|

Some Highlights:

SOURCE KCM #HomeOwner #Buyer #Seller #RealEstate #SimardRealtyGroup #joineXpRealty

0 Comments

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means. On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index… “…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.” Their methodology states: “To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.” So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990 It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis. With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year! Bottom Line With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers. SOURCE KCM #Buyers #HousingAffordability #RealEstate #SimardRealtyGroup #eXpRealty As loved ones start to get older, we start to wonder: how long will they be able to live alone? Will they need someone there to help them with daily life? There’s a reason to ask those questions now more than ever, as the average age in the U.S. is 78 years old! As a result, 41% of Americans in the market are searching for a home that can accommodate a multigenerational family. The graph below shows the number of people by generation that purchased a multigenerational home because they will either be taking care of an aging parent or they just want to spend time together. Of those buyers, 26% indicated they will be taking care of an aging parent, and 14% said they want to spend time with an aging parent. These numbers do not come as a surprise. According to Pew Research Center, 64 million Americans (20% of the population) lived in a multigenerational household in 2016 (Last numbers available). An increasing number of studies affirm the benefits of being part of a multigenerational household. These benefits aren’t just for the grandchildren, but for the grandparents as well. According to these two resources:

The University of Oxford “Children who are close to their grandparents have fewer emotional and behavioral problems and are better able to cope with traumatic life events, like a divorce or bullying at school”. Boston College “Researchers found that emotionally close ties between grandparents and adult grandchildren reduced depressive symptoms in both groups”. This research gives helpful insight into why 41% of Americans are in the market to buy a multigenerational home. Bottom Line If you have a home that could accommodate a multigenerational family and are thinking about selling, now is the perfect time to put it on the market! The number of buyers looking for this type of home will only continue to increase. SOURCE KCM #Generation #Millenial #SeniorMarket #SimardRealtyGroup #eXpRealty Some Highlights:

SOURCE KCM #ForBuyers #ForSellers #HousingMarketUpdate #SimardRealtyGroup #eXpRealty

Before making any big purchases, moving money around, or making any big-time life changes, consult your loan officer. They will be able to tell you how your decision could impact your home loan.

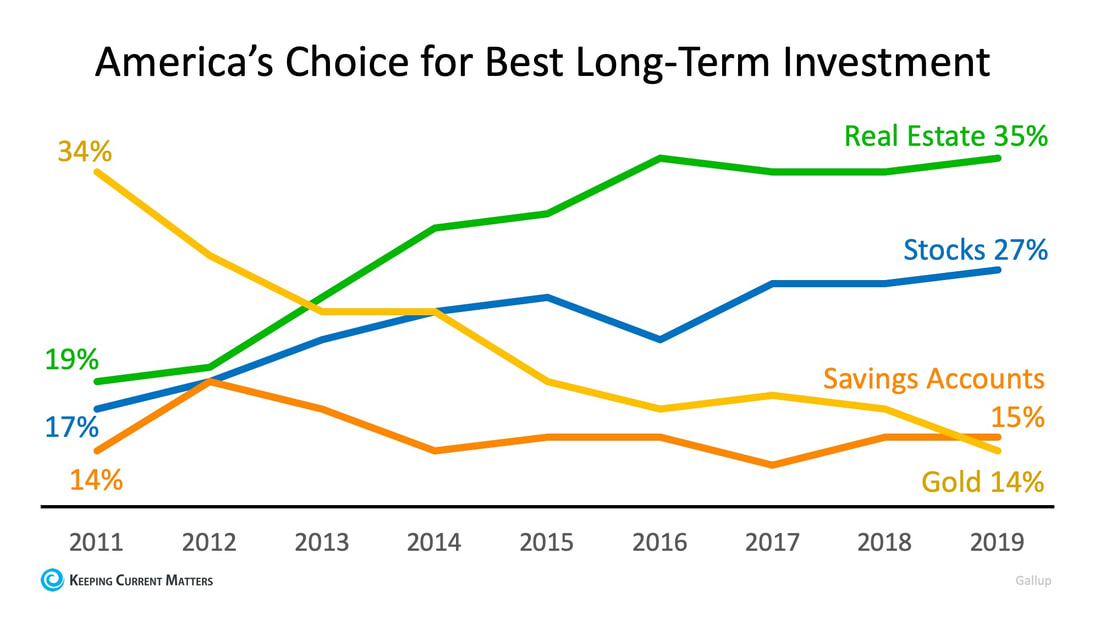

#GranbyHomes #Homesforsale #Realestate #Simsburyhomes #HomeValues #RealEstateAdvise #RealtorGranby #RealEstateSimsbury #StephenSimard #eXpRealty Every year, Gallup surveys Americans to determine their choice for the best long-term investment. Respondents are given a choice between real estate, stocks, gold, and savings accounts. For the sixth year in a row, real estate has come out on top as the best long-term investment! That has not always been the case. Gallup explains: “Between 2008 and 2010, covering most of the Great Recession period that saw plummeting home and stock values, Americans were as likely to name savings accounts or CDs as the best long-term investment as they were to name stocks or real estate.” This year’s results showed that 35% of Americans chose real estate, followed by stocks at 27%. The full results are shown in the chart below. Bottom LineNow that the real estate market has recovered, so has the belief of the American people in the stability of housing as a long-term investment.

SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #eXpRealty

During the summer, many families travel to their favorite vacation destination. What if instead of renting a house or staying in a hotel, you could enjoy a home of your own? If you'd like to make your vacation home dream come true, let's get together to chat!

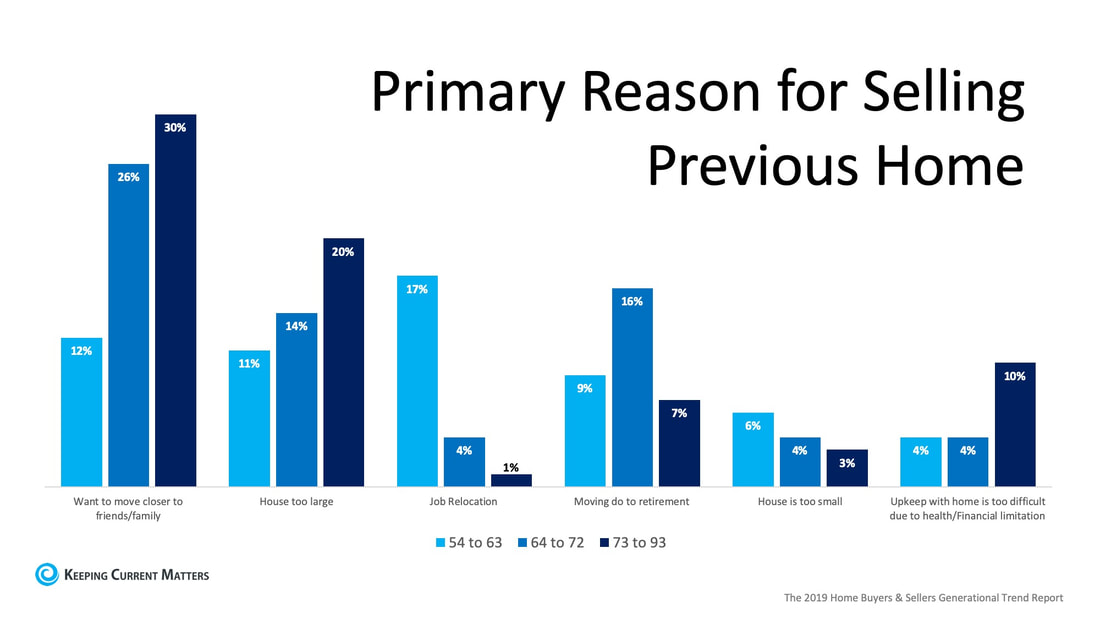

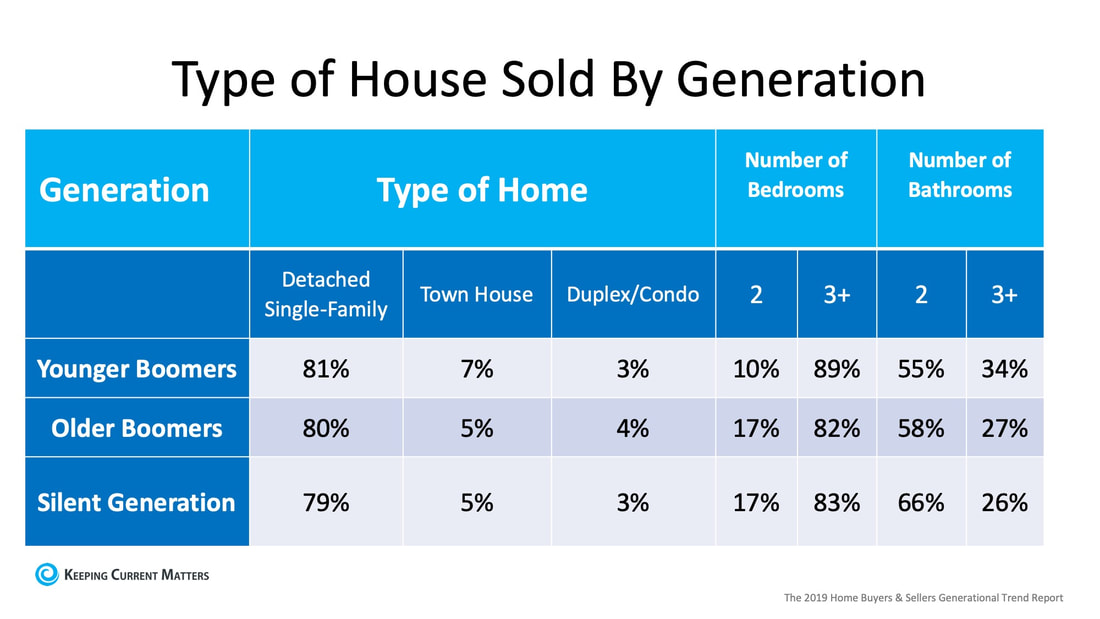

#GranbyHomes #Homesforsale #Realestate #Simsburyhomes #HomeValues #RealEstateAdvise #RealtorGranby #RealEstateSimsbury #StephenSimard #eXpRealty Many studies suggest one of the main reasons for the inventory shortage in today’s market of homes for sale is that older generations have chosen to “age in place” over moving. The 2019 Home Buyers & Sellers Generational Trend Report by NAR clarifies this point!NAR’s findings show that Baby Boomers (43%) and the Silent Generation (12%) made up 56% of sellers in 2018! This means the majority of sellers last year were over the age of 54. This also shows these generations ARE moving! The report also shared the reasons why they chose to move. According to the research, the top reason was a desire to be closer to friends and family. Below is a full breakdown: As we can see, they have plenty of reasons to sell their current home! But what type of homes are they trading in? Once again, the report demonstrated that older generations are not keeping that 3-bedroom, 2-bath colonial home. Instead, they are putting it on the market and moving on with their lives!

Bottom Line If you are living in a house that no longer fits your needs, contact a local real estate professional who can help you find a home that will! SOURCE KCM #BabyBoomers #SeniorMarket #Sellers #SimardRealtyGroup #eXpRealty In today’s real estate market, low inventory dominates the conversation in many areas of the country. It can often be frustrating to be a first-time homebuyer if you aren’t prepared.

In a realtor.com article entitled, “How to Find Your Dream Home—Without Losing Your Mind,” the author highlights some steps that first-time homebuyers can take to help carry their excitement of buying a home throughout the whole process. 1. Get Pre-Approved for a Mortgage Before You Start Your Search One way to show you are serious about buying your dream home is to get pre-qualified or pre-approvedfor a mortgage before starting your search. Even if you are in a market that is not as competitive, understanding your budget will give you the confidence of knowing whether or not your dream home is within your reach. This step will also help you narrow your search based on your budget and won’t leave you disappointed if the home you tour, and love, ends up being outside your budget! 2. Know the Difference Between Your ‘Must-Haves’ and ‘Would-Like-To-Haves’ Do you really need that farmhouse sink in the kitchen to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Could the ‘man cave’ of your dreams be a future renovation project instead of a make-or-break right now? Before you start your search, list all the features of a home you would like and then qualify them as ‘must-haves’, ‘should-haves’, or ‘absolute-wish list’ items. This will help keep you focused on what’s most important. 3. Research and Choose a Neighborhood You Want to Live In Every neighborhood has its own charm. Before you commit to a home based solely on the house itself, the article suggests test-driving the area. Make sure that the area meets your needs for “amenities, commute, school district, etc. and then spend a weekend exploring before you commit.” 4. Pick a House Style You Love and Stick to It Evaluate your family’s needs and settle on a style of home that would best serve those needs. Just because you’ve narrowed your search to a zip code, doesn’t mean that you need to tour every listing in that zip code. An example from the article says, “if you have several younger kids and don’t want your bedroom on a different level, steer clear of Cape Cod–style homes, which typically feature two or more bedrooms on the upper level and the master on the main.” 5. Document Your Home Visits Once you start touring homes, the features of each individual home will start to blur together. The article suggests keeping your camera handy to document what you love and don’t love about each property you visit. Making notes on the listing sheet as you tour the property will also help you remember what the photos mean, or what you were feeling while touring the home. Bottom Line In a high-paced, competitive environment, any advantage you can give yourself will help you on your path to buying your dream home. SOURCE KCM #Buyers #Sellers #DreamHome #SimardRealtyGroup #eXpRealty Home values have softened over the last twelve months. We are no longer seeing 6-7% annual appreciation levels for the national housing market. The current numbers are closer to 4%. Some have suggested that year-over-year appreciation levels could fall to 3% or less this year.

However, a stronger-than-expected economy and a good spring housing market have changed some opinions. Some analysts are now predicting that home value appreciation may begin to increase as we move forward. Here are three examples: Mark Fleming, Chief Economist of First American “Data on the movement of unadjusted house prices during the early spring home-buying season won’t be available for a few more months, but it’s quite likely that price appreciation will accelerate again.” CoreLogic’s April “Home Price Insights” “Home prices nationwide, including distressed sales, increased year over year by 3.7% in March 2019 compared with March 2018…The CoreLogic HPI Forecast indicates that home prices will increase by 4.8% on a year-over-year basis from March 2019 to March 2020.” Pulsenomics’ Quarterly “Home Price Expectation Survey”

Bottom Line Price appreciation has slowed over the past year. However, a strong economy and a good housing market have many experts thinking that home values might re-accelerate moderately throughout the rest of this year. SOURCE KCM #ForBuyers #ForSellers #Pricing #SimardRealtyGroup #eXpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed