|

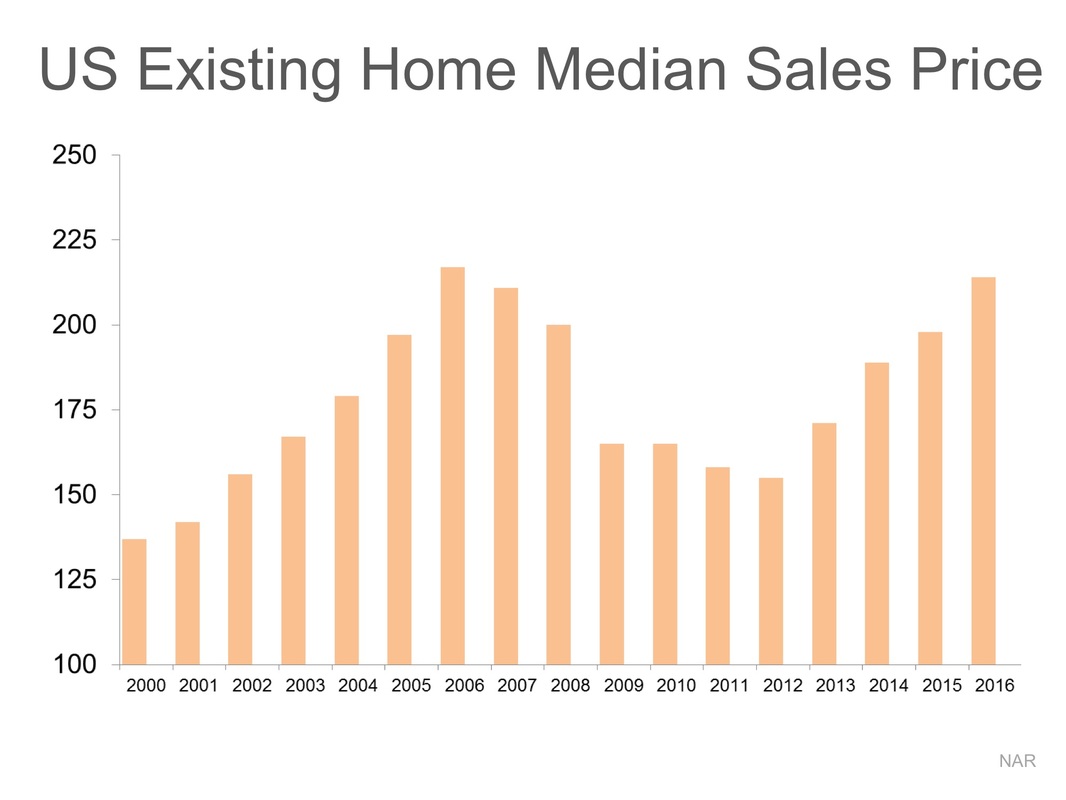

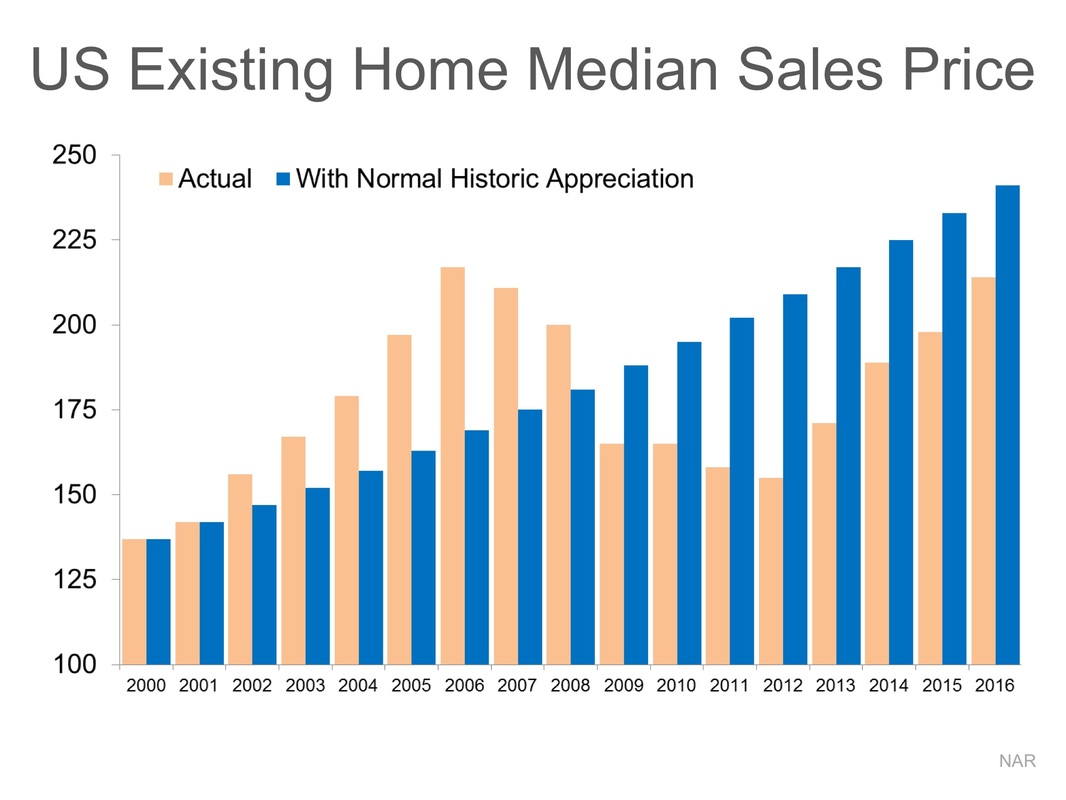

There are some industry pundits claiming that residential home values have risen too quickly and that current levels are on the verge of another housing bubble. It is easy to see how this thinking has taken form if we look at a graph of home prices from 2000 to today. The graph definitely looks like a rollercoaster ride. And, as prices begin to reach 2006 levels again, it “seems logical” that the next part of the ride would be downhill. However, this graph includes the anomaly of the price bubble and the correction (the housing crash). What if the bubble & bust didn’t occur? Let’s assume that instead of the rise and fall in home prices that we saw last decade, we just had normal historic appreciation from 2000 to today. According to the 100+ experts that are surveyed for the Home Price Expectation Survey, normal annual appreciation for residential single family homes from 1987 to 1999 was 3.6%. Starting with the median home price in 2000, we added 3.6% to it each year since then. Here is that graph intermixed with the above graph. What this shows us is that, had the bubble and crash not occurred and instead we just had normal annual appreciation over this period, prices would actually be greater than they are today.

Bottom Line There is no reason for alarm as prices seem to be right in line with where they should be. Source KCM #HomeValues #BubbleRange #HomeSelling #SimardRealtyGroup

0 Comments

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form.

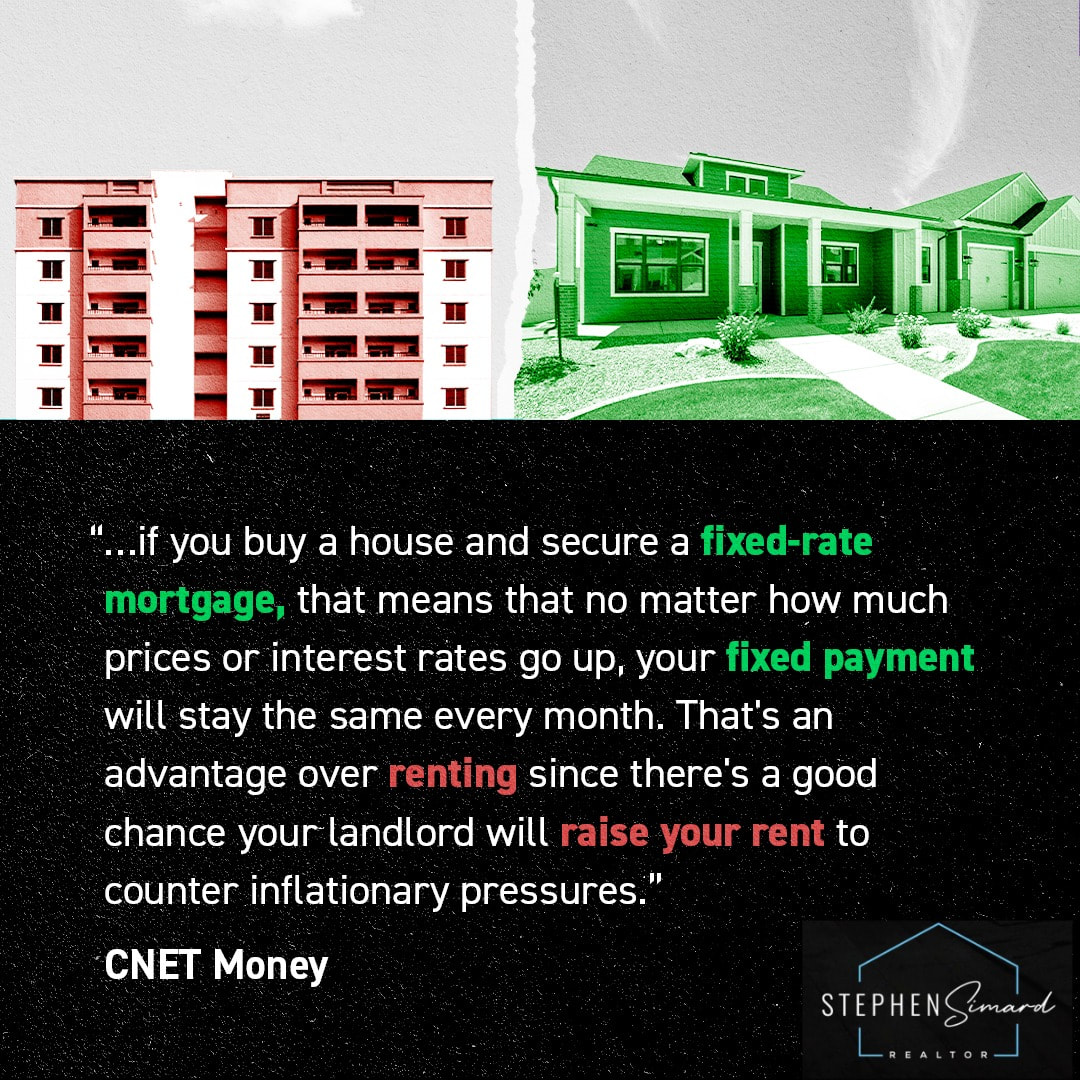

Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago. There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history. 1. The government has set new guidelines that now demand that the bank prove beyond any doubt that you are indeed capable of affording the mortgage. During the run-up in the housing market, many people ‘qualified’ for mortgages that they could never pay back. This led to millions of families losing their home. The government wants to make sure this can’t happen again. 2. The banks don’t want to be in the real estate business. Over the last seven years, banks were forced to take on the responsibility of liquidating millions of foreclosures and also negotiating another million plus short sales. Just like the government, they don’t want more foreclosures. For that reason, they need to double (maybe even triple) check everything on the application. However, there is some good news in the situation. The housing crash that mandated that banks be extremely strict on paperwork requirements also allows you to get a mortgage interest rate as low as 3.43%, the latest reported rate from Freddie Mac. The friends and family who bought homes ten or twenty ago experienced a simpler mortgage application process but also paid a higher interest rate (the average 30 year fixed rate mortgage was 8.12% in the 1990’s and 6.29% in the 2000’s). If you went to the bank and offered to pay 7% instead of less than 4%, they would probably bend over backwards to make the process much easier. Bottom Line Instead of concentrating on the additional paperwork required, let’s be thankful that we are able to buy a home at historically low rates. Source KCM #Paperwork #Mortgage #HomeBuying #SimardRealtyGroup There are many benefits to homeownership. One of the top ones is being able to protect yourself from rising rents and lock in your housing cost for the life of your mortgage.

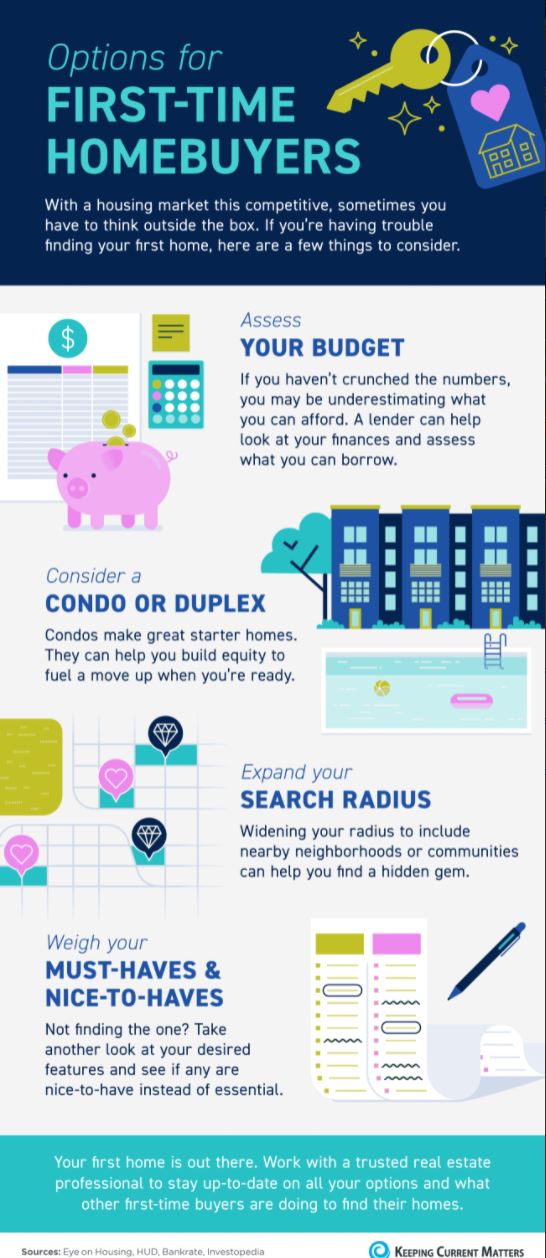

Don’t Become Trapped Jonathan Smoke, Chief Economist at realtor.com, reported on what he calls a “Rental Affordability Crisis.” He warns that, “Low rental vacancies and a lack of new rental construction are pushing up rents, and we expect that they’ll outpace home price appreciation in the year ahead.” In the Joint Center for Housing Studies at Harvard University's 2015 Report on Rental Housing, they reported that 49% of rental households are cost-burdened, meaning they spend more than 30% of their income on housing. These households struggle to save for a rainy day and pay other bills, such as food and healthcare. It’s Cheaper to Buy Than Rent In Smoke’s article, he went on to say, “Housing is central to the health and well-being of our country and our local communities. In addition, this (rental affordability) crisis threatens the future value of owned housing, as the burdensome level of rents will trap more aspiring owners into a vicious financial cycle in which they cannot save and build a solid credit record to eventually buy a home.” “While more than 85% of markets have burdensome rents today, it’s perplexing that in more than 75% of the counties across the country, it is actually cheaper to buy than rent a home. So why aren’t those unhappy renters choosing to buy?” Know Your Options Perhaps you have already saved enough to buy your first home. HousingWirereported that analysts at Nomura believe: "It’s not that Millennials and other potential homebuyers aren’t qualified in terms of their credit scores or in how much they have saved for their down payment. It’s that they think they’re not qualified or they think that they don’t have a big enough down payment.” (emphasis added) Many first-time homebuyers who believe that they need a large down payment may be holding themselves back from their dream home. As we have reported before, in many areas of the country, a first-time home buyer can save for a 3% down payment in less than two years. You may have already saved enough! Bottom Line Don’t get caught in the trap so many renters are currently in. If you are ready and willing to buy a home, find out if you are able. Let’s get together to determine if you could qualify for a mortgage now! SOURCE KCM #BuyVsRent #RentalTrap #KnowYourOptions #HomeBuyers #SimardRealtyGroup Looking for an updated, move in ready condo conveniently located in the Woodland Manor Community? This is it. Finished lower level adds 224 sq ft of extra space perfect for additional living room or office. Remodeled eat in kitchen with slider leads to the back patio area and good sized yard. Updated baths and newly added water heater. Located close to shopping, schools, bus line, and highways. See it now, make it yours, and enjoy affordable living. FHA Approved!

View more here: 199homesteadstreetc10.thebestlisting.com/ #JustListed #Manchester #SellingCT #SimardRealtyGroup Some Highlights:

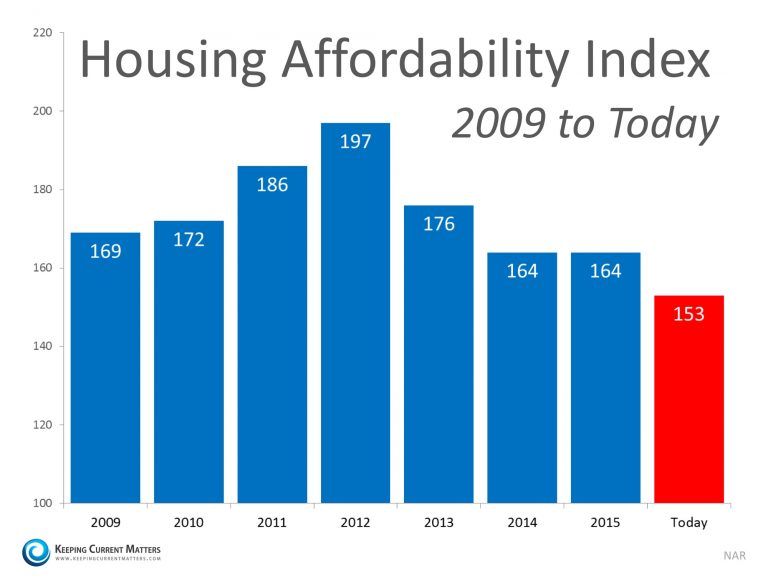

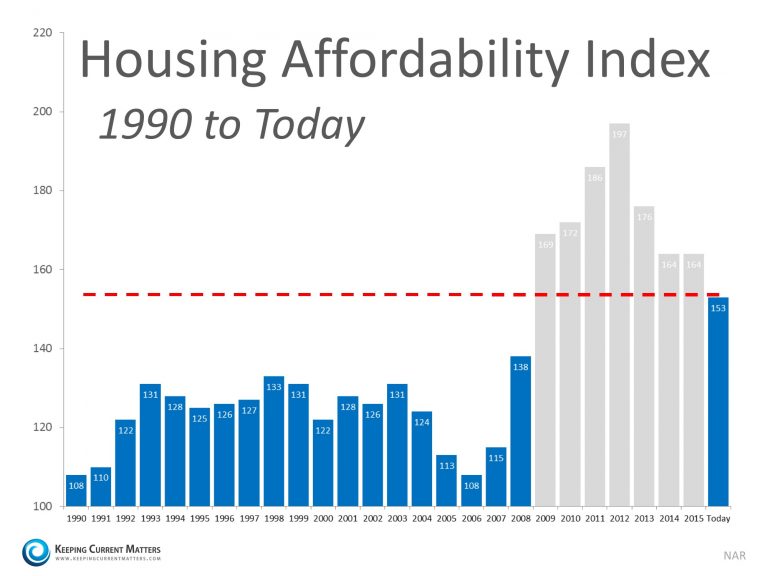

Source KCM #SupplyandDemand #RealEstateMarket #SimardRealtyGroup Some industry pundits are saying that the housing market may be heading for a slowdown. One of the data points they use is the falling numbers of the Housing Affordability Index, as reported by the National Association of Realtors (NAR). Here is how NAR defines the index: “The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data.” Basically, a value of 100 means a family earning the median income earns enough to qualify for a mortgage on a median priced home, based on the price and mortgage interest rates at the time. Anything above 100 means the family has more than enough to qualify. The higher the index the easier it is to afford a home. Why the concern? The index has been declining over the last several years as home values increased. Some are concerned that too many buyers could be priced out of the market. Here is a snapshot of the index since 2009: But, wait a minute… Though the index has decreased over the last four years, we must realize that at that time there was an overabundance of housing inventory and as many as one out of three listings was a distressed property (foreclosure or short sale). All prices dropped dramatically and distressed properties sold at major discounts. Then, mortgage rates fell like a rock. The market is recovering and values are coming back nicely. That has caused the index to fall. However, let’s remove the crisis years and look at the current index as compared to the index from 1990 – 2008. We can see that, even though prices have increased, historically low mortgage rates have put the index in a better position than every year for the nineteen years prior to the crash. Bottom Line

The Housing Affordability Index is in great shape and should not be seen as a challenge to the real estate market’s continued recovery. SOURCE KCM #HousingAffordability #Homebuyers #ForBuyers #HousingMarketUpdate #SimardRealtyGroup Price Improved! 68 Buttles Rd, Granby CT @ $190k

Looking for location and value? Come home to this Ranch set in the Poet's Corner section of Granby. A perfect first time home option, downsize, or condo alternative. Large Eat in kitchen opens to a good sized living room. Hardwood floors, newer roof, newer furnace, updated windows, and public water connected. Continue Reading: http://68buttlesroad.worldsbestlisting.com/ #PriceReduced #PriceImproved #Granby #SellingCT #SimardRealtyGroup PRICE REDUCED! 11 Washington Dr, Granby CT @ $179,500

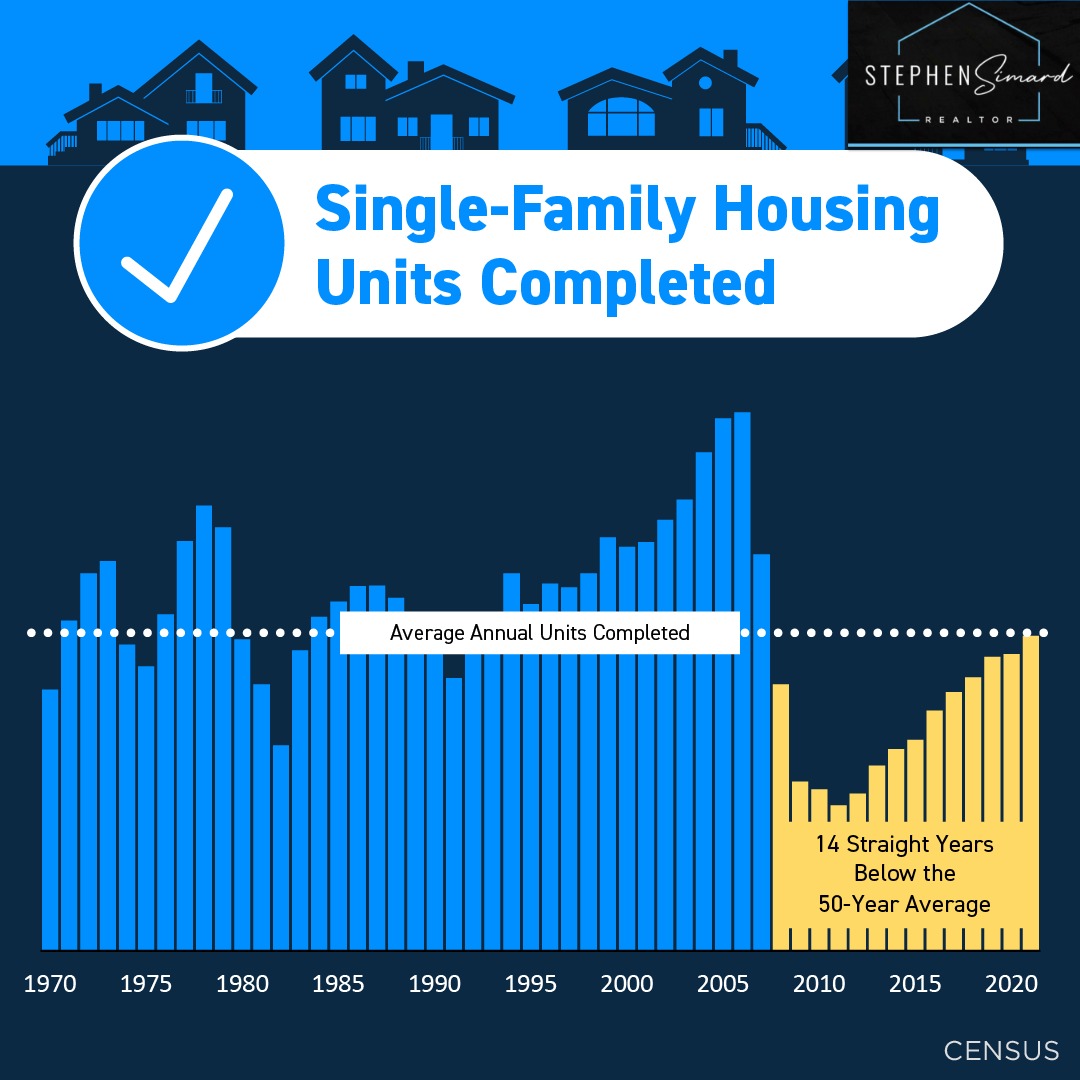

Come home to this Poets Corner charmer set on a cu-de-sac near the Granby/Simsbury line. Many improvements made including a new furnace and newer roof. Hardwood throughout, eat in kitchen, and family room with sliders leading to an open private backyard. Continue reading here: http://11washingtondrive.thebestlisting.com/ #PriceReduced #PriceImproved #Granby #SellingCT #SimardRealtyGroup Many experts have been calling upon home builders to ramp up construction to help with the lack of existing inventory for sale. For the past two months, new home sales have surged, with July’s total coming in at the highest since October 2007.

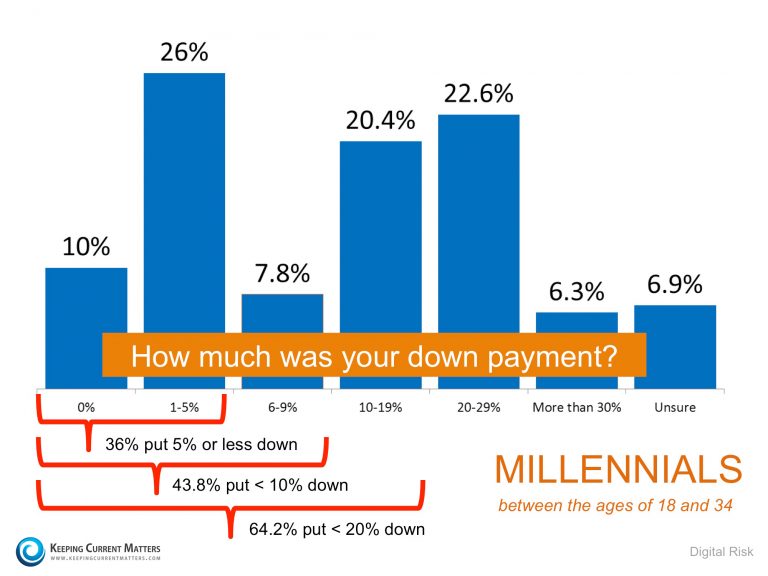

The latest estimates from the US Census Bureau and Department of Housing and Urban Development show that sales in July were 31.3% higher than this time last year, and 12.4% higher than last month, at a seasonally adjusted annual rate of 654,000. Zillow’s Chief Economist, Svenja Gudell, echoed the reaction of some as she commented: “July(‘s) new home sales data was a surprise, but a welcome one. For years, the market has been practically begging builders to both ramp up their efforts overall and to put more focus on serving the less expensive end of the market. Today's data confirms both are happening in earnest.” The National Association of Home Builder’s (NAHB) Chairman, Ed Brady, didn’t seem as surprised: “This rise in new home sales is consistent with our builders’ reports that market conditions have been improving. As existing home inventory remains flat, we should see more consumers turning to new construction.” NAHB’s Chief Economist, Robert Dietz, believes this is just the start for new home sales if market conditions continue: “July’s positive report shows there is a need for new single-family homes, buoyed by increased household formation, job gains and attractive mortgage rates. This uptick in demand should translate into increased housing production throughout 2016 and into next year.” The existing home sales numbers for July will be released today and will shed more light on the overall health of the housing market. Bottom Line New home sales hit their highest mark in over 9 years. Buyers are out in force to find a home that fits their needs. Many are turning to new construction, as the inventory of existing homes has not been able to keep up with demand. SOURCE KCM #HousingMarket #RealEstateNews #SimardRealtyGroup Fannie Mae’s “What do consumers know about the Mortgage Qualification Criteria?” Study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home. Myth #1: “I Need a 20% Down Payment”Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down payment required. Many believe that they need at least 20% down to buy their dream home. New programs actually let buyers put down as little as 3%. Below are the results of a Digital Risk survey of Millennials who recently purchased a home. As you can see, 64.2% were able to purchase their home by putting down less than 20%, with 43.8% putting down less than 10%! Myth #2: “I need a 780 FICO Score or Higher to Buy”The survey revealed that 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary to qualify. Many Americans believe a ‘good’ credit score is 780 or higher. To help debunk this myth, let’s take a look at the latest Ellie Mae Origination Insight Report, which focuses on recently closed (approved) loans. As you can see below, 54.1% of approved mortgages had a credit score of 600-749. Bottom LineWhether buying your first home or moving up to your dream home, knowing your options will definitely make the mortgage process easier. Your dream home may already be within your reach.

Source KCM #MortgageMyths #Buyers #KnowRealEstate #SimardRealtyGroup |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed