|

Some Highlights:

SOURCE KCM #FirstTimeHomeBuyer #Infographic #SimardRealtyGroup #eXpRealty

0 Comments

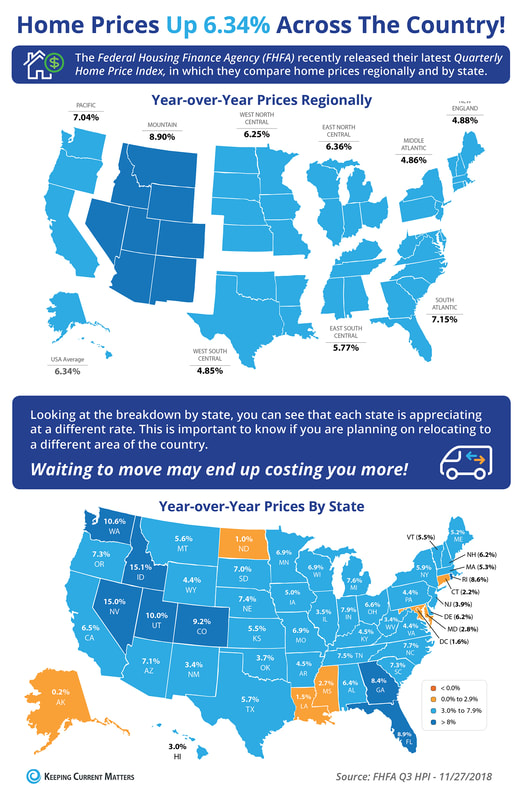

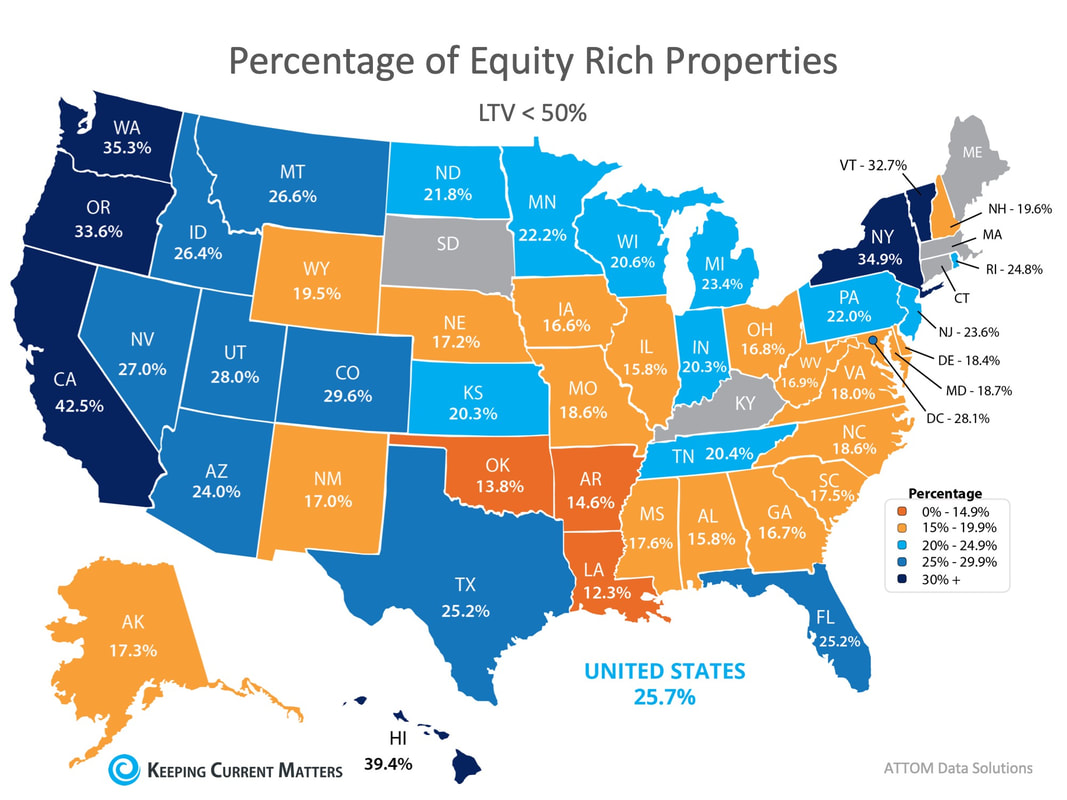

Home sales numbers are leveling off, the rate of price appreciation has slowed to more historically normal averages, and inventory is finally increasing. We are headed into a more normal housing market. However, some are seeing these adjustments as red flags and are suggesting that we are headed back to the same challenges we experienced in 2008. Today, let’s look at one set of statistics that prove the current market is nothing like the one that preceded the housing crash last decade. The previous bubble was partially caused by unhealthy levels of mortgage debt. New purchasers were putting down the minimum down payment, resulting in them having little if any equity in their homes. Existing homeowners were using their homes as ATMs by refinancing and swapping their equity for cash. When prices started to fall, many homeowners found themselves in a negative equity situation (where their mortgage was higher than the value of their home) so they walked away which caused prices to fall even further. When this happened, even more homeowners found themselves in negative equity situations which caused them to walk away as well, and so a vicious cycle formed. Today, the equity situation is totally different. According to a new report from ATTOM Data Solutions more than 1-in-4 homes with a mortgage have at least 50% equity. The report explains: “…nearly 14.5 million U.S. properties were equity rich — where the combined estimated amount of loans secured by the property was 50 percent or less of the property’s estimated market value…The 14.5 million equity rich properties in Q3 2018 represented 25.7 percent of all properties with a mortgage.” In addition, according to the U.S. Census Bureau, 30.3% of homes in the country have no mortgage on them. Almost 50% of all homes have at least 50% equity.

If we take both numbers, the 30.3% of all homes without a mortgage and the 17.9% with at least 50% equity (25.7% of the 69.3% of homes with a mortgage), we realize that 48.2% of all homes in the country have at least 50% equity. Bottom Line Unlike 2008, almost half of the homeowners in the country are sitting on massive amounts of home equity. They will not be walking away from their homes if the housing market begins to soften. SOURCE KCM #ForSellers #ForBuyers #SimardRealtyGroup #eXpRealty

Every year at this time there are many homeowners who decide to wait until after the holidays to list their homes. Here are 5 powerful reasons why waiting until after the holidays to sell your home probably doesn't make sense. Let's get together today to discuss how we can market your home this holiday season!

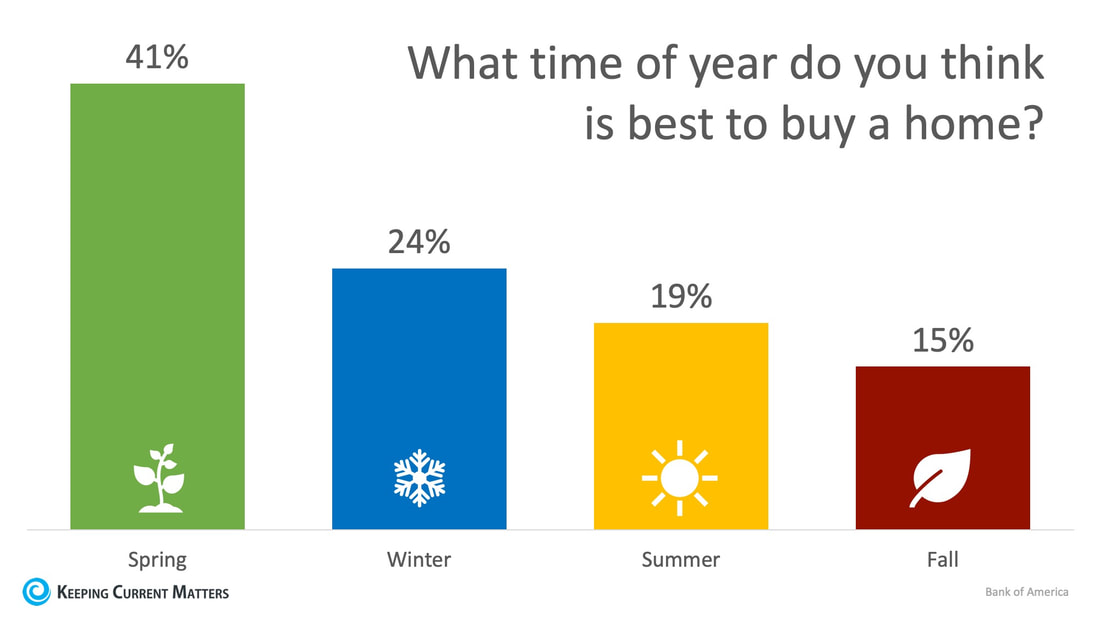

In real estate, the spring is often seen as the ideal time to buy or sell a house. The term “Spring Buyer’s Season” exists for a reason, as renters and those looking to move on from their current home thaw out from the winter and hit the market ready to buy. According to Bank of America’s annual Home Buyer Insights Report, 41% of renters surveyed agree that spring is the best time to buy a home. The surprising result, however, is that when ranking the seasons, winter comes in second at 24%. In many areas of the country, the spring and summer are the most competitive seasons for buyers. Families with children often want to move over the summer to make sure that their kids are ready for school in the fall. This often leads those families who haven’t found homes to buy to push pause on their search in the fall and winter months.

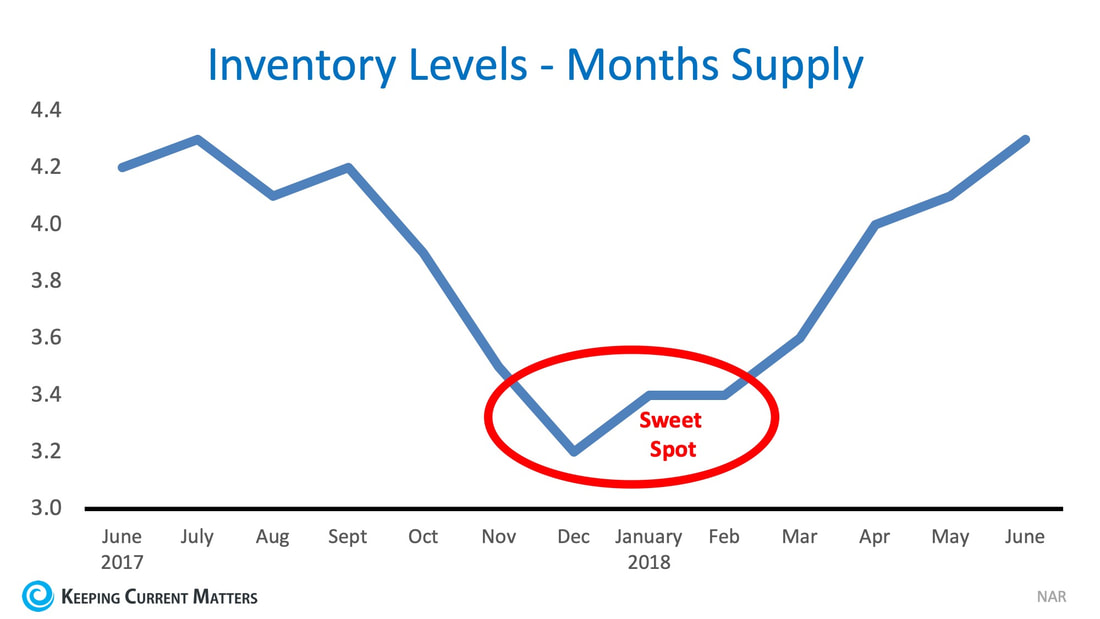

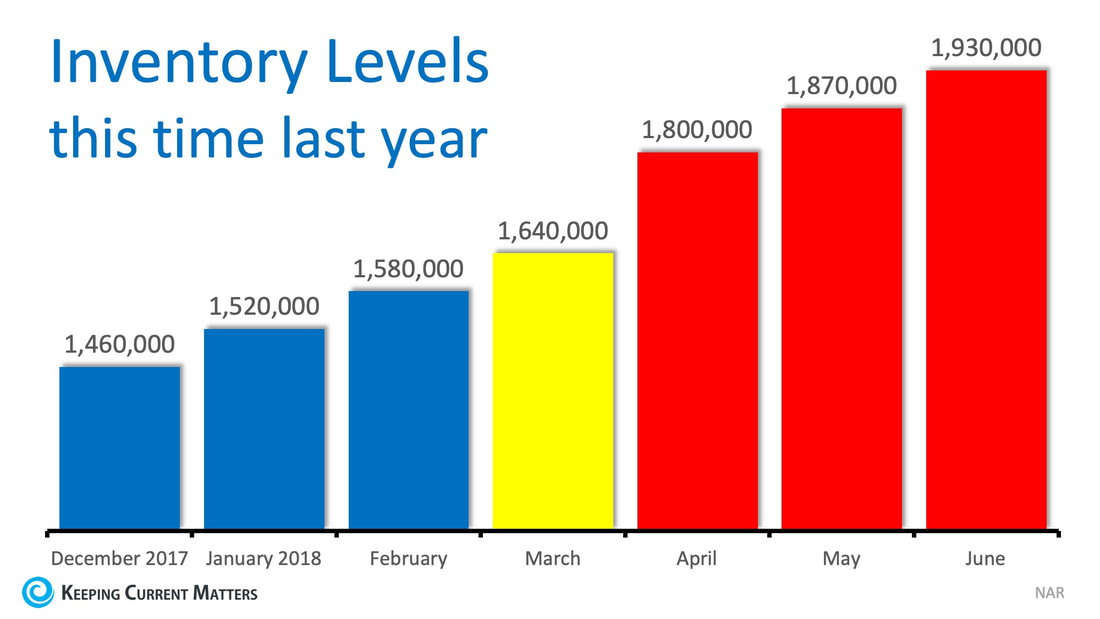

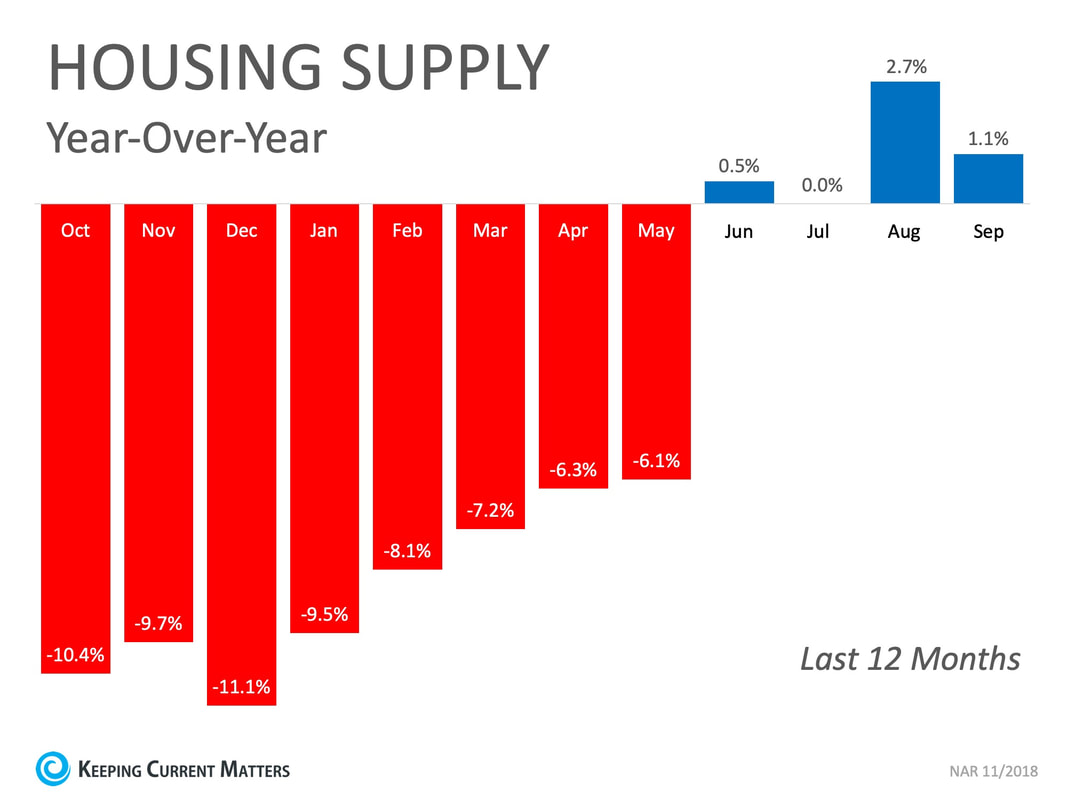

This creates a great environment for buyers to find a home with less competition. According to moving.com, scheduling a move during the winter months also comes with the best price. “If you define ‘best’ by cost then, generally speaking, you are more likely to save on a move during the late September to April window. Demand for movers usually slows down during this time frame and rates are low.” There are also many benefits to listing your house for sale during the winter months as well! As we recently mentioned, buyers who are out in the winter are serious about wanting to find a home, and there is traditionally less competition on the market which gives you greater exposure to those buyers. Bottom Line As always, the best time to buy or move all depends on each individual buyer or seller’s goals and needs. If you are one of the many who would like to make a move this winter, contact a local real estate professional who can help you create a plan to make it happen! SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #joineXpRealty Many sellers believe that spring is the best time to place their homes on the market because buyer demand traditionally increases at that time of year, but what they don’t realize is that if every homeowner believes the same thing, then that is when they will have the most competition! The #1 Reason to List Your Home in the Winter Months is Less Competition! Housing supply traditionally shrinks at this time of year, so the choices buyers have will be limited. The chart below was created using the months’ supply of listings from the National Association of Realtors. As you can see, the ‘sweet spot’ to list your home for the most exposure naturally occurs in the late fall and winter months (November – February). Temperatures aren’t the only thing that heats up in the spring – so do listings! In 2017, listings increased by nearly half a million houses from December to June. Don’t wait for these listings to come to market before you decide to list your house.

Added Bonus: Only Serious Buyers Are Out in the Winter At this time of year, only those purchasers who are serious about buying a home will be in the marketplace. You and your family will not be bothered and inconvenienced by mere ‘lookers.’ The lookers are at the mall or online doing their holiday shopping. Bottom Line If you have been debating whether or not to sell your home and are curious about market conditions in your area, talk with a local real estate professional who can help you decide the best time to list your house for sale. SOURCE KCM #ForSellers #MoveUpBuyers #SellingMyths #SimardRealtyGroup #eXpRealty Many homebuyers think that saving for their down payment is enough to buy the house of their dreams, but what about the closing costs that are required to obtain a mortgage?

By law, a homebuyer will receive a loan estimate from their lender 3 days after submitting their loan application and they should receive a closing disclosure 3 days before the scheduled closing on their home. The closing disclosure includes final details about the loan and the closing costs. But what are closing costs anyway? According to Trulia: “Closing costs are lender and third-party fees paid at the closing of a real estate transaction, and they can be financed as part of the deal or be paid upfront. They range from 2% to 5% of the purchase price of a home. (For those who buy a $150,000 home, for example, that would amount to between $3,000 and $7,500 in closing fees.)” Keep in mind that if you are in the market for a home above this price range, your costs could be significantly greater. As mentioned before, Closing costs are typically between 2% and 5% of your purchase price.Trulia continues to give great advice, saying that: “…understanding and educating yourself about these costs before settlement day arrives might help you avoid any headaches at the end of the deal.” Bottom Line Speak with your lender and agent early and often to determine how much you’ll be responsible for at closing. Finding out that you’ll need to come up with thousands of dollars right before closing is not a surprise anyone is ever looking forward to. SOURCE KCM #ForBuyers #MoveUpBuyers #SimardRealtyGroup #eXpRealty

One way to show you're serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search.

#preapproved #sellingyourhome #sellingCT #SimardRealtyGroup #eXpRealty Some Highlights:

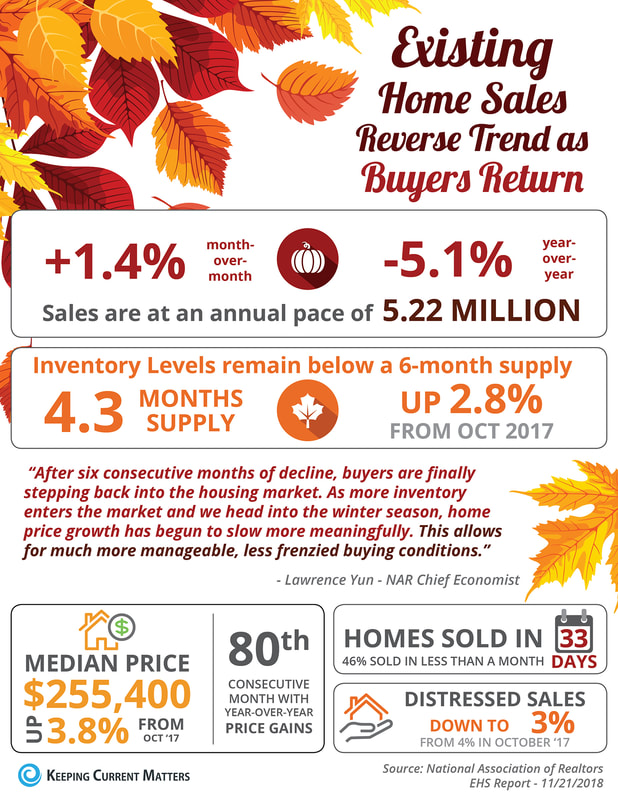

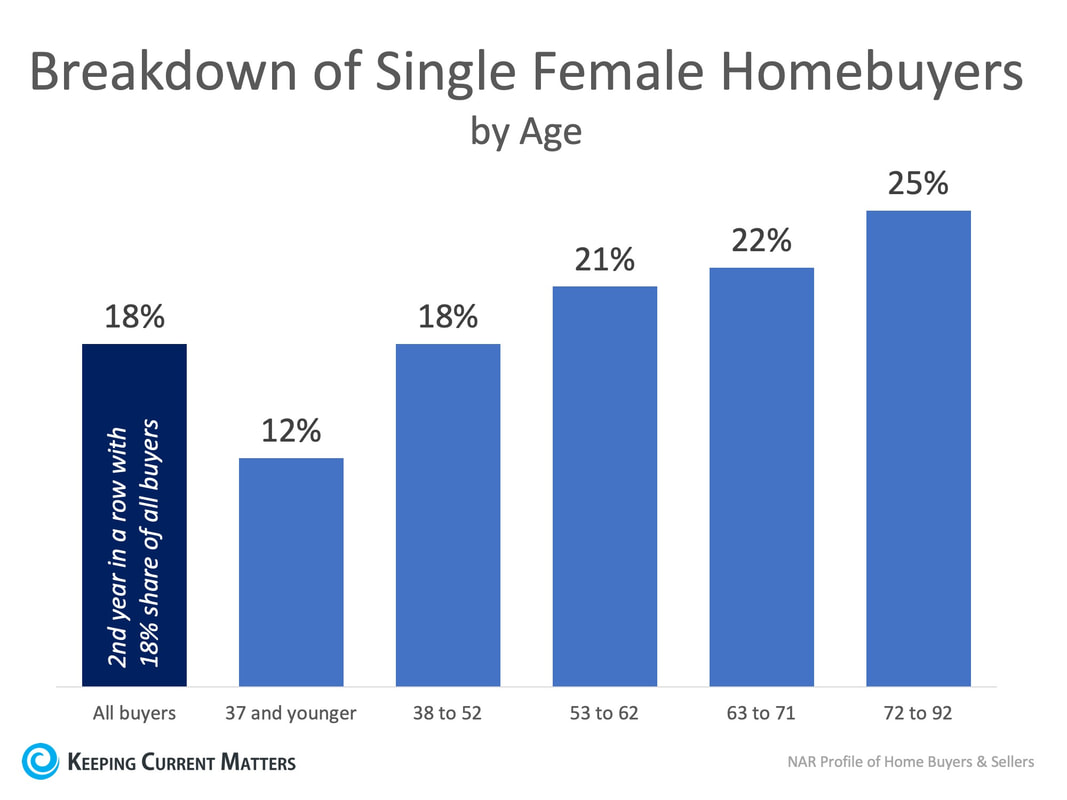

SOURCE KCM #ForBuyers #Infographics #HousingMarketUpdate #SimardRealtyGroup #eXpRealty Everyone wants a place to call home; a place that gives them a sense of security. We are currently seeing major interest from females who want to achieve this dream, and the numbers are proving it! In 2018, for the second year in a row, single female buyers accounted for 18% of all buyers. In 2017, 60% of millennial women listed as the primary borrowers on mortgages were single. According to the 2018 Home Buyer and Seller Generational Trends Report by the National Association of Realtors, one in five homebuyers in the U.S. were single females (most of them part of the baby boomer generation) as you can see in the graph below: This does not come as a surprise since 50.8% of the U.S. population is female and 15.6% of them are 65 years and over, according to the Census Bureau.

What are the reasons for this demographic’s booming interest in homeownership?Bankrate published an article with what they believe to be some of the reasons:

Not really; The Institute of Luxury Home Marketing recently stated that: “The number of female billionaires grew faster globally in 2017 than the number of male billionaires. This redistribution of wealth has seen an impact on luxury real estate both in its purchase and design attributes – and obviously, this is important for realtors to recognize when relating to their clients.” Bottom Line Whether you are a millennial who wants to buy a starter home, a billionaire looking for that luxury home you’ve always wanted, or maybe even someone who just went through a gray divorce, contact a local real estate professional who can help you create your real estate portfolio and start investing your money in real estate today! SOURCE KCM #FirstTimeHomeBuyers #Millenials #SimardRealtyGroup #eXpRealty Every year at this time there are many homeowners who decide to wait until after the holidays to list their homes for the first time, while others who already have their homes on the market decide to take them off until after the holidays. Here are seven great reasons not to wait:

6. The desire to own a home doesn’t stop when the holidays come. Buyers who were unable to find their dream homes during the busy spring and summer months are still searching!

7. The supply of listings increases substantially after the holidays. Also, in many parts of the country, new construction will continue to surge and reach new heights which will lessen the demand for your house in 2019. Bottom Line Waiting until after the holidays to sell your home probably doesn’t make sense. SOURCE KCM #ForSellers #ForBuyers #SimardRealtyGroup #eXpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed