|

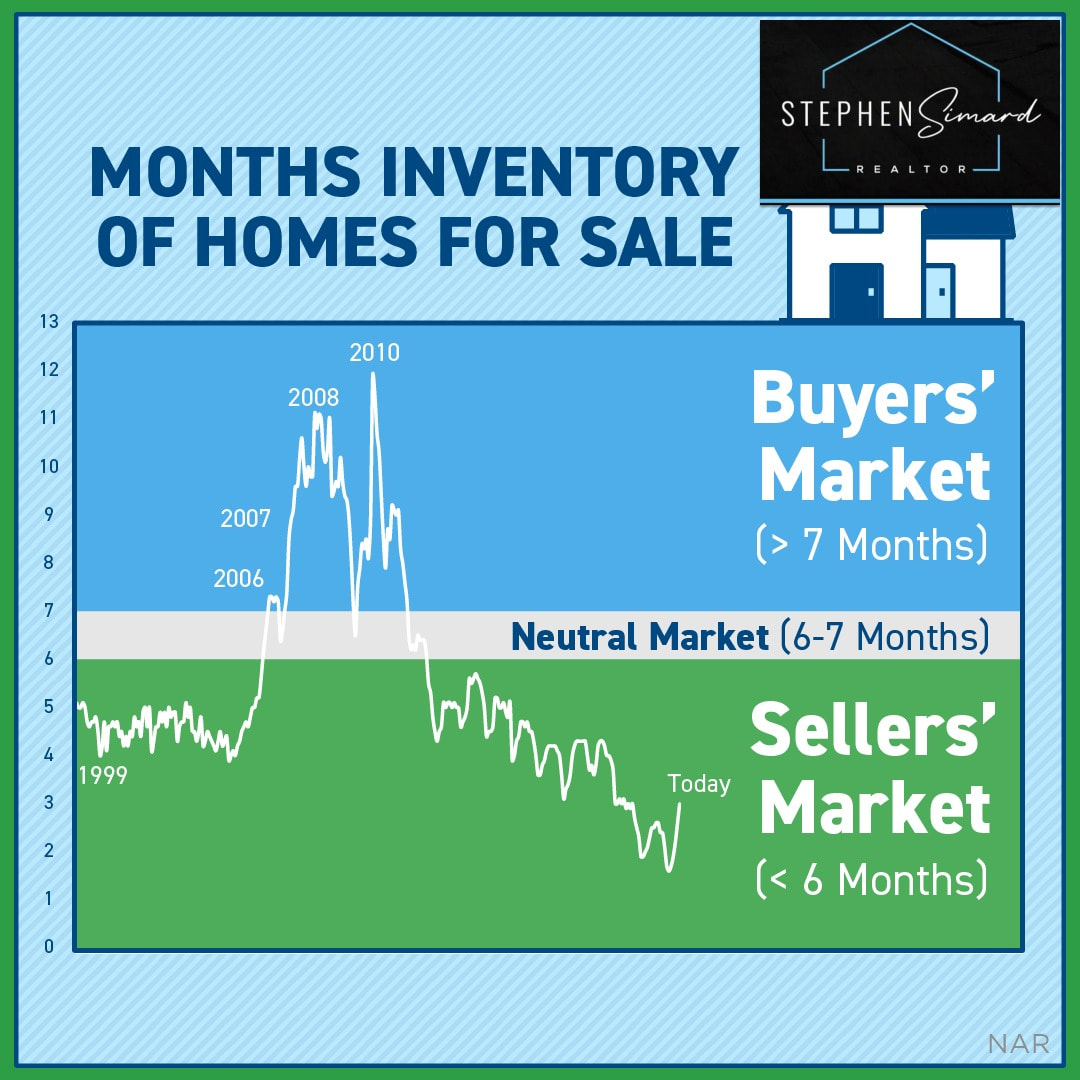

While growing, the months’ supply of homes available for sale today is still firmly in sellers’ market territory. That means you should still be ready for a competitive market, just one that’s not as frenzied as the past two years. DM me so you have an expert guide to help you navigate today’s shifting market as you buy or sell a home.

Source : KCM #sellersmarket #housingmarket #realestatemarket #expertanswers #stayinformed #staycurrent #powerfuldecisions #confidentdecisions #realestate #homevalues #homeownership #homebuying #realestategoals #realestatetipsandadvice #keepingcurrentmatters #StephenSimardRealtor #RealBroker

0 Comments

Some Highlights

Source: KCM FirstTimeHomeBuyers #ForBuyers #HousingMarketUpdates #Infographics #MoveUpBuyers #StephenSimardRealtor #RealBroker If you’re a homeowner looking to move, you have a great opportunity today thanks to your home equity. Ongoing home price appreciation has driven your home’s value up. The resulting equity may be some (if not all) of what you need for your down payment on your next home. To find out how much equity you have in your house, DM me.

Source: KCM #homeequity #opportunity #sellyourhouse #moveuphome #dreamhome #realestate #homeownership #realestategoals #instarealtor #realestatetipsoftheday #realestatetipsandadvice #keepingcurrentmatters #StephenSimardRealtor #RealBroker If you’re following the news, chances are you’ve seen or heard some headlines about the housing market that don’t give the full picture. The real estate market is shifting, and when that happens, it can be hard to separate fact from fiction. That’s where a trusted real estate professional comes in. They can help debunk the headlines so you can really understand today’s market and what it means for you.

Here are three common housing market myths you might be hearing, along with the expert analysis that provides better context. Myth 1: Home Prices Are Going To Fall One piece of fiction many buyers may have seen or heard is that home prices are going to crash. That’s because headlines often use similar, but different, terms to describe what’s happening with prices. A few you might be seeing right now include:

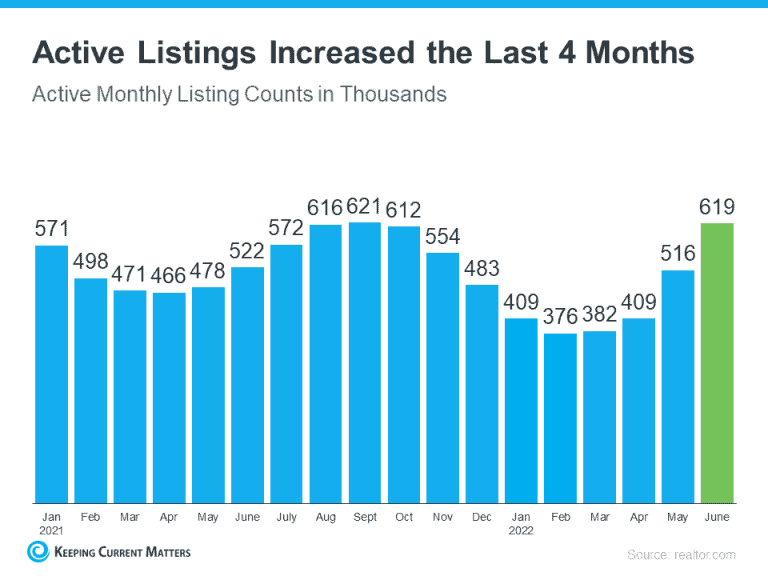

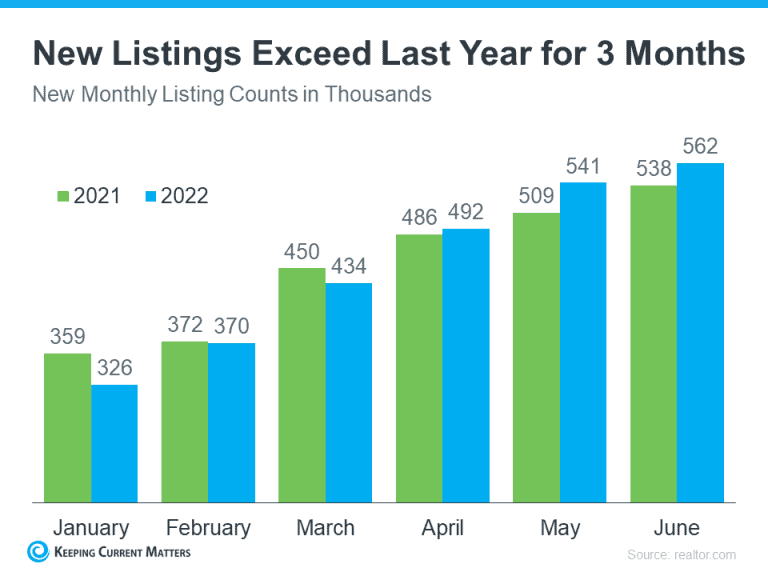

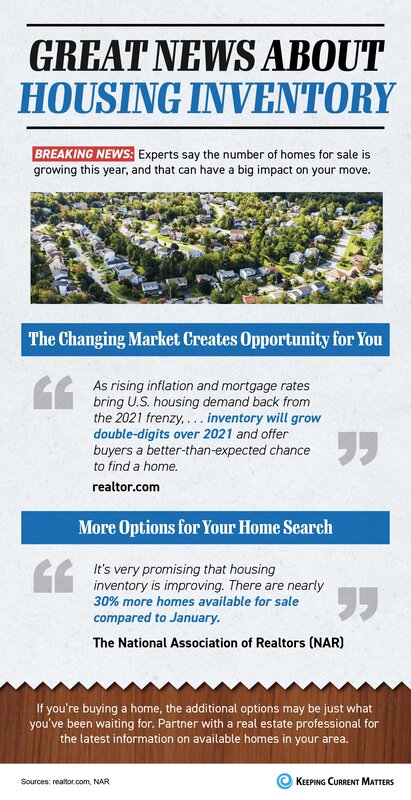

The fact is, experts aren’t calling for a decrease in prices. Instead, they forecast appreciation will continue, just at a decelerated pace. That means home prices will continue rising and won’t fall. Selma Hepp, Deputy Chief Economist at CoreLogic, explains: “. . . higher mortgage rates coupled with more inventory will lead to slower home price growth but unlikely declines in home prices.” Myth 2: The Housing Market Is in a Correction Another common myth is that the housing market is in a correction. Again, that’s not the case. Here’s why. According to Forbes: “A correction is a sustained decline in the value of a market index or the price of an individual asset. A correction is generally agreed to be a 10% to 20% drop in value from a recent peak.” As mentioned above, home prices are still appreciating, and experts project that will continue, just at a slower pace. That means the housing market isn’t in a correction because prices aren’t falling. It’s just moderating compared to the last two years, which were record-breaking in nearly every way. Myth 3: The Housing Market Is Going To Crash Some headlines are generating worry that the housing market is a bubble ready to burst. But experts say today is nothing like 2008. One of the reasons why is because lending standards are very different today. Logan Mohtashami, Lead Analyst for HousingWire, explains: “As recession talk becomes more prevalent, some people are concerned that mortgage credit lending will get much tighter. This typically happens in a recession, however, the notion that credit lending in America will collapse as it did from 2005 to 2008 couldn’t be more incorrect, as we haven’t had a credit boom in the period between 2008-2022.” During the last housing bubble, it was much easier to get a mortgage than it is today. Since then, lending standards have tightened significantly, and purchasers who acquired a mortgage over the last decade are much more qualified than they were in the years leading up to the crash. Bottom Line No matter what you’re hearing about the housing market, trust the experts and partner with a local real estate professional. When you do, you’ll have a knowledgeable authority on your side that knows the ins and outs of the market, including current trends, historical context, and so much more. Source: KCM #BuyingMyths #ForBuyers #ForSellers #HousingMarketUpdates #Pricing #SellingMyths #StephenSimardRealtor #RealBroker Watch Here: https://www.youtube.com/watch?v=ulMUuvFDoAA Source: KCM #StephenSimardRealtor #RealBroker #ExpertInsightsonWheretheHousingMarketIsHeading There are more homes for sale today than at any time last year. So, if you tried to buy a home last year and were outbid or out priced, now may be your opportunity. The number of homes for sale in the U.S. has been growing over the past four months as rising mortgage rates help slow the frenzy the housing market saw during the pandemic. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains why the shifting market creates a window of opportunity for you: “This is an opportunity for people with a secure job to jump into the market, when other people are a little hesitant because of a possible recession. . . They’ll have fewer buyers to compete with.” Two Reasons There Are More Homes for Sale The first reason the market is seeing more homes available for sale is the number of sales happening each month has decreased. This slowdown has been caused by rising mortgage rates and rising home prices, leading many to postpone or put off buying. The graph below uses data from realtor.com to show how active real estate listings have risen over the past four months as a result. The second reason the market is seeing more homes available for sale is because the number of people selling their homes is also rising. The graph below outlines new monthly listings coming onto the market compared to last year. As the graph shows, for the past three months, more people have put their homes on the market than the previous year. Bottom Line

The number of homes for sale across the country is growing, and that means more options for those thinking about buying a home. This is the opportunity many have been waiting for who were outbid or out priced last year. Source: KCM #FirstTimeHomeBuyers #ForBuyers #MoveUpBuyers #StephenSimardRealtor #RealBroker Wondering if home prices are going to fall? Even though the market is undergoing a shift and inventory is increasing, experts say home prices won't fall. Instead, they're forecasting prices will climb, just at a slower pace. DM me if you have questions about what's happening with home prices in our area.

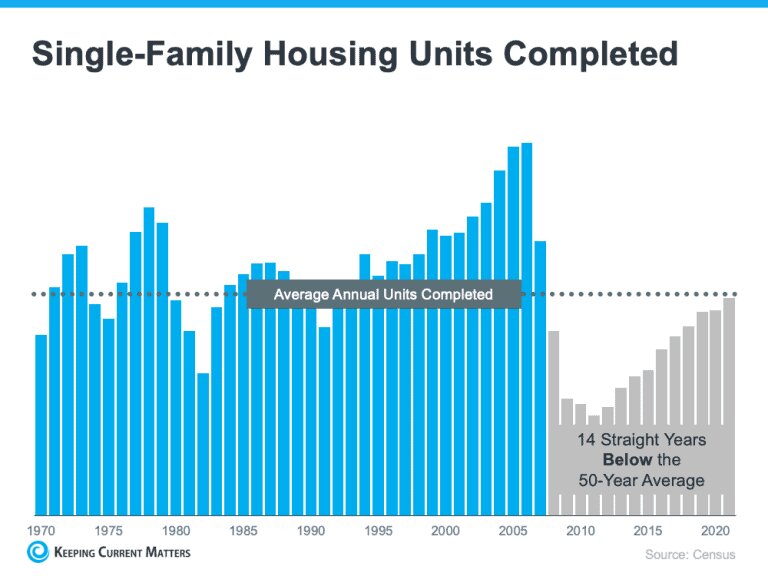

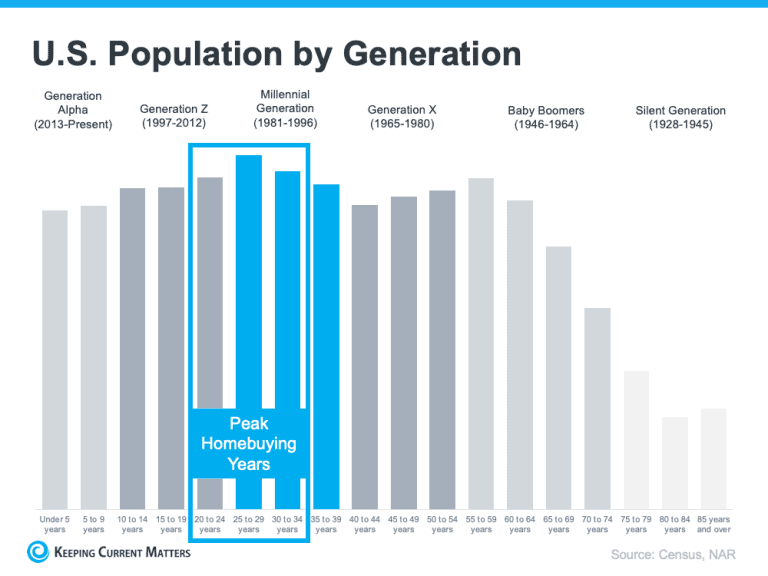

Source: KCM #realestateexperts #realestate #homeownership #homebuying #realestategoals #realestatetips #realestateadvice #realestatemarket #realestateagents #instarealestate #instarealtor #realestatetipsoftheday #realestatetipsandadvice #keepingcurrentmatters #StephenSimardRealtor #RealBroker If you’re thinking about making a move, you probably want to know what’s going to happen to home prices for the rest of the year. While experts say price growth will moderate due to the shifting market, ongoing appreciation is expected. That means home prices won’t fall. Here’s a look at two key reasons experts forecast continued price growth: supply and demand. While Growing, Housing Supply Is Still Low Even though inventory is increasing this year as the market moderates, supply is still low. The graph below helps tell the story of why there still aren’t enough homes on the market today. It uses data from the Census to show the number of single-family homes that were built in this country going all the way back to the 1970s. The blue bars represent the years leading up to the housing crisis in 2008. As the graph shows, right before the crash, homebuilding increased significantly. That’s because buyer demand was so high due to loose lending standards that enabled more people to qualify for a home loan. The resulting oversupply of homes for sale led to prices dropping during the crash and some builders leaving the industry or closing their businesses – and that led to a long period of underbuilding of new homes. And even as more new homes are constructed this year and in the years ahead, this isn’t something that can be resolved overnight. It’ll take time to build enough homes to meet the deficit of underbuilding that took place over the past 14 years. Millennials Will Create Sustained Buyer Demand Moving Forward The frenzy the market saw during the pandemic is because there was more demand than homes for sale. That drove home prices up as buyers competed with one another for available homes. And while buyer demand has moderated today in response to higher mortgage rates, data tells us demand will continue to be driven by the large generation of millennials aging into their peak homebuying years (see graph below): Odeta Kushi, Deputy Chief Economist at First American, explains:

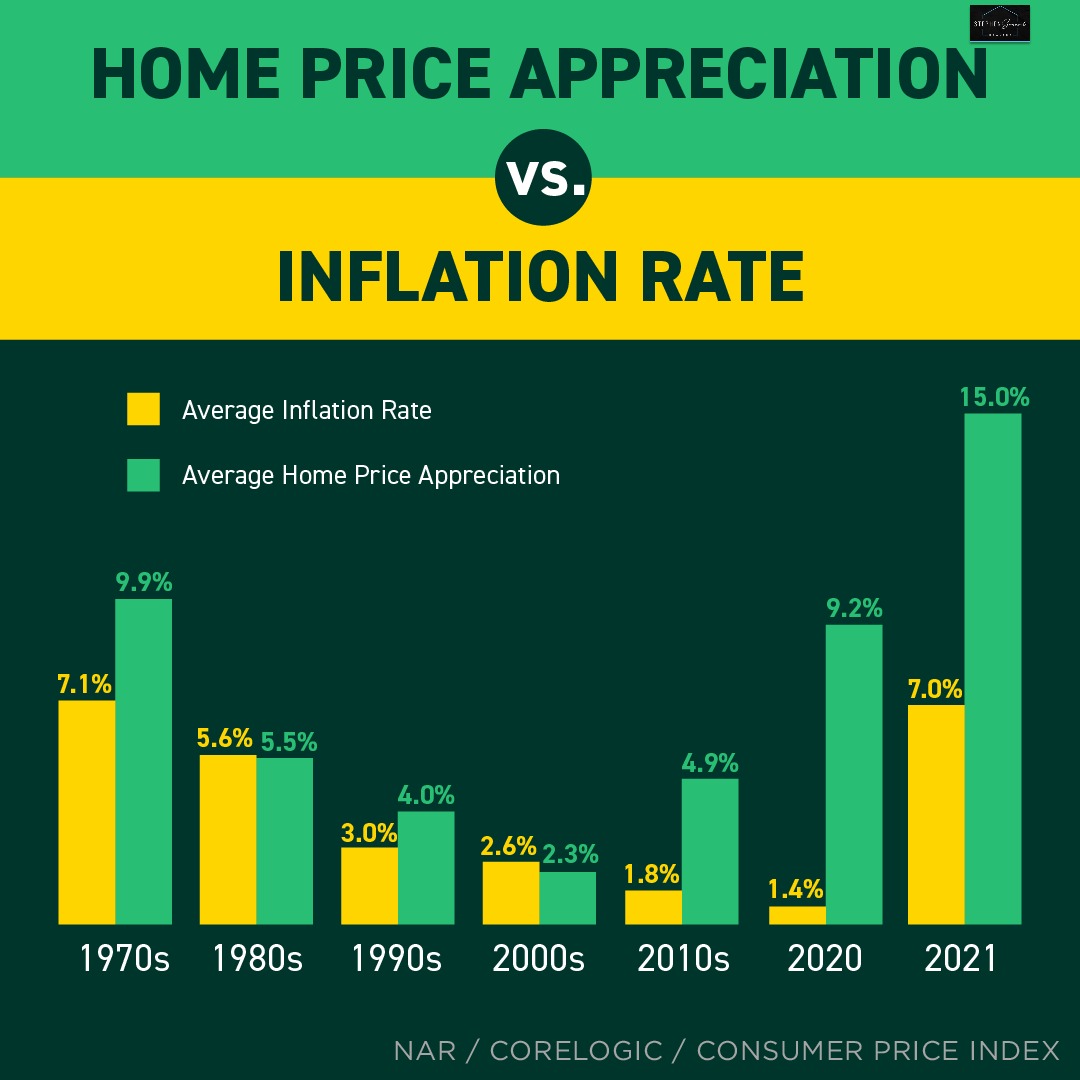

“. . . millennials continue to transition to their prime home-buying age and will remain the driving force in potential homeownership demand in the years ahead.” That combination of millennial demand and low housing supply continues to put upward pressure on home prices. As Bankrate says: “After all, supplies of homes for sale remain near record lows. And while a jump in mortgage rates has dampened demand somewhat, demand still outpaces supply, thanks to a combination of little new construction and strong household formation by large numbers of millennials.” What This Means for Home Prices If you’re worried home values will fall, rest assured that experts forecast ongoing home price appreciation thanks to the lingering imbalance of supply and demand. That means home prices won’t decline. Bottom Line Based on today’s factors driving supply and demand, experts project home price appreciation will continue. It’ll just happen at a more moderate pace as the housing market continues its shift back toward pre-pandemic levels. Source: KCM #ForBuyers #ForSellers #HousingMarketUpdates #Pricing #StephenSimardRealtor #RealBroker A home is a tangible asset that typically holds or grows in value. In most decades, home prices have outperformed inflation. If you’re thinking about buying a home today, know that history shows homeownership is a good hedge against inflation. If you’re ready to start your home search, DM me.

Source: KCM #inflation #homeownership #investinyourfuture #opportunity #housingmarket #househunting #makememove #homegoals #houseshopping #housegoals #investmentproperty #keepingcurrentmatters #StephenSimardRealtor #RealBroker Some Highlights

Source: KCM #FirstTimeHomeBuyers #ForBuyers #HousingMarketUpdates #Infographics #MoveUpBuyers #StephenSimardRealtor #RealBroker |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed