|

When supply is low and demand is high, items rise in value. That’s exactly what’s happening to home prices this summer. DM me to learn why buying a home that’s appreciating is a great investment this year.

#Homepriceapprecation #expertanswers #purchasingpower #NAR #buyingpower #affordability #realestate #homevalues #realestatemarket #realestateexperts #instarealestate #instarealtor #realestatetipsoftheday #realestatetipsandadvice #keepingcurrentmatters

0 Comments

Some Highlights:

SOURCE KCM #ForBuyers #ForSellers #Infographics #SimardRealtyGroup #eXpRealty Recent data shows two things:

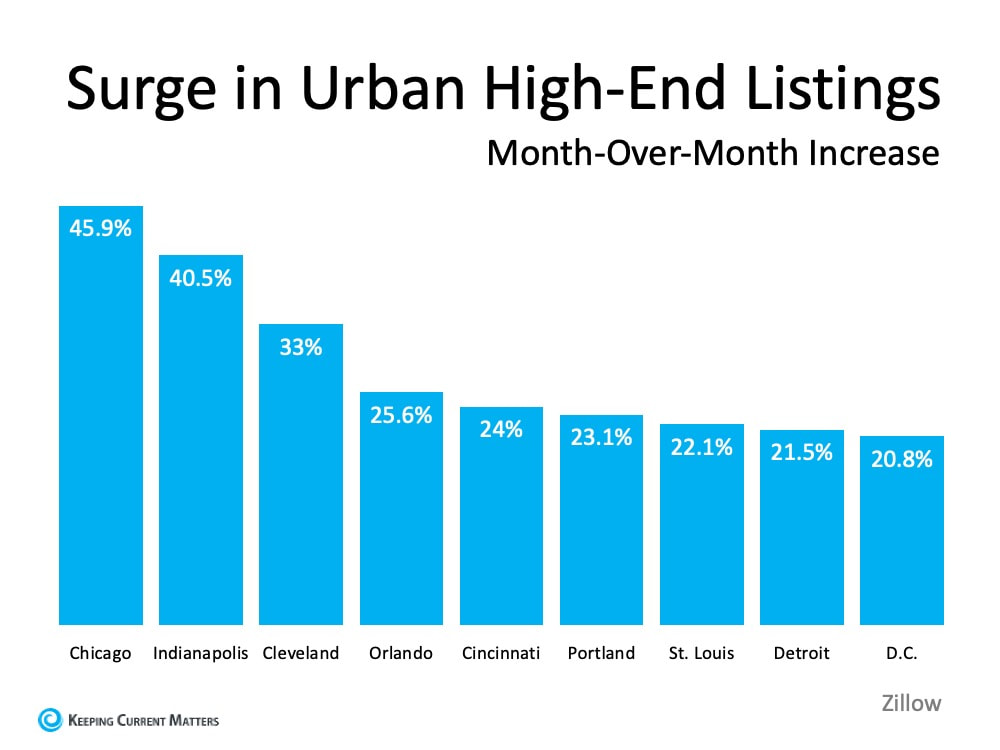

1. Homebuyers are rapidly returning to the housing market this summer. 2. Available home inventory cannot keep up with homebuyer demand. DM me to explore your options as a homebuyer, or to learn more about how selling now can make your house rise to the top of the pool for buyers. #supplyanddemand #sellyourhouse #moveuphome #dreamhome #realestate #homeownership #realestategoals #realestatetips #realestatelife #realestatenews #newlisting #homeforsale #realestatetipsoftheday #keepingcurrentmatters As remote work continues on for many businesses and Americans weigh the risks of being in densely populated areas, will more people start to move out of bigger cities? Spending extra time at home and dreaming of more indoor and outdoor space is certainly sparking some interest among homebuyers. Early data shows an initial trend in this direction of moving from urban to suburban communities, but the question is: will the trend continue? According to recent data from Zillow, there is a current surge in urban high-end listings in some larger metro areas. The month-over-month increase in these homes going on the market indicates more urban homeowners may be ready to make a move out of the city, particularly at the upper end of the market (See graph below): Why are people starting to move out of larger cities?With the ongoing health crisis, it’s no surprise that many people are starting to consider this shift. A July survey from HomeLight notes the top reasons people are actually moving today:

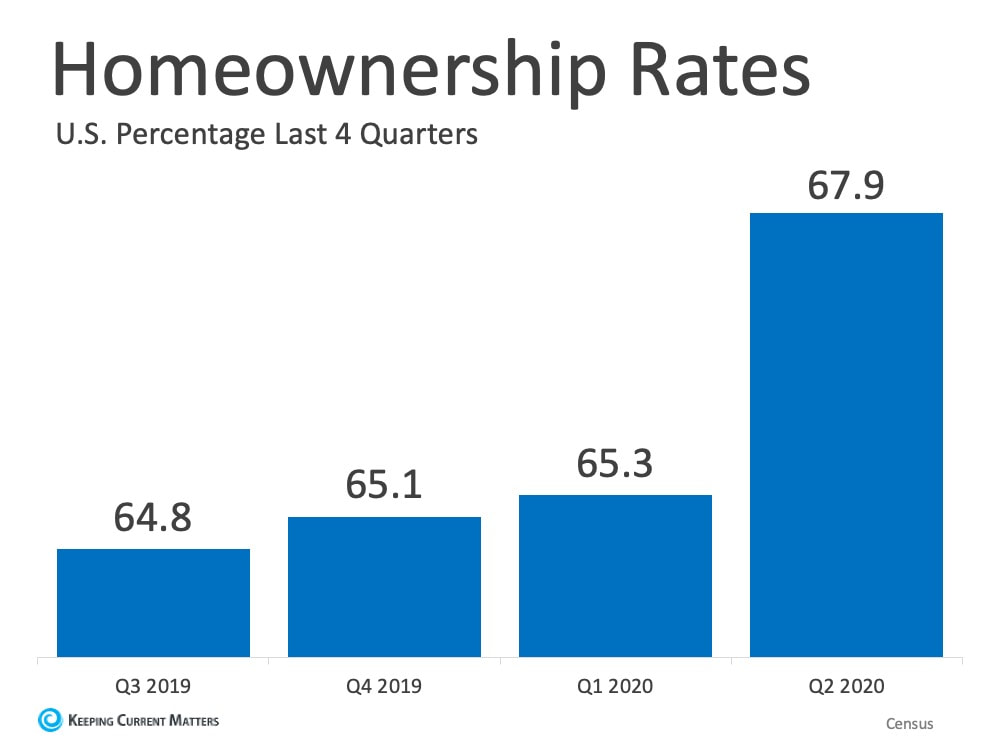

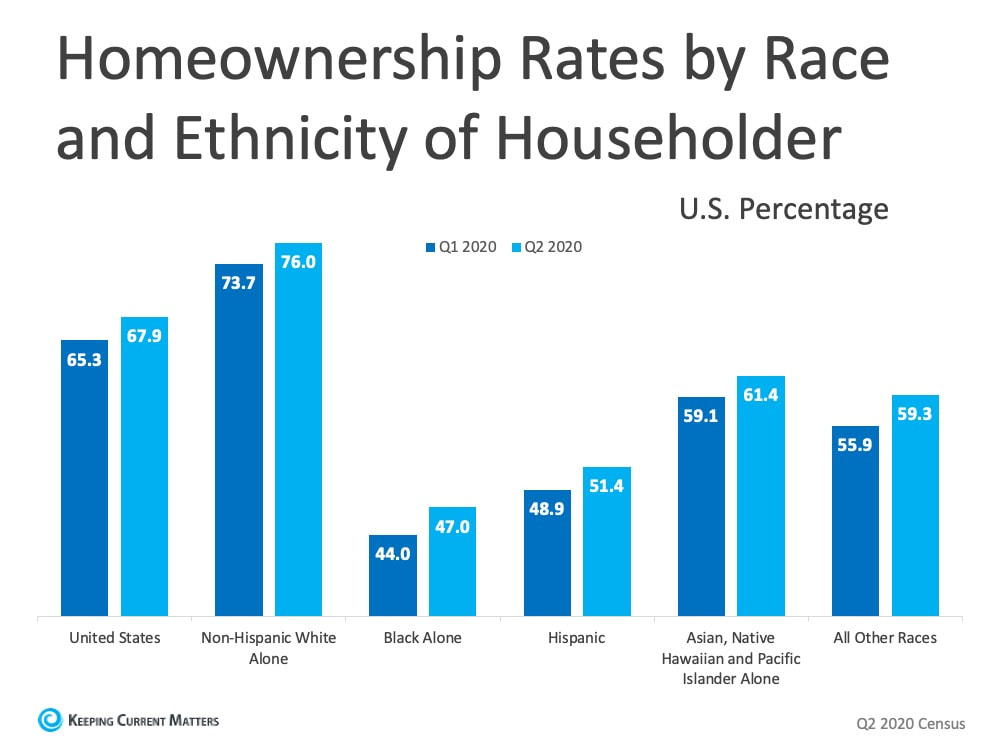

More space, proximity to fewer people, and a desire to own at a more affordable price point are highly desirable features in this new era, so the list makes sense. John Burns Consulting notes: “The trend is accelerating faster than anyone could have predicted. The need for more space is driving suburban migration.” In addition, Sheryl Palmer, CEO of Taylor Morrison, a home building company, indicates: “Most recently, we’re really seeing a pickup in folks saying they want more rural or suburban locations. Initially, there was a lot of talk about that, but it’s really coming through our buyers today.” The National Association of Home Builders (NAHB) also shares: “New home demand is improving in lower density markets, including small metro areas, rural markets and large metro exurbs, as people seek out larger homes and anticipate more flexibility for telework in the years ahead. Flight to the suburbs is real.” Will the shift pick up speed and continue on? The question remains, will this interest in suburban and rural living continue? Some, like Lawrence Yun, Chief Economist at the National Association of Realtors (NAR) think the possibility is there, but it is still quite early to tell for sure. Yun notes: “Homebuyers considering a move to the suburbs is a growing possibility after a decade of urban downtown revival…Greater work-from-home options and flexibility will likely remain beyond the virus and any forthcoming vaccine.” While much of the energy behind this trend has largely been accelerated by the current health crisis, monitoring the momentum over time is critically important. Businesses are discovering new and innovative ways to function in remote environments, so the shift has the potential to stick. Much like the economic recovery, however, the long-term impact may hinge largely on the health situation throughout this country. Bottom Line Early data is showing a shift from urban to suburban markets, but keeping an eye on this trend will help us understand how it will ultimately play out. It may just be a temporary swing in a new direction until Americans once again feel a sense of comfort in the cities they’ve grown to love. SOURCE KCM #ForBuyers #ForSellers #Moving #SimardRealtyGroup #eXpRealty So far, it’s been quite a ride this year, and our nation has truly seen its fair share of hurdles. From COVID-19 to record unemployment and then the resulting recession, just to name a few, the second quarter of 2020 has had more than a few challenges. Amidst the many roadblocks, however, the U.S. homeownership rate rose again, signaling great strength in the recovery of the housing market and an indication that even in a time of crisis, Americans still feel confident about buying a home. Yesterday, the U.S. Census Bureau announced: “The homeownership rate of 67.9 percent was 3.8 percentage points higher than the rate in the second quarter 2019 (64.1 percent) and 2.6 percentage points higher than the rate in the first quarter 2020 (65.3 percent).” The increase is also represented by race and ethnicity of the householder: There are many reasons why the homeownership rate in this country is rising, and one of the key factors is historically-low mortgage rates. Rates hovering at all-time lows are helping to drive affordability and enabling more potential homeowners to enter the market today. According to Ralph McLaughlin, Chief Economist for Haus:

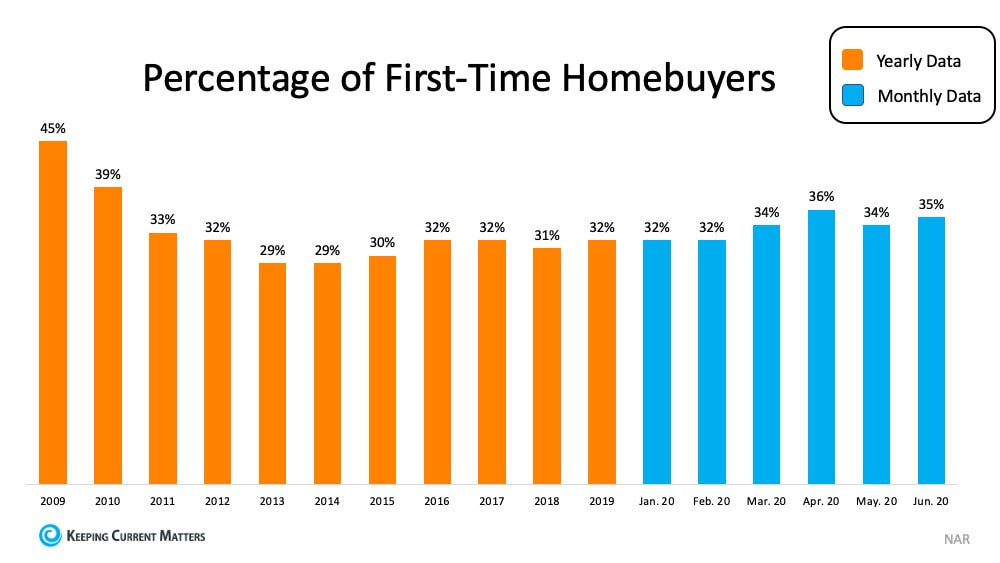

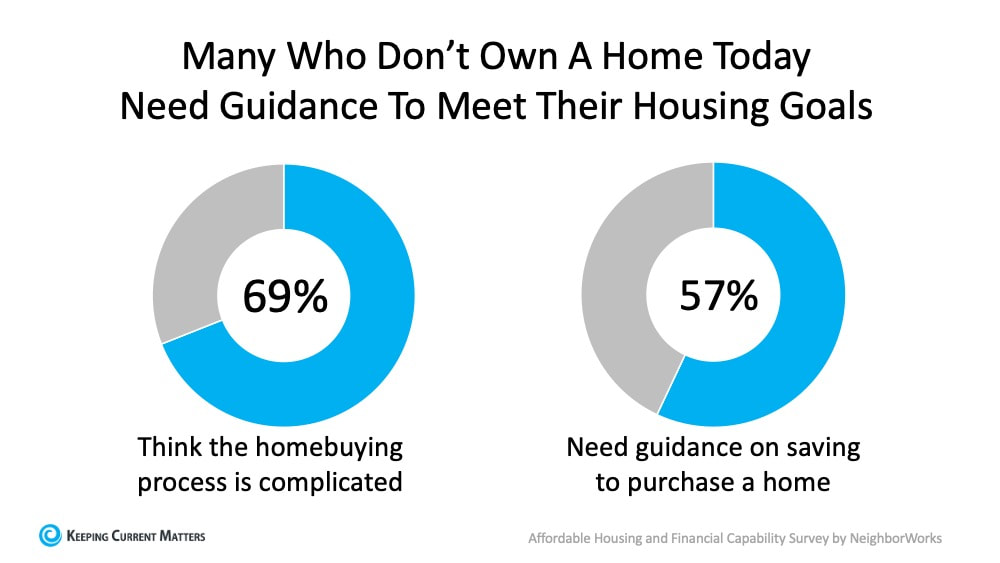

“Mortgage rates are the icing on the cake for households that were thinking about buying…They found an unexpected opportunity during the worst economic downturn America has seen since the Great Depression.” In addition, many potential homebuyers have been using their time this year to search for homes that offer more space than their current rental apartments. Many of these homebuyers are younger and, as noted by Odeta Kushi, Deputy Chief Economist at First American, are the buyers driving the homeownership rate in an upward direction: “Big jump in the homeownership rate today, mostly driven by younger households. We saw a spike in the number of owners, and a decline in the number of renters. This is the highest rate of homeownership since 2008.” This growth is outstanding news for the housing market and for those who have recently found their new homes. If homeownership is on your shortlist this year, maybe now is a great time to meet with a real estate professional to evaluate your current situation. Perhaps historically low mortgage rates can help you to become a homeowner too. Bottom Line If you’re thinking of buying a home this year, contact a local real estate professional today to take your dream one step closer to reality. SOURCE KCM #Demographics #InterestRates #ForBuyers #SimardRealtyGroup #joineXpRealty In June, the number of first-time homebuyers accounted for 35% of the existing homes sold, a trend that’s been building steadily throughout the year. According to the National Association of Realtors (NAR): “The share of first-time buyers increased in March through June—right into the heart of the pandemic period and the surge in unemployment—and is now trending higher than the 29% to 32% average in past years since 2012.” (See graph below): Why the rise in first-time homebuying?NAR continues to say: “The major factor is, arguably, low mortgage rates. As of the week ended July 16, the 30-year fixed mortgage rate dropped to 2.98%. With rates so low that are locked in under a 30-year mortgage, the typical mortgage payment, estimated at $1,036, has fallen below the median rent, at $1,045. For potential home buyers who were thinking of purchasing a home anyway before the pandemic outbreak and who are likely to remain employed, the low mortgage rate may be the clincher.” Clearly, historically low mortgage rates are encouraging many to buy. With the average mortgage payment now estimated at a lower monthly cost than renting, it’s a great time for first-time homebuyers to enter the market. According to the Q2 2020 Housing Trends Report from the National Association of Homebuilders (NAHB): “Eighty-four percent of Gen Z’s planning to buy a home are first timers, compared to 68% of Millennials, 52% of Gen X’s, and 21% of Boomers. Looking at results by region shows that over 60% of prospective buyers in the Northeast and South are buying a home for the first time. The share is above 55% in the Midwest and West.” There are, however, challenges for first-time buyers. A recent survey conducted by NeighborWorks America also notes that understanding the homebuying process may be the most significant barrier for many hopeful homeowners: “Homeownership is a particular challenge for many, despite high levels of interest. Americans believe there are many benefits to homeownership and half of non-owners will seek information about the process in the next few years…a large share of non-owners say the process is too challenging and only a minority know where to find advice if they wanted it. And although many would seek the guidance of community and non-profit programs, only one in three non-owners are aware of such services.” If you’re among the first-time homebuyers who feel the process is complicated, you’re not alone. If you’re not sure where to begin or you simply want help in figuring out how to save for a home, finding a trusted real estate advisor to work with is a critical step toward your success. A real estate professional can help you understand the process, review your current situation, and guide you with a plan to help you to feel confident when buying a home.

Bottom Line If you’re interested in purchasing a home and need help getting started, reach out to a local real estate professional today to take advantage of the support available to guide you through each step of the way. SOURCE KCM #FirstTimeHomeBuyers #ForBuyers #SimardRealtyGroup #eXpRealty The residential real estate market is remaining resilient as the country still struggles to beat the COVID-19 pandemic. Three separate reports recently revealed how the housing market is still showing growth. Here’s a look at each one.

1. Ivy Zelman’s Real Estate Broker Survey The survey explains that purchaser demand remains strong: “This month’s overall homebuyer demand rating…was easily the strongest sequential gain in our survey history…Strength continues to be led by the entry-level…While high-end demand is less robust in an absolute sense, there has also been relative improvement, with contacts attributing incremental improvement to the stock market’s rebound, record low mortgage rates and luxury customers trading out of high-priced cities.” 2. The National Association of Home Builders Housing Market Index The index reveals that builder confidence has returned to levels last seen prior to the pandemic: “In a strong signal that the housing market is ready to lead a post-COVID economic recovery, builder confidence in the market for newly-built single-family homes jumped 14 points to 72 in July, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The HMI now stands at the solid pre-pandemic reading in March before the outbreak affected much of the nation.” 3. The realtor.com Housing Market Recovery Index This index leverages a weighted average of four key components of the housing industry, tracking each of the following:

It then compares the current status “to the last week of January 2020 market trend, as a baseline for pre-COVID market growth. The overall index is set to 100 in this baseline period. The higher a market’s index value, the higher its recovery and vice versa.” The latest results came in at 101, with realtor.com explaining: “The U.S. Housing Market has recovered from the immediate disruption caused by the COVID pandemic and returned to January 2020 growth levels.” Bottom Line Real estate brokers, home builders, and industry data all agree that the housing market has surged back to pre-COVID levels, showing growth, strength, and incredible resilience. SOURCE KCM #HousingMarketUpdate #RealEstateUpdate #Recovery #SimardRealtyGroup #eXpRealty Some Highlights

SOURCE KCM #ForBuyers #ForSellers #Infographics #SimardRealtyGroup #eXpRealty Homeownership can truly warm your heart when you need it most. If you’re thinking of buying a home this year, DM me so you’re sure to have a trusted expert on your side.

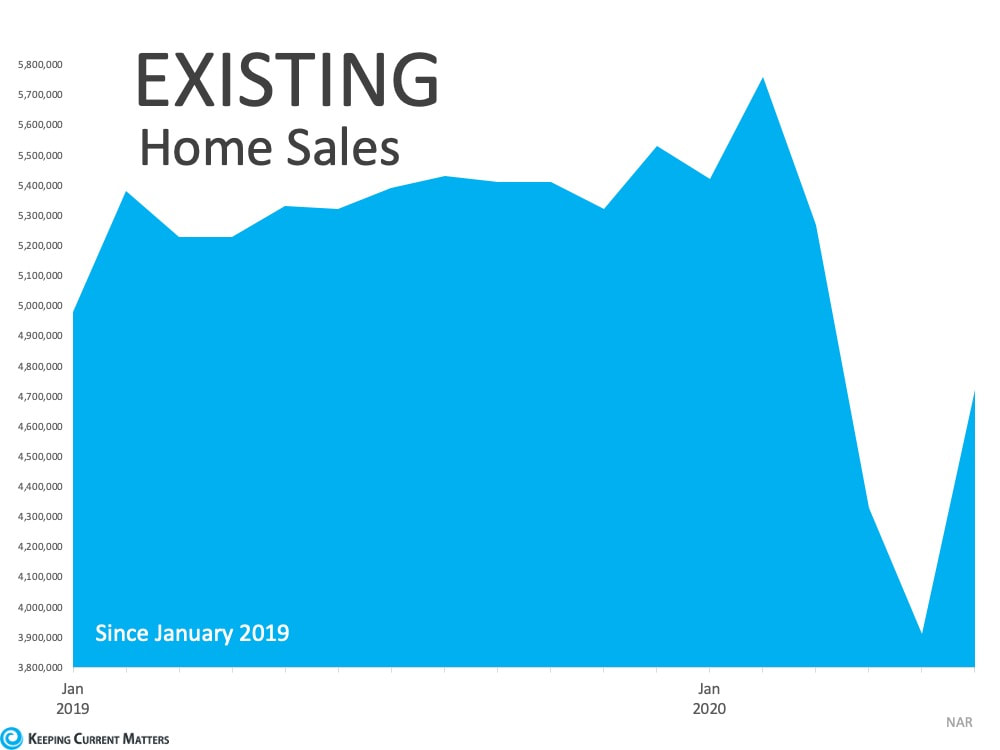

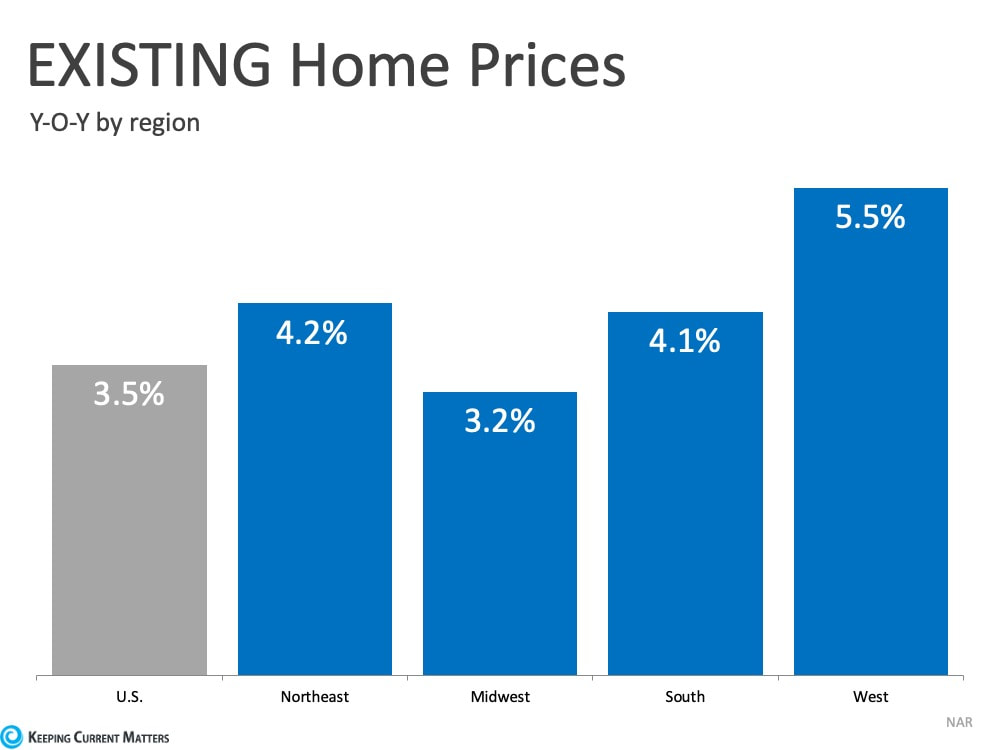

#buynow #firsttimehomebuyer #opportunity #housingmarket #househunting #makememove #locationlocationlocation #newlisting #homeforsale #renovated #starterhome #dreamhome #curbappeal #keepingcurrentmatters With a worldwide health crisis that drove a pause in the economy this year, the housing market was greatly impacted. Many have been eagerly awaiting some bright signs of a recovery. Based on the latest Existing Home Sales Report from the National Association of Realtors (NAR), June hit a much-anticipated record-setting rebound to ignite that spark. According to NAR, home sales jumped 20.7% from May to a seasonally-adjusted annual rate of 4.72 million in June: “Existing-home sales rebounded at a record pace in June, showing strong signs of a market turnaround after three straight months of sales declines caused by the ongoing pandemic…Each of the four major regions achieved month-over-month growth.” This significant rebound is a major boost for the housing market and the U.S. economy. According to Lawrence Yun, Chief Economist for NAR, the momentum has the potential to continue on, too: “The sales recovery is strong, as buyers were eager to purchase homes and properties that they had been eyeing during the shutdown…This revitalization looks to be sustainable for many months ahead as long as mortgage rates remain low and job gains continue.” With mortgage rates hitting an all-time low, dropping below 3% for the first time last week, potential homebuyers are poised to continue taking advantage of this historic opportunity to buy. This fierce competition among buyers is contributing to home price increases as well, as more buyers are finding themselves in bidding wars in this environment. The report also notes: “The median existing-home price for all housing types in June was $295,300, up 3.5% from June 2019 ($285,400), as prices rose in every region. June’s national price increase marks 100 straight months of year-over-year gains.” The graph below shows home price increases by region, powered by low interest rates, pent-up demand, and a decline in inventory on the market: Yun also indicates:

“Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.” Bottom Line Buyers returning to the market is a great sign for the economy, as housing is still leading the way toward a recovery. If you’re ready to buy a home this year, reach out to a local real estate professional to make sure you have the best possible guide with you each step of the way. SOURCE KCM #ForBuyers #ForSellers #HousingMarketUpdates #SimardRealtyGroup #eXpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed