|

If you’re a buyer who’s been waiting for your dream home to come onto the market, then today’s rising supply of homes for sale could be a dream come true. That’s because the more listings there are, the more options you have to choose from. DM me if you’re ready to start looking for homes in our local area.

Source: KCM #homeownership #opportunity #newlistings #homeforsale #starterhome #dreamhome #firsttimehomebuyer #housingmarket #househunting #makememove #homegoals #keepingcurrentmatters #StephenSimard #RealBrokerLLC

0 Comments

It can be tempting, especially with how hot the housing market has been over the past two years, to consider selling your home on your own. But today’s market is at a turning point, making it more essential than ever to work with a real estate professional.

Not only will a trusted real estate advisor keep you updated and help you make the best decisions based on current market trends, but they’re also experts in managing the many aspects of selling your house. Here are five key reasons why working with a real estate professional makes sense today. 1. A Professional Follows the Latest Market Trends With higher mortgage rates, rising home prices, and a growing number of homes for sale, today’s housing market is showing signs of a shift back toward more pre-pandemic levels. When conditions change, following the trends and staying on top of new information is crucial when you sell. That makes working with an expert real estate advisor critical today. They know your local area and follow national trends too. More importantly, they’ll know what this data means for you, and as the market shifts, they’ll be able to help you navigate it and make your best decision. 2. A Professional Helps Maximize Your Pool of Buyers Your agent’s role in bringing in buyers is important. Real estate professionals have a large variety of tools at their disposal, such as social media followers, agency resources, and the Multiple Listing Service (MLS) to ensure your house is viewed by the most buyers. Investopedia explains why it’s risky to sell on your own without the network an agent provides: “You don’t have relationships with clients, other agents, or a real estate agency to bring the largest pool of potential buyers to your home. A smaller pool of potential buyers means less demand for your property, which can translate into waiting longer to sell your home and possibly not getting as much money as your house is worth.” 3. A Professional Understands the Fine Print Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. The National Association of Realtors (NAR) explains it best, saying: “Selling a home typically requires a variety of forms, reports, disclosures, and other legal and financial documents. . . . Also, there’s a lot of jargon involved in a real estate transaction; you want to work with a professional who can speak the language.” A real estate professional knows exactly what needs to happen, what all the paperwork means, and how to work through it efficiently. They’ll help you review the documents and avoid any costly missteps that could occur if you try to handle them on your own. 4. A Professional Is a Trained Negotiator If you sell without a professional, you’ll also be solely responsible for all the negotiations. That means you’ll have to coordinate with:

Instead of going toe-to-toe with all these parties alone, lean on an expert. They’ll know what levers to pull, how to address everyone’s concerns, and when you may want to get a second opinion. 5. A Professional Knows How To Set the Right Price for Your House If you sell your house on your own, you may over or undershoot your asking price. That could mean you’ll leave money on the table because you priced it too low or your house will sit on the market because you priced it too high. Pricing a house requires expertise. NAR explains it like this: “A great real estate agent will look at your home with an unbiased eye, providing you with the information you need to enhance marketability and maximize price.” Real estate professionals know the ins and outs of how to price your house accurately and competitively. To do so, they compare your house to recently sold homes in your area and factor in the current condition of your home. These steps are key to making sure it’s set to move quickly while still getting you the highest possible final sale price. Bottom Line Whether it’s following local and national trends and guiding you through a shifting market or pricing your house right, a real estate agent has essential insights you’ll want to rely on throughout the transaction. Don’t go at it alone. If you plan to sell, reach out to a local real estate professional so you have an expert on your side. Source: KCM #ForSellers#FSBOs #StephenSimard #RealBrokerLLC As you pay down your home loan and your house appreciates in value, you gain equity and grow your net worth. And the equity you build can be used to help fuel your next move. If you want to learn how much equity you have in your home and how it can power a move-up, DM me today.

Source: KCM #homeequity #homevalues #networth #dreamhome #purchasingpower #buyingpower #homepriceappreciation #sellyourhouse #moveuphome #realestategoals #realestatetips #realestatelife #realestatenews #keepingcurrentmatters #StephenSimard #RealBrokerLLC A recent survey from Bankrate asks prospective buyers to identify the biggest obstacles in their homebuying journey. It found that 36% of those polled said saving for a down payment is one of their primary hurdles to buying a home.

If you feel the same way, the good news is there are many down payment assistance programs available that can help you achieve your homeownership goals. The key is understanding where to look and learning what options are available. Here’s some information that can help you. You Can Qualify Even if You’ve Purchased a Home Before There are several misconceptions about down payment assistance programs. For starters, many people believe there’s only assistance available for first-time homebuyers. While first-time buyers have many options to explore, repeat buyers have some, too. According to the latest Homeownership Program Index from downpaymentresource.com: “It is a common misconception that homebuyer assistance is only available to first-time homebuyers, however, 38% of homebuyer assistance programs in Q1 2022 did not have a first-time homebuyer requirement.” That means repeat buyers could qualify for over one-third of the assistance programs available. And if you’re a repeat buyer, you may still be able to take advantage of some first-time homebuyer programs, depending on your personal situation. That’s because downpaymentresource.com also notes many of the first-time homebuyer programs use the U.S. Department of Housing and Urban Development’s definition of a first-time homebuyer. Under their definition, you could qualify as a first-time buyer if you’re:

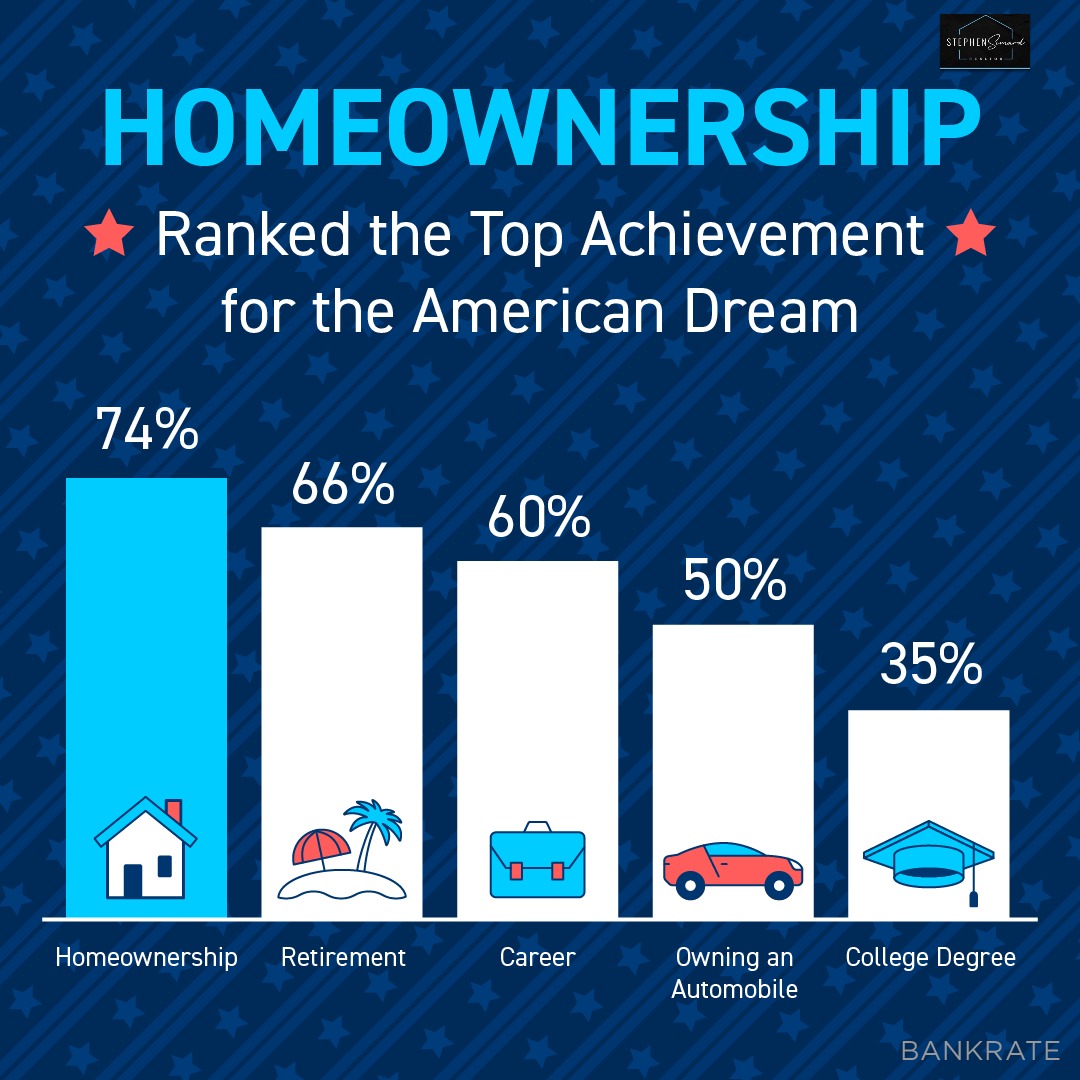

That means no matter where you are in your homeownership journey, there could be an option available for you. You May Be Eligible for Programs Based on Your Location or Profession In addition to broader options available for repeat and first-time homebuyers, there are other types of down payment assistance programs that you could qualify for based on your location. According to the National Association of Realtors (NAR): “Many local governments and non-profit organizations offer down-payment assistance grants and loans, targeted to area borrowers and often with specific borrower requirements.” Plus, there are programs and special benefits for individuals working in certain professions or with unique statuses, including teachers, doctors and nurses, and veterans. Ultimately, that means there are many federal, state, and local programs available for you to explore. The best way to do that is to connect with a local real estate professional and your lender to learn more about what’s available in your area. Bottom Line Down payment assistance programs have helped many homebuyers achieve their dreams, and if you qualify, they could help you too. Connect with a local real estate advisor and trusted lender today to begin exploring your options. Source: KCM #BuyingMyths #DownPayments #ForBuyers #StephenSimard #RealBrokerLLC A home is lot of things – it’s a roof over your head, a place to call your own, and it’s typically a strong financial investment. That’s why homeownership still ranks as the top accomplishment Americans feel proud of. DM me so you have an expert guide to help you accomplish your dream of #homeownership.

Source: KCM #realestate #AmericanDream #powerfuldecisions #confidentdecisions #homevalues #homeownership #homebuying #realestategoals #realestatetips #realestatelife #starterhome #dreamhome #keepingcurrentmatters #StephenSimard #RealBrokerLLC There’s no denying the housing market has delivered a fair share of challenges to homebuyers over the past two years. Two of the biggest hurdles homebuyers faced during the pandemic were the limited number of homes for sale and the intensity and frequency of bidding wars. But those two things have reached a turning point.

As you may have already heard, the number of homes for sale has increased this year, and even more so this spring. As Danielle Hale, Chief Economist for realtor.com, explains: “New listings–a measure of sellers putting homes up for sale–were up 6% above one year ago. Home sellers in many markets across the country continue to benefit from rising home prices and fast-selling homes. That’s prompted a growing number of homeowners to sell homes this year compared to last, giving home shoppers much needed options.” This is encouraging news. More homes coming onto the market give you a greater chance of finding one that checks all your boxes. Buyer Competition Moderating Helps Inventory Grow Even More Mark Fleming, Chief Economist at First American, says inventory growth is happening not just because there’s an increase in the number of listings coming onto the market, but also because buyer demand has moderated some in light of higher mortgage rates and other economic factors: “There has been a pickup in the inventory that we’ve seen recently, but it’s not from a big increase in new listings . . . but rather a slowdown in the pace of sales. And remember that months’ supply measures the inventory of sale relative to the pace of sales. Same inventory, fewer sales, means more months’ supply.” Basically, the market is shifting away from the frenzy of buyer competition seen during the pandemic, and that’s helping available inventory grow. In their latest forecast, realtor.com also mentions the moderation of demand as a key factor and projects the inventory growth should continue: “As rising inflation and mortgage rates bring U.S. housing demand back from the 2021 frenzy, . . . inventory will grow double-digits over 2021 and offer buyers a better-than-expected chance to find a home.” How This Impacts You The combination of more homes coming onto the market and a slower pace of home sales means you’ll have more options to choose from as you search for your next home. That’s great news if you’ve been searching for a while with little to no luck. Just remember, there isn’t a sudden surplus of inventory, just more homes to choose from than even a few months ago. So, you’ll still want to be decisive and move fast when you find the right home for you. And when you do, you may be faced with less competition from other buyers too. If you’ve been waiting to jump into the market because the intensity of the bidding wars was intimidating or if you’ve been outbid on several homes, this moderation could help make the homebuying process a bit smoother. It’s not that it’ll be easy or that bidding wars are a thing of the past – that’s not the case. But it won’t feel nearly as impossible. Bottom Line As the housing market begins its shift back toward pre-pandemic levels, you could have a unique opportunity in front of you. With moderating levels of buyer competition and more homes actively for sale, your home search may have gotten a bit less challenging. Reach out to a trusted real estate professional to begin the process today. Source: KCM #FirstTimeHomeBuyers#ForBuyers#HousingMarketUpdates#MoveUpBuyers#StephenSimard #RealBrokerLLC

Source: KCM

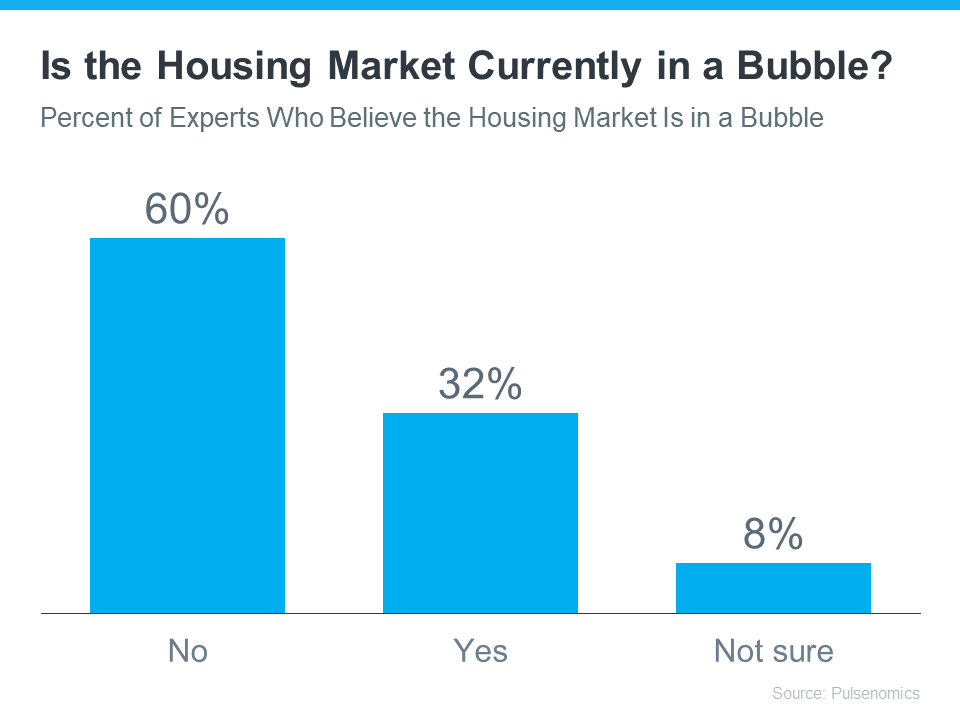

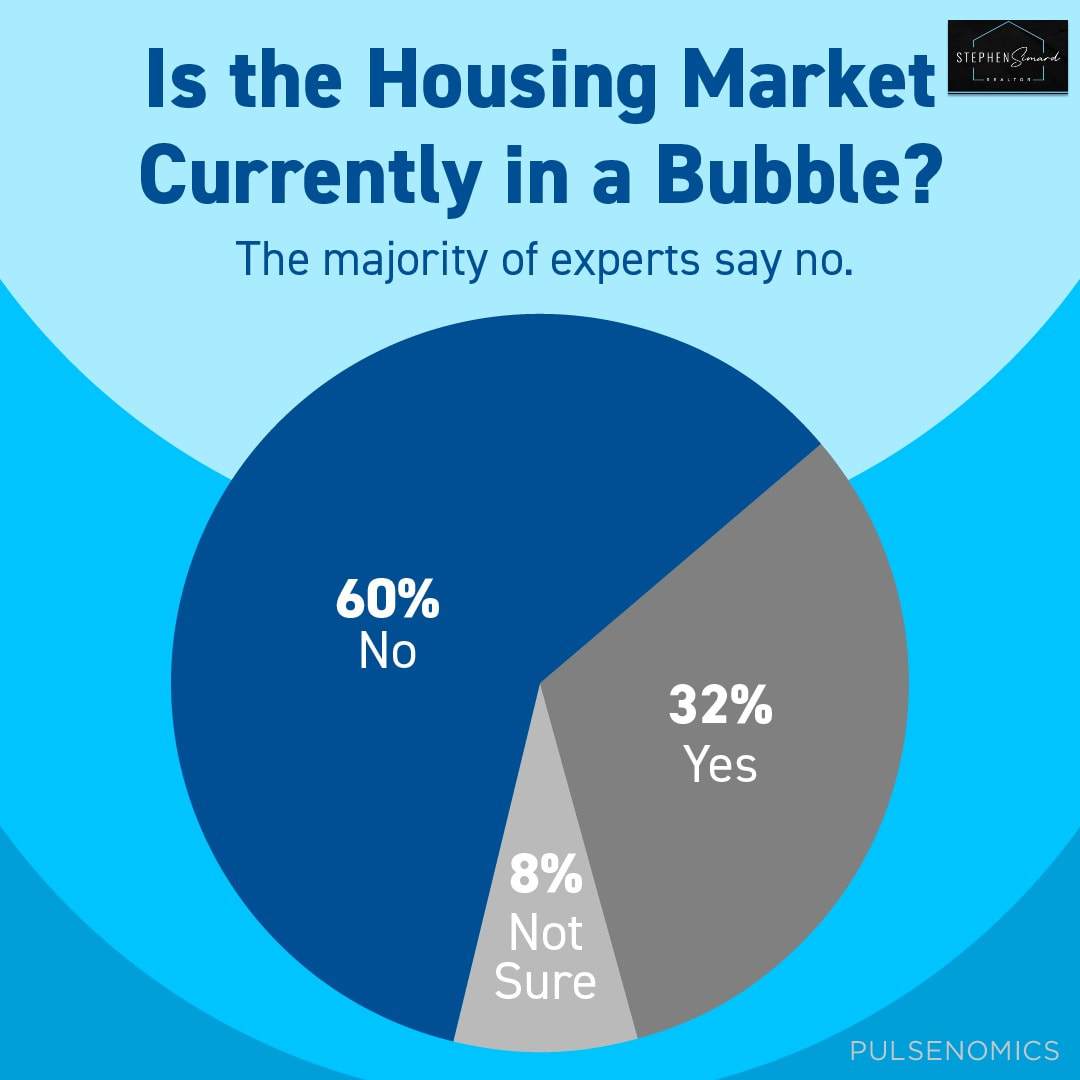

#GranbyRealtor #StephenSimardRealtor #RealBrokerLLC #HomePriceAppreciationHelpsBuildYourWealth You may be reading headlines and hearing talk about a potential housing bubble or a crash, but it’s important to understand that the data and expert opinions tell a different story. A recent survey from Pulsenomics asked over one hundred housing market experts and real estate economists if they believe the housing market is in a bubble. The results indicate most experts don’t think that’s the case (see graph below): As the graph shows, a strong majority (60%) said the real estate market is not currently in a bubble. In the same survey, experts give the following reasons why this isn’t like 2008:

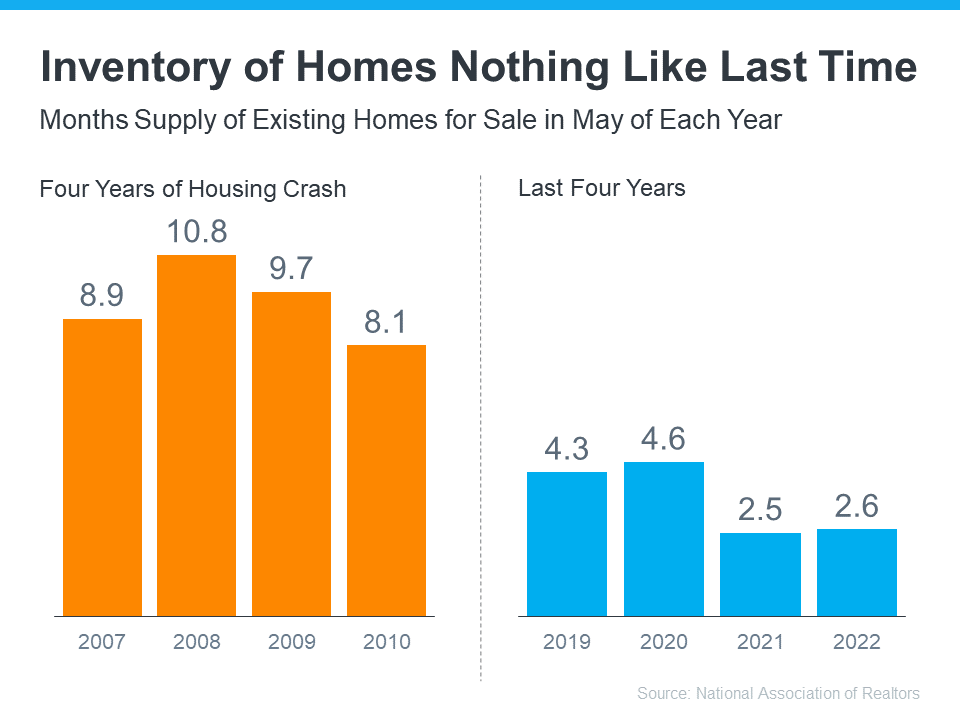

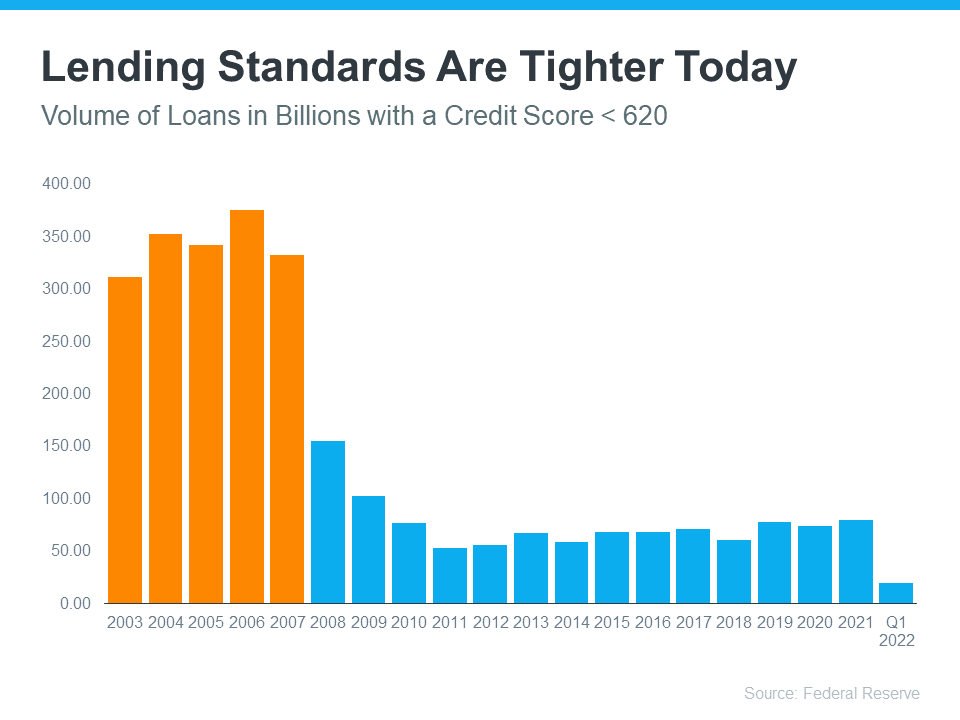

1. Low Housing Inventory Is Causing Home Prices To RiseThe supply of homes available for sale needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation. As the graph below shows, there were too many homes for sale from 2007 to 2010 (many of which were short sales and foreclosures), and that caused prices to tumble. Today, there’s still a shortage of inventory, which is causing ongoing home price appreciation (see graph below): Inventory is nothing like the last time. Prices are rising because there’s a healthy demand for homeownership at the same time there’s a limited supply of homes for sale. Odeta Kushi, Deputy Chief Economist at First American, explains: “The fundamentals driving house price growth in the U.S. remain intact. . . . The demand for homes continues to exceed the supply of homes for sale, which is keeping house price growth high.” 2. Mortgage Lending Standards Today Are Nothing Like the Last TimeDuring the housing bubble, it was much easier to get a mortgage than it is today. Here’s a graph showing the mortgage volume issued to purchasers with a credit score less than 620 during the housing boom, and the subsequent volume in the years after: This graph helps show one element of why mortgage standards are nothing like they were the last time. Purchasers who acquired a mortgage over the last decade are much more qualified than they were in the years leading up to the crash. Realtor.com notes:

“. . . Lenders are giving mortgages only to the most qualified borrowers. These buyers are less likely to wind up in foreclosure.” Bottom Line A majority of experts agree we’re not in a housing bubble. That’s because home price growth is backed by strong housing market fundamentals and lending standards are much tighter today. If you have questions, let’s connect to discuss why today’s housing market is nothing like 2008. SOURCE: KCM #MarketReport #Housing #Bubble #RealEstateAdvice #StephenSimard #RealBrokerLLC A majority of experts don’t believe the housing market is in a bubble. That’s because lending standards and housing inventory are very different today than they were in 2008. DM me so we can discuss the difference and why buying or selling could be a great move for you this summer.

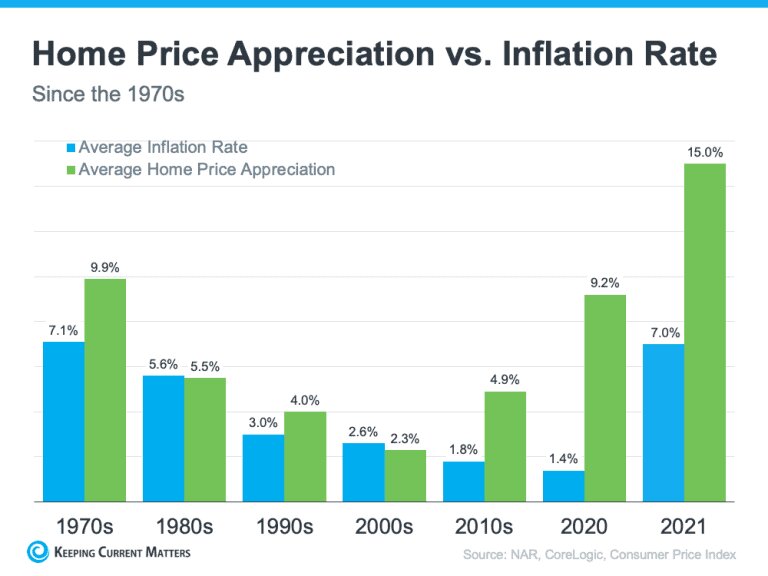

Source: KCM #notabubble #housingmarket #expertanswers #stayinformed #staycurrent #powerfuldecisions #confidentdecisions #realestate #realestateexperts #instarealestate #instarealtor #realestatetipsoftheday #realestatetipsandadvice #keepingcurrentmatters #StephenSimard #RealBrokerLLC If you’re following along with the news today, you’ve heard about rising inflation. Today, inflation is at a 40-year high. According to the National Association of Home Builders (NAHB): “Consumer prices accelerated again in May as shelter, energy and food prices continued to surge at the fastest pace in decades. This marked the third straight month for inflation above an 8% rate and was the largest year-over-year gain since December 1981.” With inflation rising, you’re likely feeling it impact your day-to-day life as prices go up for gas, groceries, and more. These climbing consumer costs can put a pinch on your wallet and make you re-evaluate any big purchases you have planned to ensure they’re still worthwhile. If you’ve been thinking about purchasing a home this year, you’re probably wondering if you should continue down that path or if it makes more sense to wait. While the answer depends on your situation, here’s how homeownership can help you combat the rising costs that come with inflation. Homeownership Helps You Stabilize One of Your Biggest Monthly Expenses Investopedia explains that during a period of high inflation, prices rise across the board. That’s true for things like food, entertainment, and other goods and services, even housing. Both rental prices and home prices are on the rise. So, as a buyer, how can you protect yourself from increasing costs? The answer lies in homeownership. Buying a home allows you to stabilize what’s typically your biggest monthly expense: your housing cost. When you have a fixed-rate mortgage on your home, you lock in your monthly payment for the duration of your loan, often 15 to 30 years. James Royal, Senior Wealth Management Reporter at Bankrate, says: “A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same. That’s certainly not the case if you’re renting.” So even if other prices increase, your housing payment will be a reliable amount that can help keep your budget in check. If you rent, you don’t have that same benefit, and you won’t be protected from rising housing costs. Investing in an Asset That Historically Outperforms Inflation While it’s true rising home prices and higher mortgage rates mean that buying a house today costs more than it did even a few months ago, you still have an opportunity to set yourself up for a long-term win. That’s because, in inflationary times, you want to be invested in an asset that outperforms inflation and typically holds or grows in value. The graph below shows how the average home price appreciation outperformed the average inflation rate in most decades going all the way back to the seventies – making homeownership a historically strong hedge against inflation (see graph below): So, what does that mean for you? Today, experts forecast home prices will only go up from here thanks to the ongoing imbalance of supply and demand. Once you buy a house, any home price appreciation that does occur will grow your equity and your net worth. And since homes are typically assets that grow in value, you have peace of mind that history shows your investment is a strong one.

That means, if you’re ready and able, it makes sense to buy today before prices rise further. Bottom Line If you’ve been thinking about buying a home this year, it makes sense to act soon, even with inflation rising. That way you can stabilize your monthly housing cost and invest in an asset that historically outperforms inflation. If you’re ready to get started, work with a trusted real estate advisor so you have expert advice on your specific situation when you’re ready to buy a home. Source: KCM #FirstTimeHomeBuyers #ForBuyers #Pricing #StephenSimard #RealBrokerLLC |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed