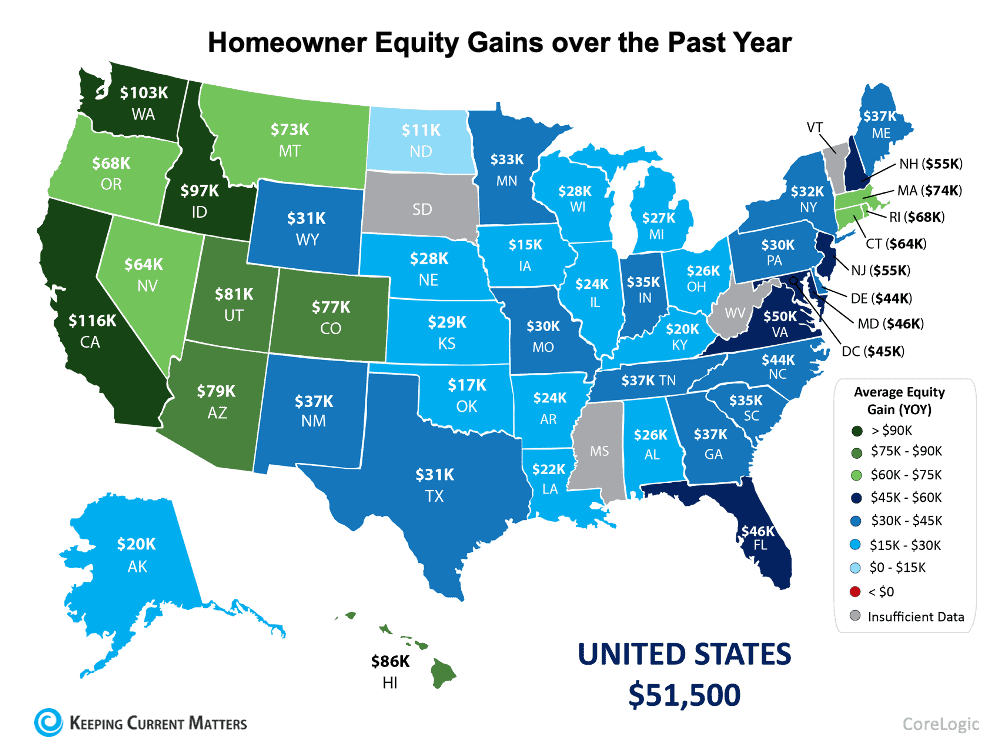

Homeownership is still a crucial part of the American dream. For those people who own a home (and those looking to buy one), it’s clear that being a homeowner has considerable benefits both emotionally and financially. In addition to long-term stability, buying a home is one of the best ways to increase your net worth. This boost to your wealth comes in the form of equity. Equity is the difference between what you owe on the home and its market value based on factors like price appreciation. The best thing about equity is that it often grows without you even realizing it, especially in a sellers’ market like we’re in now. In today’s real estate market, the combination of low housing supply and high buyer demand is driving home values up. This is giving homeowners a significant equity boost. According to the latest data from CoreLogic, the amount of equity homeowners have has continued to grow as home values appreciate. Here are some key takeaways from the Homeowner Equity Insights Report:

What does all of that mean for you?

If you’re already a homeowner, you likely have more equity in your house than you realize. The numbers in the map above reflect year-over-year growth. If you’ve been in your home for longer than a year, you’ll likely have even more equity than that. That equity can take you places. You can use the equity you’ve gained to fuel your next move, achieve other life goals, and more. On the other hand, if you haven’t purchased a home yet, understanding equity can help you realize why homeownership is a worthwhile goal. Homeowners across the nation gained an average of over $50,000 in equity this year. Don’t miss out on this chance to grow your net worth. Bottom Line If you want to learn more, talk with a real estate professional. A trusted advisor can help you understand where home prices are today, how they contribute to a homeowner’s net worth, and the impact equity can have when you own a home. SOURCE KCM #Pricing #ForSellers #ForBuyers #SimardRealtyGroup #JoinRealBrokerLLC

0 Comments

Mortgage rates are hovering near 3%. Low rates present buyers with a golden opportunity to lock in a low monthly payment for the life of their loan. If you’ve been waiting for low rates, they’re already within reach. DM me if you’re ready to take advantage of today’s mortgage rates.

#mortgagerates #homebuyingpower #lowmonthlypayments #purchasingpower #buyingpower #homepriceappreciation #affordability #firsttimehomebuyer #homeownership #investinyourfuture #realestatetips #realestatestats #realestateinfo #keepingcurrentmatters Are you looking to buy a home? If so, we’ve got good news for you.

While there’s no denying the housing market is having a great year, many of the headlines are focused on the perks for sellers. But what about buyers today? As a buyer, you’re likely braving bidding wars and weighing low mortgage rates versus price appreciation as you search for your dream home. If you find yourself a bit discouraged, hear this: there are clear signs buyers may have more opportunities this fall. According to realtor.com, the sweet spot for buyers is just around the corner. In a recent study, experts analyzed housing market trends by looking at data from the past several years. When applied to the current market, experts determined the ideal week to buy a home this year. The research says: “Nationally, the best time to buy in 2021 is the week of October 3-9. This week historically has shown the best balance of market conditions that favor buyers.” So, what’s that mean for you? If you’re looking to buy a home, there’s a golden window of opportunity coming. Here’s what you can expect from that week. Increased Housing Supply The number of homes available for sale should increase. According to realtor.com, you can expect to see more new listings come to market the week of October 3. The findings estimate we’ll see roughly 17.6% more homes available than we saw at the start of the year. This means you’ll have more options to choose from which should be a welcome relief in a market with tight housing supply. Fewer Bidding Wars With more homes available, you should also see a slight decline in the number of bidding wars. Having more options means buyers may not be competing as intensely for the homes on the market because there are more choices to go around. This means when you write an offer, you may have less competition and a better chance of being the top bid. Just remember, it’s still important to come in with a strong offer. Adjusted Homes Prices As we move into the end of the year, the findings from realtor.com note this week may also be one of the peak weeks for price reductions in 2021. Historically the data shows an average of 7.0% of homes have a price reduction that week. Why? When housing supply ticks up, sellers need to look for other ways to make their house stand out. This means, while home prices are still appreciating overall, you may see some homes with price adjustments from eager sellers. The process of closing a house takes time. To close before end of year, sellers may be more motivated this October. Bottom Line If you’re in the market for a home, don’t lose steam now. Data shows early October may give you the long-awaited opportunity to find the home of your dreams. Lean on a trusted real estate professional as your ally and advisor to help keep you motivated so you can find the perfect home. SOURCE: KCM #FirstTimeHomeBuyers #HousingMarketUpdate #SimardRealtyGroup #RealBrokerLLC Home prices have appreciated significantly across the country. If you’re a homeowner, that means you have an incredible opportunity in front of you. Now is a great time to use the housing wealth you’ve built up to power a move. DM me today so we can discuss all the options your home equity unlocks.

SOURCE : KCM #realestateopportunity #homevalues #homeownergoals #sellyourhouse #moveuphome #dreamhome #realestate #homeownership #realestategoals #expertanswers #stayinformed #staycurrent #powerfuldecisions #confidentdecisions #keepingcurrentmatters In today’s real estate market, buyers shouldn’t shop for a home with the expectation they’ll be able to negotiate a lower sales price. In a typical housing market, buyers try to determine how much less than the asking price they can offer and still get the home. From there, the buyer and seller typically negotiate and agree on a revised price somewhere in the middle.

Things Are Different Today Today’s housing market is anything but normal. According to the National Association of Realtors (NAR), homes today are:

Homes selling quickly and receiving multiple offers highlights how competitive the housing market is right now. This is due, in large part, to the low supply of homes for sale. Low supply and high demand mean homes often sell for more than the asking price. In some cases, they sell for a lot more. Selma Hepp, Deputy Chief Economist at CoreLogic, explains how these stats can impact buyers: “The imbalance between robust demand and dismal availability of for-sale homes has led to a continual bidding over asking prices, which reached record levels in recent months. Now, almost 6 in 10 homes listed are selling over the asking price.” You May Need To Rethink How You Look at a Home’s Asking Price What does that mean for you? If you’ve found your dream home, you need to be realistic about today’s housing market and how that impacts the offer you’ll make. Offering below or even at a home’s asking price may not cut it. In today’s market, the highest bidder often wins the home, much like at an auction. Currently, the asking price is often the floor of the negotiation rather than the ceiling. If you really love a home, it may ultimately sell for more than the sellers are asking. That’s important to keep in mind as you work with your agent to craft an offer. Understand An Appraisal Gap Can Happen Because of today’s home price appreciation and the auction-like atmosphere in the selling process, appraisal gaps – the gap between the price of your contract and the appraisal for the house – are more frequent. According to data from CoreLogic: “Beginning in January 2020, nationally, 7% of purchase transactions had a contract price above the appraisal, but by May 2021, the frequency had increased to 19% of purchase transactions.” When this happens, your lender won’t loan you more than the home’s appraised value, and the seller may ask you to make up the difference out of pocket. Buyers in today’s market need to be prepared for this possibility. Know your budget, know what you can afford, and work with a trusted advisor who can offer expert advice along the way. Bottom Line Bidding wars and today’s auction-like atmosphere mean buyers need to rethink how they look at the asking price of a home. Work with a real estate professional who can advise you on the current market and help determine what the market value is on your dream home. SOURCE : KCM #BuyingMyths #FirstTimeHomeBuyers #ForBuyers #HousingMarketUpdates #MoveUpBuyers Remote work is changing what we need from our home. Does yours have a dedicated office space? Do you have enough room to support a true work-life balance? If not, it might be time to address your shifting needs. DM me today so we can find the home that’s right for you.

#homegoals #worklifebalance #homeoffice #workfromhome #housingmarket #househunting #makememove #homegoals #houseshopping #housegoals #locationlocationlocation #newlisting #dreamhome #realestatetipsandadvice #justsold #keepingcurrentmatters Some Highlights

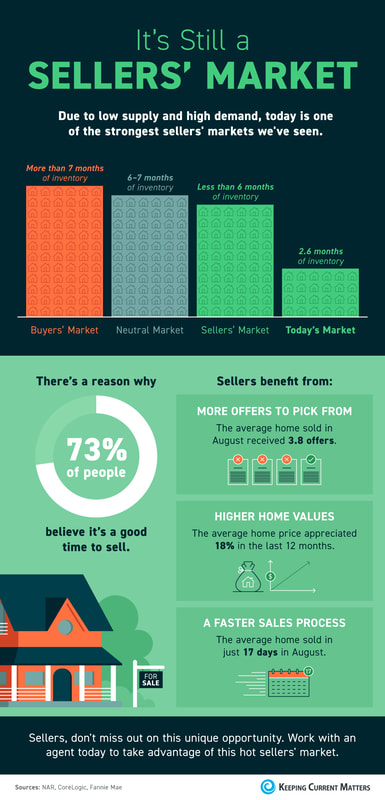

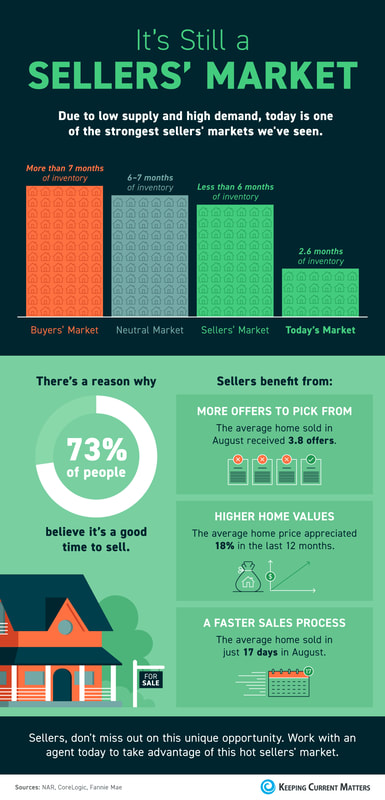

-Due to low supply and high demand, today is one of the strongest sellers’ markets we’ve seen. -Sellers can benefit from more offers to pick from, higher home values, and a faster sales process. That might be why 73% of people believe it’s a good time to sell. -Sellers, don’t miss out on this unique opportunity. Work with an agent to take advantage of this hot sellers’ market. SOURCE:KCM #Pricing #SellersMarket #Infographics #SimardRealtyGroup #joinRealBrokerLLC Buyers need to be mindful of any misconceptions about the housing market – from what the current supply looks like to how much homes are selling for. It takes professionals who study expert opinions and data to separate fact from fiction. DM me today to see why it’s still a good time to buy.

SOURCE : KCM #homebuyingmyths #housingfacts #homeownershiptruths #expertanswers #stayinformed #staycurrent #powerfuldecisions #confidentdecisions #realestate #opportunity #housingmarket #househunting #keepingcurrentmatters If you’re a renter with a desire to become a homeowner, or a homeowner who’s decided your current house no longer fits your needs, you may be hoping that waiting a year might mean better market conditions to purchase a home. To determine if you should buy now or wait, you need to ask yourself two simple questions:

Let’s shed some light on the answers to both of these questions. What will home prices be like in 2022? Three major housing industry entities project continued home price appreciation for 2022. Here are their forecasts:

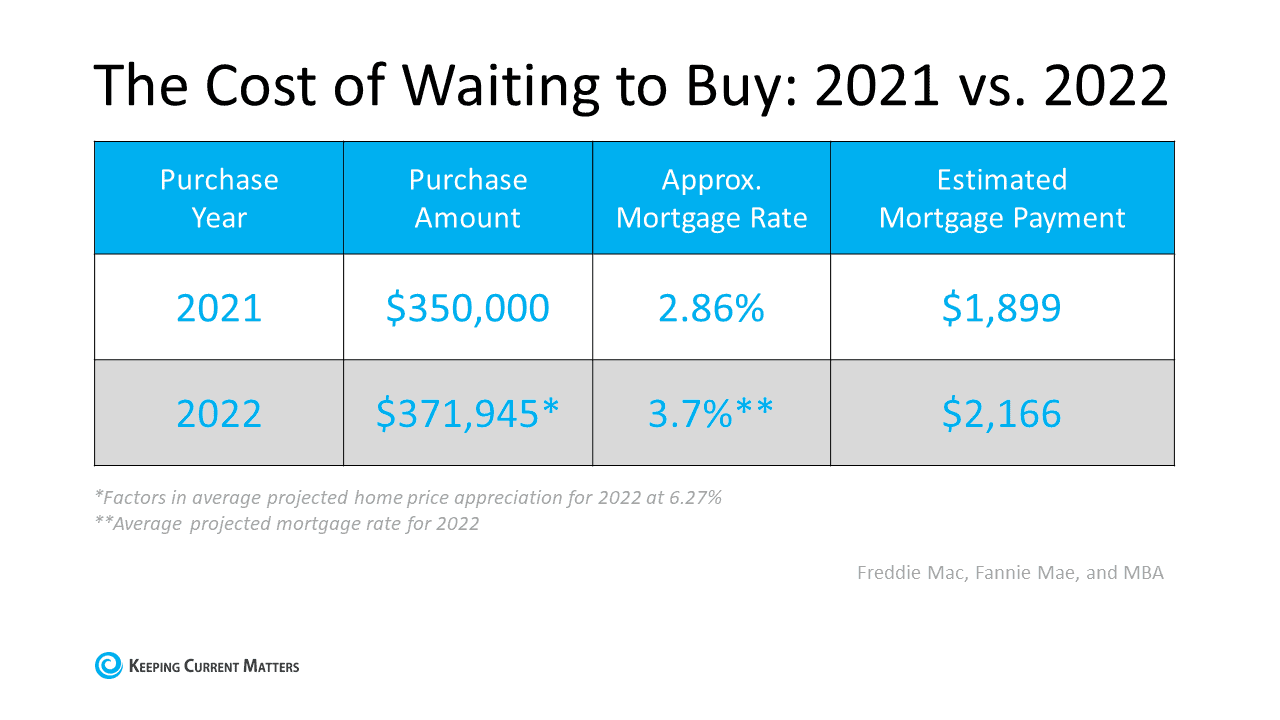

Using the average of the three projections (6.27%), a home that sells for $350,000 today would be valued at $371,945 by the end of next year. That means, if you delay, it could cost you more. As a prospective buyer, you could pay an additional $21,945 if you wait. Where will mortgage rates be by the end of 2022? Today, the 30-year fixed mortgage rate is hovering near historic lows. However, most experts believe rates will rise as the economy continues to recover. Here are the forecasts for the fourth quarter of 2022 by the three major entities mentioned above:

That averages out to 3.7% if you include all three forecasts, and it’s nearly a full percentage point higher than today’s rates. Any increase in mortgage rates will increase your cost. What does it mean for you if both home values and mortgage rates rise? You’ll pay more in mortgage payments each month if both variables increase. Let’s assume you purchase a $350,000 home this year with a 30-year fixed-rate loan at 2.86% after making a 10% down payment. According to the mortgage calculator from Smart Asset, your monthly mortgage payment (including principal and interest payments, and estimated home insurance, taxes in your area, and other fees) would be approximately $1,899. That same home could cost $371,945 by the end of 2022, and the mortgage rate could be 3.7% (based on the industry forecasts mentioned above). Your monthly mortgage payment, after putting down 10%, would increase to $2,166. The difference in your monthly mortgage payment would be $267.

That’s $3,204 more per year and $96,120 over the life of the loan. If you consider that purchasing now will also let you take advantage of the equity you’ll build up over the next calendar year, which is approximately $22,000 for a house with a similar value, then the total net worth increase you could gain from buying this year is over $118,000. Bottom Line When asking if you should buy a home, you probably think of the non-financial benefits of owning a home as a driving motivator. When asking when to buy, the financial benefits make it clear that doing so now is much more advantageous than waiting until next year. SOURCE KCM #BuyingMyths #Pricing #HousingMarketUpdate #SimardRealtyGroup #RealBrokerLLC 73% of consumers polled believe it’s a good time to sell versus just 48% a year ago. Buyer demand is still high and housing supply is still low. If you’re a seller, that means there’s a golden opportunity for you this fall. DM me so we can talk more about today’s unique sellers’ market and what it means for you.

#sellersmarket #greattimetosell #sellyourhouse #homevalues #moveuphome #dreamhome #realestate #homeownership #realestategoals #realestateexperts #instarealestate #instarealtor #realestatetipsoftheday #realestatetipsandadvice #keepingcurrentmatters |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed