|

Some Highlights:

SOURCE KCM #infographics #ForBuyers #SimardRealtyGroup #ExpRealty

0 Comments

Congratulations to our Buyers! Wishing you lots of happiness in your new home!

#SOLD #HappyBuyers #SimardRealtyGroup #JoinExpRealty How do you select the members of your team who are going to help you make your dream of owning a home a reality? What should you be looking for? How do you know if you’ve found the right agent or lender?

The most important characteristic that you should be looking for in your agent is someone who is going to take the time to really educate you on the choices available to you and your ability to buy in today’s market. As Dave Ramsey, the financial guru, advises: “When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.” Do your research. Ask your friends and family for recommendations of professionals whom they have used in the past and have had good experiences with. Look for members of your team who will be honest and trustworthy; after all, you will be trusting them with helping you make one of the biggest financial decisions of your life. Whether this is your first or fifth time buying a home, you want to make sure that you have an agent who is going to have the tough conversations with you, not just the easy ones. If your offer isn’t accepted by the seller, or they think that there may be something wrong with the home that you’ve fallen in love with, you would rather know what they think than make a costly mistake. According to a Consumer Housing Trends Study, millennials have already started to prefer a more hands-on approach to their real estate experience: “While older generations rely on real estate agents for information and expertise, millennials expect real estate agents to become trusted advisers and strategic partners.” Look for someone to invest in your family’s future with you. You want an agent who isn’t focused on the transaction but is instead focused on helping you understand the process while helping you find your dream home. Bottom Line In this world of Google searches, where it seems like all the answers are just a mouse-click away, you need an agent who is going to educate you and share the information that you need to know before you even know you need it. SOURCE KCM #ForBuyers #SimardRealtyGroup #JoinExpRealty Every homeowner wants to make sure they maximize their financial reward when selling their home. But how do you guarantee that you receive maximum value for your house? Here are two keys to ensure that you get the highest price possible. 1. Price it a LITTLE LOW This may seem counterintuitive. However, let’s look at this concept for a moment. Many homeowners think that pricing their home a little OVER market value will leave them room for negotiation. In actuality, this just dramatically lessens the demand for your house (see chart below). Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price it so that demand for the home is maximized. By doing this, the seller will not be fighting with a buyer over the price, but will instead have multiple buyers fighting with each other over the house.

Realtor.com gives this advice: “Aim to price your property at or just slightly below the going rate. Today’s buyers are highly informed, so if they sense they’re getting a deal, they’re likely to bid up a property that’s slightly underpriced, especially in areas with low inventory.” 2. Use a Real Estate Professional This, too, may seem counterintuitive. The seller may think they would make more money if they didn’t have to pay a real estate commission. With this being said, studies have shown that homes typically sell for more money when handled by a real estate professional. A new study by Collateral Analytics, reveals that FSBOs don’t actually save any money, and in some cases may be costing themselves more, by not listing with an agent. In the study, they analyzed home sales in a variety of markets in 2016 and the first half of 2017. The data showed that: “FSBOs tend to sell for lower prices than comparable home sales, and in many cases below the average differential represented by the prevailing commission rate.” The results of the study showed that the differential in selling prices for FSBOs when compared to MLS sales of similar properties is about 5.5%. Sales in 2017 suggest the average price was near 6% lower for FSBO sales of similar properties. Bottom Line Price your house at or slightly below the current market value and hire a professional. This will guarantee that you maximize the price you get for your house. SOURCE KCM #Forsellers #FSBO #SimardRealtyGroup #JoinExpRealty Good bathroom remodel ideas aren't just about saving you money. They're about helping you start your day off right.

Let's get real: The first room you stumble into in the morning—bleary-eyed, dazed, and yawning—should be a soothing oasis. A bathroom that achieves those lofty heights? That's a bathroom you can love. That's why these most special of rooms are second only to kitchens as the areas homeowners eagerly spend time and money renovating—and that catch a buyer's eye when you're trying to sell. Bathroom remodel ideas: where to beginBut exactly which upgrades are the best, in terms of both usefulness and return on investment? Do you need to start knocking down walls and renovate the entire room, or you can you start smaller? Before you go nuts installing saunas and rain shower heads, check out this second installment in our series Renovations That Really Pay Off, for some smarter tweaks you'll be very glad you made. Reglaze, don't replace, the tub“No, no, no--do not put in a new tub,” says Rebecca Knaster, associate broker with Manhattan's William Raveis. “It'll cost thousands between the tub and the installation.” Instead, have the tub reglazed for “around $1,500,” which will make it look brand new. Matt Plaskoff, founder of One Week Bath, agrees that if the shower area “is in decent shape,” it’s best to concentrate on the front part of the bathroom, which “sets the tone for the space.” Invest in a new sinkFace washing, teeth brushing, gerbil bathing—your sink sees a lot of use. It's also the very first thing a buyer notices in a bathroom, says Knaster. “Step 1 for getting the most bang for your buck is a new contemporary sink,” she says. “It will set you back a few hundred dollars and make all the difference.” Just note whether the bathroom sink you already have is an undermount(where the edge is below the countertop to create an uninterrupted surface) or overmount (where the sink lip comes up over the countertop), says interior designer Randal Weeks, founder of Aidan Gray Home. An undermount can be difficult to remove unless it's under a formica top. If the sink is adhered to the surface, the top will also have to go, which quickly drives up the cost. One easy and dramatic sink upgrade Weeks recommends for an inexpensive bathroom remodel is replacing separate hot and cold faucets with a sleek single-handle faucet that starts at $70. Go for timeless tileBathroom remodel ideas in general should appeal to a broader range of people and provide better return on investment. While natural stone is hot, Weeks prefers neutral styles for this reason. Pricey stones are taste-specific, he notes, and can give a busy look that's a turnoff regardless of expense. In fact, Weeks says one of the biggest issues buyers consider when making offers is the cost of redoing other people’s “bad choices.” So go forcrowd-pleasing features such as bright white subway tiles, which run a mere 21 cents each. The payoff? “You can add $10,000 of value to your home by selecting timeless elements that won’t date it.” Upgrade your lightingIt's not just Snow White's evil stepmother and the Kardashians who spend lots of time staring into the mirror on the bathroom wall. For most of us, lighting and lighting fixtures are critical elements. “Dated light fixtures are a turnoff,” says Knaster. “For no more than $100 you can buy a basic but nice bathroom light fixture.” Install a double vanityThe last thing you need in the morning is a battle with your partner over who gets the sink. It's no wonder “I'm looking for a double vanity” is one of the most common things heard by Will Johnson, a Hendersonville, TN, real estate agent and founder of the Sell and Stage Team. A double vanity typically costs between $200 and $800, with installation falling around $220, Johnson says—and it's a wise investment when you're undergoing a bathroom remodel. Johnson has clients who “won't buy a house simply because there's only one sink in the master bathroom!” Swap in new fixtures “Old materials such as bronze can instantly date your bathroom,” says Johnson. To knock out this easy DIY update, simply purchase new door handles, drawer pulls, and towel bars for a bathroom remodel that's quick, easy, and inexpensive too. A nice chrome drawer pull can cost as little as $3, while a towel bar can average $30. Get a water-saving toiletThis may not sound like a bathroom remodel idea that will do much—it's just the toilet! But beyond updating the look of the room, a toilet replacement could save you some serious green. Old toilets use 6 gallons of water per flush, gobbling up about 30% of all residential water in U.S. homes. Go green when you swap out your throne. New WaterSense models using only 1.28 gallons per flush (e.g., TOTO’s Carlyle II 1G toilet) conserve up to 18,000 gallons of water annually. The initial cost of $974 will shave more than $110 per year off a water bill and add up to almost $2,200 over the lifetime of the toilet. Bonus: The latest water-saving thrones actually work. But skip the bidet Bidets may be considered the Rolls-Royce of toilet upgrades, but most bathrooms simply don't have room for them. What's worse: Most Americans have no idea what on Earth these things are and may even be weirded out by them. “My personal opinion is that our society is not accustomed to this practice and doesn't see the extra value in them,” says Tracy Kay Griffin, an expert designer at Express Homebuyers in Springfield, VA. “We haven't renovated a home yet where we thought it would be a good investment to add a bidet.” Just say nay to the bidet. Source: Realtor.com #BathroomIdeas #Tips #Realtor.com #SimardRealtyGroup #ExpRealty Some Highlights:

SOURCE KCM #Infographic #Sellers #Buyers #SimardRealtyGroup #JoinExpRealty Recently released data from Fannie Mae’s National Housing Survey revealed that rising home prices were the catalyst behind an eight-point jump in the net percentage of respondents who say now is a good time to sell. The index is now 21 points higher than it was this time last year.

Overall, 62% of Americans surveyed said that now is a good time to sell (up from 58%), while 26% of respondents said that now is not a good time to sell (down from 30%). The net score is the difference between the two percentages, or 36%. According to CoreLogic, home prices are now up 6.7% over last year and 78.8% of homeowners with a mortgage in the US now have significant equity (defined as 20% or more). As home prices have increased, more and more homeowners have realized that now is a good time to sell their homes in order to take advantage of the extra equity they now have. At the same time, however, rising prices have had the exact opposite impact on the good-time-to-buy scale as many buyers are nervous that they will not be able to afford a home; the net score dropped 5 points to 18%. Doug Duncan, Vice President & Chief Economist at Fannie Mae, had this to say, “In the early stages of the economic expansion, home selling sentiment trailed home buying sentiment by a significant margin. The reverse is true today. The net good time to sell share is now double the net good time to buy share, with record high percentages of consumers citing home prices as the primary reason for both perceptions. Such a sizable gap between selling and buying sentiment, if it persists, could weigh on the housing market through the rest of the year.” Buyer demand continues to outpace the supply of homes for sale, which has driven prices up across the country. Until the supply starts to better match demand, there will be a gap between the sentiments surrounding buying and selling. Bottom Line If you are considering listing your home for sale this year, now is the time! SOURCE KCM #ForBuyes #Pricing #SimardRealtyGroup #JoinExpRealty Here are five reasons listing your home for sale this fall makes sense.

1. Demand Is Strong The latest Buyer Traffic Report from the National Association of Realtors (NAR) shows that buyer demand remains very strong throughout the vast majority of the country. These buyers are ready, willing, and able to purchase… and are in the market right now! More often than not, multiple buyers are competing with each other to buy a home. Take advantage of the buyer activity currently in the market. 2. There Is Less Competition Now Housing inventory is still under the 6-month supply that is needed for a normal housing market. This means that, in the majority of the country, there are not enough homes for sale to satisfy the number of buyers in the market. This is good news for homeowners who have gained equity as their home values have increased. However, additional inventory could be coming to the market soon. Historically, the average number of years a homeowner stayed in their home was six, but that number has jumped to an average of almost nine years since 2008. There is a pent-up desire for many homeowners to move, as they were unable to sell over the last few years because of a negative equity situation. As home values continue to appreciate, more and more homeowners will be given the freedom to move. The choices buyers have will continue to increase. Don’t wait until this other inventory comes to market before you decide to sell. 3. The Process Will Be Quicker Today’s competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. This makes the entire selling process much faster and much simpler as buyers know exactly what they can afford before home shopping. According to Ellie Mae’s latest Origination Insights Report, the time to close a loan has dropped to 43 days, after seeing a 12-month high of 48 days in January. 4. There Will Never Be a Better Time to Move Up If your next move will be into a premium or luxury home, now is the time to move-up! The inventory of homes for sale at these higher price ranges has forced these markets into a buyer’s market. This means that if you are planning on selling a starter or trade-up home, your home will sell quickly AND you’ll be able to find a premium home to call your own! Prices are projected to appreciate by 5.0% over the next year according to CoreLogic. If you are moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. 5. It’s Time to Move on With Your Life Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should? Only you know the answers to the questions above. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to move on and start living the life you desire. That is what is truly important. SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #JoinExpRealty Some Highlights:

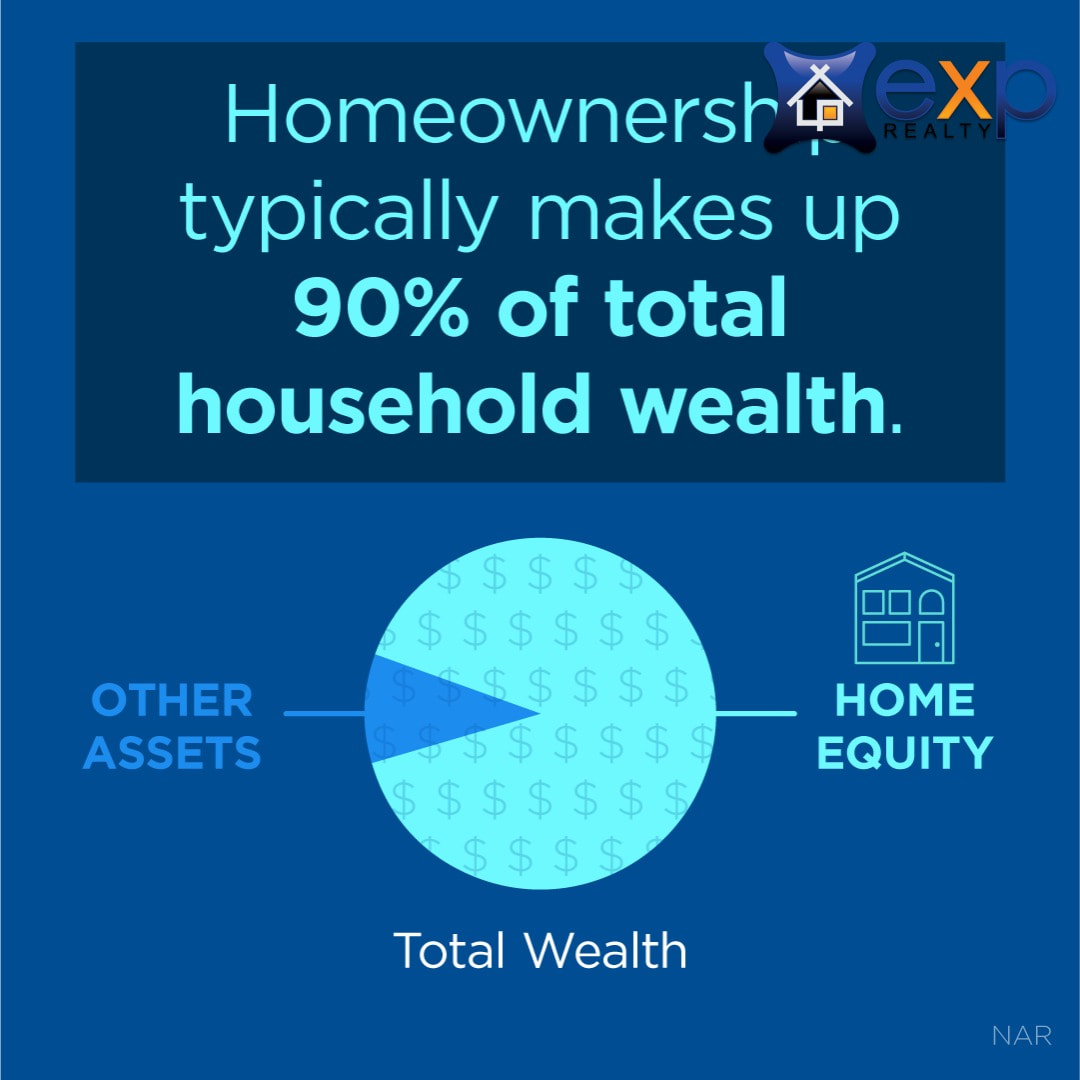

SOURCE KCM #ForBuyers #Infographics #SimardRealtyGroup #JoinExpRealty Hearth just released their 2017 State of the American Dream report which showed that Americans still see homeownership as an integral piece of the American Dream. The report confirmed that “all generations–including millennials–agree homeownership is very important to achieving the American Dream.”

Americans ranked “owning a home I love” higher than any other options (including “starting a family” and “finding a fulfilling career”) as an important part of the American Dream. Despite some claims that homeownership’s importance to the American Dream is in decline, the report found that the dream of homeownership remains strong. Of Americans who said they think achieving the American Dream is important, 70% think homeownership is important to the dream, and 41% think homeownership is very important to the dream. What about Millennials? Hearth addresses the desires of millennials by explaining: “Contrary to popular opinion, millennials who want to achieve the American Dream are 5% more likely than Baby Boomers to think homeownership is important. And two-thirds of millennial renters view homeownership as important to the American Dream. Although millennials are often portrayed as fickle and transient, they actually seek the stability of homeownership even more than their parents.” Other Key Findings from the Report:

The report concluded: “This survey revealed a powerful finding: Across demographic groups, homeownership remains a precondition of the American Dream.” SOURCE KCM #ForBuyers #SimardRealtyGroup #JoinExpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed