|

In today’s economy, everyone seems to be searching for signs that a recovery is coming soon. Many experts agree that it may actually already be in motion or will be starting by the 3rd quarter of this year. With the housing market positioned to lead the way out of this recession, builder confidence might be a bright spark that gets the recovery fire started. The construction of new homes coming right around the corner is a huge part of that effort, and it may drive your opportunity to make a move this year. According to the National Association of Home Builders (NAHB): “New home sales jumped in May, as housing demand was supported by low interest rates, a renewed household focus on housing, and rising demand in lower-density markets. Census and HUD estimated new home sales in May at a 676,000 seasonally adjusted annual pace, a 17% gain over April.” In addition, builder confidence is also rising, opening up opportunity for newly constructed homes in the market. The NAHB also notes: “In a sign that housing stands poised to lead a post-pandemic economic recovery, builder confidence in the market for newly-built single-family homes jumped 21 points to 58 in June, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI). Any reading above 50 indicates a positive market.” As noted above, this upward trend is supported by builders reporting an increase in demand for single-family homes in suburban neighborhoods with lower-density populations, a result of the COVID-19 health crisis. Moreover, the most recent Monthly New Residential Construction Report from the U.S. Census indicates that authorized building permits for new residential construction increased by 14.4% month-over-month from April to May, and housing starts were also up 4.3% over the same time period. (See graph below): Although housing permits and starts are both considerably lower than they were at this time last year, indicating the new construction market is still working on building its way back up, the trends are moving in the right direction when it comes to having an impact on the U.S. economy. They’re also poised to create the much-needed new homes for Americans to purchase in a time when inventory is so scarce.

Dean Mon, Chairman of the NAHB notes: “As the nation reopens, housing is well-positioned to lead the economy forward…Inventory is tight, mortgage applications are increasing, interest rates are low and confidence is rising. And buyer traffic more than doubled in one month even as builders report growing online and phone inquiries stemming from the outbreak.” The gap between homes to buy and the high demand from purchasers may be narrowed by new construction, and the data shows that these homes are on their way into the housing market. So, if you’ve debated whether or not to sell your house this year because you’re not sure where to move, a newly-built home – designed to your specific liking – may be your answer. Bottom Line With new residential construction right around the corner, you can feel confident about selling your house and having a place to move into. Maybe it’s time to finally design the home you’ve always wanted. Reach out to a local real estate professional today to discuss selling your house while demand from eager buyers is high. SOURCE KCM #ForBuyers #NewConstruction #HousingMarketUpdates #SimardRealtyGroup #eXpRealty

0 Comments

One of the biggest questions on everyone’s minds these days is: What’s going to happen to the housing market in the second half of the year? Based on recent data on the economy, unemployment, real estate, and more, many economists are revising their forecasts for the remainder of 2020 – and the outlook is extremely encouraging. Here’s a look at what some experts have to say about key areas that will power the industry and the economy forward this year.

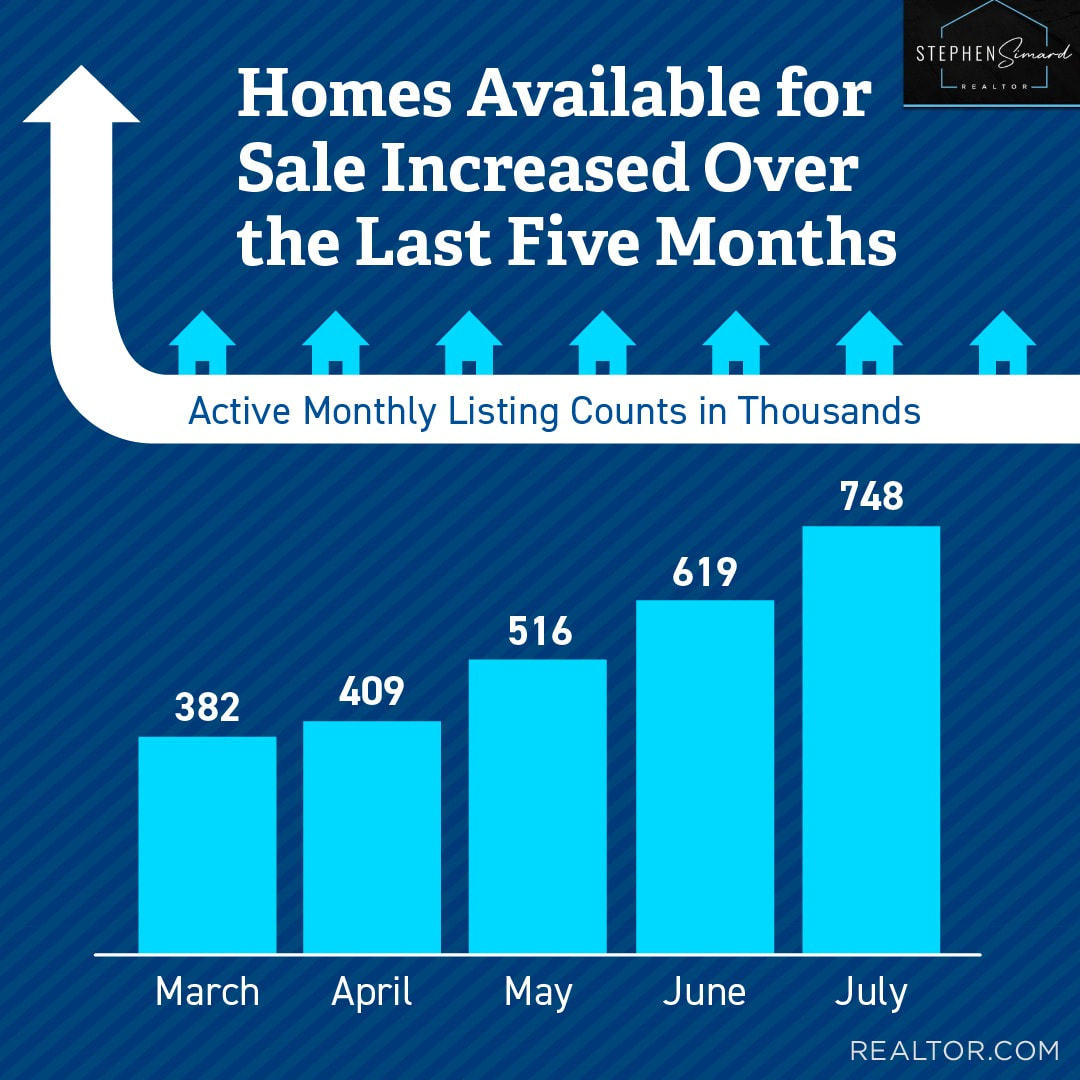

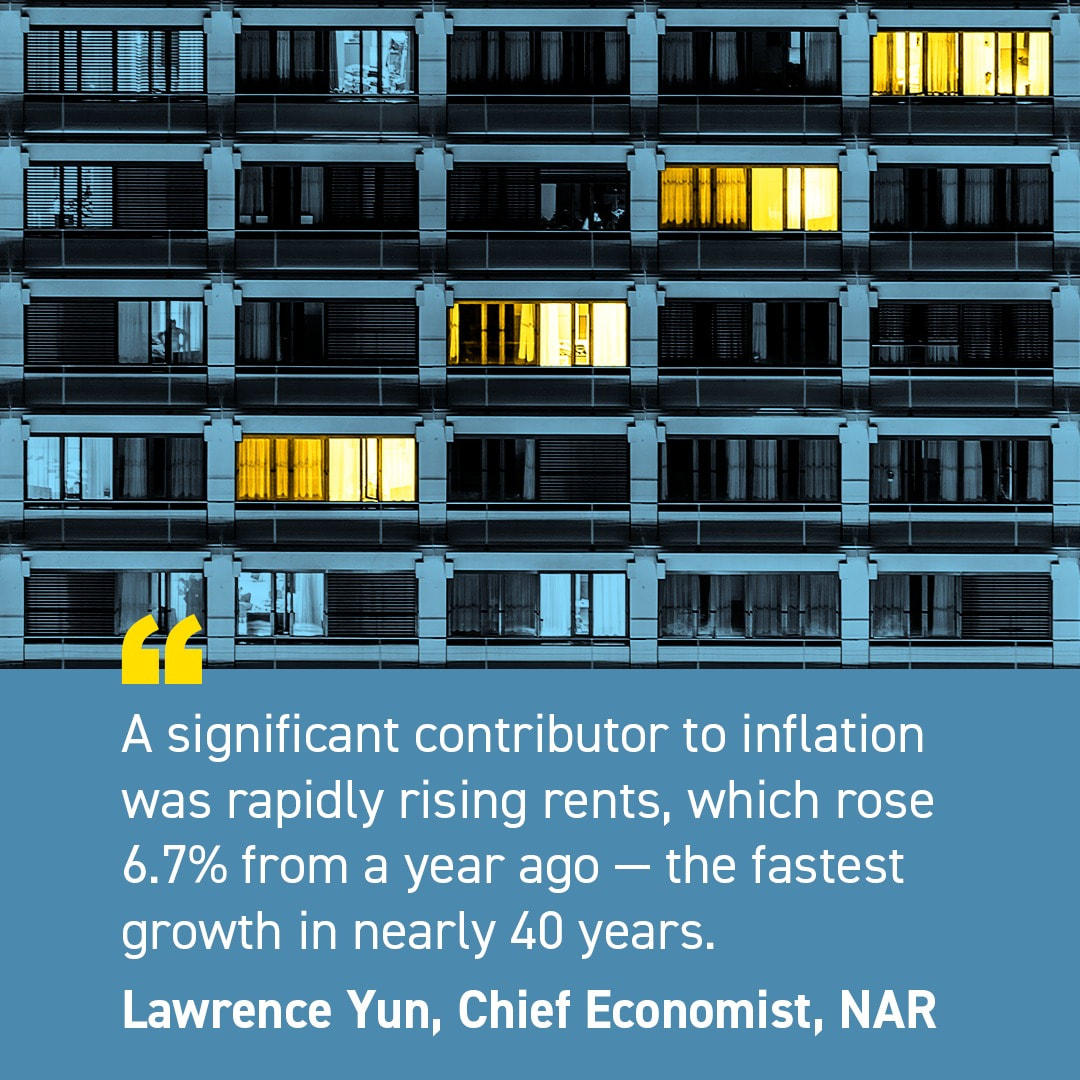

Mortgage Purchase Originations: Joel Kan, Associate Vice President of Economic and Industry Forecasting, Mortgage Bankers Association “The recovery in housing is happening faster than expected. We anticipated a drop off in Q3. But, we don’t think that’s the case anymore. We revised our Q3 numbers higher. Before, we predicted a 2 percent decline in purchase originations in 2020, now we think there will be 2 percent growth this year.” Home Sales: Lawrence Yun, Chief Economist, National Association of Realtors “Sales completed in May reflect contract signings in March and April – during the strictest times of the pandemic lock down and hence the cyclical low point…Home sales will surely rise in the upcoming months with the economy reopening, and could even surpass one-year-ago figures in the second half of the year.” Inventory: George Ratiu, Senior Economist, realtor.com “We can project that the next few months will see a slow-yet-steady improvement in new inventory…we projected a stepped improvement for the May through August months, followed by a return to historical trend for the September through December time frame.” Mortgage Rates: Freddie Mac “Going forward, we forecast the 30-year fixed-rate mortgage to remain low, falling to a yearly average of 3.4% in 2020 and 3.2% in 2021.” New Construction: Doug Duncan, Chief Economist, Fannie Mae “The weaker-than-expected single-family starts number may be a matter of timing, as single-family permits jumped by a stronger 11.9 percent. In addition, the number of authorized single-family units not yet started rose 5.4 percent to the second-highest level since 2008. This suggests that a significant acceleration in new construction will likely occur.” Bottom Line The experts are optimistic about the second half of the year. If you paused your 2020 real estate plans this spring, reach out to a local real estate professional today to determine how you can re-engage in the process. SOURCE KCM #ForBuyers #ForSellers #HousingMarketUpdates #SimardRealtyGroup #eXpRealty Some Highlights

SOURCE KCM #FSBO #RealEstateProfessional #StephenSimard #SimardRealtyGroup #eXpRealty More and more data points show that buyers are ready to enter the market this summer. DM me to discuss why high homebuyer demand puts potential sellers in a great position to make a move this season.

#realestate #mortgage #expertanswers #stayinformed #staycurrent #powerfuldecisions #confidentdecisions #realestateexpert #realestateagency #realestateadvice #realestateblog #realestatemarket #realestatetipsandadvice #keepingcurrentmatters Earlier this month, realtor.com announced the release of their initial Housing Recovery Index, a weekly guide showing how the pandemic has impacted the residential real estate market. The index leverages a weighted average of four key components of the housing industry, tracking each of the following:

The index then compares the current status “to the last week of January 2020 market trend, as a baseline for pre-COVID market growth. The overall index is set to 100 in this baseline period. The higher a market’s index value, the higher its recovery and vice versa.” The graph below charts the index by showing how the real estate market started out strong in early 2020, and then dropped dramatically at the beginning of March when the pandemic paused the economy. It also shows the strength of the recovery since the beginning of May. It’s clear to see that the housing market is showing promising signs of recovery from the deep economic cuts we experienced earlier this spring. As noted by Dean Mon, Chairman of the National Association of Home Builders (NAHB):

“As the nation reopens, housing is well-positioned to lead the economy forward.” The data today indicates the housing market is already on the way up. Bottom Line Staying connected to the housing market’s performance over the coming months will be essential, as we continue to evaluate exactly how the housing market is doing in this uncharted time ahead. SOURCE KCM #ForBuyers #ForSellers #HousingMarketUpdates #SimardRealtyGroup #eXpRealty The New York Times recently ran an article regarding unemployment titled: Don’t Cheer Too Soon. Keep an Eye on the Core Jobless Rate. The piece suggests we should look at unemployment numbers somewhat differently. The author of the article, Jed Kolko, is a well-respected economist who is currently the Chief Economist at Indeed, the world’s largest online jobs site. Previously, he was Chief Economist and VP of Analytics at Trulia, the online real estate site. Kolko suggests “the coronavirus pandemic has broken most economic charts and models, and all the numbers we regularly watch need a closer look.” He goes on to explain that the decline in the unemployment number reported by the Bureau of Labor Statistics (BLS) earlier this month was driven by a drop in temporary layoffs. If we strip those out, we’re left with what Kolko calls the core unemployment rate. Many economists have struggled with how to deal with the vast number of temporary layoffs, as a complete shutdown of the economy has never happened before. As the article states, in the last unemployment report: “73 percent of all unemployed people said they were temporarily unemployed, which means they had a return-to-work date or they expected to return to work in six months. Before the pandemic, temporary unemployment was never more than one-quarter of total unemployment.” The core unemployment rate handles this issue and also deals with another concern economists have discussed for years: the exclusion of the marginally attached. These are people who are available and want to work, but count as out of the labor force rather than unemployed because they haven’t searched for work in the past four weeks. Kolko’s core rate does three things:

Removing the temporarily unemployed makes sense according to the article: “Initial pandemic relief efforts focused on money for people to manage a temporary loss of income and funds to keep businesses afloat until they could bring their workers back. The hope and the goal is for the temporarily unemployed to return to their old jobs, rather than have them lose their jobs and have to search for new ones when jobs have become scarcer.” The Bad News and the Good News Clearly, the adjustments Kolko makes dramatically impact the way we look at unemployment. The bad news is, using his core rate, there was an increase in unemployment from April to May. The conventional rate reported by the BLS showed a decrease in unemployment. The good news is that the core rate compares more favorably to the last recession in 2008. Here’s the breakdown: Bottom LineThe unemployment rate is a key indicator of how the economy is doing. Heading into a highly contested election this November, the BLS report releasing next week will be scrutinized like no other by members on both sides of the aisle. Mr. Kolko’s take is just one additional way to evaluate how unemployment is impacting American families.

SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #eXpRealty A worldwide pandemic and an economic recession have had a tremendous effect on the nation. The uncertainty brought about by both has made predicting consumer behavior nearly impossible. For that reason, forecasting home prices has become extremely difficult.

Normally, there’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Mortgage applications to buy a home just rose to the highest level in 11 years while inventory of homes for sale is at (or near) an all-time low. That would usually indicate strong appreciation for home values as we move throughout the year. Some experts, however, are not convinced the current rush of purchasers is sustainable. Ralph McLaughlin, Chief Economist at Haus, explained in their June 2020 Hausing Market Forecast why there is concern: “The upswing that we’ll see this summer is a result of pent-up demand from homebuyers and supply-in-progress from homebuilders that has simply been pushed off a few months. However, after this pent-up demand goes away, the true economic scarring due to the pandemic will begin to affect the housing market as the tide of pent-up demand goes out.” The virus and other challenges currently impacting the industry have created a wide range of thoughts regarding the future of home prices. Here’s a list of analysts and their projections, from the lowest depreciation to the highest appreciation:

We can garner two important points from this list:

Bottom Line Whether you’re thinking of buying a home or selling your house, know that home prices will not change dramatically this year, even with all of the uncertainty we’ve faced in 2020. SOURCE KCM #ForBuyers #ForSellers #Pricing #SimardRealtyGroup #eXpRealty Historically low mortgage rates are a key motivator for buyers to return to the market right now. More buyers means more opportunities for potential sellers. DM me to find out why this summer is a great time to buy or sell a home.

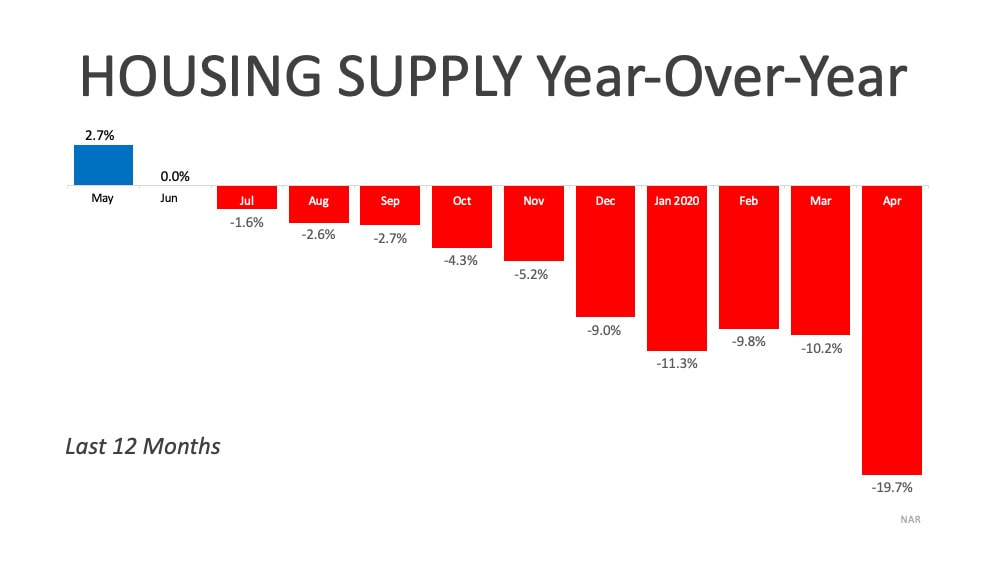

#buyahome #sellyourhouse #moveuphome #dreamhome #realestate #homeownership #realestategoals #firsttimehomebuyer #opportunity #housingmarket #househunting #makememove #homegoals #realestateblog #keepingcurrentmatter According to the latest FreddieMac Quarterly Forecast, mortgage interest rates have fallen to historically low levels this spring and they’re projected to remain low. This means there’s a huge incentive for buyers who are ready to purchase. And homeowners looking for eager buyers can take advantage of this opportune time to sell as well. There’s a very positive outlook on interest rates going forward, as the projections from the FreddieMac report indicate continued lows into 2021: “Going forward, we forecast the 30-year fixed-rate mortgage to remain low, falling to a yearly average of 3.4% in 2020 and 3.2% in 2021.” With mortgage rates hovering at such compelling places, ongoing buyer interest is bound to keep driving the housing market forward. Rates also reached another record low last week, so homebuyers are in what FreddieMac is identifying as the buying mood: “While the rebound in the economy is uneven, one segment that is exhibiting strength is the housing market. Purchase demand activity is up over twenty percent from a year ago, the highest since January 2009. Mortgage rates have hit another record low due to declining inflationary pressures, putting many homebuyers in the buying mood. However, it will be difficult to sustain the momentum in demand as unsold inventory was at near record lows coming into the pandemic and it has only dropped since then.” There’s no doubt that even though buyers are ready to purchase, it’s hard for many of them to find a home to buy today. Mortgage rates aren’t the only thing hovering near all-time lows; homes available for sale are too. With housing inventory as scarce as it is today – a nearly 20% year-over-year decline in available homes to purchase – keeping buyers in the purchasing mood may be tough if they can’t find a home to buy (See graph below): What does this mean for buyers?

Competition is hot with so few homes available for purchase and low mortgage rates are helping to drive affordability as well. Getting pre-approved now will help you gain a competitive advantage and accelerate the homebuying process, so you’re ready to go when you find that perfect home you’d like to buy. Working quickly and efficiently with a trusted real estate professional will help put you in a position to act fast when you’re ready to make your move. What does this mean for sellers? If you’re thinking of selling your house, know that the motivation for buyers to purchase right now is as high as ever with rates where they are today. Selling now before other sellers come to market in your neighborhood this summer might put your house high on the list for many buyers. Homebuyers are clearly in the mood to buy, and with today’s safety guidelines and precautions in place to show your house, confidence is also on your side. Bottom Line Whether you’re looking to buy or sell, there’s great motivation to be in the housing market, especially with mortgage rates hovering at this historic all-time low. Let’s connect today to make sure you’re ready to make your move. SOURCE KCM #HomeBuyers #HousingSupply #ForBuyers #SimardRealtyGroup #eXpRealty Congratulations to our sellers! Thank you for trusting Simard Realty Group.

Click on the link below to see more photos of this lovely home: https://20byrondrive.thebestlisting.com/ #Sold #HappySellers #Granby #SellingCT #SimardRealtyGroup #StephenSimard #eXpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed