|

Some Highlights:

SOURCE KCM #RealEstateInvestement #HousingMarket #Infographics #SimardRealtyGroup #eXpRealty

0 Comments

So you made an offer and it was accepted. Now, your next task is to have the home inspected prior to closing. Agents oftentimes make your offer contingent on a clean home inspection.

This contingency allows you to renegotiate the price you paid for the home, ask the sellers to cover repairs, or in some cases, to walk away. Your agent can advise you on the best course of action once the report is filed. How to Choose an Inspector Your agent will most likely have a short list of inspectors that they have worked with in the past that they can recommend to you. HGTV recommends that you consider the following five areas when choosing the right home inspector for you: 1. Qualifications – find out what’s included in your inspection and if the age or location of your home may warrant specific certifications or specialties. 2. Sample Reports – ask for a sample inspection report so you can review how thoroughly they will be inspecting your dream home. In most cases, the more detailed the report, the better. 3. References – do your homework – ask for phone numbers and names of past clients who you can call to ask about their experiences. 4. Memberships – Not all inspectors belong to a national or state association of home inspectors, and membership in one of these groups should not be the only way to evaluate your choice. Membership in one of these organizations often means that continued training and education are provided. 5. Errors & Omission Insurance – Find out what the liability of the inspector or inspection company is once the inspection is over. The inspector is only human, after all, and it is possible that they might have missed something they should have seen. Ask your inspector if it’s okay for you to tag along during the inspection. That way they can point out anything that should be addressed or fixed. Don’t be surprised to see your inspector climbing on the roof or crawling around in the attic and on the floors. The job of the inspector is to protect your investment and find any issues with the home, including but not limited to: the roof, plumbing, electrical components, appliances, heating & air conditioning systems, ventilation, windows, the fireplace and chimney, the foundation, and so much more! Bottom Line They say, ‘ignorance is bliss,’ but not when investing your hard-earned money into a home of your own. Work with a professional who you can trust to give you the most information possible about your new home so that you can make the most educated decision about your purchase. SOURCE KCM #HomeInspection #ForBuyers #ForSellers #SimardRealtyGroup #eXpRealty In this day and age of being able to shop for anything anywhere, it is really important to know what you’re looking for when you start your home search.

If you’ve been thinking about buying a home of your own for some time now, you’ve probably come up with a list of things that you’d LOVE to have in your new home. Many new homebuyers fantasize about the amenities that they see on television or Pinterest, and start looking at the countless homes listed for sale through rose-colored glasses. Do you really need that farmhouse sink in the kitchen to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Could the “man cave” of your dreams be a future renovation project instead of a make-or-break right now? The first step in your home buying process should be getting pre-approved for your mortgage. This allows you to know your budget before you fall in love with a home that is way outside of it. The next step is to list all the features of a home that you would like, and to qualify them as follows:

Having this list fleshed out before starting your search will save you time and frustration. It also lets your agent know what features are most important to you before they start showing you houses in your desired area. SOURCE KCM #ForBuyers #ForSellers #WantVSNeed #DreamHome #SimardRealtyGroup #eXpRealty In today’s fast-paced world where answers are a Google search away, there are some who may wonder what the benefits of hiring a real estate professional to help them in their home search are. The truth is, the addition of more information causes more confusion.

Shows like Property Brothers, Fixer Upper, and dozens more on HGTV have given many a false sense of what it’s like to buy and sell a home. Now more than ever, you need an expert on your side who is going to guide you toward your dreams and not let anything get in the way of achieving them. Buying and/or selling a home is definitely not something you want to DIY (Do It Yourself)! Here are just some of the reasons you need a real estate professional in your corner: There’s more to real estate than finding a house you like online! There are over 230 possible steps that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to ensure you achieve your dream? You Need a Skilled Negotiator In today’s market, hiring a talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step of the way – from the original offer, to the possible renegotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes. What is the home you’re buying or selling worth in today’s market? There is so much information on the news and on the Internet about home sales, prices, and mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively and correctly price your home at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a lowball offer? Dave Ramsey, the financial guru, advises: “When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.” Hiring an agent who has his or her finger on the pulse of the market will make your buying or selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear. Bottom Line Today’s real estate market is highly competitive. Having a professional who’s been there before to guide you through the process is a simple step that will give you a huge advantage! SOURCE KCM #RealEstateProfessional #FirstTimeBuyers #FirstTimeSellers #SimardRealtyGroup #eXpRealty Congrats to our seller!

"Filley New construction! Be the first to live in this well built home with views of Talcott Mountain. This sun filled Colonial Home has the perfect layout, just what todays buyer desires. Filley St welcomes you with an inviting 2 story foyer with beautiful trim, wonderful light, staircase and gleaming hardwood. The eat in granite kitchen is sun drenched with natural light, wet bar and loads of custom maple cabinetry. " Read full property info here: https://51filleyst.thebestlisting.com/ #UnderContract #Bloomfield #SellingCt #SimardRealtyGroup #eXpRealty Young buyers (Millennials & Gen Z) have waited longer than previous generations to enter the housing market for their first home. However, this hasn’t stopped them from dreaming about the home they will eventually buy. Many spend hours searching listings and building Pinterest boards of their favorite home features.

According to a survey from Open Listings, 70% of single renters are more likely to spend their Sunday nights swiping through house listings than dating profiles. All that time window shopping has led 45% of millennials to expect the first home they buy to be their “dream home”! They are willing to wait longer, save more for a larger down payment, and are pickier about the listings they want to tour and the features that they want to see in their first home. Waiting a little longer to buy a home than their parents or grandparents did has also helped young buyers become more established in their careers prior to making such a large purchase. Lawrence Yun, NAR’s Chief Economist, recently commented, “Older millennials are now entering the prime earning stages of their careers, and the size and costs of homes they purchase reflect this. Their choices are falling more in line with their Gen X and boomer counterparts.” In some areas of the country, high competition in the starter home market forces young buyers to wait longer. The extra money they save during that time opens their search to bigger, more expensive homes. If this trend continues, older millennials will skip the starter home altogether, going straight to a trade-up or premium home instead. Bottom Line If you are one of the many young renters planning on buying your first home soon, meet with a local real estate professional who can help determine what type of home will best suit your present and future needs. SOURCE KCM #RentVSBuy #MoveUpBuyers #SimardRealtyGroup #eXpRealty

Many experts are revising their initial predictions for 2019 to reflect more aggressive projections for home price appreciation. This is great news for homeowners who will gain even more equity in their homes as prices rise! Let's get together to chat about what this means for you!

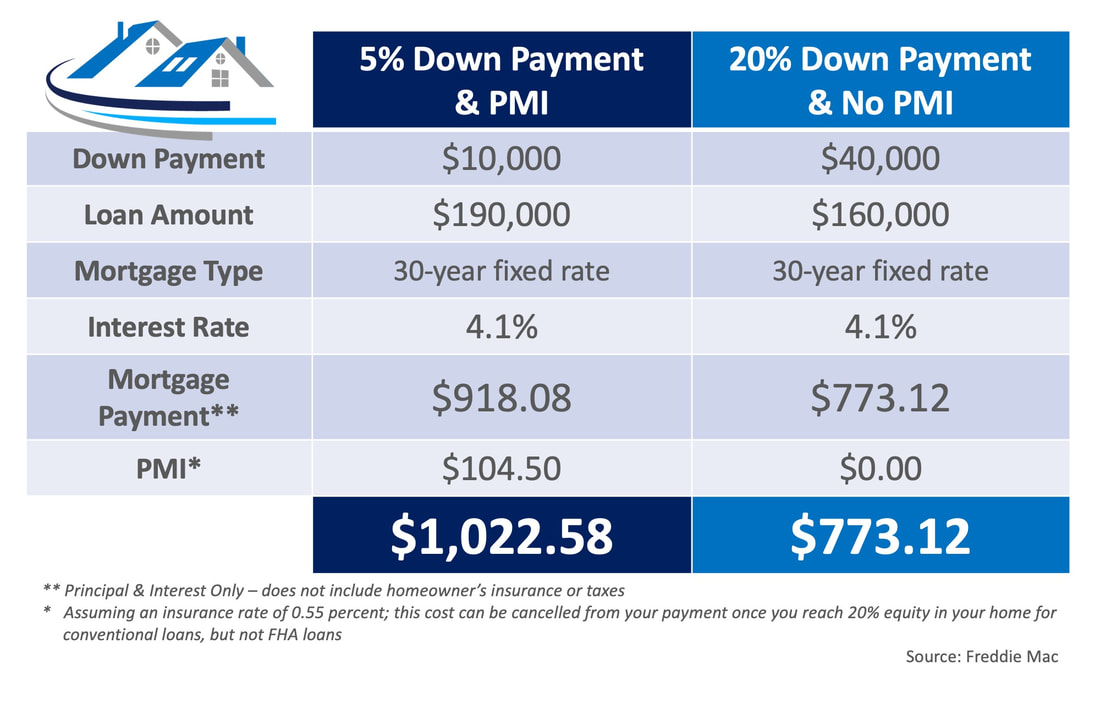

#GranbyHomes #Homesforsale #Realestate #Simsburyhomes #HomeValues #RealEstateAdvise #RealtorGranby #RealEstateSimsbury #StephenSimard #eXpRealty Whether it is your first time or your fifth, it is always important to know all the facts when it comes to buying a home. With the large number of mortgage programs available that allow buyers to purchase homes with down payments below 20%, you can never have too much information about Private Mortgage Insurance (PMI). What is PMI? Freddie Mac defines PMI as: “An insurance policy that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%. Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment.” As the borrower, you pay the monthly premiums for the insurance policy, and the lender is the beneficiary. Freddie Mac goes on to explain that: “The cost of PMI varies based on your loan-to-value ratio – the amount you owe on your mortgage compared to its value – and credit score, but you can expect to pay between $30 and $70 per month for every $100,000 borrowed.” According to the National Association of Realtors, the average down payment for all buyers last year was 13%. For first-time buyers, that number dropped to 7%, while repeat buyers put down 16% (no doubt aided by the sale of their homes). This just goes to show that for a large number of buyers last year, PMI did not stop them from buying their dream homes. Here’s an example of the cost of a mortgage on a $200,000 home with a 5% down payment & PMI, compared to a 20% down payment without PMI: The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:

“It’s no doubt an added cost, but it’s enabling you to buy now and begin building equity versus waiting 5 to 10 years to build enough savings for a 20% down payment.” Bottom Line If you have questions about whether you should buy now or wait until you’ve saved a larger down payment, let’s get together to discuss our market’s conditions and help you make the best decision for you and your family. SOURCE KCM #Mortgage #PMI #SimardRealtyGroup #eXpRealty When buying a home today, why is there so much paperwork mandated by the lenders for a mortgage loan application? It seems like they need to know everything about you. Furthermore, it requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any other time in history. 1. The government has set new guidelines that now demand that the bank proves beyond any doubt that you are indeed capable of paying the mortgage. During the run-up to the housing crisis, many people ‘qualified’ for mortgages that they could never pay back. This led to millions of families losing their home. The government wants to make sure this can’t happen again. 2. The banks don’t want to be in the real estate business. Over the last several years, banks were forced to take on the responsibility of liquidating millions of foreclosures and negotiating an additional million plus short sales. Just like the government, they don’t want more foreclosures. For that reason, they have to double (maybe even triple) check everything on the application. However, there is some good news in this situation. The housing crash that mandated that banks be extremely strict on paperwork requirements also allowed you to get a low mortgage interest rate. The friends and family who bought homes ten or twenty years ago experienced a simpler mortgage application process, but also paid a higher interest rate (the average 30-year fixed rate mortgage was 8.12% in the 1990s and 6.29% in the 2000s). If you went to the bank and offered to pay 7% instead of around 4%, they would probably bend over backward to make the process much easier. Bottom Line Instead of concentrating on the additional paperwork required, let’s be thankful that we are able to buy a home at historically low rates. SOURCE KCM #ForBuyers #ForSellers #Mortgage #SimardRealtyGroup #eXpRealty Here are 5 compelling reasons listing your home for sale this summer makes sense.

1. Demand Is Strong The latest Buyer Traffic Index from the National Association of Realtors (NAR) shows that buyer demand remains strong throughout the vast majority of the country. These buyers are ready, willing, and able to purchase… and are in the market right now! More often than not, multiple buyers are competing with each other for the same home. Take advantage of the buyer activity currently in the market. 2. There Is Less Competition Now Housing inventory is still under the 6-month supply needed for a normal housing market. This means that, in most of the country, there are not enough homes for sale to satisfy the number of buyers. Historically, the average number of years a homeowner stayed in his or her home was six, but that number has hovered between nine and ten years since 2011. Many homeowners have a pent-up desire to move, as they were unable to sell over the last few years due to a negative equity situation. As home values continue to appreciate, more and more homeowners are granted the freedom to move. Many homeowners were reluctant to list their home over the last couple of years for fear that they would not find a home to move in to. That is all changing now as more homes come to market at the higher end. The choices buyers have will continue to increase. Don’t wait until additional inventory comes to market before you to decide to sell. 3. The Process Will Be Quicker Today’s competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. Buyers know exactly what they can afford before home shopping. This makes the entire selling process much faster and simpler. According to Ellie Mae’s latest Origination Insights Report, the time to close a loan has dropped to 43 days. (Last numbers available.) 4. There Will Never Be a Better Time to Move Up If your next move will be into a premium or luxury home, now is the time to move up! The inventory of homes for sale at these higher price ranges has created a buyer’s market. This means that if you are planning on selling a starter or trade-up home, it will sell quickly, AND you’ll be able to find a premium home to call your own! According to CoreLogic, prices are projected to appreciate by 4.8% over the next year. If you are moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. 5. It’s Time to Move on with Your Life Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than having the freedom to go on with your life the way you think you should? Only you know the answers to these questions. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to start living the life you desire. That is what is truly important. SOURCE KCM #ForBuyers #ForSellers #HousingMarketUpdate #SimardRealtyGroup #eXpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed