|

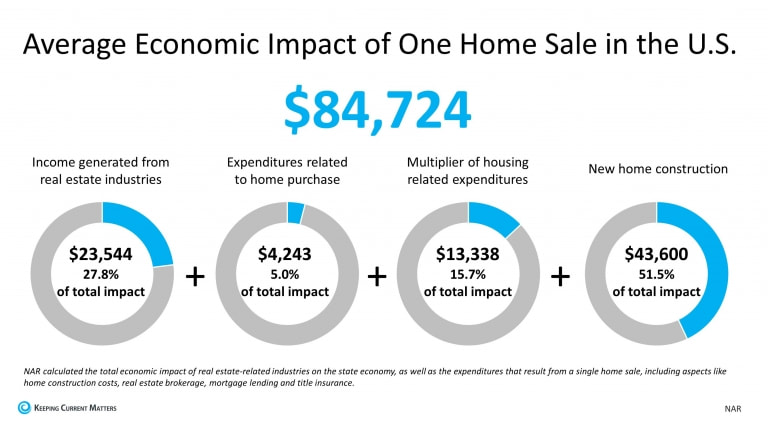

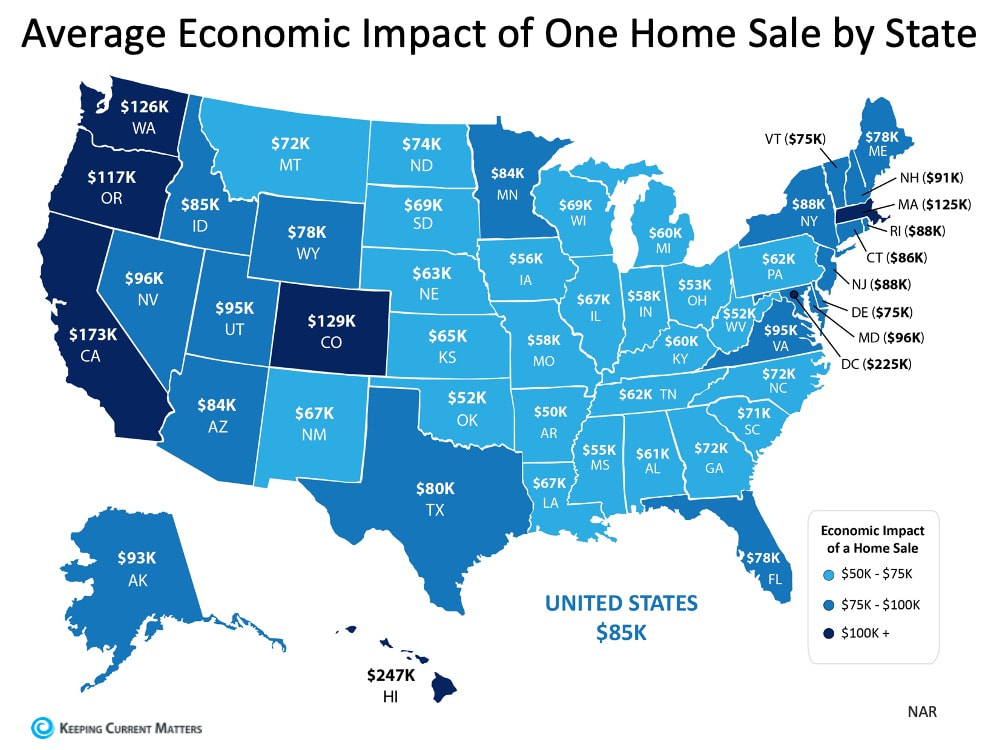

We’re in a changing real estate market, and life, in general, is changing too – from how we grocery shop and meal prep to the ways we can interact with our friends and neighbors. Even practices for engaging with agents, lenders, and all of the players involved in a real estate transaction are changing to a virtual format. What isn’t changing, however, is one key thing that can drive the local economy: buying a home. We’re all being impacted in different ways by the effects of the coronavirus. If you’re in a position to buy a home today, know that you’re a major economic force in your neighborhood. And while we all wait patiently for the current pandemic to pass, there are a lot of things you can do in the meantime to keep your home search on track. Every year the National Association of Realtors (NAR) shares a report that notes the full economic impact of home sales. This report summarizes: “The total economic impact of real estate related industries on the state economy, as well as the expenditures that result from a single home sale, including aspects like home construction costs, real estate brokerage, mortgage lending and title insurance.” Here’s the breakdown of how the average home sale boosts the economy: When you buy a home, you’re making an impact. You’re fulfilling your need for shelter and a place to live, and you’re also generating jobs and income for the appraiser, the loan officer, the title company, the real estate agent, and many more contributors to the process. For every person or business that you work with throughout the transaction, there’s also likely a team behind the scenes making it all happen, so the effort multiplies substantially. As noted above in the circle on the right, the impact is almost double when you purchase new construction, given the extra labor it requires to build the home. The report also breaks down the average economic impact by state: As a buyer, you have an essential need for a home – and you can make an essential impact with homeownership, too. That need for shelter, comfort, and a safe place to live will always be alive and well. And whenever you’re able to act on that need, whether now or later, you’ll truly be creating gains for you, your family, local business professionals, and the overall economy.

Bottom Line Whenever you purchase a home, you’re an economic driver. Even if you’re not ready or able to make a move now, there are things you can do to keep your own process moving forward so you’re set when the time is right for you. Reach out to a local real estate professional to keep your home search – and your local contributions – on track. SOURCE KCM #ForBuyers #SimardRealtyGroup #eXpRealty

0 Comments

The angst caused by the coronavirus has most people on edge regarding both their health and financial situations. It’s at times like these when we want exact information about anything we’re doing – even the correct protocol for grocery shopping. That information brings knowledge, and this gives us a sense of relief and comfort.

If you’re thinking about buying or selling a home today, the same need for information is very real. But, because it’s such a big step in our lives, that desire for clear information is even greater in the homebuying or selling process. Given the current level of overall anxiety, we want that advice to be truly perfect. The challenge is, no one can give you “perfect” advice. Experts can, however, give you the best advice possible. Let’s say you need an attorney, so you seek out an expert in the type of law required for your case. When you go to her office, she won’t immediately tell you how the case is going to end or how the judge or jury will rule. If she could, that would be perfect advice. What a good attorney can do, however, is discuss with you the most effective strategies you can take. She may recommend one or two approaches she believes will be best for your case. She’ll then leave you to make the decision on which option you want to pursue. Once you decide, she can help you put a plan together based on the facts at hand. She’ll help you achieve the best possible resolution and make whatever modifications in the strategy are necessary to guarantee that outcome. That’s an example of the best advice possible. The role of a real estate professional is just like the role of the lawyer. An agent can’t give you perfect advice because it’s impossible to know exactly what’s going to happen throughout the transaction – especially in this market. An agent can, however, give you the best advice possible based on the information and situation at hand, guiding you through the process to help you make the necessary adjustments and best decisions along the way. An agent will get you the best offer available. That’s exactly what you want and deserve. Bottom Line If you’re thinking of buying or selling, contact a local real estate professional to make sure you get the best advice possible. SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #eXpRealty Some Highlights:

Find your home value: https://www.simardrealtygroup.com/home-value.html Start your home search: https://www.simardrealtygroup.com/home-search.html Sell with Stephen. My promise, you will sell for more and save thousands on fees. Lets get started. SOURCE KCM #Downpayments #Infographics #MoveUpBuyers #SimardRealtyGroup #eXpRealty There’s a lot of anxiety right now regarding the coronavirus pandemic. The health situation must be addressed quickly, and many are concerned about the impact on the economy as well.

Amidst all this anxiety, anyone with a megaphone – from the mainstream media to a lone blogger – has realized that bad news sells. Unfortunately, we will continue to see a rash of horrifying headlines over the next few months. Let’s make sure we aren’t paralyzed by a headline before we get the full story. When it comes to the health issue, you should look to the Centers for Disease Control and Prevention (CDC) or the World Health Organization (WHO) for the most reliable information. Finding reliable resources with information on the economic impact of the virus is more difficult. For this reason, it’s important to shed some light on the situation. There are already alarmist headlines starting to appear. Here are two such examples surfacing this week. 1. Goldman Sachs Forecasts the Largest Drop in GDP in Almost 100 Years It sounds like Armageddon. Though the headline is true, it doesn’t reflect the full essence of the Goldman Sachs forecast. The projection is actually that we’ll have a tough first half of the year, but the economy will bounce back nicely in the second half; GDP will be up 12% in the third quarter and up another 10% in the fourth. This aligns with research from John Burns Consulting involving pandemics, the economy, and home values. They concluded: “Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.” The economy will suffer for the next few months, but then it will recover. That’s certainly not Armageddon. 2. Fed President Predicts 30% Unemployment! That statement was made by James Bullard, President of the Federal Reserve Bank of St. Louis. What Bullard actually said was it “could” reach 30%. But let’s look at what else he said in the same Bloomberg News interview: “This is a planned, organized partial shutdown of the U.S. economy in the second quarter,” Bullard said. “The overall goal is to keep everyone, households and businesses, whole” with government support. According to Bloomberg, he also went on to say: “I would see the third quarter as a transitional quarter” with the fourth quarter and first quarter next year as “quite robust” as Americans make up for lost spending. “Those quarters might be boom quarters,” he said. Again, Bullard agrees we will have a tough first half and rebound quickly. Bottom Line There’s a lot of misinformation out there. If you want the best advice on what’s happening in the current housing market, contact your local real estate agent. SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #eXpRealty

5 Simple Graphs That Prove This Is Not Like the Last Time

There's a lot of evidence showing that today's housing market is nothing like it was during the last recession. Let's connect to talk about your questions and specific needs. #TopGranbyRealtor #StephenSimard #ExpRealty #GranbyRealEstate #GranbyConnecticut #FindyourGranbyhome #Newhomesforsale #SimardRealtyGroup #Granbyhomesforsale #JoinExpRealty #Simsburyhomes With interest rates hitting all-time lows over the past few weeks, many homeowners are opting to refinance. To decide if refinancing your home is the best option for you and your family, start by asking yourself these questions:

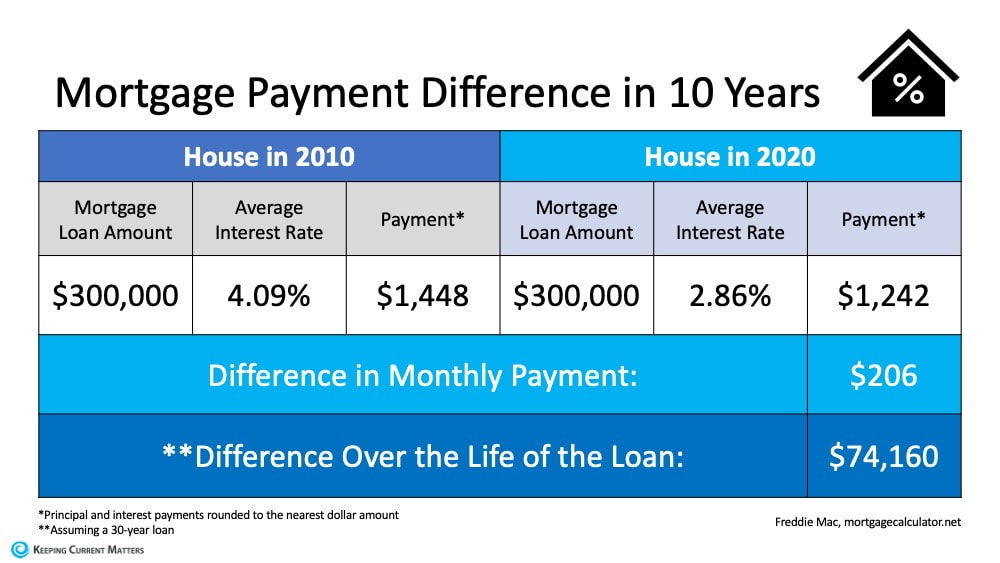

Why do you want to refinance? There are many reasons to refinance, but here are three of the most common ones: 1. Lower Your Interest Rate and Payment: This is the most popular reason. Is your current interest rate higher than what’s available today? If so, it might be worth seeing if you can take advantage of the current lower rates. 2. Shorten the Term of Your Loan: If you have a 30-year loan, it may be advantageous to change it to a 15 or 20-year loan to pay off your mortgage sooner rather than later. 3. Cash-Out Refinance: You might have enough equity to cash out and invest in something else, like your children’s education, a business venture, an investment property, or simply to increase your cash reserve. Once you know why you might want to refinance, ask yourself the next question: How much is it going to cost? There are fees and closing costs involved in refinancing, and The Lenders Network explains: “As an example, let’s say your mortgage has a balance of $200,000. If you were to refinance that loan into a new loan, total closing costs would run between 2%-4% of the loan amount. You can expect to pay between $4,000 to $8,000 to refinance this loan.” They also explain that there are options for no-cost refinance loans, but be on the lookout: “A no-cost refinance loan is when the lender pays the closing costs for the borrower. However, you should be aware that the lender makes up this money from other aspects of the mortgage. Usually charging a slightly higher interest rate so they can make the money back.” Keep in mind that, given the current market conditions and how favorable they are for refinancing, it can take a little longer to execute the process today. This is because many other homeowners are going this route as well. As Todd Teta, Chief Officer at ATTOM Data Solutions notes about recent mortgage activity: “Refinancing largely drove the trend, with more than twice as many homeowners trading in higher-interest mortgages for cheaper ones than in the same period of 2018.” Clearly, refinancing has been on the rise lately. If you’re comfortable with the up-front cost and a potential waiting period due to the high volume of requests, then ask yourself one more question: Is it worth it? To answer this one, do the math. Will it help you save money? How much longer do you need to own your home to break even? Will your current home meet your needs down the road? If you plan to stay for a few years, then maybe refinancing is your best move. If, however, your current home doesn’t fulfill your needs for the next few years, you might want to consider using your equity for a down payment on a new home instead. You’ll still get a lower interest rate than the one you have on your current house, and with the equity you’ve already built, you can finally purchase the home you’ve been waiting for. Bottom Line Today, more than ever, it’s important to start working with a trusted real estate advisor. Whether you connect by phone or video chat, a real estate professional can help you understand how to safely navigate the housing market so that you can prioritize the health of your family without having to bring your plans to a standstill. Whether you’re looking to refinance, buy, or sell, a trusted advisor knows the best protocol as well as the optimal resources and lenders to help you through the process in this fast-paced world that’s changing every day. SOURCE KCM #ForSellers #SimardRealtyGroup #eXpRealty Some Highlights

SOURCE KCM #Infographics #SimardRealtyGroup #eXpRealty With all of the havoc being caused by COVID-19, many are concerned we may see a new wave of foreclosures. Restaurants, airlines, hotels, and many other industries are furloughing workers or dramatically cutting their hours. Without a job, many homeowners are wondering how they’ll be able to afford their mortgage payments.

In spite of this, there are actually many reasons we won’t see a surge in the number of foreclosures like we did during the housing crash over ten years ago. Here are just a few of those reasons: The Government Learned its Lesson the Last Time During the previous housing crash, the government was slow to recognize the challenges homeowners were having and waited too long to grant relief. Today, action is being taken swiftly. Just this week:

When the housing market was going strong in the early 2000s, homeowners gained a tremendous amount of equity in their homes. Many began to tap into that equity. Some started to use their homes as ATM machines to purchase luxury items like cars, jet-skis, and lavish vacations. When prices dipped, many found themselves in a negative equity situation (where the mortgage was greater than the value of their homes). Some just walked away, leaving the banks with no other option but to foreclose on their properties. Today, the home equity situation in America is vastly different. From 2005-2007, homeowners cashed out $824 billion worth of home equity by refinancing. In the last three years, they cashed out only $232 billion, less than one-third of that amount. That has led to:

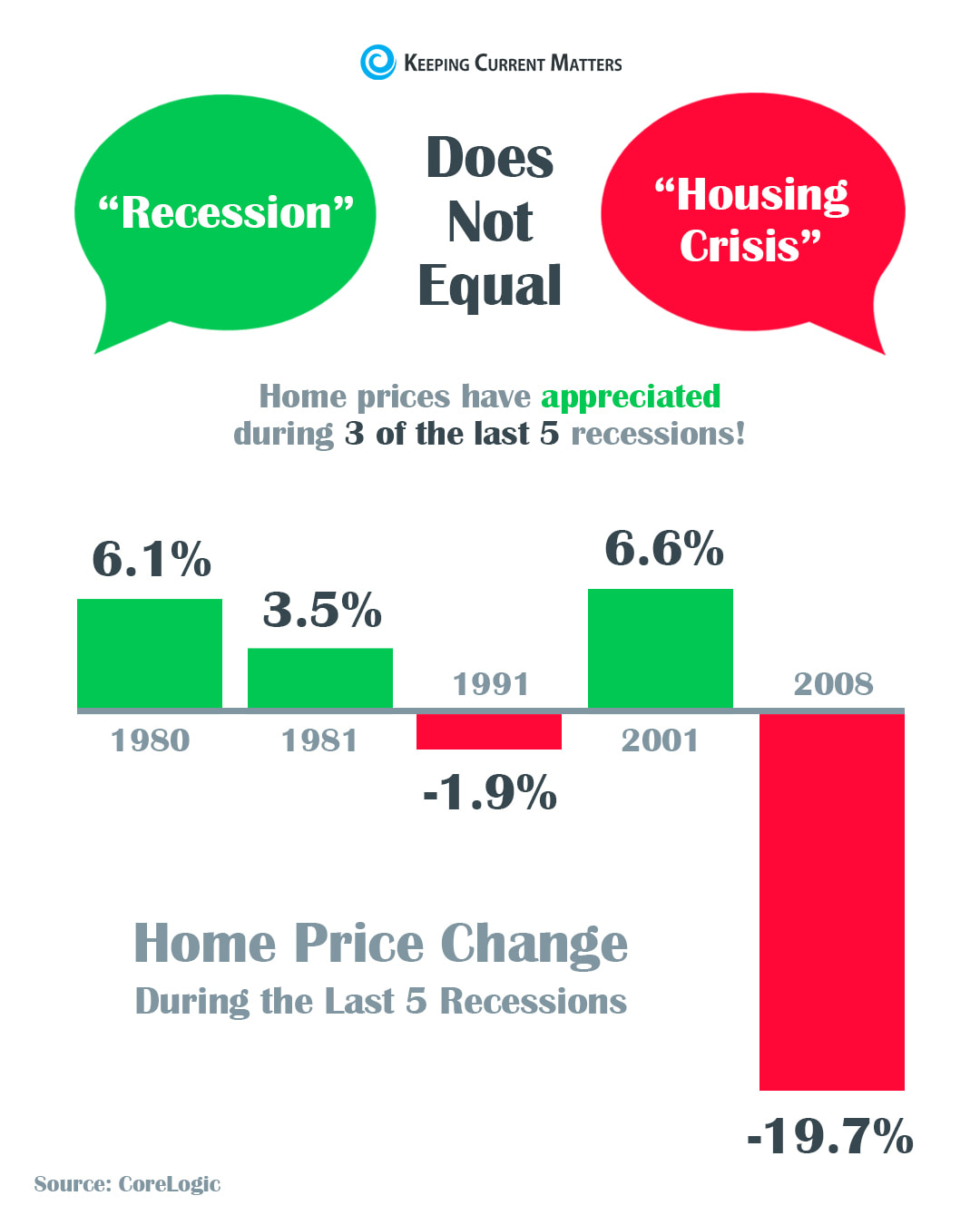

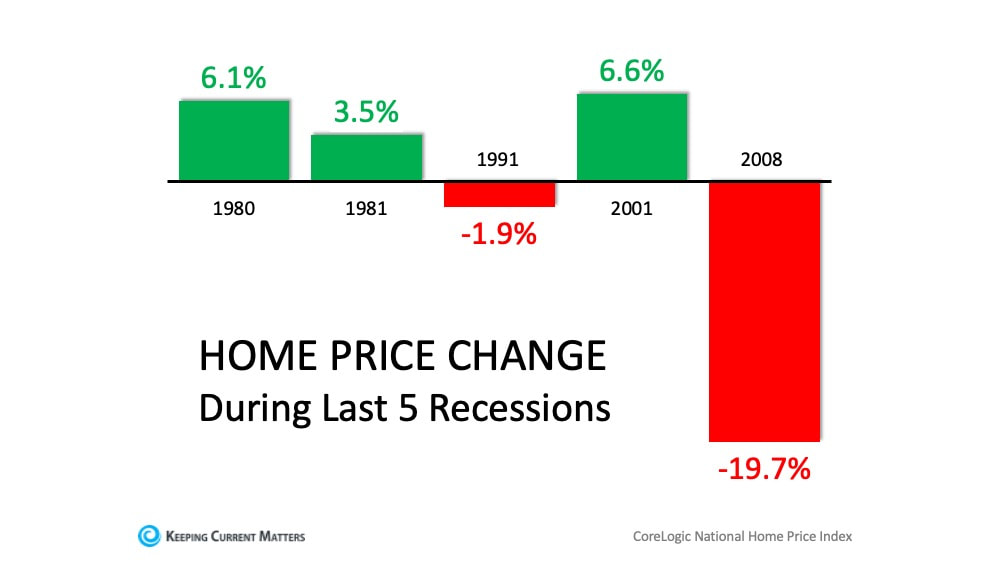

Even if prices dip (and most experts are not predicting that they will), most homeowners will still have vast amounts of value in their homes and will not walk away from that money. There Will Be Help Available to Individuals and Small Businesses The government is aware of the financial pain this virus has caused and will continue to cause. Yesterday, the Associated Press reported: “In a memorandum, Treasury proposed two $250 billion cash infusions to individuals: A first set of checks issued starting April 6, with a second wave in mid-May. The amounts would depend on income and family size.” The plan also recommends $300 billion for small businesses. Bottom Line These are not going to be easy times. However, the lessons learned from the last crisis have Americans better prepared to weather the financial storm. For those who can’t, help is on the way. SOURCE KCM #HousingMarketUpdates #Foreclosures #ForSellers #ForBuyers #SimardRealtyGroup #eXpRealty In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data. Digging into past experiences by reviewing historical trends and understanding the peaks and valleys of what’s come before us is one of the many ways we can confidently evaluate any situation. With concerns of a global recession on everyone’s minds today, it’s important to take an objective look at what has transpired over the years and how the housing market has successfully weathered these storms. 1. The Market Today Is Vastly Different from 2008 We all remember 2008. This is not 2008. Today’s market conditions are far from the time when housing was a key factor that triggered a recession. From easy-to-access mortgages to skyrocketing home price appreciation, a surplus of inventory, excessive equity-tapping, and more – we’re not where we were 12 years ago. None of those factors are in play today. Rest assured, housing is not a catalyst that could spiral us back to that time or place. According to Danielle Hale, Chief Economist at Realtor.com, if there is a recession: “It will be different than the Great Recession. Things unraveled pretty quickly, and then the recovery was pretty slow. I would expect this to be milder. There’s no dysfunction in the banking system, we don’t have many households who are overleveraged with their mortgage payments and are potentially in trouble.” In addition, the Goldman Sachs GDP Forecast released this week indicates that although there is no growth anticipated immediately, gains are forecasted heading into the second half of this year and getting even stronger in early 2021. Both of these expert sources indicate this is a momentary event in time, not a collapse of the financial industry. It is a drop that will rebound quickly, a stark difference to the crash of 2008 that failed to get back to a sense of normal for almost four years. Although it poses plenty of near-term financial challenges, a potential recession this year is not a repeat of the long-term housing market crash we remember all too well. 2. A Recession Does Not Equal a Housing Crisis Next, take a look at the past five recessions in U.S. history. Home values actually appreciated in three of them. It is true that they sank by almost 20% during the last recession, but as we’ve identified above, 2008 presented different circumstances. In the four previous recessions, home values depreciated only once (by less than 2%). In the other three, residential real estate values increased by 3.5%, 6.1%, and 6.6% (see below): 3. We Can Be Confident About What We KnowConcerns about the global impact COVID-19 will have on the economy are real. And they’re scary, as the health and wellness of our friends, families, and loved ones are high on everyone’s emotional radar.

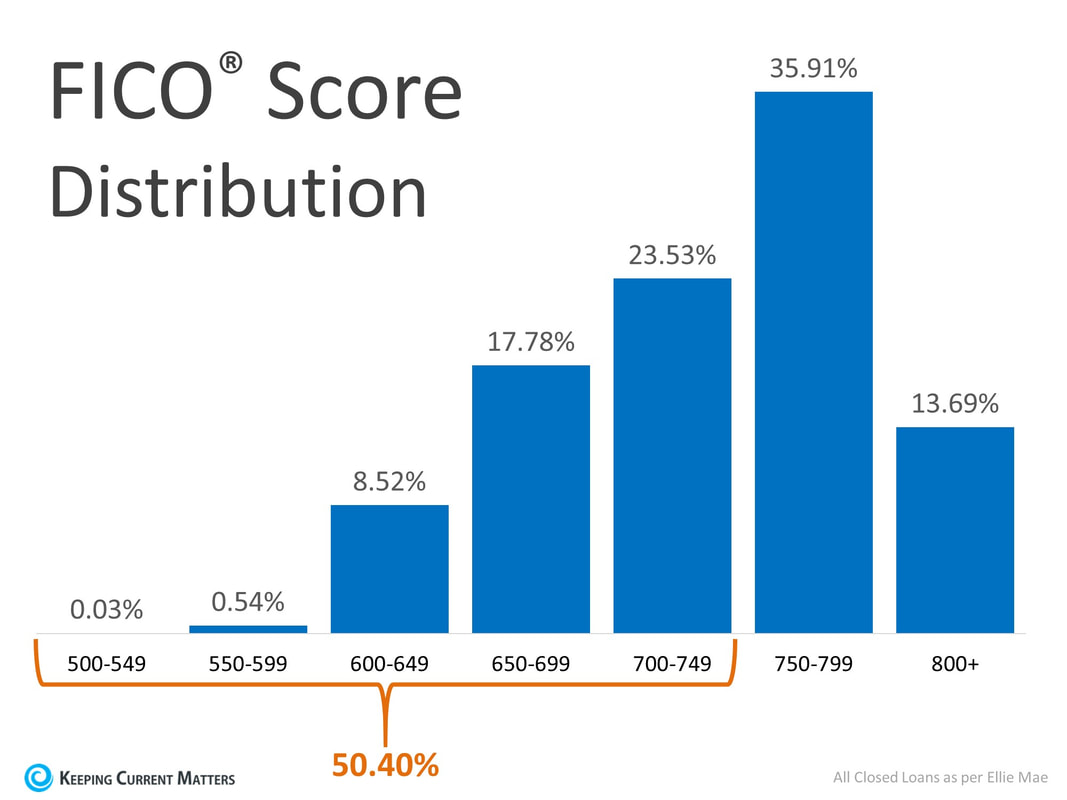

According to Bloomberg, “Several economists made clear that the extent of the economic wreckage will depend on factors such as how long the virus lasts, whether governments will loosen fiscal policy enough and can markets avoid freezing up.” That said, we can be confident that, while we don’t know the exact impact the virus will have on the housing market, we do know that housing isn’t the driver. The reasons we move – marriage, children, job changes, retirement, etc. – are steadfast parts of life. As noted in a recent piece in the New York Times, “Everyone needs someplace to live.” That won’t change. Bottom Line Concerns about a recession are real, but housing isn’t the driver. If you have questions about what it means for your family’s homebuying or selling plans, reach out to a local real estate professional to discuss your needs. SOURCE KCM #HousingMarketUpdates #ForSellers #ForBuyers #SimardRealtyGroup #eXpRealty The 2020 Millennial Home Buyer Report shows how this generation is not really any different from previous ones when it comes to homeownership goals: “The majority of millennials not only want to own a home, but 84% of millennials in 2019 considered it a major part of the American Dream.” Unfortunately, the myths surrounding the barriers to homeownership – especially those related to down payments and FICO® scores – might be keeping many buyers out of the arena. The piece also reveals: “Millennials have to navigate a lot of obstacles to be able to own a home. According to our 2020 survey, saving for a down payment is the biggest barrier for 50% of millennials.” Millennial or not, unpacking two of the biggest myths that may be standing in the way of homeownership among all generations is a great place to start the debunking process. Myth #1: “I Need a 20% Down Payment” Many buyers often overestimate what they need to qualify for a home loan. According to the same article: “A down payment of 20% for a home of that price [$210,000] would be about $42,000; only about 30% of the millennials in our survey have enough in savings to cover that, not to mention the additional closing costs.” While many potential buyers still think they need to put at least 20% down for the home of their dreams, they often don’t realize how many assistance programs are available with as little as 3% down. With a bit of research, many renters may be able to enter the housing market sooner than they ever imagined. Myth #2: “I Need a 780 FICO® Score or Higher” In addition to down payments, buyers are also often confused about the FICO® score it takes to qualify for a mortgage, believing they need a credit score of 780 or higher. Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans, shows the truth is, over 50% of approved loans were granted with a FICO® score below 750 (see graph below): Even today, many of the myths of the homebuying process are unfortunately keeping plenty of motivated buyers on the sidelines. In reality, it really doesn’t have to be that way.

Bottom LineIf you’re thinking of buying a home, you may have more options than you think. A trusted real estate professional can answer your questions and help you determine your next steps. SOURCE KCM #BuyingMyths #DownPayments #ForBuyers #SimardRealtyGroup #eXpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed