|

Some Highlights

SOURCE KCM #Sellers #Pricing #Infographics #SimardRealtyGroup

0 Comments

If you’re looking for a home to purchase right now and having trouble finding one, you’re not alone. At a time like this when there are so few houses for sale, it’s normal to wonder if you’ll actually find one to buy. According to the National Association of Realtors (NAR), across the country, inventory of available homes for sale is at an all-time low – the lowest point recorded since NAR began tracking this metric in 1982. There are, however, more homes expected to hit the market later this year. Let’s break down the three key places they’ll likely come from as 2021 continues on.

1. Homeowners Who Didn’t Sell Last Year In 2020, many sellers decided to pause their moving plans for a number of different reasons. From health concerns about the pandemic to financial uncertainty, plenty of homeowners decided not to move last year. Now that vaccines are being distributed and there’s a light at the end of the COVID-19 tunnel, it should bring some peace of mind to many potential sellers. As Danielle Hale, Chief Economist at realtor.com, notes: “Fortunately for would-be homebuyers, we expect sellers to return to the market as we see improvement in the economy and progress against the coronavirus.” Many of the homeowners who decided not to sell in 2020 will enter the market later this year as they begin to feel more comfortable showing their house in person, understanding their financial situation, and simply having more security in life. 2. More New Homes Will Be Built Last year was a strong year for home builders, and according to the National Association of Home Builders (NAHB), 2021 is expected to be even better: “For 2021, NAHB expects ongoing growth for single-family construction. It will be the first year for which total single-family construction will exceed 1 million starts since the Great Recession.” With more houses being built in many markets around the country, homeowners looking for new houses that meet their changing needs will be able to move into their dream homes. When they sell their current houses, this will create opportunities for those looking to find a home that’s already built to do so. It sets a simple chain reaction in motion for hopeful buyers. 3. Those Impacted Financially by the Economic Crisis Many experts don’t anticipate a large wave of foreclosures coming to the market, given the forbearance options afforded to current homeowners throughout the pandemic. Some homeowners who have been impacted economically will, however, need to move this year. There are also homeowners who didn’t take advantage of the forbearance option or were already in a foreclosure situation before the pandemic began. In those cases, homeowners may decide to sell their houses instead of going into the foreclosure process, especially given the equity in homes today. Lawrence Yun, Chief Economist at NAR, explains: “Given the huge price gains recently, I don’t think many homes will have to go to foreclosure…I think homes will just be sold, and there will be cash left over for the seller, even in a distressed situation. So that’s a bit of a silver lining in that we don’t expect a massive sale of distressed properties.” As we can see, it looks like we’re going to have an increase in the number of homes for sale in 2021. With fears of the pandemic starting to ease, new homes being built, and more listings coming to the market prior to foreclosure, there’s hope if you’re planning to buy this year. And if you’re thinking of selling and making a move, doing so while demand for your house is high might create an outstanding move-up option for you. Bottom Line Housing demand is high and supply is low, so if you’re thinking of moving, it’s a great time to do so. There are likely many buyers who are looking for a home just like yours, and there are options coming for you to find a new house too. Contact a local real estate professional today to see how you can benefit from the opportunities available in your local market. SOURCE KCM #HousingMarketUpdate #SellingMyth #BuyingMyth #SimardRealtyGroup

You may have more home equity today than you realize. Let's connect to plan how you can leverage that equity in your next move.

#TopGranbyRealtor #StephenSimard #ExpRealty #GranbyRealEstate #GranbyConnecticut #FindyourGranbyhome #Newhomesforsale #SimardRealtyGroup #Granbyhomesforsale #JoinExpRealty #Simsburyhomes The housing market has been scorching hot over the last twelve months. Buyers and their high demand have far outnumbered sellers and a short supply of houses. According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), sales are up 23.7% from the same time last year while the inventory of homes available for sale is down 25.7%. There are 360,000 fewer single-family homes for sale today than there were at this time last year. This increase in demand coupled with such limited supply is leading to more bidding wars throughout the country.

Rose Quint, Assistant Vice President for Survey Research with the National Association of Home Builders (NAHB), recently reported: “The number one reason long-time searchers haven’t made a home purchase is not because of their inability to find an affordably-priced home, but because they continue to get outbid by other offers.” A survey in the NAHB report showed that 40% of buyers have been outbid for a home they wanted to purchase. This is more than twice the percentage in 2019, which was 19%. What does this mean for sellers today? It means sellers have tremendous leverage when negotiating with buyers. In negotiations, leverage is the power that one side may have to influence the other side while moving closer to their negotiating position. A party’s leverage is based on its ability to award benefits or eliminate costs on the other side. In today’s market, a buyer wants three things:

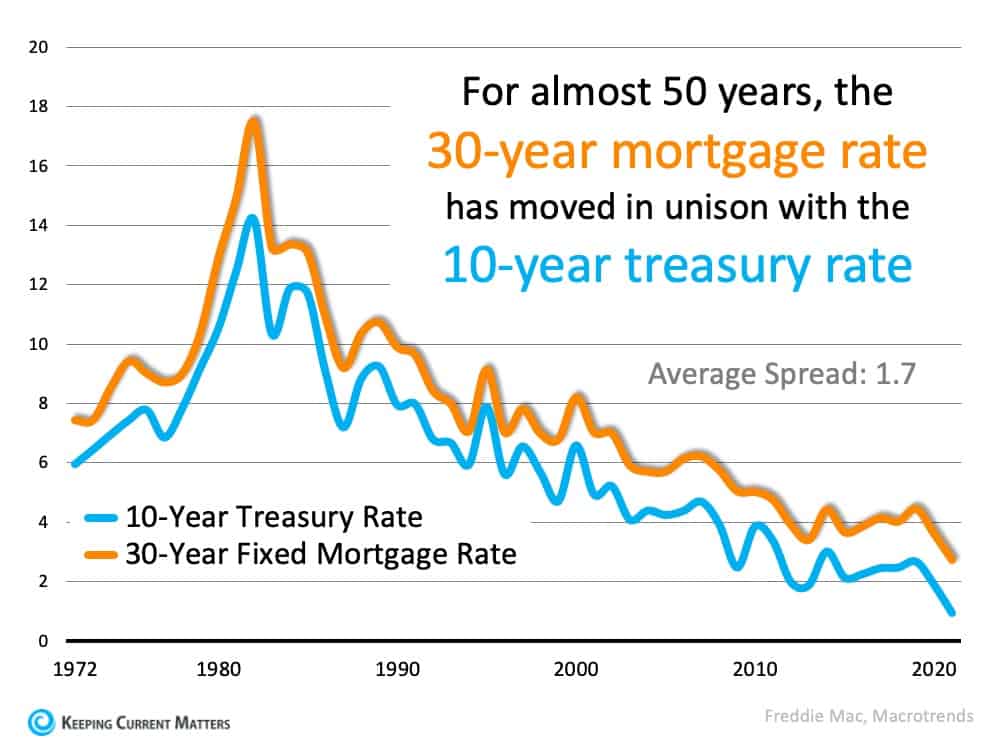

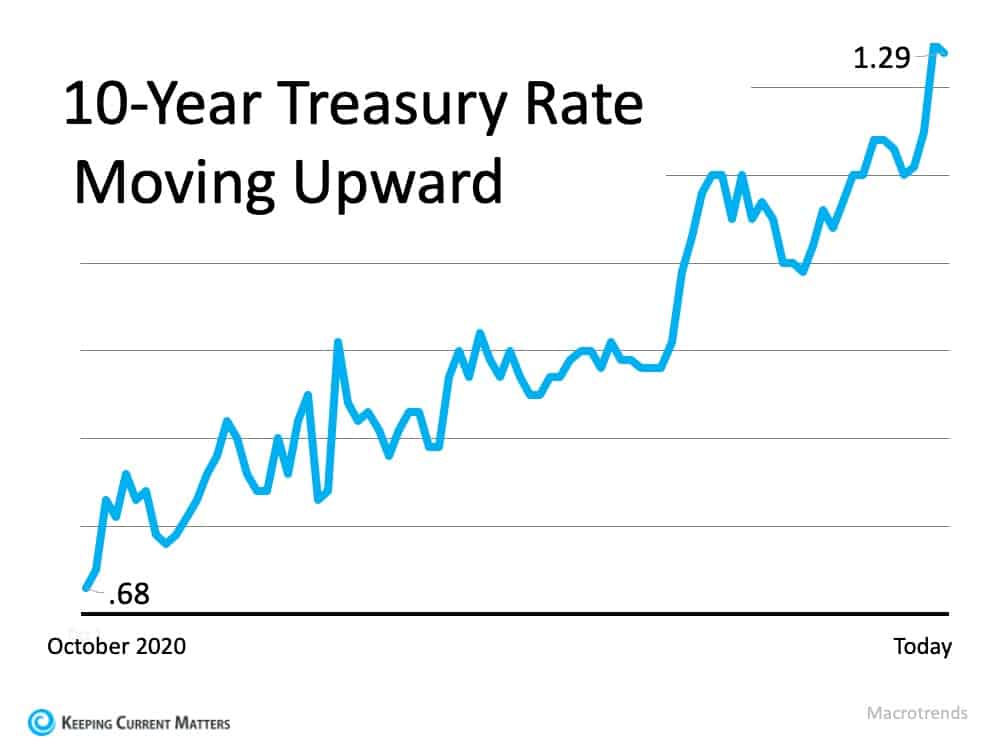

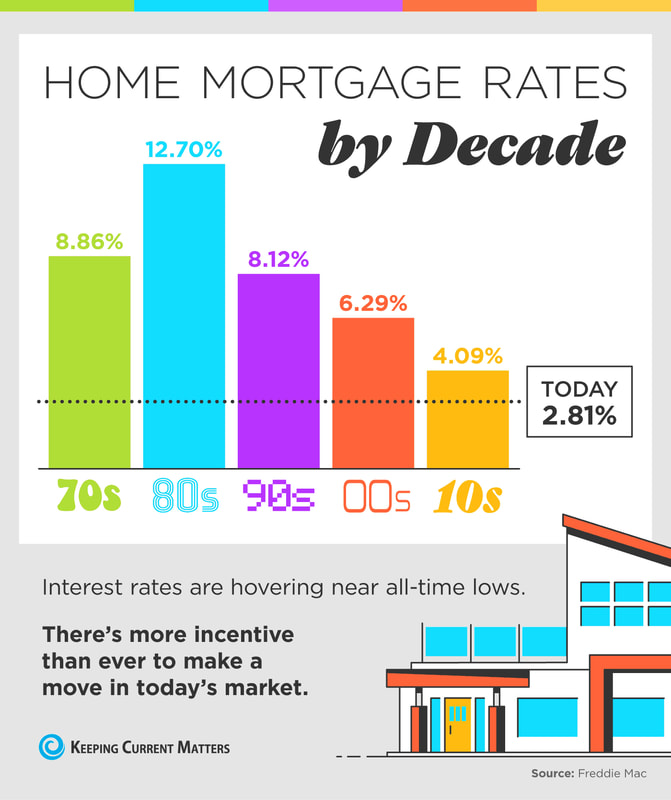

These three buyer needs give the homeowner tremendous leverage when selling their house. Most realize this leverage enables the seller to sell at a good price. However, there may be another need the seller has that can be satisfied by using this leverage. Here’s an example: Odeta Kushi, Deputy Chief Economist at First American, recently identified a situation in which many sellers are finding themselves today: “As mortgage rates are expected to remain near 3%, millennials continue to form households and more existing homeowners tap their equity for the purchase of a better home…Many homeowners may want to upgrade, but do not for fear that they will be unable to find a home to buy.” She then offers a possible solution: “While the fear of not being able to find something to buy will not disappear in a limited supply environment, new housing supply can incentivize existing homeowners to move.” There’s no doubt many sellers would love to build a new home to perfectly fit their changing wants and needs. However, most builders require that they sell their house first. If the seller sells their home, where would they live while their new home is being constructed? Going back to the concept of leverage: As mentioned, buyers have compelling reasons to purchase a home now, and many homeowners have challenges to address if they want to sell. Perhaps they can make a deal to satisfy each party’s needs. But how? The seller may decide to sell their home to the buyer at today’s price, which will enable the purchaser to take advantage of current mortgage rates. In return, the buyer might lease the house back to the seller for a pre-determined length of time while the seller’s new home is being built. A true win-win negotiation. Not every buyer will agree to such a deal – but you only need one. That’s just one example of how a seller might be able to overcome a challenge because of the leverage they have in today’s market. Maybe you feel a need to make certain repairs before selling. Perhaps you need time to get permits or approvals for certain upgrades you made to the house. Whatever the challenge, you may be able to work it out. Bottom Line If you’re considering selling your house now but worry a huge obstacle stands in your way, contact a local real estate professional. Maybe with the leverage you currently have, you can negotiate a deal that will allow you to make the move of your dreams. SOURCE KCM #Pricing #SellingMyths #NewConstruction #SimardRealtyGroup We’re currently experiencing historically low mortgage rates. Over the last fifty years, the average on a Freddie Mac 30-year fixed-rate mortgage has been 7.76%. Today, that rate is 2.81%. Flocks of homebuyers have been taking advantage of these remarkably low rates over the last twelve months. However, there’s no guarantee rates will remain this low much longer. Whenever we try to forecast mortgage rates, we should consider the advice of Mark Fleming, Chief Economist at First American: “You know, the fallacy of economic forecasting is don’t ever try and forecast interest rates and/or, more specifically, if you’re a real estate economist mortgage rates, because you will always invariably be wrong.” Many things impact mortgage rates. The economy, inflation, and Fed policy, just to name a few. That makes forecasting rates difficult. However, there’s one metric that has held up over the last fifty years – the relationship between mortgage rates and the 10-year treasury rate. Here’s a graph detailing this relationship since Freddie Mac started keeping mortgage rate records in 1972: There’s no denying the close relationship between the two. Over the last five decades, there’s been an average 1.7-point spread between these two rates. It’s this long-term relationship that has some forecasters projecting an increase in mortgage rates as we move throughout the year. This is based on the recent surge in the 10-year treasury rate shown here: The spread between the two is now 1.53, indicating mortgage rates could rise. Actually, a bump-up in rate has already begun. As Joel Kan, Associate VP of Economic Forecasting for the Mortgage Bankers Association, reveals:

“Expectations of faster economic growth and inflation continue to push Treasury yields & mortgage rates higher. Since hitting a survey low in December, the 30-year fixed rate has slowly risen, & last week climbed to its highest level since Nov 2020.” How high might they go in 2021? No one knows for sure. Sam Khater, Chief Economist for Freddie Mac, recently suggested: “While there are multiple temporary factors driving up rates, the underlying economic fundamentals point to rates remaining in the low 3% range for the year.” What does this mean for you? Whether you’re a first-time buyer or you’ve purchased a home before, even an increase of half a point in mortgage rate (2.81 to 3.31%) makes a big difference. On a $300,000 mortgage, that difference (including principal and interest) is $82 a month, $984 a year, or a total of $29,520 over the life of the home loan. Bottom Line Based on the 50-year symbiotic relationship between treasury rates and mortgage rates, it appears mortgage rates could be headed up this year. It may make sense to buy now rather than wait. SOURCE KCM #BuyingMyths #InterestRates #Buyers #SimardRealtyGroup Homes are selling very quickly these days, and many are getting multiple offers, too. Having an expert to guide you through the homebuying process is more important than ever. DM to make sure you have a trusted advisor on your side if you’re ready to find your dream home this year.

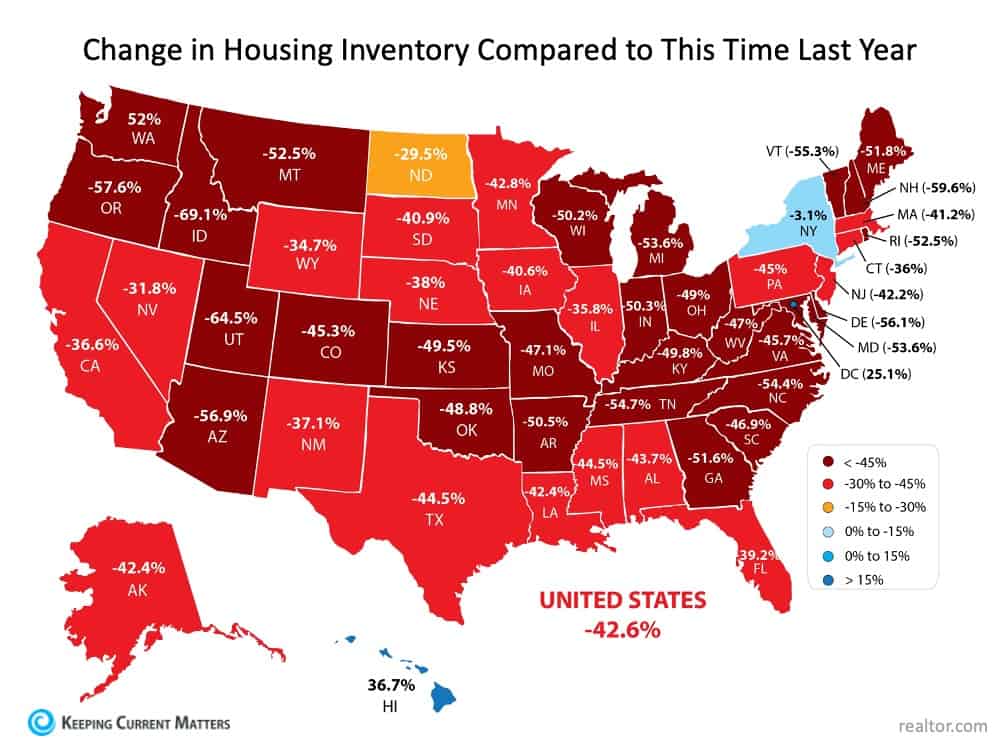

#buyingahome #realestate #firsttimehomebuyer #opportunity #housingmarket #househunting #downsizing #locationlocationlocation #newlisting #homeforsale #renovated #starterhome #dreamhome #curbappeal #keepingcurrentmatters In today’s housing market, it seems harder than ever to find a home to buy. Before the health crisis hit us a year ago, there was already a shortage of homes for sale. When many homeowners delayed their plans to sell at the same time that more buyers aimed to take advantage of record-low mortgage rates and purchase a home, housing inventory dropped even further. Experts consider this to be the biggest challenge facing an otherwise hot market while buyers continue to compete for homes. As Danielle Hale, Chief Economist at realtor.com, explains: “With buyers active in the market and seller participation lagging, homes are selling quickly and the total number available for sale at any point in time continues to drop lower. In January as a whole, the number of for sale homes dropped below 600,000.” Every month, realtor.com releases new data showing the year-over-year change in inventory of existing homes for sale. As you can see in the map below, nationwide, inventory is 42.6% lower than it was at this time last year: Does this mean houses aren’t being put on the market for sale?

Not exactly. While there are fewer existing homes being listed right now, many homes are simply selling faster than they’re being counted as current inventory. The market is that competitive! It’s like when everyone was trying to find toilet paper to buy last spring and it was flying off the shelves faster than it could be stocked in the stores. That’s what’s happening in the housing market: homes are being listed for sale, but not at a rate that can keep up with heavy demand from competitive buyers. In the same realtor.com report, Hale explains: “Time on the market was 10 days faster than last year meaning that buyers still have to make decisions quickly in order to be successful. Today’s buyers have many tools to help them do that, including the ability to be notified as soon as homes meeting their search criteria hit the market. By tailoring search and notifications to the homes that are a solid match, buyers can act quickly and compete successfully in this faster-paced housing market.” The Good News for Homeowners The health crisis has been a major reason why potential sellers have held off this long, but as vaccines become more widely available, homeowners will start making their moves. Ali Wolf, Chief Economist at Zonda, confirms: “Some people will feel comfortable listing their home during the first half of 2021. Others will want to wait until the vaccines are widely distributed.” With more homeowners getting ready to sell later this year, putting your house on the market sooner rather than later is the best way to make sure your listing shines brighter than the rest. When you’re ready to sell your house, you’ll likely want it to sell as quickly as possible, for the best price, and with little to no hassle. If you’re looking for these selling conditions, you’ll find them in today’s market. When demand is high and inventory is low, sellers have the ability to create optimal terms and timelines for the sale, making now an exceptional time to move. Bottom Line Today’s housing market is a big win for sellers, but these conditions won’t last forever. If you’re in a position to sell your house now, you may not want to wait for your neighbors to do the same. Contact a local real estate professional for advice on how to sell your house safely so you’re able to benefit from today’s high demand and low inventory. SOURCE KCM #SellingMyths #Pricing #SimardRealtyGroup Some Highlights

SOURCE KCM #InterestRates #ForBuyers #SimardRealtyGroup #StephenSimard High buyer demand is heating up today’s housing market. If you have a vacation home that just doesn’t fit your needs anymore, this spring is a perfect time to sell while buyers have destination fever. DM me to get started on the selling process.

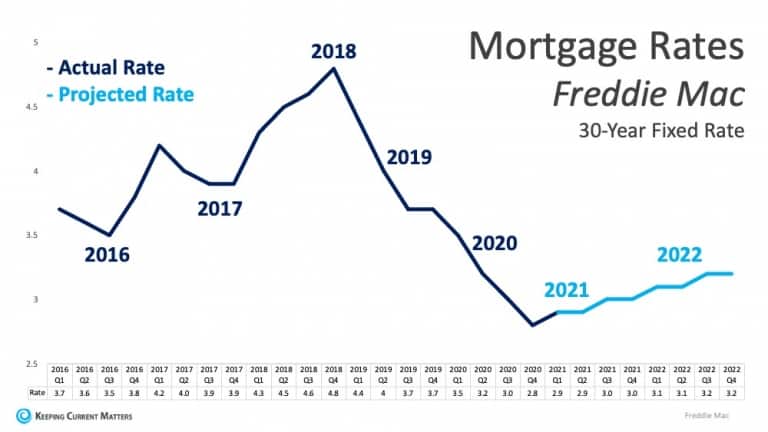

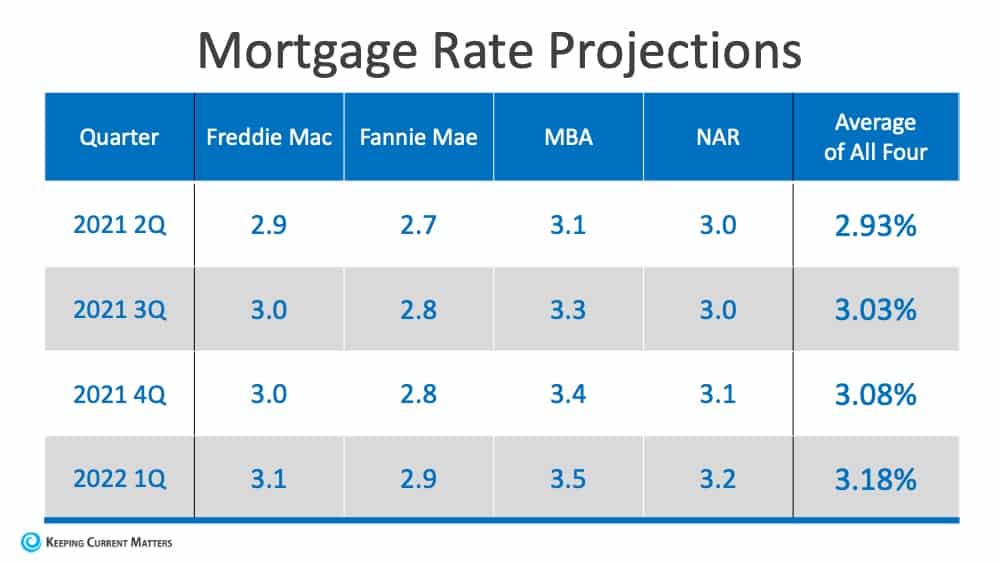

#sellyourhouse #vacationhome #destinationfever #getaway #moveuphome #dreamhome #realestate #homeownership #realestategoals #realestatetips #realestatelife #realestatenews #realestatetipsandadvice #justsold #keepingcurrentmatters With mortgage interest rates hitting record lows so many times recently, some are wondering if we’ll see low rates continue throughout 2021, or if they’ll start to rise. Recently, Freddie Mac released their quarterly forecast, noting: “The average 30-year fixed-rate mortgage hit a record low over a dozen times in 2020 and the low interest rate environment is projected to continue through this year. We expect interest rates to average below 3% through the end of 2021. While this is a modest rise from 2020 averages, the recent vote by the Federal Reserve to keep interest rates anchored near zero should keep rates low.” As shown in the graph below, Freddie Mac is projecting low rates going forward with a modest rise that’s expected to continue through 2022. Freddie Mac isn’t the only authority forecasting low rates with a slight rise. Fannie Mae, The Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) also anticipate low rates with a small increase as 2021 continues on. Here’s the quarterly breakdown of their projections and how they’re expected to play out over the next year: It’s important to note that, while a small change in interest rates can have a substantial impact on monthly mortgage payments, these rates are still incredibly low compared to where they were just a couple of years ago.

What does this mean for buyers? Low mortgage rates are creating an outstanding opportunity for current homebuyers to get more for their money while staying within their budget. As the economy gets stronger and we recover from the challenges of 2020, it’s natural for rates to potentially rise in response to a healthier economy. Mark Fleming, Chief Economist at First American, reminds us: “Rising interest rates reduce house-buying power and affordability, but are often a sign of a strong economy, which increases home buyer demand. By any historic standard, today’s mortgage rates remain historically low and will continue to boost house-buying power and keep purchase demand robust.” With low rates fueling activity among hopeful buyers, there are a lot of people who are highly motivated and looking for homes to purchase right now. In this environment, it can be challenging to find a home to buy, so a local real estate agent will be key to your success if you’re thinking of buying too. Working with a trusted real estate professional to navigate the process while rates are in your favor might be the best move you can make. Bottom Line If you’re ready to buy a home, it may be wise to make your move before mortgage rates begin to rise. Contact a local real estate professional to discuss how today’s low rates can create more opportunities for you this year. SOURCE KCM #InterestRates #HousingMarketUpdate #SimardRealtyGroup |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed