|

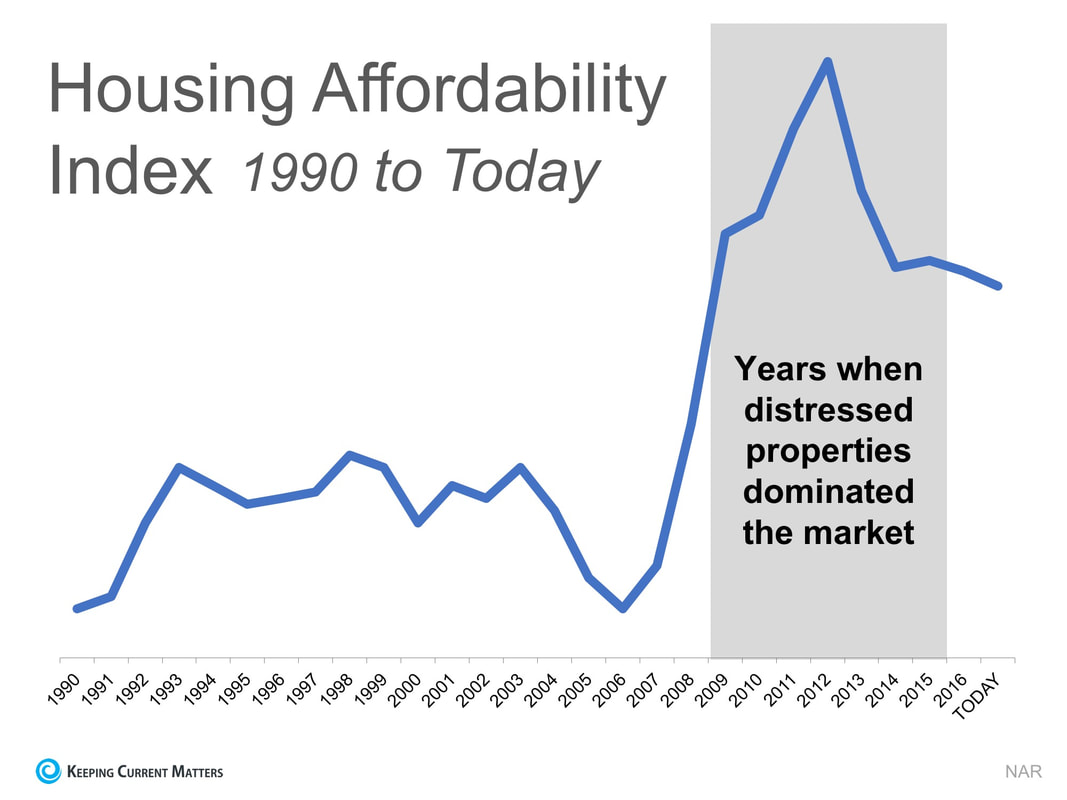

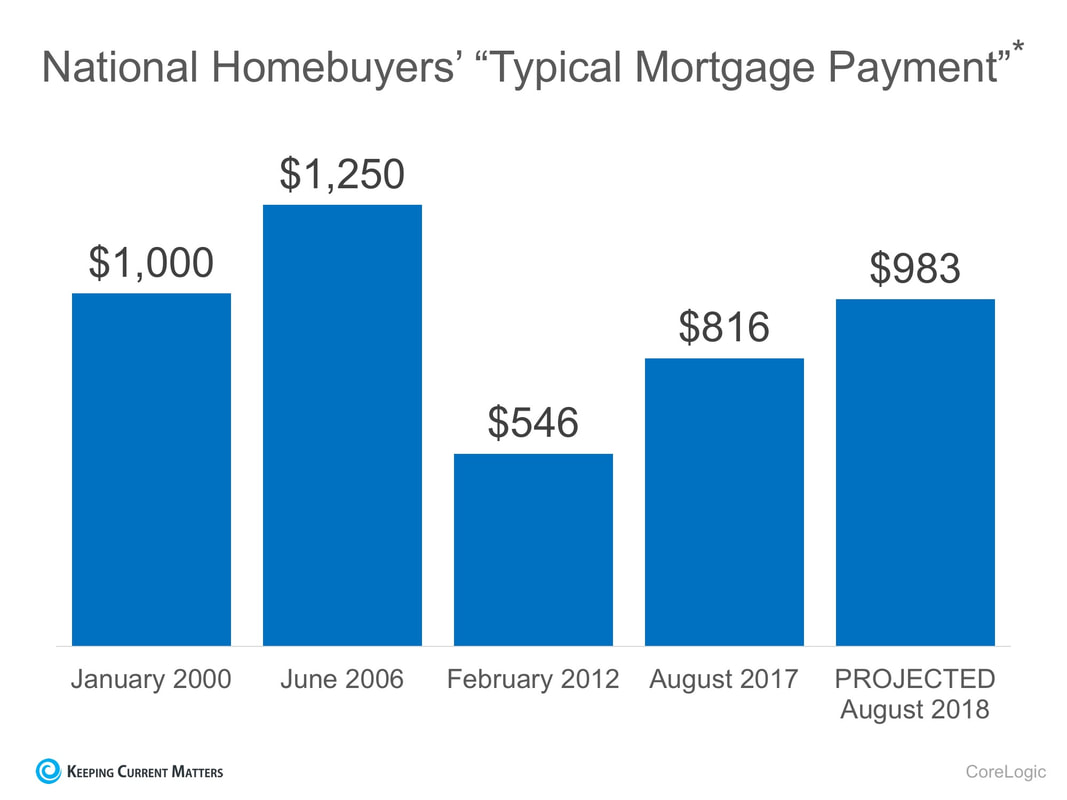

There is a lot of discussion about the current state of housing affordability for both first-time and move-up buyers, and much of the narrative is tarnished with a negative slant. However, the truth is that housing affordability is better today than at almost any time in our history. The naysayers are correct in the fact that affordability today is not as good as it has been over the last several years. But, we must remember that home prices collapsed during the housing crash, and distressed properties (foreclosures and short sales) kept home values depressed for years. When we compare affordability to the decades that proceeded the crash, a different story is revealed. Here is a graph of the National Association of Realtors’ Housing Affordability Index. The higher the graph, the more affordable homes are. We can see that affordability is better today than in the fifteen years prior to the boom and bust. CoreLogic just published a report showing the National Homebuyers’ “Typical Mortgage Payment.” Here is a graph of their findings: It reveals that, though a ‘typical’ housing payment was less expensive in 2012 (remember distressed properties), it is currently less expensive than it was in 2000 and is still projected to be lower next year than it was in 2000.

Bottom Line Mark Fleming, Chief Economist at First American, explained it best: “While borrowing power for the potential home buyer has fallen relative to the low point of 2012, it remains high today and will remain high next year, relative to the long run average. If you don’t want to rent anymore and are considering becoming a homeowner, even if mortgage rates rise next year, your borrowing power will remain strong by historic standards.” SOURCE KCM #Buyers #RentVSBuy #SimardRealtyGroup #JoinExpRealty

0 Comments

Owning a home has great financial benefits, yet many continue to rent! Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed.

Zillow recently reported that: “In reality, buying or renting a home is an intensely personal decision, with emotional and even financial considerations that go beyond whether to invest in this one (admittedly large) asset. Looking strictly at housing market numbers, there is a concrete point at which buying a home makes more financial sense than renting it.” What proof exists that owning is financially better than renting? 1. We recently highlighted the top 5 financial benefits of homeownership:

2. Studies have shown that a homeowner’s net worth is 44x greater than that of a renter. 3. Just a few months ago, we explained that a family that purchased an average-priced home at the beginning of 2017 could build more than $48,000 in family wealth over the next five years. 4. Some argue that renting eliminates the cost of taxes and home repairs, but every potential renter must realize that all the expenses the landlord incurs are already baked into the rent payment– along with a profit margin!! Bottom Line Owning a home has always been, and will always be, better from a financial standpoint than renting. SOURCE KCM #HomeBuyers #BuyingMyths #SimardRealtyGroup #JoinExpRealty Some Highlights:

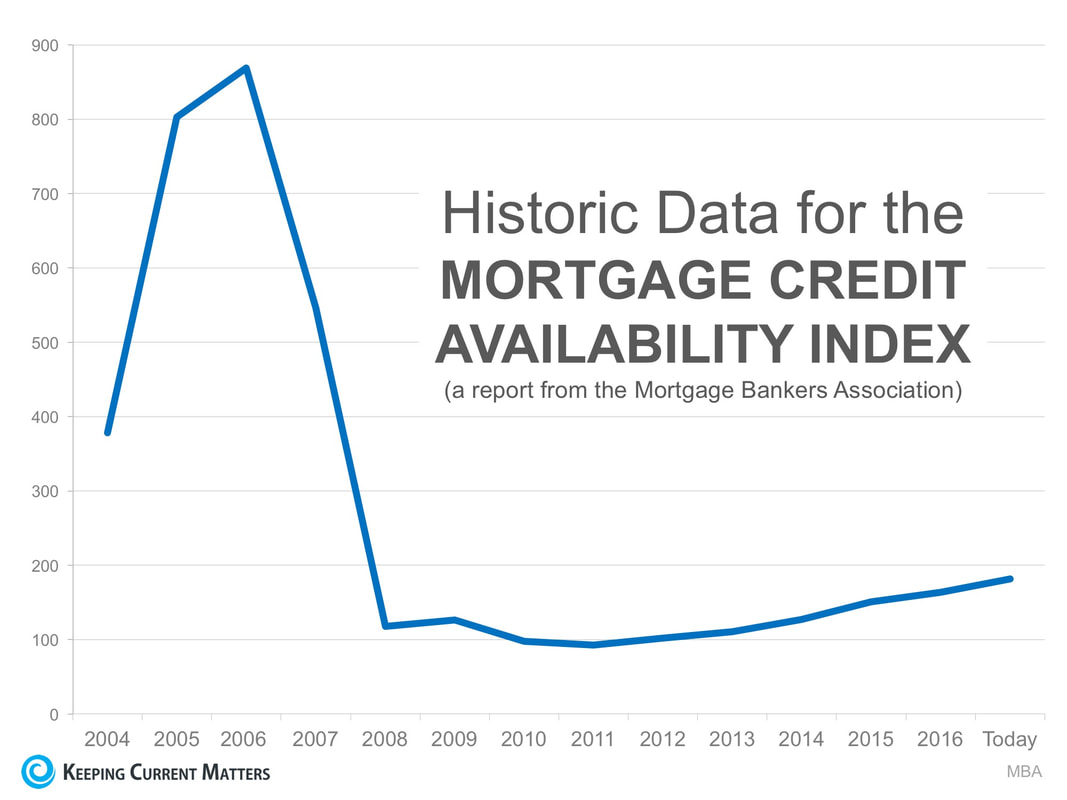

SOURCE KCM #ForSellers #ForBuyers #Infographics #SimarRealtyGroup #ExpRealty There is little doubt that it is easier to get a home mortgage today than it was last year. The Mortgage Credit Availability Index (MCAI), published by the Mortgage Bankers Association, shows that mortgage credit has become more available in each of the last several years. In fact, in just the last year:

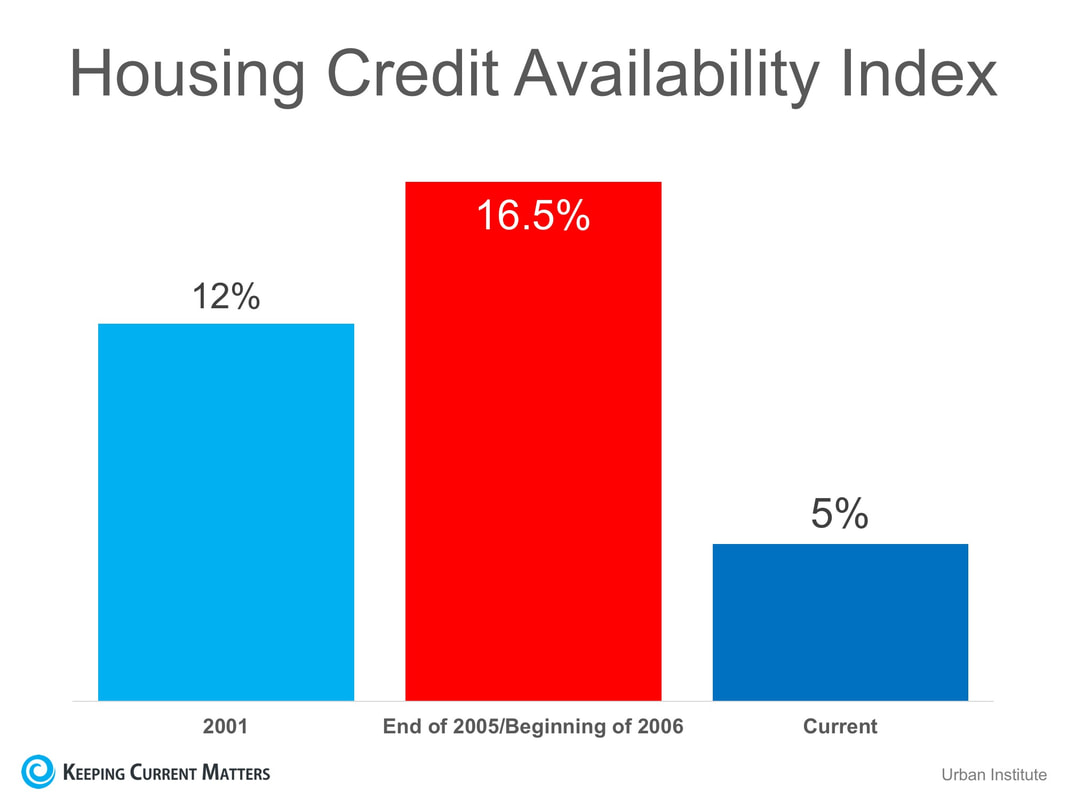

This has some people worrying that we are returning to the lax lending standards which led to the boom and bust that real estate experienced ten years ago. Let’s alleviate some of that concern. The graph below shows the MCAI going back to the boom years of 2004-2005. The higher the graph line, the easier it was to get a mortgage As you can see, lending standards were much more lenient from 2004 to 2007. Though it has gradually become easier to get a mortgage since 2011, we are nowhere near the lenient standards during the boom. The Urban Institute also publishes a Home Credit Availability Index (HCAI). According to the Institute, the HCAI: “Measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates … it is easier to get a loan.” Here is a graph showing their findings: Again, today’s lending standards are nowhere near the levels of the boom years. As a matter of fact, they are more stringent than they were even before the boom.

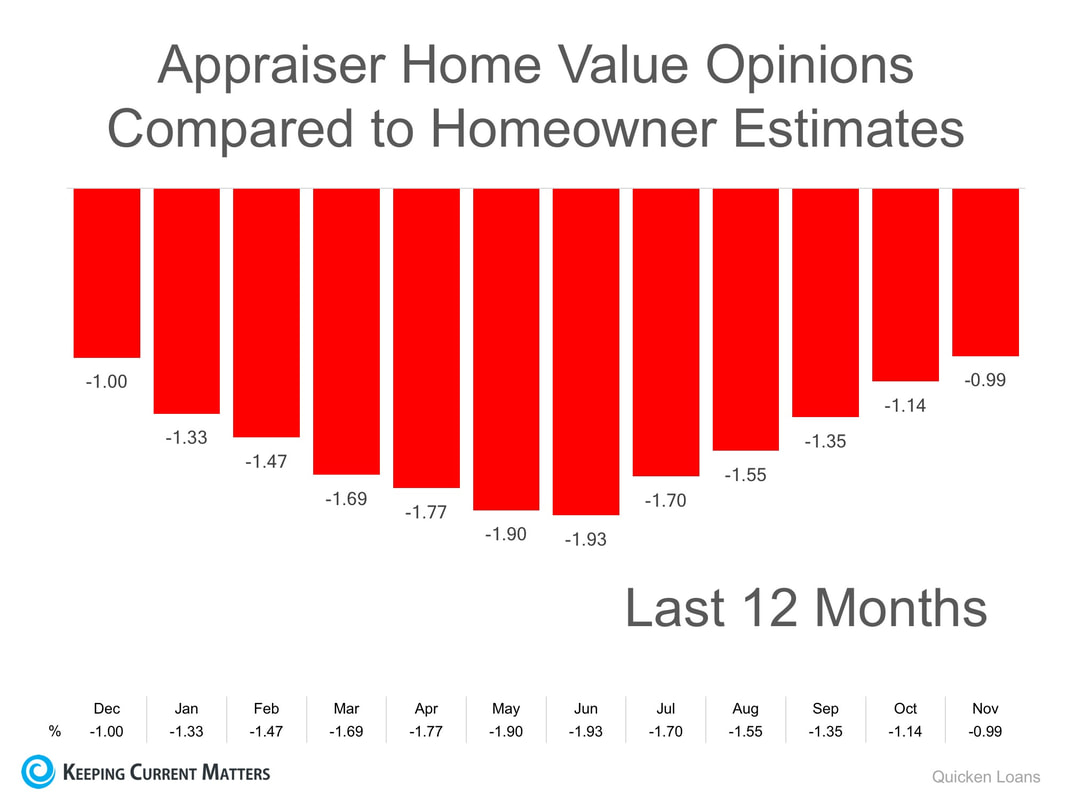

Bottom Line It is getting easier to gain financing for a home purchase. However, we are not seeing the irresponsible lending that caused the housing crisis. SOURCE KCM #BuyingMyths #ForBuyers #SimardRealtyGroup #ExpRealty In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting that home values could appreciate by another 5%+ over the next twelve months. One major challenge in such a market is the bank appraisal. If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank. Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their house is worth, and an appraiser’s evaluation of that same home. Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges anyone looking to buy or sell in today’s market to remember the impact of this challenge: “Based on the HPPI, it appears homeowners in the markets where prices are rising faster than the national average – like Denver, Seattle and San Francisco – are continuing to underestimate just how quickly home values are rising, so the average appraisal is higher than homeowner estimate. On the inverse of that, homeowners in areas where the values aren’t rising as fast may think they are rising faster than they are, leading to the appraisal lagging the estimate.” The chart below illustrates the changes in home price estimates over the last 12 months. Bottom Line

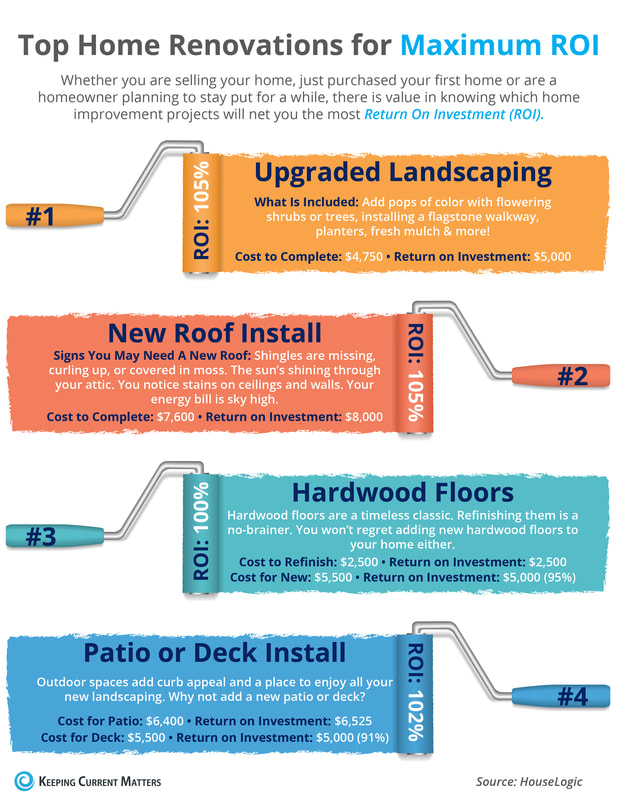

Every house on the market must be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, meet with an experienced professional who can guide you through this and any other obstacles that may arise. SOURCE KCM #Sellers #Buyers #HomeOwners #SimardRealtyGroup #ExpRealty Some Highlights:

SOURCE KCM #ForBuyers #ForSellers #Infographics #SimardRealtyGroup #JoinExpRealty Whether you are a renter who is searching for your dream home or a homeowner who feels like your only option is to renovate, you have at least one thing in common: feeling stuck in place.

According to data from the National Association of Realtors’ Profile of Home Buyers & Sellers, the average amount of time that a family stays in their home remained at 10 years in 2017. This mark ties the highest marks set in 2014 and 2016. Back in 1985, when data was first collected on this subject, homeowners stayed in their homes for an average of only 5 years. There are many reasons why homeowners have decided to stay and not to sell. A recent Wall Street Journalarticle had this to say, “Americans aren’t moving in part because inventory levels have fallen near multidecade lows and home prices have risen to records. Many homeowners are choosing to stay and renovate, in turn making it more difficult for renters to enter the market.” Sam Khater, Deputy Chief Economist for CoreLogic, equated the lack of inventory to “not having enough oil in your car and your gears slowly [coming] to a grind.” Historically, a normal market (in which prices increase at the rate of inflation) requires a 6-7 month supply of inventory. There hasn’t been that much supply since August of 2012! Over the course of the last 12 months, inventory has hovered between a 3.5 to 4.4-month supply, meaning that prices have increased and buyers are still out in force! Challenges in the new-home construction market have “helped create a bottleneck in the market in which owners of starter homes aren’t trading up to newly built homes, which tend to be pricier, in turn creating a squeeze for millennial renters looking to get into the market.” “Economists said baby boomers also aren’t in a hurry to trade in the dream homes they moved into in middle age for condominiums or senior living communities because many are staying healthy longer or want to remain near their children.” So, what can you do if you feel stuck & want to move on? Don’t give up! If you are looking to move-up to an existing luxury home, there are deals to be had in the higher-priced markets. Demand is strong in the starter and trade-up home markets which means that your house will sell quickly. Work with your real estate professional to build in contingencies that allow you more time to find your dream home; the right buyer will wait. SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #JoinExpRealty Every year at this time, many homeowners decide to wait until after the holidays to put their homes on the market for the first time, while others who already have their homes on the market decide to take them off until after the holidays. Here are seven great reasons not to wait:

Bottom Line Waiting until after the holidays to sell your home probably doesn’t make sense. #ForSellers #MoveUpBuyers #SimardRealtyGroup #ExpRealty Some Highlights:

Source KCM #ForBuyers #Infographics #SimardRealtyGroup #ExpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed