|

Are you planning on renting this year? If so, keep in mind that rents are expected to continue rising. If you’re looking to stabilize your monthly housing costs, DM me today so we can discuss how homebuying could be the alternative you’re looking for.

#firsttimehomebuyer #homeownership #investinyourfuture #risingrents #housingaffordability #dreamhome #housingmarket #househunting #homegoals #houseshopping #housegoals #keepingcurrentmatters

0 Comments

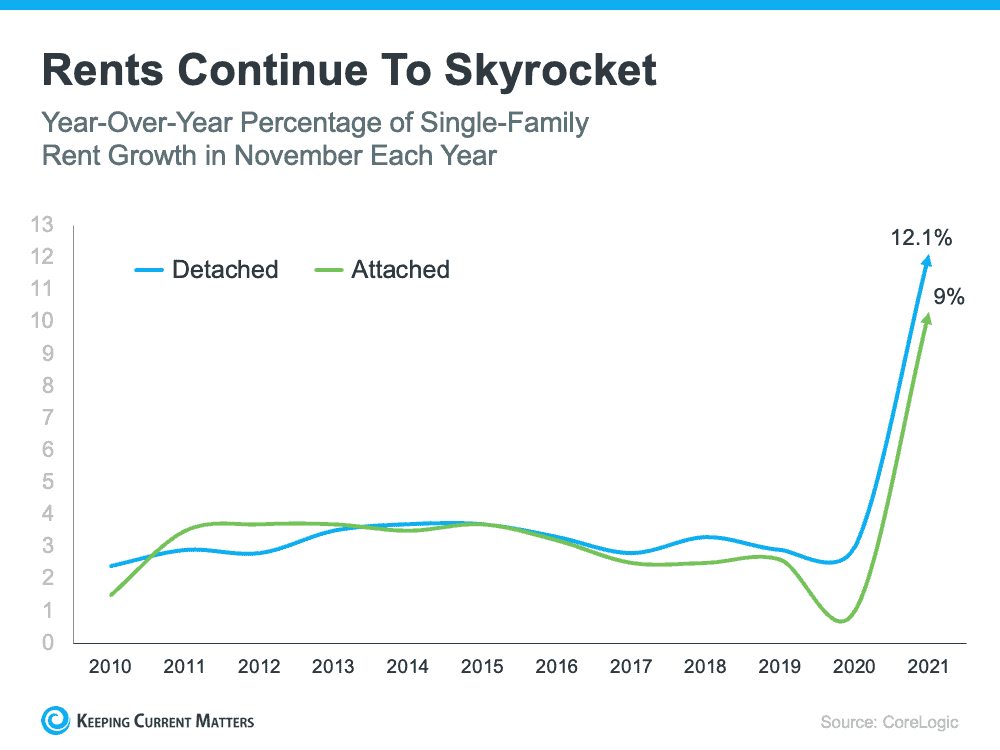

If you were thinking about buying a home this year, but already pressed pause on your plans due to rising home prices and increasing mortgage rates, there’s something you should consider. According to the latest report from ATTOM Data, owning a home is more affordable than renting in the majority of the country. The 2022 Rental Affordability Report says: “. . . Owning a median-priced home is more affordable than the average rent on a three-bedroom property in 666, or 58 percent, of the 1,154 U.S. counties analyzed for the report. That means major home ownership expenses consume a smaller portion of average local wages than renting.” Other experts in the industry offer additional perspectives on renting today. In the latest Single-Family Rent Index from CoreLogic, single-family rent saw the fastest year-over-year growth in over 16 years when comparing data for November each year (see graph below): Molly Boesel, Principal Economist at CoreLogic, stresses the importance of what the data shows:

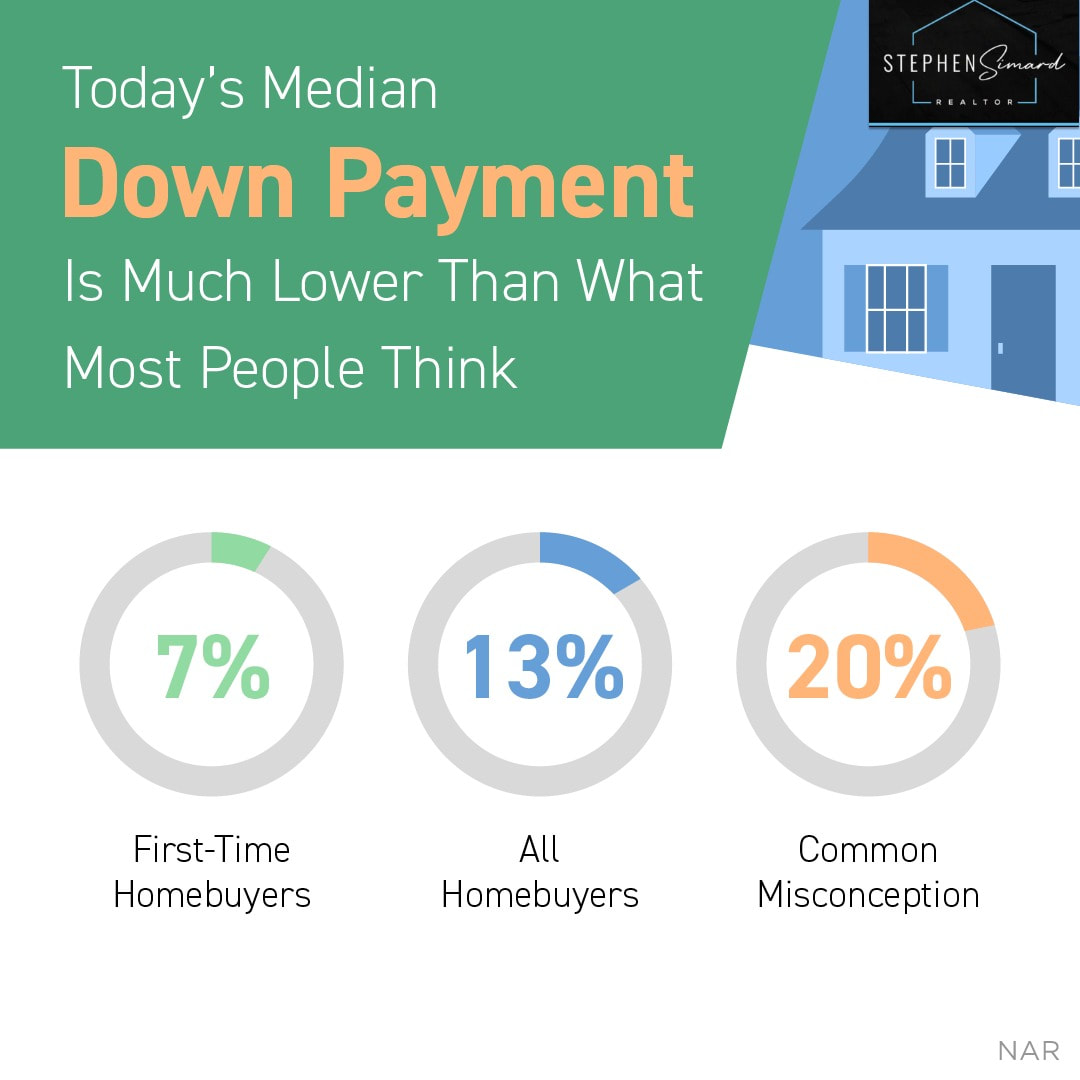

“Single-family rent growth hit its sixth consecutive record high. . . . Annual rent growth . . . was more than three times that of a year earlier. Rent growth should continue to be robust in the near term, especially as the labor market continues to improve.” What Does This Mean for You? While it’s true home prices and mortgage rates are rising, so are monthly rents. As a prospective buyer, rising rates and prices shouldn’t be enough to keep you on the sideline, though. As the chart above shows, rents are skyrocketing. The big difference is, when you rent, that rising cost benefits your landlord’s investment strategy, but it doesn’t deliver any sort of return for you. In contrast, when you buy a home, your monthly mortgage payment serves as a form of forced savings. Over time, as you pay down your loan and as home values rise, you’re building equity (and by extension, your own net worth). Not to mention, you’ll lock in your mortgage payment for the duration of your loan (typically 15 to 30 years) and give yourself a stable and reliable monthly payment. When asking yourself if you should keep renting or if it’s time to buy, think about what Todd Teta, Chief Product Officer at ATTOM Data, says: “. . . Home ownership still remains the more affordable option for average workers in a majority of the country because it still takes up a smaller portion of their pay.” If buying takes up a smaller portion of your pay and has benefits renting can’t provide, the question really becomes: is renting really worth it? Bottom Line If you’re weighing your options between renting and buying, it’s important to look at the full picture. While buying a home can feel like a daunting process, having a trusted advisor on your side is key. Work with an agent to explore your options so you can learn more about the benefits of homeownership today. SOURCE:KCM #BuyingMyths #FirstTimeHomeBuyers #ForBuyers #InterestRates #Pricing #Rent vs. Buy #SimardRealtyGroup #RealBrokerLLC There’s a common misconception that you need 20% for a down payment. Even though there are benefits to putting additional money down when you buy a home, the median down payment for all homebuyers is 13% and only 7% for first-time buyers. DM me today so we can discuss what you need to make your home purchase.

#firsttimehomebuyers #downpayment #homebuying #realestateagency #expertanswers #stayinformed #staycurrent #powerfuldecisions #confidentdecisions #realestate #homebuying #realestategoals #realestatetips #keepingcurrentmatters Some Highlights

SOURCE: KCM #FirstTimeHomeBuyers #ForBuyers #Infographics #Move-UpBuyers #SimardRealtyGroup #RealBrokerLLC If you’re working remotely for the foreseeable future, why limit yourself to a home down the road from your old office? Remote work means you can broaden your search and your possibilities. DM me today if you’d like to see what’s available in your expanded home search radius.

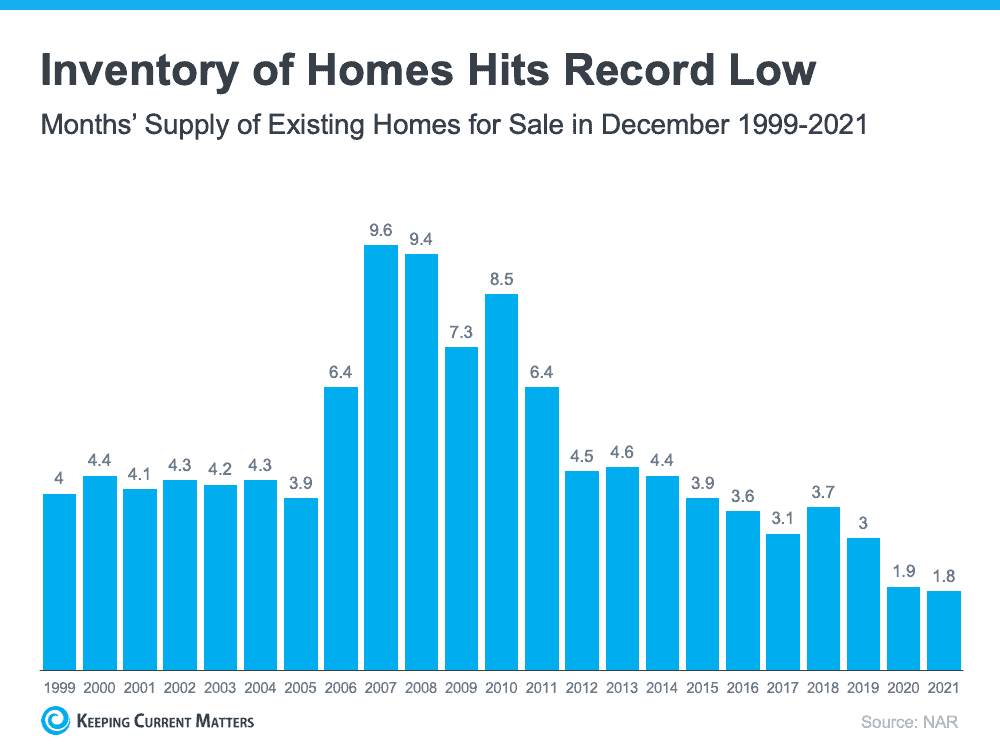

#remotework #workfromhome #homeownership #opportunity #housingmarket #househunting #makememove #homegoals #realestatemarket #realestateexperts #instarealestate #instarealtor #realestatetipsoftheday #realestatetipsandadvice #keepingcurrentmatters If you’re thinking about selling your house in 2022, you truly have a once-in-a-lifetime opportunity at your fingertips. When selling anything, you always hope for strong demand for the item coupled with a limited supply. That maximizes your leverage when you’re negotiating the sale. Home sellers are in that exact situation right now. Here’s why. Demand Is Very Strong According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), 6.18 million homes were sold in 2021. This was the largest number of home sales in 15 years. Lawrence Yun, Chief Economist for NAR, explains: “Sales for the entire year finished strong, reaching the highest annual level since 2006. . . . With mortgage rates expected to rise in 2022, it’s likely that a portion of December buyers were intent on avoiding the inevitable rate increases.” Demand isn’t expected to weaken this year, either. In addition, the Mortgage Finance Forecast, published last week by the Mortgage Bankers’ Association (MBA), calls for existing-home sales to reach 6.4 million homes this year. Supply Is Very Limited The same sales report from NAR also reveals the months’ supply of inventory just hit the lowest number of the century. It notes: “Total housing inventory at the end of December amounted to 910,000 units, down 18% from November and down 14.2% from one year ago (1.06 million). Unsold inventory sits at a 1.8-month supply at the present sales pace, down from 2.1 months in November and from 1.9 months in December 2020.” The reality is, inventory decreases every year in December. That’s just how the typical seasonal trend goes in real estate. However, the following graph emphasizes how this December was lower than any other December going all the way back to 1999. Right Now, Sellers Have Maximum Leverage

As mentioned above, when there’s strong demand for an item and a limited supply of it available, the seller has maximum leverage in the negotiation. In the case of homeowners who are thinking about selling, there may never be a better time than right now. While demand is this high and inventory is this low, you’ll have leverage in all aspects of the sale of your house. Today’s buyers know they need to be flexible negotiators that make very competitive offers, so here are a few areas that could tip in your favor when your house goes on the market:

Bottom Line If you’re thinking of selling your house this year, now is the optimal time to list it. Contact a local real estate professional to learn more about putting your house on the market today. SOURCE: KCM #ForSellers #HousingMarketUpdates #SimardRealtyGroup #RealBrokerLLC

SOURCE: KCM

#TopGranbyRealtor #StephenSimard #RealBrokerLLC Americans are more aware than ever of the effects climate change and natural disasters can have on their homes. According to a report from realtor.com:

“More than 3 in 4 recent buyers, 78%, took [natural disasters] into account when choosing the locations of their homes, . . .” The study also found that many existing homeowners (34%) have already considered selling their houses and moving to a new location because of the changing climate. If you’re like those homeowners and are weighing your options about what to do next, here’s some information to keep in mind as you begin the process of selling your existing house and searching for your new home. Do Your Research and Work with a Real Estate Advisor To Find a Home That Meets Your Needs As a homeowner, it’s impossible to control what types of weather events your home is exposed to. As Maiclaire Bolton Smith, Senior Leader of Research and Content Strategy for CoreLogic, says: “You can’t necessarily remove the location from around you, but there are things you can do to mitigate damage that can happen.” The first step is understanding how to navigate your home sale and purchase with these specific issues in mind. While that can seem like a difficult undertaking at first, with the appropriate resources and experts on your side, you can simplify the process. The Mortgage Reports provides some tips for purchasing your next house, including, but not limited to:

Ultimately, your best resource throughout the process is a trusted real estate professional. An agent will help you navigate the sale and required disclosures for your existing home, be your expert advisor on local guidelines and information, and keep your goals and concerns top of mind. Even if your advisor doesn’t have the answers to all your questions about how your next home will stand up to natural disasters, they can help connect you with experts and resources who will. Bottom Line If you’re becoming more mindful about the effects of climate change and you’re ready to make a move, you’re not alone. A trusted real estate advisor can help you as you navigate the sale of your current house and find the perfect spot for your next home. SOURCE:KCM #ForSellers #HousingMarketUpdates #Move-UpBuyers #SimardRealtyGroup #RealBrokerLLC Using the best digital tools to sell your house is more important than ever. Homebuyers expect to find the most useful information about your home quickly and easily, and an agent has the tools to make sure they can. DM me to learn about the ways we can put digital tools to work so you can maximize your home sale.

#digitaltools #sellertools #sellyourhouse #realestate #homeownership #realestategoals #realestatetips #realestateagent #realestateexpert #realestatemarket #realestateexperts #instarealestate #realestatetipsoftheday #justsold #keepingcurrentmatters Many members of Generation Z (Gen Z) are aging into adulthood and deciding whether to rent or buy a home. If you find yourself in this group, it’s important to understand you’re never too young to start thinking about homeownership. The sooner you start planning, the sooner you can move on from renting.

As you set off on your journey and plan your next move, here are a few reasons to think about homebuying this year. The Reasons Gen Z Want To Become Homeowners While the majority of Gen Z haven’t entered the housing market yet, a large portion plan to according to a realtor.com report. The report found that 72% of Gen Z would rather purchase a home than rent long-term. As George Ratiu, Manager of Economic Research for realtor.com, says: “With nearly three-quarters of those surveyed preferring to buy versus renting long-term, the housing industry should be prepared for millions of Gen Z buyers to bring a new wave of demand along a similar stage-of-life timeline as the millennial generation before them.” But why do so many members of Gen Z value homeownership? According to the latest Home Buyers and Sellers Generational Trends Report from the National Association of Realtors (NAR), young homebuyers – more than any other age group – want to become homeowners because they want to have a place of their very own. That may be because one of the biggest benefits of homeownership is having a place that you can truly make your own by customizing it to your style and personality. Whether that’s the décor, painting, or renovations, when you own your home, you don’t have to limit yourself to what your lease and landlord will allow. Not to mention, owning a home provides much greater long-term stability and security than renting. When you own a home, there’s also protection from steadily rising rental costs because your monthly mortgage payment is locked in for the length of your loan (typically 15 to 30 years). Work with a Real Estate Professional To Achieve Your Goals Whether you’re just getting started on your homebuying journey, you want to learn more about the process, or you’re fully committed to buying your first home this year, it’s especially important to connect with a trusted real estate advisor soon, as you won’t be the only first-time buyer in the market. According to a recent survey from realtor.com, a majority of first-time buyers surveyed are looking to purchase a home in 2022. As the survey notes: “First-time home buyers retain their optimism despite a challenging housing market in the past year. Hoping to achieve their goal of homeownership and provide a comfortable space for their families, young buyers are setting out to learn what they can about the market and setting their list of priorities for their home purchase.” That means you’ll likely face strong competition from other first-time buyers. One way to get a leg-up on that competition is to work with a real estate professional to make sure you have the support you need to make an informed and confident decision. Bottom Line If you’re planning your next move, you’re not alone. Just know it’s never too early to consider the benefits of homeownership over renting. To learn more, make a connection with a real estate advisor so you have a trusted professional on your side to help you explore your options. SOURCE:KCM #Demographics #FirstTimeHomeBuyers #ForBuyers #GenZ #SimardRealtyGroup #RealBrokerLLC |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed