls.” Agents are experts in the local real estate market. They have insight into what’s worked for other buyers in your area and what sellers may be looking for in an offer. It may seem simple, but catering to what a seller needs can help your offer stand out. 4. Make a Strong, but Fair Offer According to the latest Realtors Confidence Index from NAR, 40% of offers today are above the list price. In such a competitive market, emotions and prices can run high. Having an agent to help you submit a strong, yet fair offer is critical in these situations. Your agent can help you understand the market value of the home and recent sales trends in the area. 5. Be a Flexible Negotiator When putting together an offer, your trusted real estate advisor will help you consider which levers you can pull, including contract contingencies (conditions you set that the seller must meet for the purchase to be finalized). Of course, there are certain contingencies you don’t want to give up. Freddie Mac explains: "Resist the temptation to waive the inspection contingency, especially in a hot market or if the home is being sold ‘as-is’, which means the seller won’t pay for repairs. Without an inspection contingency, you could be stuck with a contract on a house you can’t afford to fix.” Bottom Line Today’s competitive landscape makes it more important than ever to make a strong offer on a home. Work with a local real estate professional to make sure you rise to the top along the way. SOURCE:KCM #BuyingMyths #FirstTimeHomeBuyers #ForBuyers #Move-UpBuyers #SimardRealtyGroup #RealBrokerLLC If you’re thinking of selling your house, there’s good news. The number of buyers in the market still far outweigh how many houses are available for sale, especially as millennials reach homebuying age. That's great news for you and your house sale. DM me today so we can discuss what this demand means for you.

#millennialhomebuyers #justsold #sellyourhouse #buyerdemand #firsttimehomebuyer #opportunity #housingmarket #househunting #expertanswers #stayinformed #staycurrent #powerfuldecisions #keepingcurrentmatters Once you’ve found your dream home and applied for a mortgage, there are some key things to keep in mind before you close. It’s exciting to start thinking about moving in and decorating your new place, but before you make any large purchases, move your money around, or make any major life changes, be sure to consult your lender – someone who’s qualified to explain how your financial decisions may impact your home loan.

Here’s a list of things you shouldn’t do after applying for a mortgage. They’re all important to know – or simply just good reminders – for the process. 1. Don’t Deposit Cash into Your Bank Accounts Before Speaking with Your Bank or Lender. Lenders need to source your money, and cash isn’t easily traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer. 2. Don’t Make Any Large Purchases Like a New Car or Furniture for Your Home. New debt comes with new monthly obligations. New obligations create new qualifications. People with new debt have higher debt-to-income ratios. Since higher ratios make for riskier loans, qualified borrowers may end up no longer qualifying for their mortgage. 3. Don’t Co-Sign Other Loans for Anyone. When you co-sign, you’re obligated. With that obligation comes higher debt-to-income ratios as well. Even if you promise you won’t be the one making the payments, your lender will have to count the payments against you. 4. Don’t Change Bank Accounts. Remember, lenders need to source and track your assets. That task is much easier when there’s consistency among your accounts. Before you transfer any money, speak with your loan officer. 5. Don’t Apply for New Credit. It doesn’t matter whether it’s a new credit card or a new car. When you have your credit report run by organizations in multiple financial channels (mortgage, credit card, auto, etc.), your FICO® score will be impacted. Lower credit scores can determine your interest rate and possibly even your eligibility for approval. 6. Don’t Close Any Credit Accounts. Many buyers believe having less available credit makes them less risky and more likely to be approved. This isn’t true. A major component of your score is your length and depth of credit history (as opposed to just your payment history) and your total usage of credit as a percentage of available credit. Closing accounts has a negative impact on both of those determinants of your score. Bottom Line Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved. If your job or employment status has changed recently, share that with your lender as well. The best plan is to fully disclose and discuss your intentions with your loan officer before you do anything financial in nature. SOURCE:KCM #BuyingMyths #ForBuyers #SimardRealtyGroup #RealBrokerLLC You may not realize it, but homeownership acts as forced savings as you build equity with each mortgage payment you make. In other words, your home is an investment in your future. DM me today if you’re ready to buy or if you want to know how you can use the equity in your existing home to address your changing needs.

SOURCE : KCM #homeequity #forcedsavings #expertanswers #homepriceappreciation #realestate #homevalues #homeownership #rentvsbuy #homebuying #realestategoals #realestatetips #realestatelife #realestatemarket #keepingcurrentmatters If you’re thinking of buying a home, you’re probably wondering what you need to save for your down payment. Is it 20% of the loan, or could you put down less? While there are lower down payment programs available that allow qualified buyers to put down as little as 3.5%, it’s important to understand the many perks that come with a 20% down payment.

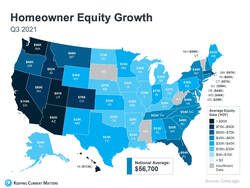

Here are four reasons why putting 20% down may be a great option if it works within your budget. 1. Your Interest Rate May Be Lower A 20% down payment vs. a 3-5% down payment shows your lender you’re more financially stable and not a large credit risk. The more confident your lender is in your credit score and your ability to pay your loan, the lower the mortgage interest rate they’ll likely be willing to give you. 2. You’ll End Up Paying Less for Your Home The larger your down payment, the smaller your loan amount will be for your mortgage. If you’re able to pay 20% of the cost of your new home at the start of the transaction, you’ll only pay interest on the remaining 80%. If you put down 5%, the additional 15% will be added to your loan and will accrue interest over time. This will end up costing you more over the lifetime of your home loan. 3. Your Offer Will Stand Out in a Competitive Market In a market where many buyers are competing for the same home, sellers often like to see offers come in with 20% or larger down payments. The seller gains the same confidence as the lender in this scenario. You are seen as a stronger buyer with financing that’s more likely to be approved. Therefore, the deal will be more likely to go through. 4. You Won’t Have To Pay Private Mortgage Insurance (PMI)What is PMI? According to Freddie Mac: “For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It is not the same thing as homeowner’s insurance. It’s a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment less than 20%. . . . Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment.” As mentioned earlier, if you put down less than 20% when buying a home, your lender will see your loan as having more risk. PMI helps them recover their investment in you if you’re unable to pay your loan. This insurance isn’t required if you’re able to put down 20% or more. Many times, home sellers looking to move up to a larger or more expensive home are able to take the equity they earn from the sale of their house to put 20% down on their next home. With the equity homeowners have today, it creates a great opportunity to put those savings toward a larger down payment on a new home. Bottom Line If you’re looking to buy a home, consider the benefits of 20% down versus a smaller down payment. Lean on a professional for expert advice to help make your homeownership goals a reality. SOURCE KCM #DownPayments #FirstTimeHomebuyer #MoveUpBuyer #SimardRealtyGroup #RealBrokerLLC When you think of homeownership, what’s the first thing that comes to mind? Chances are you might focus on the non-financial benefits, like the security or stability a home provides. But what about equity? While it can be overlooked, a homeowner’s equity helps build long-term wealth over time. Here’s a look at what equity is and why it matters. For a homeowner, your equity is the current value of your home minus what you owe on the loan. So, as home values climb, your equity does too. That’s exactly what’s happening today. There aren’t enough homes on the market to meet buyer demand, so bidding wars and multiple offers are driving prices up. That’s because people are willing to pay more to buy a home. Right now, this low supply and high demand are giving current homeowners a significant equity boost. Dr. Frank Nothaft, Chief Economist at CoreLogic, explains it like this: “Home price growth is the principal driver of home equity creation. The CoreLogic Home Price Index reported home prices were up 17.7% for the past 12 months ending September, spurring the record gains in home equity wealth.” To find out just how much rising home values have impacted equity, we turn to the latest Homeowner Equity Insights from CoreLogic. According to that report, the average homeowner’s equity has grown by $56,700 over the last 12 months. Curious how your state stacks up? Check out the map below to find out the average equity gain for your area.  How Rising Equity Impacts You

If you’re already a homeowner, equity not only builds your wealth, it also opens doors for you to achieve your goals. It works like this: when you sell your house, the equity you built up comes back to you in the sale. You can use those proceeds to fuel your next move, especially if you’ve decided your needs have changed and you’re looking for something new. If you’re thinking about becoming a homeowner, understanding the importance of equity can help you realize why homeownership is a worthwhile goal. It builds your wealth and gives you peace of mind that your investment is a wise one, not just from a lifestyle perspective, but from a financial one too. Bottom Line Whether you’re a current homeowner or you’re ready to become one, it’s important to know how equity works and why it matters. If this inspires you to make a move, work with a trusted real estate professional to explore your options and find out what steps you need to take next. SOURCE : KCM #ForSellers #HousingMarketUpdates #Pricing #SimardRealtyGroup #RealBrokerLLC The mortgage pre-approval process is one of the most important steps you can take as a buyer. Not only does it help you understand what you can afford, it shows sellers you’re serious about buying their home. DM me any questions you have about the process so you can get started on your homeownership journey.

#homebuyingprocess #homegoals #homeowner #firsttimehomebuyer #opportunity #housingmarket #househunting #realestateexperts #instarealestate #instarealtor #realestatetipsoftheday #realestatetipsandadvice #keepingcurrentmatters |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed