|

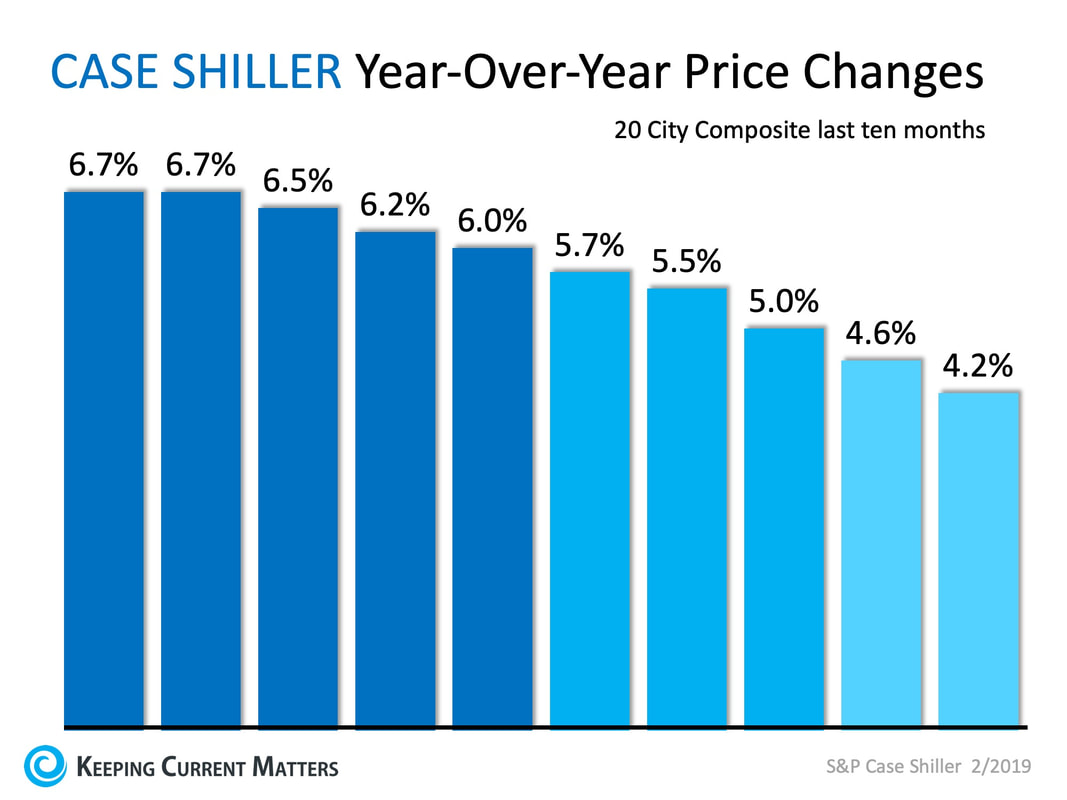

Home prices have appreciated considerably over the last five years. This has some concerned that we may be in for another dramatic correction. However, recent statistics suggest home values will not crash as they did a decade ago. Instead, this time they will come in for a soft landing. The previous housing market was fueled by an artificial demand created by mortgage standards that were far too lenient. When this demand was shut off, a flood of inventory came to market. This included heavily discounted distressed properties (foreclosures and short sales). Today’s market is totally different. Mortgage standards are tighter than they were prior to the last boom and bust. There is no fear that a rush of foreclosures will come to market. The Mortgage Bankers’ Associationjust announced that foreclosures are lower today than at any time since 1996. Case Shiller looks at the percentage of appreciation as compared to the same month the year prior. Here is a graph of their findings over the last ten months: As we can see, home price appreciation is softening as more inventory comes to market. This shows that real estate prices are not crashing, but merely returning toward historic appreciation numbers of 3.6% annually.

Bottom LineHome prices are leveling off. Long term, that is a good thing for the housing market. SOURCE KCM #FirsTimeHomeBuyers #Pricing #ForSellers #SimardRealtyGroup #eXpRealty

0 Comments

Are you planning on buying a home this year? Show homeowners that you are serious about buying by getting pre-approved for a mortgage! Let's get together to help you take the first step in making your dream of buying a home a reality!

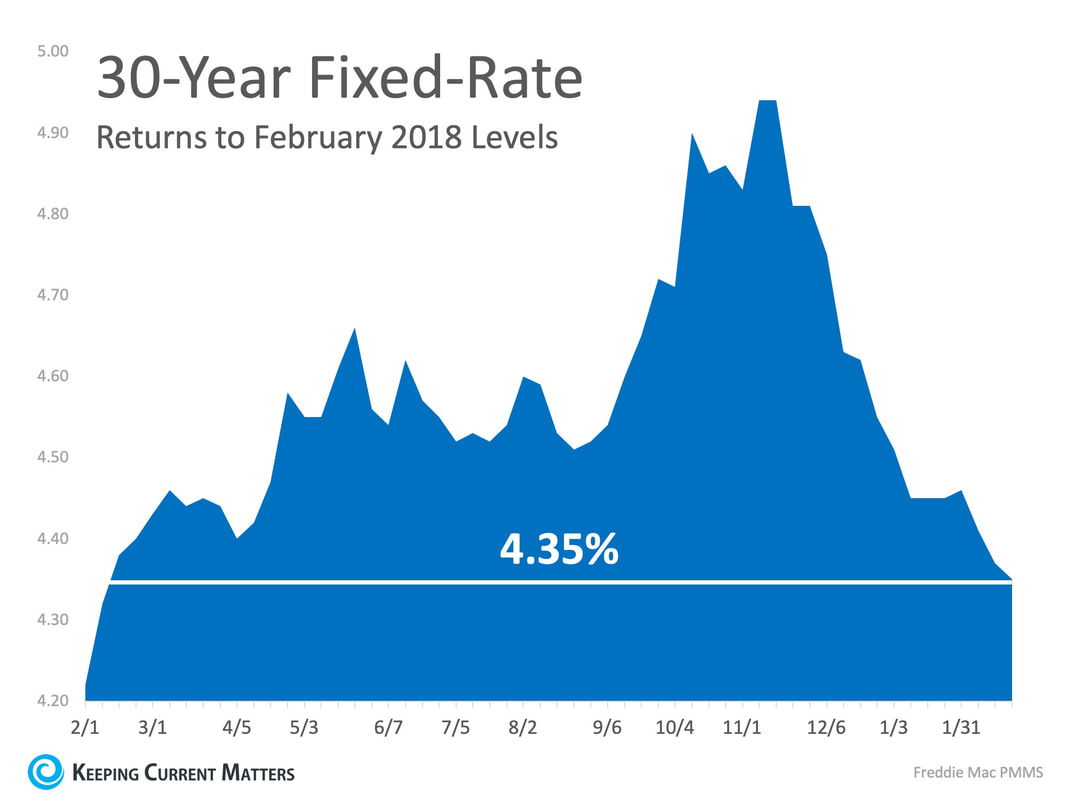

#GranbyHomes #Homesforsale #Realestate #Simsburyhomes #Homevalues #RealEstateAdvise #RealtorGranby #RealEstateSimsbury #StephenSimard #eXpRealty According to Freddie Mac’s Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at their lowest for 2019. Rates like these haven’t been seen since February 2018! Last week’s survey results reported an interest rate of 4.35%. This is a welcome change from the near 5% rates seen in mid-November. At 4.32%, the second week of February 2018 was the last time rates were this low. This can be seen in the chart below. Freddie Mac’s Chief Economist, Sam Khater, had this to say:

“Mortgage rates fell for the third consecutive week, continuing the general downward trend that began late last year. Wages are growing on par with home prices for the first time in years, and with more inventory available, spring home sales should help the market begin to recover from the malaise of the last few months.” Bottom Line If you plan on buying a home this spring, meet with a local real estate professional who can help prepare you for today’s market before rates increase! SOURCE KCM #InterestRates #ForBuyers #SimardRealtyGroup #eXpRealty Every family has a list of important dates. We celebrate birthdays, anniversaries, pet adoptions…and the list goes on. For 64.4 percent of households in the United States, this list includes the day they became a homeowner for the first time!

Why is this date important? Homeownership is not just a roof over your head! It represents shelter, stability, wealth, and pride! For decades, homeownership has been an important part of the American Dream! However, many question if the next generations see the same benefits of homeownership as their predecessors. In case we have forgotten, some of those benefits are: Non-Financial Benefits

Financial Benefits Buying a home is an investment in your future!

Bottom Line Homeownership is and will always be part of the American Dream! There are many financial and non-financial benefits to take advantage of when owning a home. If owning a home is part of your dream, contact a local real estate professional to help you with the process! SOURCE KCM #FirstTimeHomeBuyers #ForBuyers #RentVSBuy #SimardRealtyGroup #eXpRealty Some Highlights:

SOURCE KCM #DownPayments #ForBuyers #SimardRealtyGroup #eXpRealty With home prices softening, some are concerned that we may be headed toward the next housing crash. However, it is important to remember that today’s market is quite different than the bubble market of twelve years ago.

Here are three key metrics that will explain why:

HOME PRICES A decade ago, home prices depreciated dramatically, losing about 29% of their value over a four-year period (2008-2011). Today, prices are not depreciating. The level of appreciation is just decelerating. Home values are no longer appreciating annually at a rate of 6-7%. However, they have still increased by more than 4% over the last year. Of the 100 experts reached for the latest Home Price Expectation Survey, 94 said home values would continue to appreciate through 2019. It will just occur at a lower rate. MORTGAGE STANDARDS Many are concerned that lending institutions are again easing standards to a level that helped create the last housing bubble. However, there is proof that today’s standards are nowhere near as lenient as they were leading up to the crash. The Urban Institute’s Housing Finance Policy Center issues a quarterly index which, “…measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.” Last month, their January Housing Credit Availability Index revealed: “Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.” FORECLOSURE INVENTORY Within the last decade, distressed properties (foreclosures and short sales) made up 35% of all home sales. The Mortgage Bankers’ Association revealed just last week that: “The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.95 percent…This was the lowest foreclosure inventory rate since the first quarter of 1996.” Bottom Line After using these three key housing metrics to compare today’s market to that of the last decade, we can see that the two markets are nothing alike. SOURCE KCM #MoveUpBuyers #ForSellers #HousingMarketUpdate #SimardRealtyGroup #joineXpRealty

Are you planning on selling your house in 2019? You will no doubt have more than 4 questions on your mind, but knowing the answers to these will get you started with confidence! Let's get together to answer these and any other questions you may have!

#GranbyHomes #Homesforsale #Realestate #Simsburyhomes #Homevalues #RealEstateAdvise #RealtorGranby #RealEstateSimsbury #StephenSimard #eXpRealty The housing market has been hot for a while now. Homes have been flying off the shelves as fast as they have been listed. Buyers have been competing in bidding wars just to find a home to buy, let alone find their dream home.

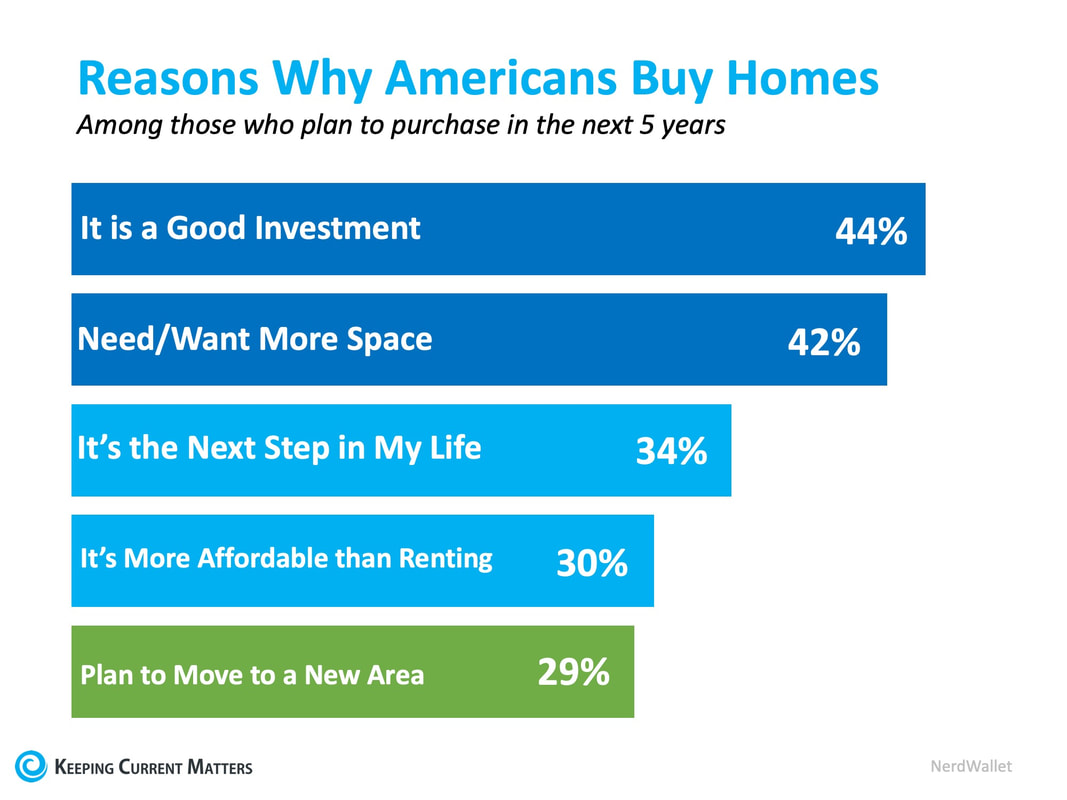

This ‘seller’s market’ has driven home prices to new heights. Home price appreciation averaged over 6% across the country. However, home price growth has recently started to cool down. The latest report from CoreLogic shows that home prices have only risen by 4.7% over the last 12 months. Many buyers and sellers planning to enter the housing market this year have started to wonder if we are headed towards another housing crash. Ralph McLaughlin, Deputy Chief Economist at CoreLogic, recently stated in an interview, “There’s no reason to panic right now, even if we may be headed for a recession. We’re seeing a cooling of the housing market, but nothing that indicates a crash. The real elephant in the room here is housing supply. ”The simple answer is we are returning to a ‘normal’ market. The inventory of homes for sale more closely matches the demand in the market. The added supply means fewer buyers are outbidding each other. Therefore, prices are experiencing less upward pressure. McLaughlin went on to explain, “If there are a lot of homes on the market and suddenly no one wants to buy them, you’ll get into a downward spiral of price competition. Right now, however, we’re in the opposite situation, there isn’t an over-abundance of homes on the market.” As more renters looking for their piece of the American Dream enter the housing market, demand for housing will continue to grow. The Joint Center for Housing Studies at Harvard University estimates over 30 million new households will enter the market from now through 2040. “There’s the natural life cycle of young people getting older and starting to do adult life things which include … buying a house and that’s a lot of potential inertia that could last indefinitely.” Bottom Line Home prices will start to appreciate by historical norms as we continue to head towards a more ‘normal’market, rather than the over 6% seen over the course of the last couple of years. This is great news! Homeowners looking to sell their home will have buyers, as more buyers will be able to afford them! SOURCE KCM #HousingMarketUpdates #Pricing #BuyVSRent #SimardRealtyGroup #joineXpRealty Many homeowners believe that rising interest rates and home prices have scared away buyers and therefore have not listed their houses for sale. However, the truth is that buyers who were unable to find a home last year are out in force, and there are even more coming! NerdWallet’s 2018 Home Buyer Report revealed that: “Approximately one-third (32%) of Americans plan to purchase a home in the next five years. Millennials are most likely to have such a purchase in their five-year plan (49%), versus 35% of Generation X and 17% of baby boomers.” As we can see, buyers are optimistic! According to the report, here are the top reasons Americans plan to buy: The most common reason Americans prioritize buying is that they believe it’s a good investment! If you’re a homeowner looking to sell, 2019 is the perfect year to put your house on the market. But why?

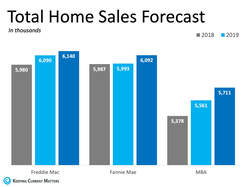

At least 3 of the renowned organizations that report on real estate market trends predict that homeowners are going to wait until 2020 to list their homes, leading to a nice increase in sales (as shown in the graph below).  Don’t wait for a competitive market; be ahead of the curve and sell your house at the best possible price! Bottom Line There are more and more buyers entering the market every day! Whether you’re a first-time homebuyer or a current homeowner looking to move-up to your next home, sit with a real estate professional who can help you with your real estate needs! SOURCE KCM #FirstTimeHomeBuyers #Sellers #BuyandSell2019 #RealEstate #SimardRealtyGroup #eXpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed