|

🎉🎉🎉 Congrats Kim! Wishing you happiness in your new home! 🏡🏡🏡

#Sold #HappyClients #SimardRealtyGroup #eXpRealty There are many conflicting headlines when it comes to describing today’s real estate market. Some are making comparisons to the market we experienced 10 years ago and are starting to believe that we may be doomed to repeat ourselves. Others are just plain wrong when it comes to what it takes to qualify for a mortgage.

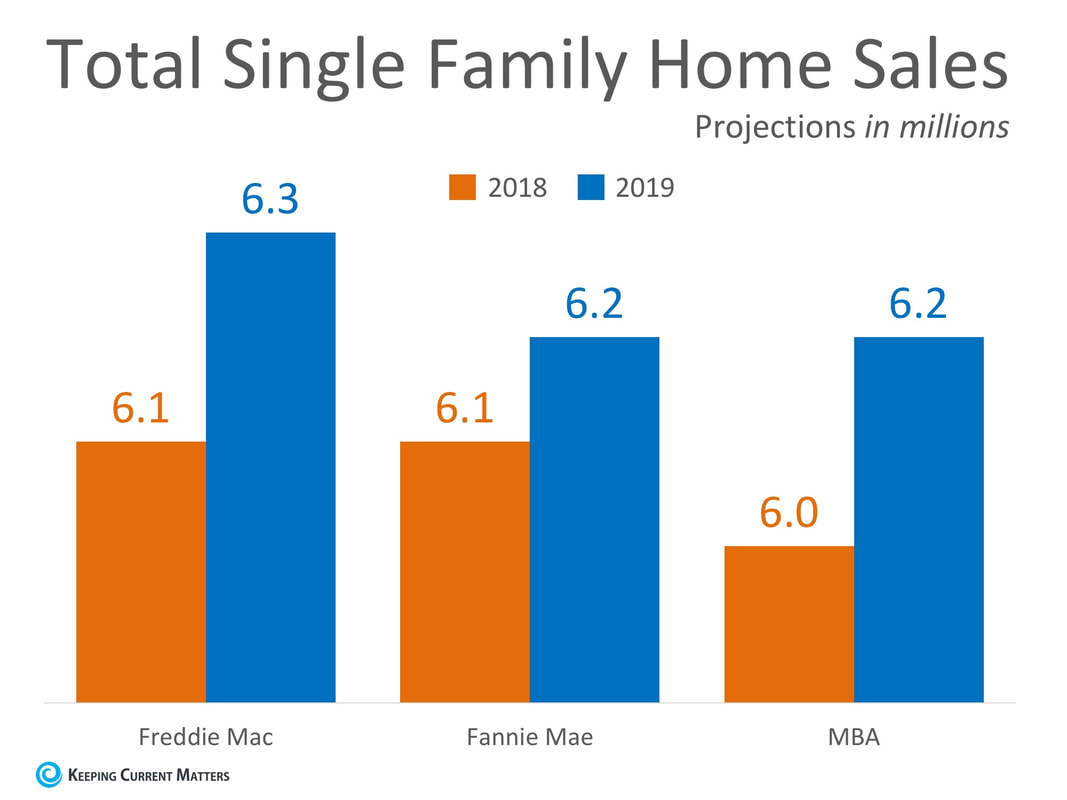

Today, we want to try and clear the air by shedding some light on what’s causing some of these headlines, as well as what’s truly going on. Myth #1: We Are Headed for Another Housing Bubble Home prices have appreciated year-over-year for the last 76 straight months. Many areas of the country are at or near their peak prices achieved before the last housing bubble burst. This has many worried that we are headed towards another housing bubble. Reality: The biggest challenge facing today’s real estate market is a lack of homes for sale! Demand is strong, as many renters have come off the fence and are searching for their dream homes. Historically, a normal market requires a 6-month supply of inventory in order for prices to rise with the rate of inflation. According to the National Association of Realtors (NAR) there is currently a 4.3-month supply of inventory. The US housing market hasn’t had 6-months inventory since August 2012! The concept of supply and demand is what is driving home prices up! Myth #2: The Rumored Recession Will Lead to Another Housing Market Crash Economists and analysts know that the country has experienced economic growth for almost a decade. When this happens, they also know that a recession can’t be too far off. But what is a recession? Merriam-Webster defines a recession as “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two consecutive quarters.” Reality: Recession DOES NOT equal housing crisis. Many people associate these two terms with one another because the last time we had a recession it was caused by a housing crisis. According to the Federal Reserve, over the last 40 years, there have been six recessions. In each of the previous five recessions, home values appreciated. Myth #3: There is an Affordability Crisis Looming Rising home prices have many concerned that the average family will no longer be able to afford the most precious piece of the American Dream – their own home. There are many different affordability indexes supported by different organizations that all measure different data. For this reason, there is a lot of confusion about what “affordable” actually means. The monthly cost of a home is determined by the home’s price and the interest rate on the mortgage used to purchase it. According to Freddie Mac, interest rates have risen from 3.95% in January to 4.59% just last week. Reality: As we mentioned earlier, home prices have appreciated year-over-year for the last 76 months, largely driven by high demand and low supply. According to a recent study by Zillow, the percentage of median income necessary to buy a home in today’s market (17.1%) is well below the mark reached in 1985 – 2000 (21%), as well as the mark reached in 2006 (25.4)! Interest rates would have to increase to 6% before buying a home would be less affordable than historical norms. The starter-home market has appreciated at higher levels (9.4% year-over-year) than any other market. One reason for this is the fact that many of the first-time buyers who have flocked to the starter-home market are being met with high competition. For some hopeful buyers, it may take more than a good offer to stand out from the crowd! Bottom LineThere is a lot of confusion in today’s real estate market. If your future plans include buying or selling, make sure you have a trusted advisor and market expert by your side to help guide you to the best decision for you and your family. SOURCE KCM #Buyers #RealEstateMarket #SimardRealtyGroup #eXpRealty Freddie Mac, Fannie Mae, and the Mortgage Bankers Association are all projecting that home sales will increase nicely in 2019. Below is a chart depicting the projections of each entity for the remainder of 2018, as well as for 2019. As we can see, Freddie Mac, Fannie Mae, and the Mortgage Bankers Association all believe that homes sales will increase steadily over the next year. If you are a homeowner who has considered selling your house recently, now may be the best time to put it on the market.

SOURCE KCM #ForSellers #HousingMarketUpdates #Move-UpBuyers

Recent price increases have some concerned that current home values are overinflated, but year-over-year appreciation is reasonable based on historic appreciation levels.

Last week, in a new report from Zillow, it was revealed that there has been a rash of price reductions across the country. According to the report:

Senior Economist Aaron Terrazas further explained: “A rising share of on-market listings are seeing price cuts, though these price cuts are concentrated at the most expensive price-points and primarily in markets that have seen outsized price gains in recent years.” What this DOESN’T MEAN for the real estate market… This doesn’t mean home values have depreciated or are about to depreciate. A seller may put a home worth $300,000 on the market for $325,000 hoping a bidding war will occur and an overanxious buyer will pay more than its actual value. That has happened often over the last few years. If the seller gets no offers and reduces the price to $300,000, it doesn’t mean the home dropped in value. It is still worth $300,000. Home prices will continue to appreciate over the next 12 months. In this same report, Terrazas remarks: “It’s far too soon to call this a buyer’s market, home values are still expected to appreciate at double their historic rate over the next 12 months, but the frenetic pace of the housing market over the past few years is starting to return toward a more normal trend.” What this DOES MEAN for the real estate market… This does mean that sellers should be more conservative when it comes to the price at which they list their homes – especially sellers in the upper end of each market. Sellers have been listing their homes at inflated prices hoping a super-hot market will deliver a buyer willing to pay virtually any price to ensure they don’t lose the house. That strategy has worked somewhat successfully over the last two years. However, the time that strategy would have worked may have passed. Again, quoting Aaron Terrazas in the report: “The housing market has tilted sharply in favor of sellers over the past two years, but there are very early preliminary signs that the winds may be starting to shift ever-so-slightly.” Bottom Line Prices are not depreciating. However, if you want to sell your house quickly and with the least amount of hassles, pricing it correctly from the beginning makes the most sense. SOURCE KCM #ForSellers #Pricing #SimardRealtyGroup #eXpRealty Every three years, the Federal Reserve conducts their Survey of Consumer Finances in which they collect data across all economic and social groups. Their latest survey data, covering 2013-2016 was recently released.

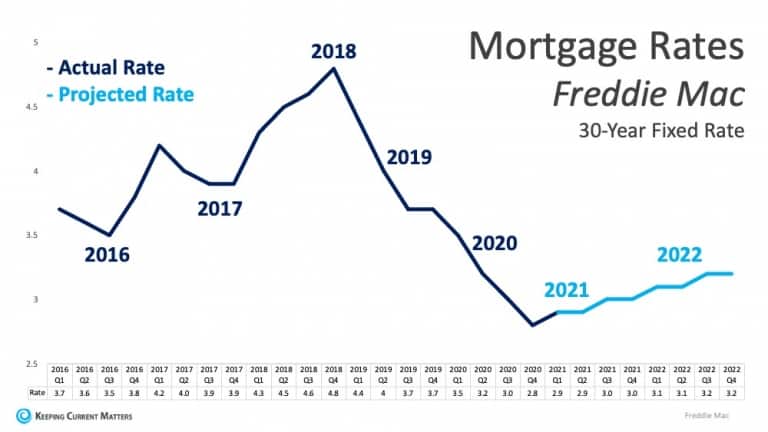

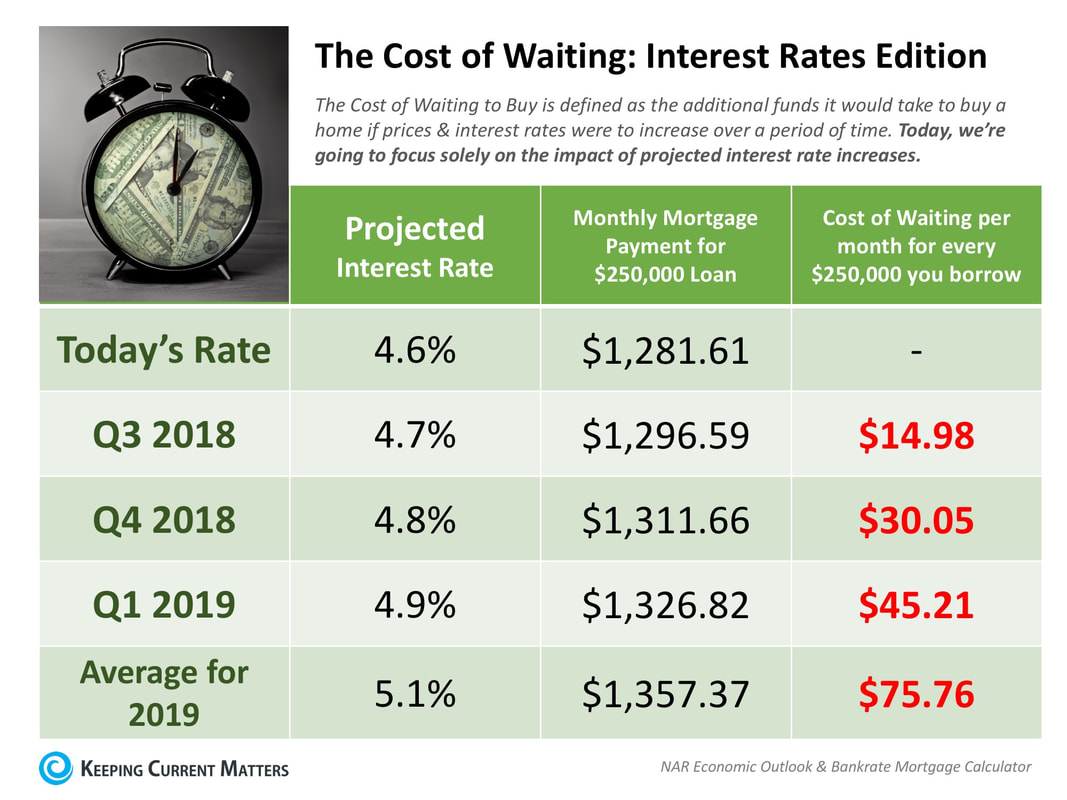

The study revealed that the median net worth of a homeowner was $231,400 – a 15% increase since 2013. At the same time, the median net worth of renters decreased by 5% ($5,200 today compared to $5,500 in 2013). These numbers reveal that the net worth of a homeowner is over 44 times greater than that of a renter. Owning a home is a great way to build family wealth As we’ve said before, simply put, homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you are contributing to your net worth by increasing the equity in your home. That is why, for the fifth year in a row, Gallup reported that Americans picked real estate as the best long-term investment. This year’s results showed that 34% of Americans chose real estate, followed by stocks at 26% and then gold, savings accounts/CDs, or bonds. Greater equity in your home gives you options If you want to find out how you can use the increased equity in your house to move to a home that better fits your current lifestyle, meet with a real estate professional in your area who can guide you through the process. SOURCE KCM #ForBuyers #HomeOwner #SimardRealtyGroup #eXpRealty Some Highlights:

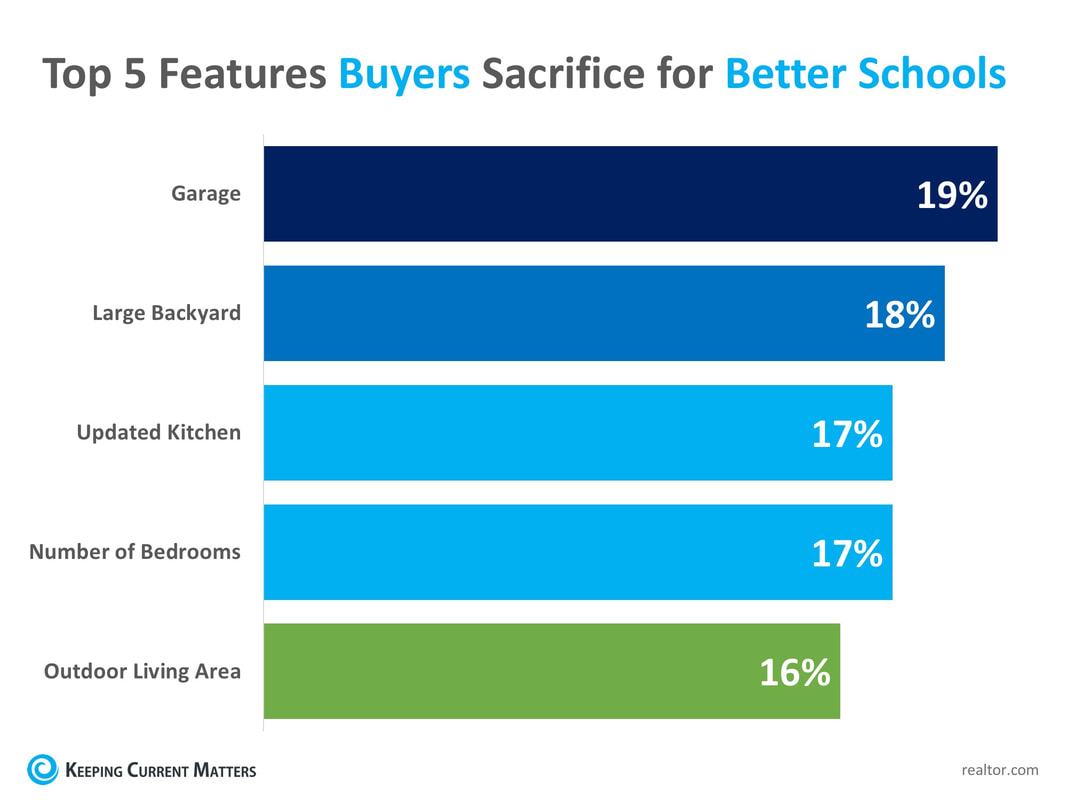

SOURCE KCM #infographic #interestrates #SimardRealtyGroup #eXpRealty It should come as no surprise that buying a home in a good school district is important to homebuyers. According to a report from Realtor.com, 86% of 18-34 year-olds and 84% of those aged 35-54 indicated that their home search areas were defined by school district boundaries. What is surprising, however, is that 78% of recent homebuyers sacrificed features from their “must-have”lists in order to find homes within their dream school districts. The top feature sacrificed was a garage at 19%, followed closely by a large backyard, an updated kitchen, the desired number of bedrooms, and an outdoor living area. The full results are shown in the graph below Buyers are attracted to schools with high test scores, accelerated academic programs, art and music programs, diversity, and before and after-school programs.

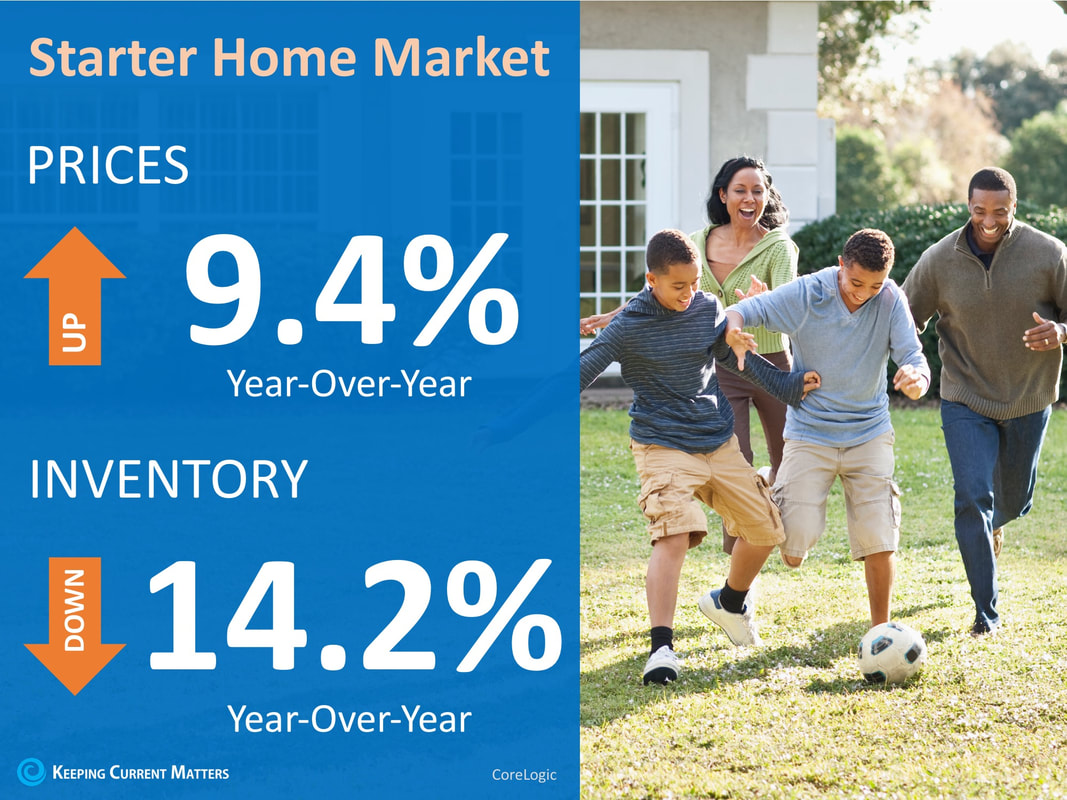

With a limited number of homes available to buy in today’s real estate market, competition is fierce for homes in good school districts. Danielle Hale, Chief Economist for Realtor.com, explained further, “Most buyers understand that they may not be able to find a home that covers every single item on their wish list, but our survey shows that school districts are an area where many buyers aren’t willing to compromise. For many buyers and not just buyers with children, ‘location, location, location,’ means ‘schools, schools, schools.’” (emphasis added) Bottom Line For buyers across the country, the quality of their children’s (or future children’s) education ranks highest on their must-have lists. Before you start the search for your next home, meet with a local real estate agent who can explain the market conditions in your area. SOURCE KCM #HomeBuyers #MoveUpBuyers #SimardRealtyGroup #joineXpRealty For many Americans, buying their first home is their first taste of achieving part of the American Dream. There is a sense of pride that comes along with owning your own home and building your family’s wealth through your monthly mortgage payment. It may seem hard to imagine that the first home you purchased (which made your dreams come true) might not be the home that will allow you to achieve the rest of your dreams. The good news is that it’s ok to admit that your home no longer fits your needs! According to CoreLogic’s latest Home Price Index, prices in the starter home market have appreciated faster than any other category over the last year, at 9.4%. At the same time, inventory in this category has dropped 14.2%. These two stats are directly related to one another. As inventory has decreased and demand has increased, prices have been driven up.

This is great news if you own a starter home and are looking to move up to a larger home as the equity in your home has risen as prices have gone up. Even better is the fact that there is a large pool of buyers out there searching for your starter home to help them achieve their American Dream! Bottom Line If you have outgrown your starter home, contact a local real estate professional who can explain the market conditions in your area and help you find your next home! SOURCE KCM #ForBuyers #ForSellers #HousingMarketUpdate #SimardRealtyGroup #eXpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed