|

Are you considering #condominiums? If you’re a first-time homebuyer, you should be. Condos feature several amenities, are low maintenance and more affordable, and could be a perfect option for you. DM me today so we can discuss all your available options.

#firsttimehomebuyer #condos #homesweethome #moreoptions #opportunity #houseshopping #housegoals #homeownership #inspiration #motivation #dreamhome #starterhome #dreamhome #downsizing #keepingcurrentmatters #

0 Comments

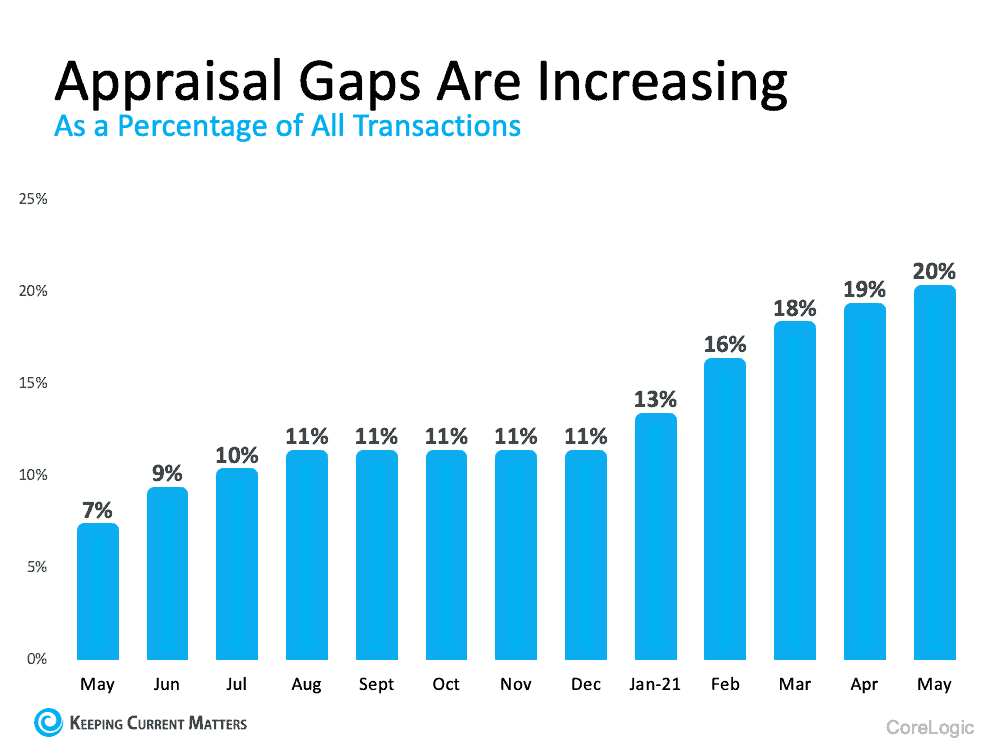

It’s economy 101 – when supply is low and demand is high, prices naturally rise. That’s what’s happening in today’s housing market. Home prices are appreciating at near-historic rates, and that’s creating some challenges when it comes to home appraisals. In recent months, it’s become increasingly common for an appraisal to come in below the contract price on the house. Shawn Telford, Chief Appraiser for CoreLogic, explains it like this: “Recently, we observed buyers paying prices above listing price and higher than the market data available to appraisers can support. This difference is known as ‘the appraisal gap . . . .’” Why does an appraisal gap happen? Basically, with the heightened buyer demand, purchasers are often willing to pay over asking to secure the home of their dreams. If you’ve ever toured a house you’ve fallen in love with, you understand. Once you start to picture yourself and your furniture in the rooms, you want to do everything you can to land the property, including putting in a high offer to try to beat out other would-be buyers. When the appraiser comes in, they look at things a bit more objectively. Their job is to assess the inherent value of the home, so they’re going to study the facts. Dustin Harris, Appraiser Coach, drives this point home: “It’s important for everyone to understand that the appraiser’s job in the end is to remain that unbiased third party, to truly tell the client what that home is worth in the current market, regardless of what decisions have been made on the price side of things.” In simple terms, while homebuyers may be willing to pay more, appraisers are there to assess the market value of the home. Their goal is to make sure the lender isn’t loaning more money than the home is worth. It’s objective, rather than emotional. In a highly competitive market like today’s, having a discrepancy between the two numbers isn’t unusual. Here’s a look at the increasing rate of appraisal gaps, according to data from CoreLogic (see graph below): What does this mean for you?

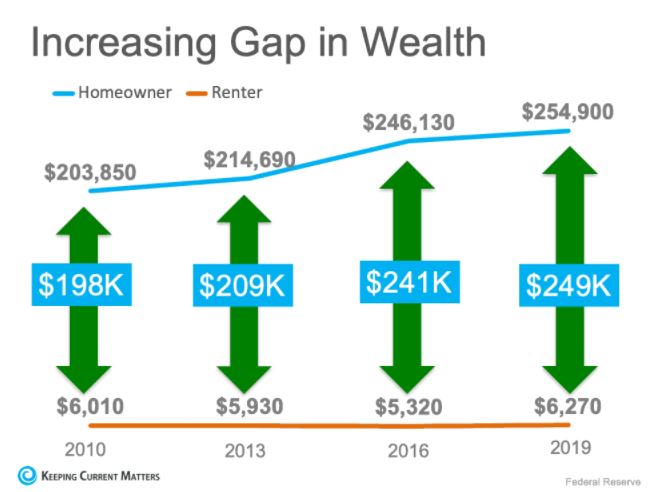

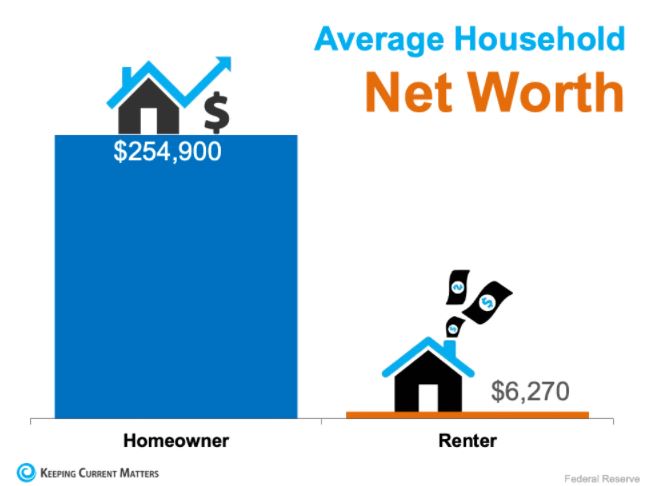

Ultimately, knowledge is power. The best thing you can do is understand an appraisal gap may impact your transaction if you’re buying or selling. If you do encounter an appraisal below your contract price, know that in today’s sellers’ market, the most common approach is for the seller to ask the buyer to make up the difference in price. Buyers, be prepared to bring extra money to the table if you really want the home. Above all else, lean on your real estate agent. Whether you’re a buyer or seller, your trusted advisor is your ally if you come up against an appraisal gap. We’ll help you understand your options and handle any additional negotiations that need to happen. Bottom Line In today’s real estate market, it’s important to stay informed on the latest trends. Work with a real estate professional to help you navigate an appraisal gap to get the best possible outcome. SOURCE KCM #BuyingMyths #Pricing #SimardRealtyGroup #joinRealBrokerLLC Becoming financially secure is an important goal for many people today, but some don’t realize just how much homeownership can help them achieve that dream. A recent report, The Journey Toward Financial Freedom, surveys Americans about their perspective on financial wellness and their goals. It shows there may be a significant misconception about the role owning a home plays in building wealth: “Home ownership is one of the indicators Americans say is least connected to financial health.” Two major personal wealth goals – homeownership and net worth – work hand-in-hand. Below are just a few reasons why, if you’re looking for financial security, homeownership should be a top priority. Homeownership Is an Important Cornerstone of Building WealthEvery three years, the Federal Reserve releases the Survey of Consumer Finances which highlights the difference in wealth between homeowners and renters. The graph below shows the findings across the previous surveys including the latest data (2019), and the results are staggering: As the graph illustrates, the gap between homeowners and renters continues to widen. That’s because homeownership contributes massively to an individual’s overall net worth. Odeta Kushi, Deputy Chief Economist at First American, highlights this idea: “. . . between 2016 and 2019, housing wealth was the single biggest contributor to the increase in net worth across all income groups . . . .” When we look even closer at the most recent data from 2019, the average homeowner’s net worth is more than 40 times greater than that of the average renter (see graph below): The gap exists in large part because homeowners build equity as their home appreciates in value and they pay off a portion of their mortgage each month. When you own your home, your monthly mortgage payment is, in essence, forced savings that come back to you when you sell your home or refinance. As a renter, you’ll never see a return on the money you pay out in rent every month.

If you’re ready to start building your net worth, the current real estate market offers several opportunities you should consider. For example, with today’s low mortgage rates, your purchasing power may be higher now than it has been in some time. That means there may be no better time than now to start working towards your homeownership goals – especially since rates are anticipated to rise in the coming months. Bottom Line Owning a home provides one of the strongest foundations for building individual wealth and lasting financial security. If you’re ready to start your path towards homeownership, talk with a trusted real estate advisor today. Source : KCM #FirstTimeHomeBuyers #ForBuyers #RentvsBuy Homeownership provides many emotional and social benefits, but it also has incredible financial benefits, too. Home equity, the difference between what you owe on a home and what it’s worth, is an amazing wealth building tool. DM me today if you’re ready to build your wealth by becoming a homeowner.

#homeequity #growyourwealth #firsttimehomebuyer #opportunity #homepriceappreciation #affordability #realestate #homevalues #realestategoals #realestatetips #homeownership #investinyourfuture #homebuying #realestatetipsandadvice #keepingcurrentmatters Some Highlights

SOURCE KCM #infographics #Forsellers #Checklist #SimardRealtyGroup #REALBrokerLLC If you’re ready to sell, now’s the time to take advantage of current prices and unseasonably strong buyer demand as we head into the cooler months. While the easing of prices may be slight, you don’t want to miss out on today’s historic price appreciation. DM me so you can strike while the iron’s hot.

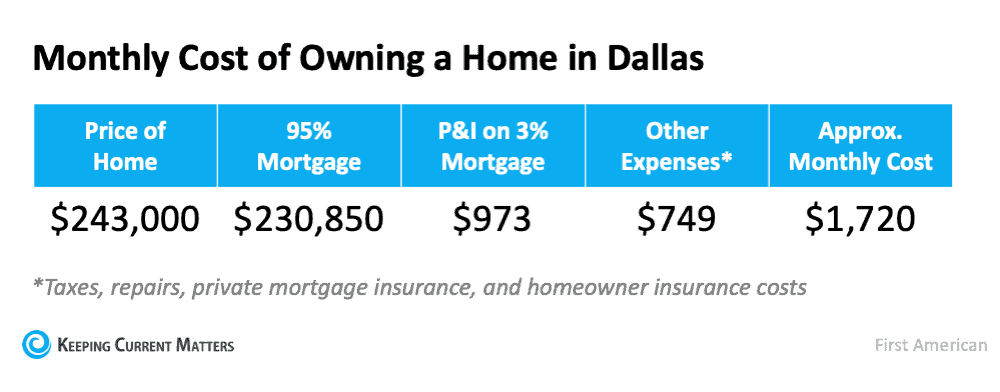

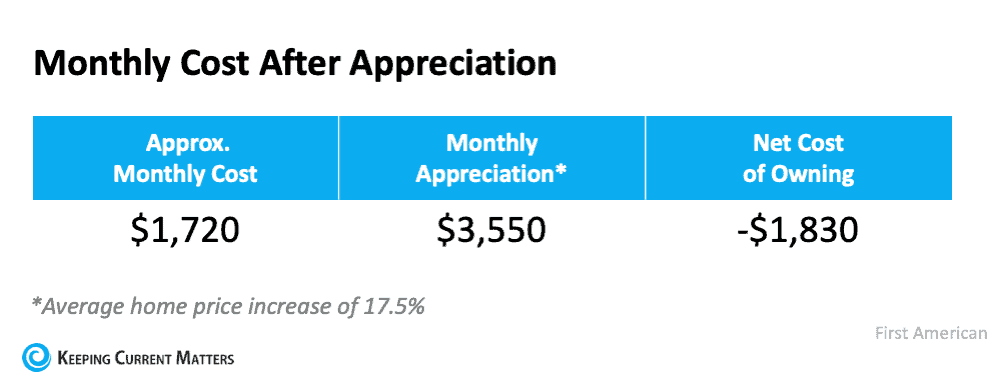

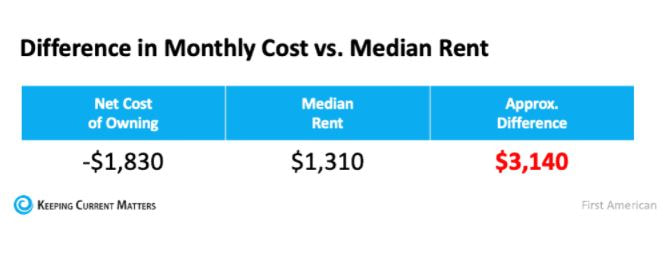

SOURCE: KCM #sellyourhouse #moveuphome #sellersmarket #realestategoals #realestatetips #realestatelife #realestatenews #expertanswers #stayinformed #staycurrent #powerfuldecisions #confidentdecisions #realestate #homevalues #keepingcurrentmatters There are many non-financial benefits of buying your own home. However, today’s headlines seem to be focusing primarily on the financial aspects of homeownership – specifically affordability. Many articles are making the claim that it’s not affordable to buy a home in today’s market, but that isn’t the case. Today’s buyers are spending approximately 20% of their income on their monthly mortgage payments. According to The Essential Guide to Creating a Homebuying Budget from Freddie Mac, the 20% of income that purchasers are currently paying is well within the 28% guideline suggested: “Most lenders agree that you should spend no more than 28% of your gross monthly income on a mortgage payment (including principal, interest, taxes and insurance).” So why is there so much talk about challenges regarding affordability? It’s Not That Homes Are Unaffordable – It’s That They’re Less Affordable.Since home prices are rising, it’s true that homes are less affordable than they have been since the housing crash fifteen years ago. Headlines making these claims aren’t incorrect; they just don’t tell the whole story. To paint the full picture, you have to look at how today stacks up with historical data. A closer analysis of affordability going further back in time reveals that homes today are more affordable than any time from 1975 to 2005. Despite that, the chatter about affordability is pushing some buyers to the sidelines. They don’t feel comfortable knowing someone else got a better deal a year ago. However, Are Homes Really Less Affordable if We Consider Equity?In a recent post, Odeta Kushi, Deputy Chief Economist at First American, offers a different take on the financial components of housing affordability. Kushi proposes we should at least consider the impact equity build-up has on the affordability equation, stating: “For those trying to buy a home, rapid house price appreciation can be intimidating and makes the purchase more expensive. However, once the home is purchased, appreciation helps build equity in the home, and becomes a benefit rather than a cost. When accounting for the appreciation benefit in our rent versus own analysis, it was cheaper to own in every one of the top 50 markets.” Let’s look at an example. In the above-mentioned post, Kushi examines the rent versus buy situation in Dallas, Texas. Kushi chose Dallas because home prices there sit near the median of the top 50 markets in the nation. Kushi first calculates the monthly mortgage payment on a median-priced home with a 5% down payment and a mortgage rate of 3% (see chart below): Kushi then takes the monthly cost and subtracts the appreciation the home had over the previous twelve months. The average house price in Dallas increased 17.5% in the second quarter of 2021 compared to last year (this is in line with the national pace). That equates to an equity benefit of approximately $3,550 each month if the pace remains the same (see chart below): We can see the equity gained each month was greater than the monthly mortgage payment, resulting in a negative cost to own. The buyer could build their net worth by $1,830 each month – after paying their mortgage. Kushi then compares the monthly cost of owning to the cost of renting (see chart below): When adding equity build-up into the equation, the cost of renting is $3,140 more expensive than owning. Again, the First American analysis shows that it’s less expensive to own in each of the top 50 markets in the country when including the equity component.

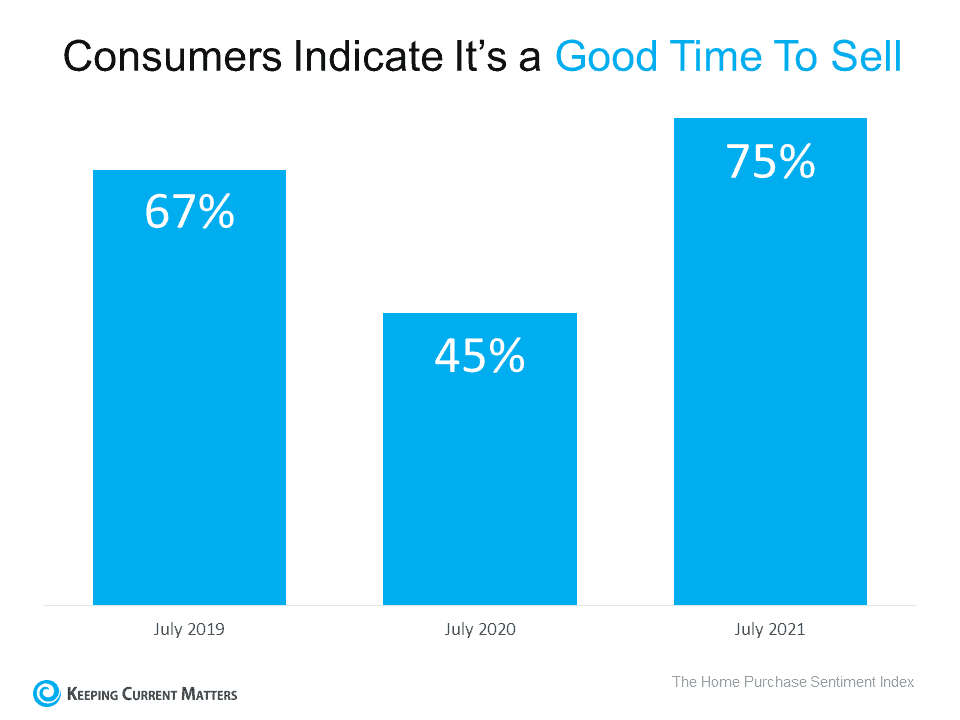

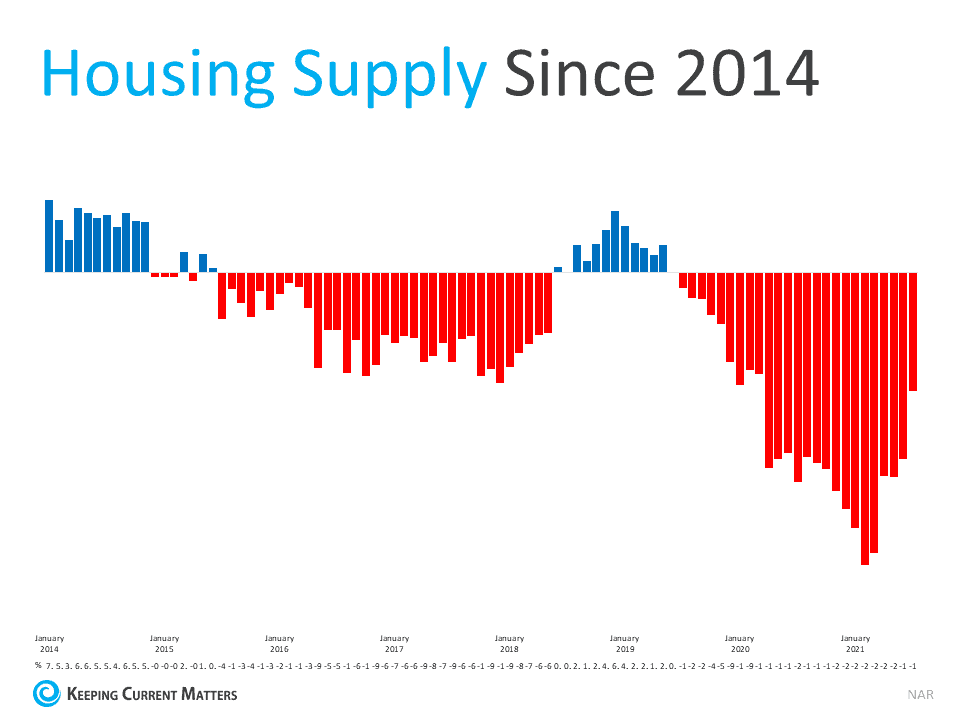

Bottom Line If you’re on the fence about whether to buy or rent right now, contact your local real estate professional to determine if the equity increase in your local market should impact your decision. Source: KCM #FirstTimeHomeBuyers #ForBuyers #InterestRates #Pricing #RentvsBuy If you’re trying to decide whether or not to sell your house, this is the time to think seriously about making a move. Fannie Mae’s recent Home Purchase Sentiment Index (HPSI) reveals the number of respondents who say it’s a good time to sell is higher now than it was over the past few summers (see graph below). Today, the majority of consumers, 75 percent, say it’s a good time to sell a house. Why is sellers sentiment up year-over-year? The higher good time to sell sentiment has to do with today’s market conditions, specifically low housing supply and high buyer demand. In the simplest terms, we don’t have enough houses available for sale to meet buyer demand. According to the latest data from the National Association of Realtors (NAR), we’re still firmly in a sellers’ market because housing supply is well below a balanced norm (shown in the graph below). Clearly, the scales are tipped in a seller’s favor today. But while housing supply is undeniably low, the right side of the graph shows how the inventory situation is improving little by little each month as more sellers list their homes for sale.

As a seller, that means each month, buyers have more options to pick from. By extension, that means your house may get less buyer attention with time. Danielle Hale, Chief Economist for realtor.com, explains it like this: “More homeowners continue to list homes for sale compared to a year ago… Notably, while new listings continue to lag behind a more ‘normal’ 2019 pace, the gap is shrinking. Even though homes continue to sell quickly thanks to high demand and limited supply, new listings are subtly shifting the balance of market conditions in favor of buyers.” So, what’s that mean for you? If you’ve been waiting for the perfect time to sell, there may not be a better chance than right now. Inventory is gradually increasing each month, so selling sooner rather than later will help you maximize your home’s potential. Bottom Line If you’re planning to sell your house, 2021 is still the year to do it. The unique mix of low supply and high demand won’t last forever. Contact a local real estate professional today to find out what you need to do now to take advantage of this sellers’ market. #Forsellers #HousingMarketUpdate #SimardRealtyGroup #RealBroker

When you buy a home, you're making a difference in your community. Let's connect today so you can be an economic driver and a homeowner too.

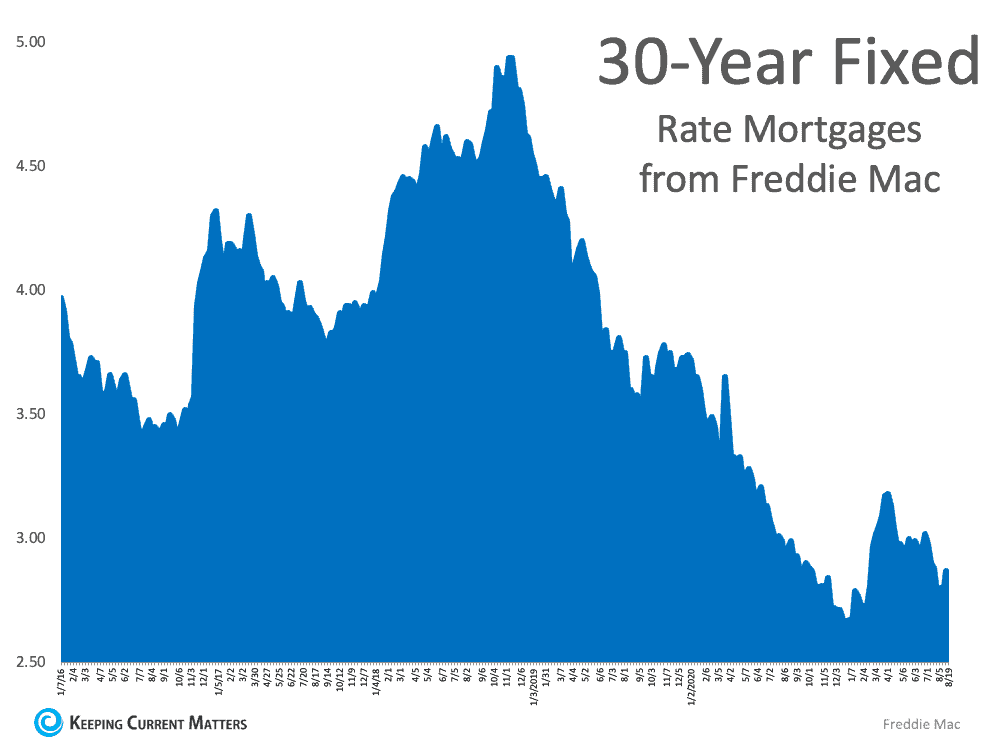

Source: KCM #TopGranbyRealtor #StephenSimard #RealBrokerLLC #GranbyRealEstate #GranbyConnecticut #FindyourGranbyhome #Newhomesforsale #SimardRealtyGroup #Granbyhomesforsale #JoinRealBrokerLLC #Simsburyhomes Mortgage rates are hovering near record lows, and that’s good news for today’s homebuyers. The graph below shows mortgage rates dating back to 2016 and where today falls by comparison. Generally speaking, when rates are low, you can afford more home for your money. That’s why experts across the industry agree – today’s low rates present buyers with an incredible opportunity. Here’s what they have to say:

Sam Khater, Chief Economist at Freddie Mac, points out the historic nature of today’s rates:“As the economy works to get back to its pre-pandemic self, and the fight against COVID-19 variants unfolds, owners and buyers continue to benefit from some of the lowest mortgage rates of all-time.” Mark Fleming, Chief Economist at First American, talks about how rates impact a buyer’s bottom line:“Mortgage rates are generally the same across the country, so a decline in mortgage rates boosts affordability equally in each market.” Danielle Hale, Chief Economist at realtor.com, also notes the significance of today’s low rates and urges buyers to carefully consider their timing:“Those who haven’t yet taken advantage of low rates to buy a home or refinance still have the opportunity to do so this summer.” Hale goes on to say that buyers who don’t act soon could see higher rates in the coming months, negatively impacting their purchasing power: “We expect mortgage rates to fluctuate near historic lows through the summer before beginning to climb this fall.” And while mortgage rates are still low today, the data from Freddie Mac indicates rates are fluctuating ever so slightly right now, as they moved up one week before inching slightly back down in their latest release. It’s important to keep in mind the influence rates have on your monthly mortgage payment. Even small increases can have a big impact on what you pay each month. Trust the experts. Today’s rates give you opportunity and flexibility in what you can afford. Don’t wait on the sidelines and hope for a better rate to come along; the rates we’re seeing today are worth capitalizing on. Bottom Line Mortgage rates hover near record lows today, but experts forecast they’ll rise in the coming months. Waiting could prove costly when that happens. Talk to your trusted real estate advisor to discuss today’s rates and determine if now’s the time for you to buy. Source: KCM #FirstTimeHomeBuyers #ForBuyers #InterestRates #MoveUpBuyers |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed