|

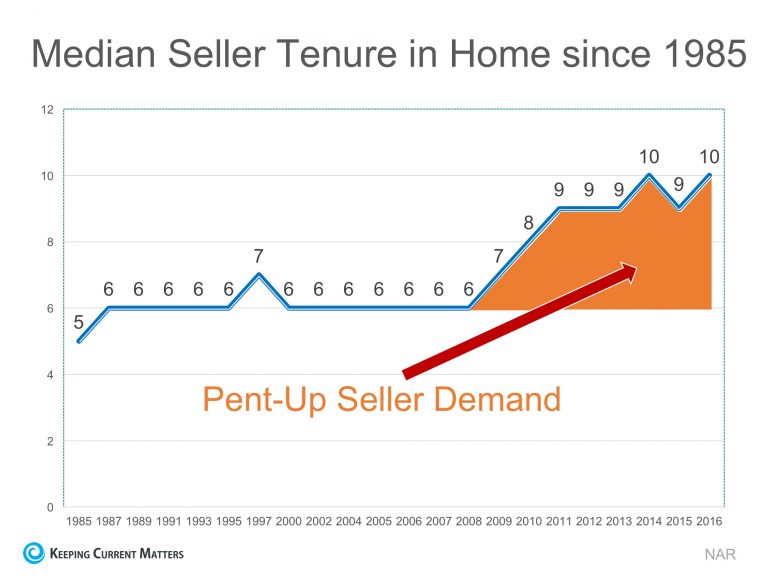

The National Association of Realtors (NAR) keeps historical data on many aspects of homeownership. One of the data points that has changed dramatically is the median tenure of a family in a home. As the graph below shows, for over twenty years (1985-2008), the median tenure averaged exactly six years. However, since 2008, that average is almost nine years – an increase of almost 50%. Why the dramatic increase?

The reasons for this change are plentiful! The fall in home prices during the housing crisis left many homeowners in a negative equity situation (where their home was worth less than the mortgage on the property). Also, the uncertainty of the economy made some homeowners much more fiscally conservative about making a move. With home prices rising dramatically over the last several years, 93.7% of homes with a mortgage are now in a positive equity situation with 79.1% of them having at least 20% equity, according to CoreLogic. With the economy coming back and wages starting to increase, many homeowners are in a much better financial situation than they were just a few short years ago. One other reason for the increase was brought to light during a recent presentation by Lawrence Yun, the Chief Economist of NAR, at the Realtor’s Summit in San Diego, CA.Yun pointed to the fact that historically, young homeowners who were either looking for more space to accommodate their growing family or looking for a better school district were more likely to move more often (every 5 years). The homeownership rate among young families, however, has still not caught up to previous generations resulting in the jump we have seen in median tenure! What does this mean for housing? Many believe that a large portion of homeowners are not in a house that is best for their current family circumstances. They could be baby boomers living in an empty, four-bedroom colonial, or a millennial couple planning to start a family that currently lives in a one-bedroom condo. These homeowners are ready to make a move. Since the lack of housing inventory is a major challenge in the current housing market, this could be great news. SOURCE KCM #HousingMarketUpdate #ForBuyers #SimardRealtyGroup #ExpRealty

0 Comments

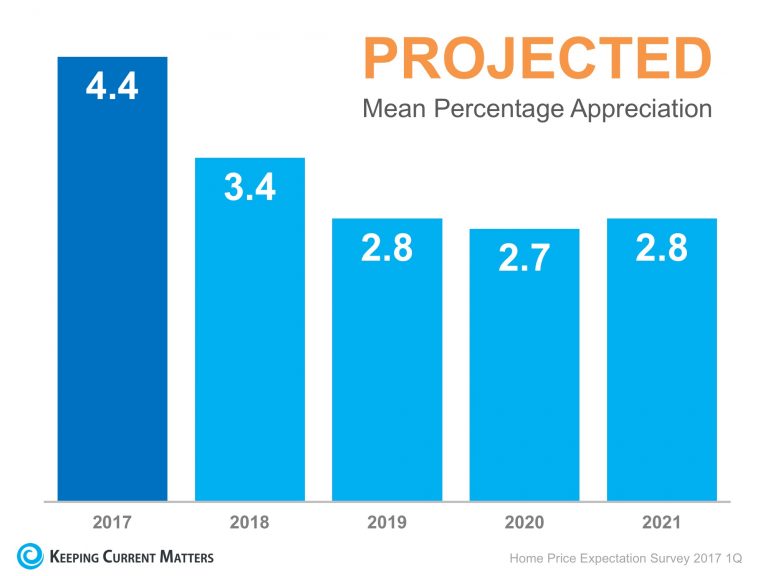

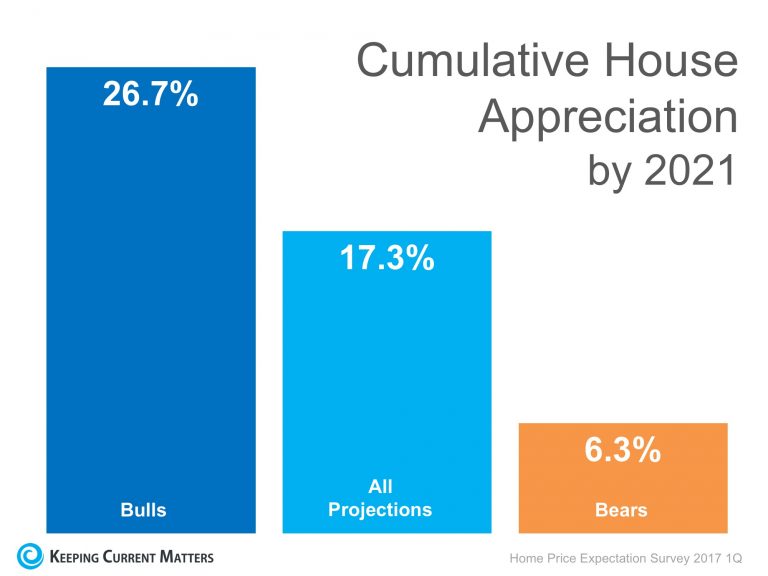

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts, and investment & market strategists about where they believe prices are headed over the next five years. They then average the projections of all 100+ experts into a single number. The results of their latest survey: Home values will appreciate by 4.4% over the course of 2017, 3.4% in 2018, 2.8% in 2019, 2.7% in 2020, and 2.8% in 2021. That means the average annual appreciation will be 3.22% over the next 5 years. The prediction for cumulative appreciation fell from 21.4% to 17.3% by 2021. The experts making up the most bearish quartile of the survey are projecting a cumulative appreciation of 6.3%. Bottom Line

Individual opinions make headlines. We believe this survey is a fairer depiction of future values. SOURCE KCM #ForBuyers #ForSellers #Pricing #ExpRealty #SimardRealtyGroup Highlights:

SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #ExpRealty The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans:

“Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number of positive social, economic, family and civic outcomes.” Today, we want to cover the section of the report that quoted several studies concentrating on the impact homeownership has on the health of family members. Here are some of the major findings on this issue revealed in the report:

Bottom Line People often talk about the financial benefits of homeownership. As we can see, there are also social benefits of owning your own home. SOURCE KCM #HomeOwnership #Buyers #ExpRealty #SimardRealtyGroup According to a survey conducted by Bankrate.com, one in four Americans are considering buying a home this year. If this statistic proves to be true, that means that 59 million people will be looking to enter the housing market in 2017.

The survey also revealed 3 key takeaways:

Holden Lewis, a mortgage analyst for Bankrate.com, pointed to one big reason why many Americans are starting to consider homeownership: “Having kids and raising a family is a primary reason why Americans take the leap into homeownership—many consider it a key component of the American dream.” Bottom Line If buying a home is a part of your dream for 2017, meet with a local professional who can help you determine if you are able to. SOURCE KCM #HomeBuyer #ExpRealty #SimardRealtyGroup So, you’ve decided to sell your house. You’ve hired a real estate professional to help you with the entire process, and they have asked you what level of access you want to provide to potential buyers.

There are four elements to a quality listing. At the top of the list is Access, followed by Condition, Financing, and Price. There are many levels of access that you can provide to your agent so that he or she can show your home. Here are five levels of access that you can give to buyers, along with a brief description:

In a competitive marketplace, access can make or break your ability to get the price you are looking for, or even sell your house at all. SOURCE KCM #ForSellers #SellerTips #SimardRealtyGroup #ExpRealty According to the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, the U.S. housing market has continued to move deeper into buy territory, supporting the belief that housing markets across the country remain a sound investment.

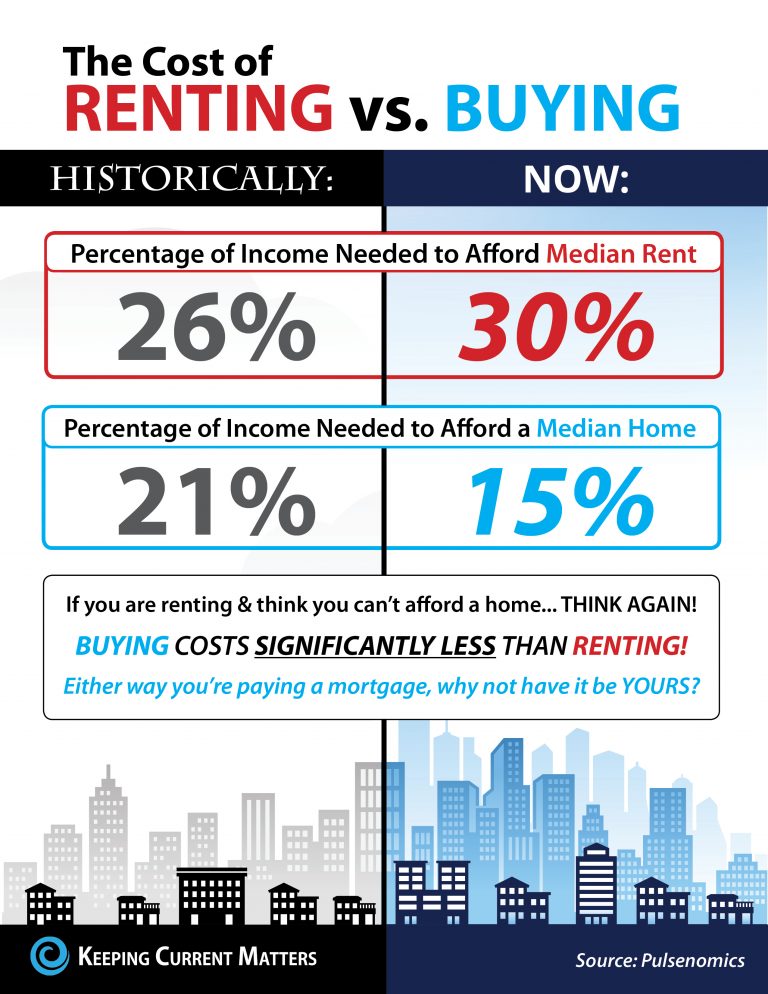

The BH&J Index is a quarterly report that attempts to answer the question: In today’s housing market, is it better to rent or buy a home? The index examines the entire US housing market and then isolates 23 major cities for comparison. The researchers “measure the relationship between purchasing property and building wealth through a buildup in equity versus renting a comparable property and investing in a portfolio of stocks and bonds.” While most of the metropolitan markets examined moved further into buy territory (16 of the 23), markets like Dallas, Denver, and Houston are currently deep into rent territory. In these three markets, it is estimated that renting will top homeownership 7 out of 10 times. Due to a lack of inventory, the home prices in the Dallas, Denver, and Houston areas have increased by 11.6%, 8.3%, and 6.6% respectively. Home prices in these areas will begin to return to more normal levels once residents realize that renting is not the best option, therefore bringing home affordability back as well. Bottom Line The majority of the country is strongly in buy territory. Buying a home makes sense socially and financially, as rents are predicted to increase substantially in the next year. Protect yourself from rising rents by locking in your housing cost with a mortgage payment now. To Find Out More About the Study: The BH&J Index and other FAU real estate activities are sponsored by Investments Limited of Boca Raton. The BH&J Index is published quarterly and is available online at http://business.fau.edu/buyvsrent. SOURCE KCM #HousingMarket #ForBuyers #JoinExpRealty #SimardRealtyGroup Some Highlights:

SOURCE KCM #InfoGraphic #BuyingVSRenting #JoinExpRealty #SimardRealtyGroup The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans:

“Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number of positive social, economic, family and civic outcomes.” Today, we want to cover the section of the report that quoted several studies concentrating on the impact homeownership has on the civic participation of family members. Here are some of the major findings on this issue revealed in the report:

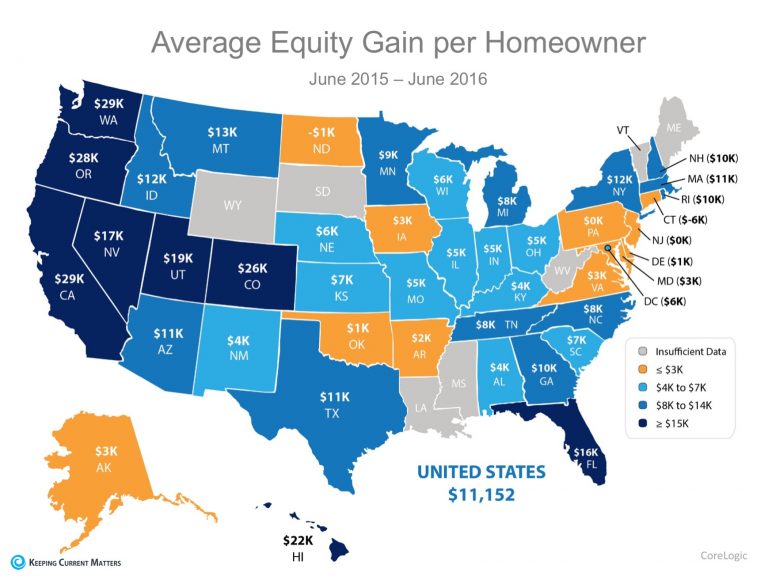

Bottom Line People often talk about the financial benefits of homeownership. As we can see, there are also social benefits of owning your own home. SOURCE KCM #SimardRealtyGroup #Homeownership #ForBuyers #ExpRealty Recently there has been a lot of talk about home prices and if they are accelerating too quickly. As we mentioned before, in some areas of the country, seller supply (homes for sale) cannot keep up with the number of buyers out looking for a home, which has caused prices to rise. The great news about rising prices, however, is that according to CoreLogic’s US Economic Outlook, the average American household gained over $11,000 in equity over the course of the last year, largely due to home value increases. The map below was created using the same report from CoreLogic and shows the average equity gain per mortgaged home from June 2015 to June 2016 (the latest data available). For those who are worried that we are doomed to repeat 2006 all over again, it is important to note that homeowners are investing their new-found equity in their homes and themselves, not in depreciating assets.

The added equity is helping families put their children through college, invest in starting small businesses, allowing them to pay off their mortgage sooner or move up to the home that will better suit their needs now. Bottom Line CoreLogic predicts that home prices will appreciate by another 5% by this time next year. If you are a homeowner looking to take advantage of your home equity by moving up to your dream home, contact an agent in your area to discuss your options! SOURCE KCM #ForBuyers #HomeOwnership #ExpRealty #SimardRealtyGroup |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed