|

Last year we saw headlines about a possible housing market bubble, and many wondered if Americans still felt confident about the value of their homes. Recently, the 2018 Houzz & Home Study revealed:

“Homeowners with mortgages have seen their home equity more than double since 2011, increasing to a record-setting $8.3 trillion in 2017.” The average homeowner gained $16,200 in home equity between Q2 2017 and Q2 2018 according to the latest release of CoreLogic’s Home Equity Report. Since 2011 home values have increased significantly throughout the country, with prices rising by 5.1% in 2018 alone. When surveyed, homeowners revealed the top four reasons why they felt their homes had increased in value.

As we can see, not only does the data show that the homes have appreciated, but homeowners also believe they know why. Many have taken advantage of the opportunity to use their newly found equity to sell their current house and move up to their dream home! 2019 will be a good year for the homeowners that still want to take advantage of their home equity! CoreLogic forecasts that home prices will increase by 4.8% by the end of the year. Bottom Line If you are a homeowner who would like to find out your current home value, contact a local real estate professional who can help you to discover the hidden opportunities in your home! SOURCE KCM #ForBuyers #ForSellers #Pricing #SimardRealtyGroup #eXpRealty

0 Comments

Whether you’re buying or selling, it can be quite the adventure, which is why you need an experienced real estate professional to guide you on the path to achieving your goal.

Contact Stephen your Realtor at 860-919-0991 [email protected] Simard Realty Group eXp Realty Recently, David Greene, co-host of the BiggerPockets podcast and a nationally renowned author and speaker, wrote an article in Forbes explaining how investing in real estate could help build wealth. Many of the points he made also apply to a family owning their own home. Here are a few:

1. Appreciation “The rising of home prices over time, is how the majority of wealth is built in real estate. This is the ‘home run’ you hear of when people make a large windfall of money. While prices fluctuate, over the long run real estate values have always gone up, always, and there is no reason to think that is going to change. One thing to consider when it comes to real estate appreciation affecting your ROI is the fact that appreciation combined with leverage offers huge returns. If you buy a property for $200,000 and it appreciates to $220,000, your property had made you a 10% return. However, you likely didn’t pay cash for the property and instead used the bank’s money. If you consider that you may have put 10% down ($20,000), you actually have doubled your investment, a 100% return.” 2. Leverage “By nature, real estate is one of the easiest assets to leverage I have ever come across—maybe the easiest. Not only is it easy to leverage the financing of it, but the terms are incredible compared to any other kind of loan. Interest rates are currently below 5%, down payments can be 20% or less, and loans are routinely amortized over 30-year periods.” 3. Paying Off the Debt “One of the best parts of investing in real estate is the fact that … you’re slowly paying down your loan balance with each payment to the bank… After enough time passes, a good chunk of every payment comes off the loan balance, and wealth is created.” 4. Forced Equity “Forced equity is a term used to refer to the wealth that is created when an investor does work to a property to make it worth more… Example of this would be adding a third or fourth bedroom to a property with only two, adding a second bathroom to a property with only one, or adding more square footage to a property with less than the surrounding houses.” Though Green was talking about investors, the same could be said about a family upgrading their own home. Bottom Line Green put it best by saying: “There are many ways to build wealth in America, but real estate might be the safest, steadiest and simplest way to do so.” SOURCE KCM #FirstTimeHomeBuyers #SimardRealtyGroup #eXpRealty

Every day, thousands of homeowners regain positive equity in their homes. You may have enough equity to sell your house and move on to your dream home.

Contact Stephen your Realtor at 860-919-0991 [email protected] Simard Realty Group eXp Realty Over the course of the last thirty years, a shift has happened. An entire generation has been raised to believe that a college education is their key to unlocking opportunities that were not available to their parent’s or grandparent’s generations.

Due to this, student loan debt has soared to $1.5 trillion and represents the largest category of debt, surpassing credit card and auto loan debt in 2010 and never looking back. As more and more Americans continue their education amongst rising tuition costs, this number will no doubt increase. Many housing experts have blamed student loans for a drop in the homeownership rate for young families, and to an extent, they’ve been right. Increased debt at the time of graduation has no doubt limited young people from being able to afford a home at the same rate as their parents or grandparents did at the same age. In a recent Forbes article, the author explained that “in just the class of 2017, the average student has about $40,000 in debt — almost enough for a 20% down payment on a median-priced home.” The Federal Reserve set out to determine exactly how much impact student loan debt has had on the homeownership rate of those 18-34 (millennials). Their results found that, “Every $1,000 in student loan debt delays homeownership by about 2.5 months, but it doesn’t prevent homeownership entirely. In fact, by the time college grads reach their 30s, those with student loan debt have a homeownership rate nearly identical to those who didn’t take out loans.” (emphasis added) In the Wall Street Journal’s coverage of the Fed report, they found that recent graduates prioritize paying off their student loans over saving for a down payment, despite their desire to be a homeowner. Many with debt want to “get that monkey off (their) back (before they) make any new investments.” This has just delayed the wave of young home buyers from hitting the market. But as Danielle Hale, the Chief Economist at realtor.com warns, “2020 will be peak millennial, the year when the largest number of millennials will turn 30.” By age 30, those who attained a bachelor’s degree right after high school will be one or two years away from paying off their loans and will have been in their career long enough to earn a higher salary. In the long run, research shows that attaining a bachelor’s degree or more actually increases the chances that someone will become a homeowner. Bottom Line If you are one of the many millennials who has prioritized paying down your student loans over saving for a down payment, you’re not alone. Even if you are a couple years away from paying off your loans, meet with a local real estate professional who can help you determine if waiting really is the best decision for you. SOURCE KCM #FirstTimeHomeBuyers #Millennials #SimardRealtyGroup #eXpRealty

If you plan on buying a home this year, it doesn't make sense to wait! Mortgage interest rates and home prices are both projected to increase significantly throughout 2019. Let's get together to discuss your home buying plans today!

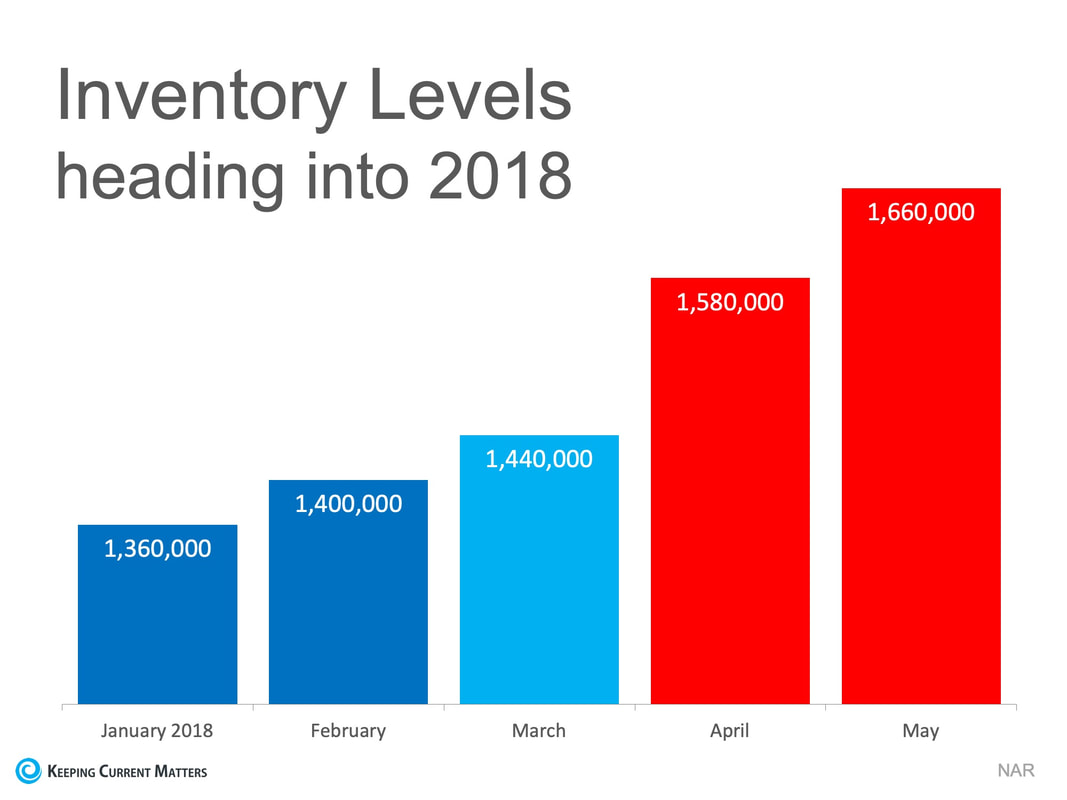

Contact Stephen your Realtor at 860-919-0991 [email protected] Simard Realty Group eXp Realty The price of any item (including residential real estate) is determined by the theory of ‘supply and demand.’ If many people are looking to buy an item and the supply of that item is limited, the price of that item increases. The supply of homes for sale dramatically increases every spring, according to the National Association of Realtors (NAR). As an example, here is what happened to housing inventory at the beginning of 2018: Putting your home on the market now, rather than waiting for increased competition in the spring, might make a lot of sense.

Bottom Line Buyers in the market during the winter are truly motivated purchasers and they want to buy now. With limited inventory currently available in most markets, sellers are in a great position to negotiate. SOURCE KCM #ForSellers #MoveUpBuyers #SellingMyths #SimardRealtyGroup #eXpRealty

Thinking about buying a home or selling your house this year? If so, you’re going to want to pay attention to where home prices are headed in 2019. The experts agree that they will continue to grow as the year goes by. Let’s get together to chat about what rising prices mean for you!

Contact Stephen your Realtor at 860-919-0991 [email protected] Simard Realty Group eXp Realty Some Highlights:

SOURCE KCM #ForSellers #FSBOs #Infographic #SimardRealtyGroup #eXpRealty

As a homeowner, there are many things to be thankful for. For example, as home values increase, so does your family's wealth. Let's get together to discuss how homeownership can benefit you and your family.

Contact Stephen your Realtor at 860-919-0991 [email protected] Simard Realty Group eXp Realty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed