|

Some Highlights:

SOURCE KCM #ForSellers #InfoGraphics #SimardRealtyGroup #ExpRealty

0 Comments

Real Estate mogul, Sean Conlon, host of The Deed: Chicago on CNBC, was recently asked the question, should you buy? Or should you rent a house?

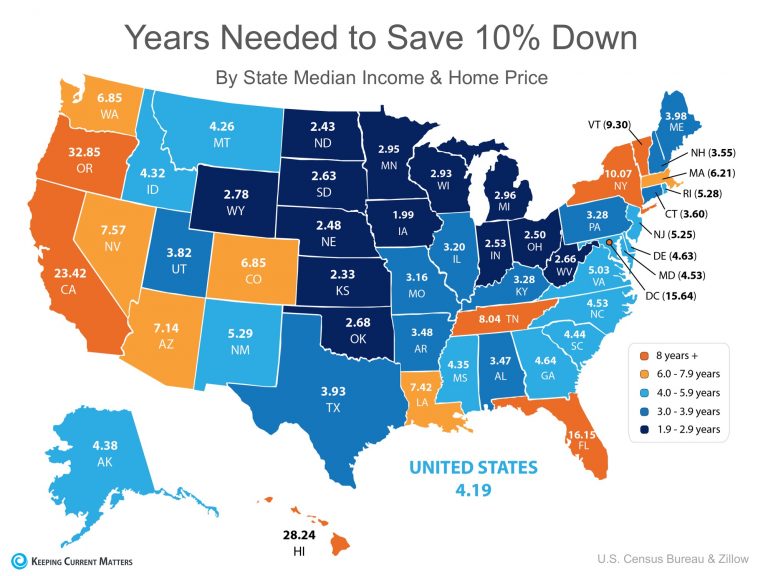

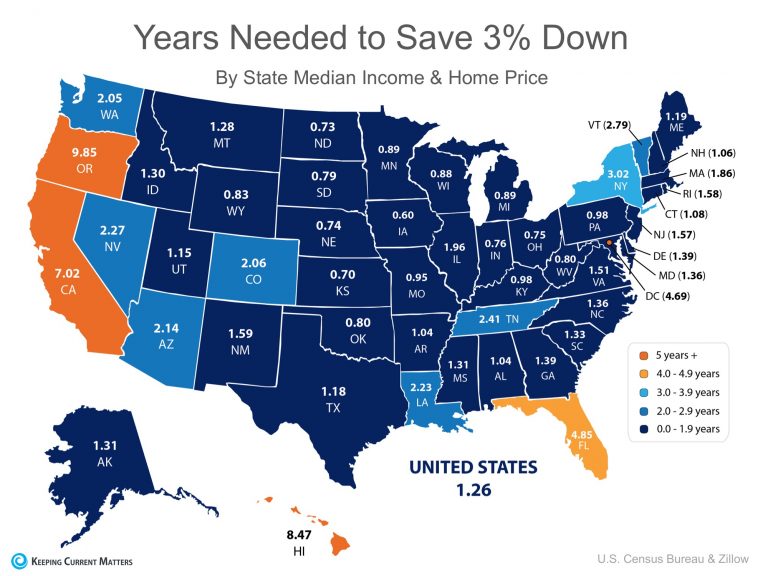

Conlon responded: “I am a true believer that you save every penny and you buy your first house… and that is still the fastest path to wealth in this country.” Conlon went on to suggest that first-time buyers put down 10-20% “if they can make it work,” and to remain in their home at least 4-5 years to see a return on their investment. Who is Sean Conlon, and why should you listen to his advice? Within a few years of working in the real estate industry, Conlon had established himself as one of the leading agents in the United States and has founded 3 billion-dollar brokerages dealing in residential, commercial and investment sales. Since immigrating to America from the United Kingdom in 1990, he believes very strongly in the American Dream and the role that homeownership plays in achieving it. Conlon is quoted on his website as saying: “I treat people the way I would like to be treated if I went in to buy a house and I work harder than anybody I know. I think if you do that in America, you will always succeed.” Bottom Line Homeownership is an investment you can leverage against in the future, that not only provides shelter and safety but also helps you build your family’s wealth. If you are debating whether or not to purchase a home this year, meet with a local real estate professional who can assist you, today! SOURCE KCM #ForBuyers #RealEstateMogul #SimardRealtyGroup #ExpRealty Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long would it take you to save for a down payment in each state? Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense. By determining the percentage of income spent renting a 2-bedroom apartment in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own. According to the data, residents in Iowa can save for a down payment the quickest in just under 2 years (1.99). Below is a map created using the data for each state What if you only needed to save 3%? What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3% down programs? Suddenly, saving for a down payment no longer takes 5 or 10 years, but becomes attainable in a year or two in many states as shown in the map below Bottom Line

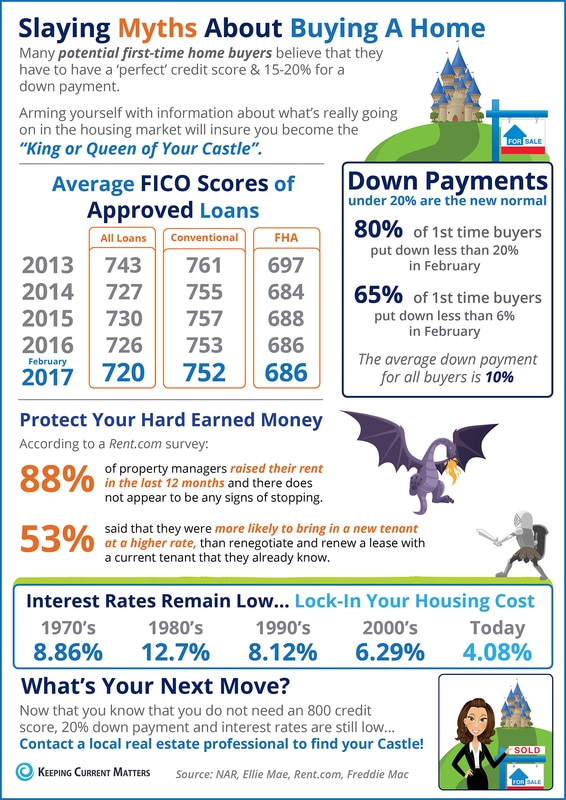

Whether you have just begun to save for a down payment, or have been saving for years, you may be closer to your dream home than you think! Meet with a local real estate professional who can help you evaluate your ability to buy today. SOURCE KCM #DownPayment #ForBuyers #JoinExpRealty #SimardRealtyGroup Some Highlights:

SOURCE KCM #InfoGraphic #HomeBuying #ExpRealty #SimardRealtyGroup Many Americans got some depressing news last week; either their tax return was not as large as they had hoped or, in some cases, they were told they owed additional money to either the Federal or State government or both. One way to save on taxes is to own your own home.

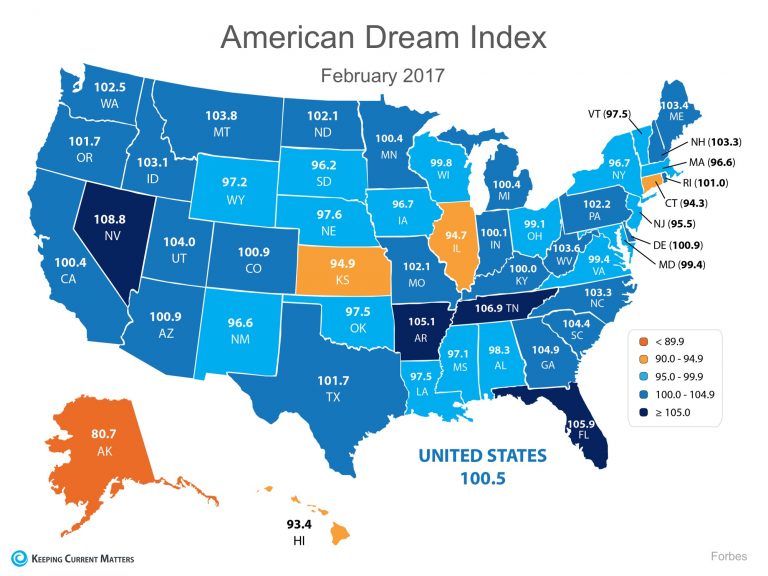

According to the Tax Policy Center’s Briefing Book -“A citizen's guide to the fascinating (though often complex) elements of the federal Tax System” - there are several tax advantages to homeownership. Here are four items, and a quote on each, from the Briefing Book: 1. Mortgage Interest Deduction “Homeowners who itemize deductions may reduce their taxable income by deducting any interest paid on a home mortgage. The deduction is limited to interest paid on up to $1 million of debt incurred to purchase or substantially rehabilitate a home. Homeowners also may deduct interest paid on up to $100,000 of home equity debt, regardless of how they use the borrowed funds. Taxpayers who do not own their home have no comparable ability to deduct interest paid on debt incurred to purchase goods and services.” 2. Property Tax Deduction “Homeowners who itemize deductions may also reduce their taxable income by deducting property taxes they pay on their homes.” 3. Imputed Rent “Buying a home is an investment, part of the returns from which is the opportunity to live in the home rent-free. Unlike returns from other investments, the return on homeownership—what economists call “imputed rent”—is excluded from taxable income. In contrast, landlords must count as income the rent they receive, and renters may not deduct the rent they pay. A homeowner is effectively both landlord and renter, but the tax code treats homeowners the same as renters while ignoring their simultaneous role as their own landlords.” 4. Profits from Home Sales “Taxpayers who sell assets must generally pay capital gains tax on any profits made on the sale. But homeowners may exclude from taxable income up to $250,000 ($500,000 for joint filers) of capital gains on the sale of their home if they satisfy certain criteria: they must have maintained the home as their principal residence in two out of the preceding five years, and they generally may not have claimed the capital gains exclusion for the sale of another home during the previous two years.” Bottom Line We are not suggesting that you purchase a house just to save on your taxes. However, if you have been on the fence as to whether 2017 is the year you should become a homeowner, this information might help with that decision. SOURCE KCM #Tax #HomeBuyers #SimardRealtyGroup #JoinExpRealty Forbes.com recently released the results of their new American Dream Index, in which they measure “the prosperity of the middle class, and…examine which states best support the American Dream.” The monthly index measures several different economic factors, including goods-producing employment, personal and commercial bankruptcies, building permits, startup activity, unemployment insurance claims, labor force participation, and layoffs. The national index score was rounded out to 100 in January and saw a modest jump to 100.5 in February. Alaska represented the lowest score on the index at 80.7, due mostly to the recent collapse in oil prices. Nevada came in with the highest score at 108.8, boosted by big gains in goods-producing jobs and new construction activity. The full results can be seen in the map below. Forbes Senior Editor Kurt Badenhausen explained why many states saw a boost in the index last month:

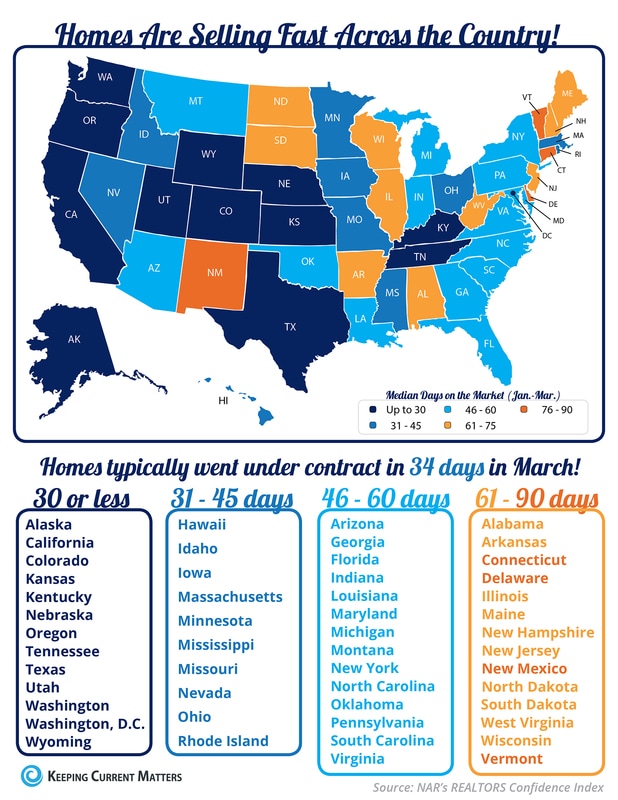

“[B]usinesses are hiring in part in anticipation of tax cuts and less regulation... Many areas of the country have experienced strong upticks in employment and construction, as well as declines in unemployment claims since the start of the year.” Bottom Line The American Dream, for many, includes being able to own a home of his or her own. With the economy improving in many areas of the country, that dream can finally become a reality. SOURCE KCM #ForBuyers #RealEstate #SimardRealtyGroup #JoinExpRealty If you thought about selling your house this year, now may be the time to do it. The inventory of homes for sale is well below historic norms and buyer demand is skyrocketing. We were still in high school when we learned the concept of supply and demand: the best time to sell something is when supply of that item is low and demand for that item is high. That defines today’s real estate market.

Jonathan Smoke, Chief Economist at realtor.com, revealed in a recent article that: “The biggest challenge to buyers this spring will be simply finding a home to buy and getting it successfully under contract. That’s because the supply of homes for sale is at an all-time low, and yet demand is strong and getting stronger.” Smoke goes on to say: “We started the year with the lowest inventory of homes available for sale that we’ve ever seen on realtor.com. While we did see inventory grow 2% in February, total inventory was down 11% over last year.” In this type of market, a seller may hold a major negotiating advantage when it comes to price and other aspects of the real estate transaction including the inspection, appraisal and financing contingencies. Bottom Line As a potential seller, you are in the driver’s seat right now. It might be time to hit the gas. SOURCE KCM #ForSellers #SimardRealtyGroup #JoinExpRealty Some Highlights:

SOURCE KCM #ForBuyers #InfoGraphics #SimardRealtyGroup #ExpRealty The Spring market is hot!!! Looking to sell? Know someone looking to sell? Lets get started. call/text 860-919-0991

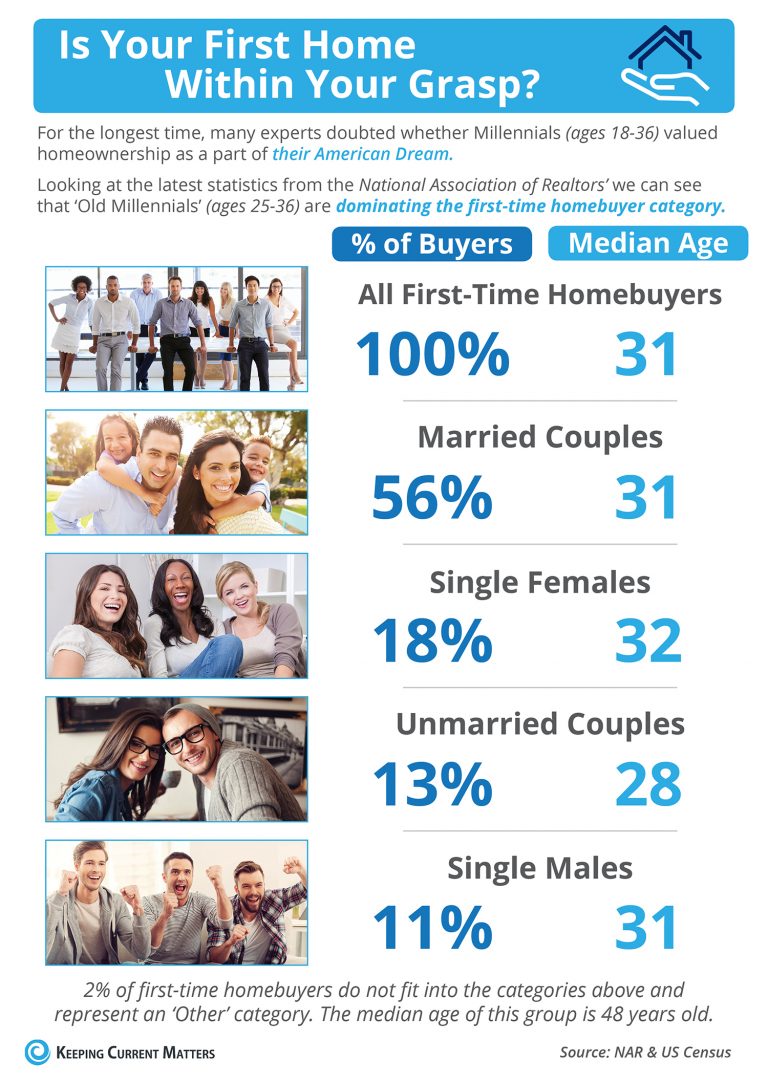

Get a home value range here : http://www.simardrealtygroup.com/home-value.html A recent report released by Down Payment Resource shows that 65% of first-time homebuyers purchased their homes with a down payment of 6% or less in the month of January.

The trend continued through all buyers with a mortgage, as 62% made a down payment of less than 20%, which is consistent with findings from December. An article by DS News points to the new wave of millennial homebuyers: “It seems that the long-awaited influx of millennial home buyers is beginning. Ellie Mae reported that mortgages to millennial borrowers for new home purchases continued their ascent in January, accounting for 84 percent of closed loans.” Among millennials who purchased homes in January, FHA loans remained popular, making up 35% of all loans closed. Ellie Mae’s Executive Vice President of Corporate Strategy Joe Tyrrell gave some insight into why: “It is not surprising to see Millennial borrowers leverage FHA loans because they typically offer lower down payments and lower average FICO score requirements than conventional loans. Across the board, we're continuing to see strong interest in homeownership from this younger generation.” Bottom Line If you are one of the many millennials who is debating a home purchase this year, contact a local professional who can help you understand your options and set you on the path to preapproval. SOURCE KCM #ForBuyers #Millennials #SimardRealtyGroup #ExpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed