|

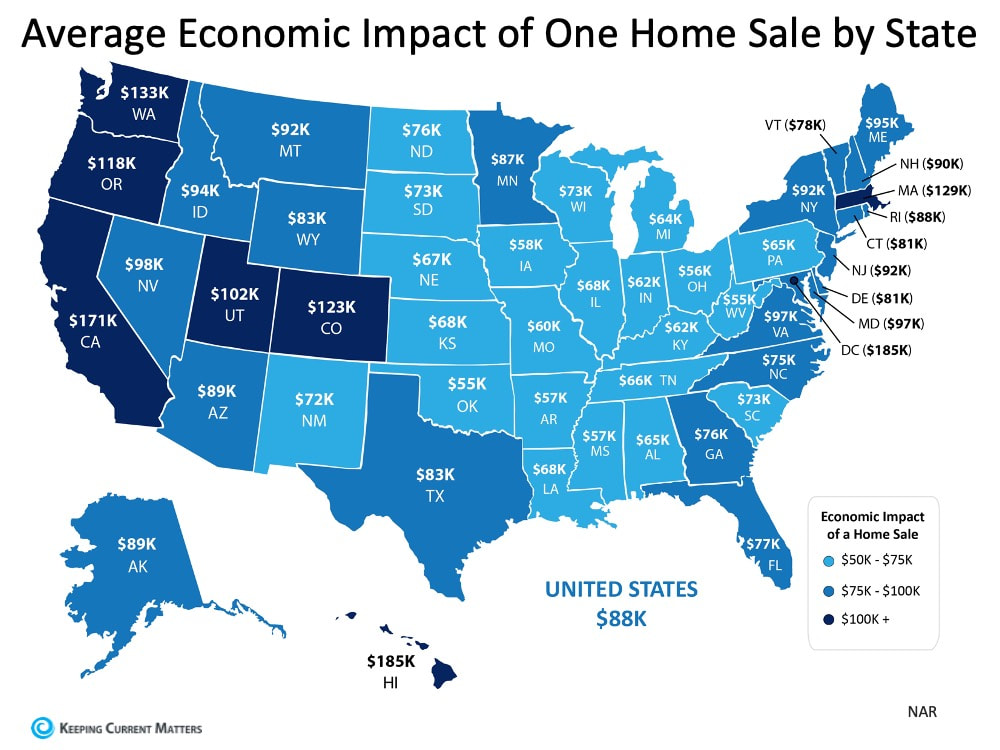

With businesses starting to slowly open back up again in some parts of the country, it’s important to understand how housing can have a major impact on the recovery of the U.S. economy. As we’ve mentioned before, buying a home is a driving financial force in this process. Today, many analysts believe one of the first things we’ll be able to safely bring back is the home building sector, creating more jobs and impacting local neighborhoods in a big way. According to Robert Dietz in The Eye on Housing: “The pace of new home sales will post significant declines during the second quarter due to the impacts of higher unemployment and shutdown effects of much of the U.S. economy, including elements of the real estate sector in certain markets. However, given the momentum housing construction held at the start of 2020, the housing industry will help lead the economy in the eventual recovery.” The National Association of Home Builders (NAHB) notes the impact new construction can have on the job market: “Building 1,000 average single-family homes creates 2,900 full-time jobs and generates $110.96 million in taxes and fees for all levels of government to support police, firefighters and schools, according to NAHB’s National Impact of Home Building and Remodeling report.” These employment opportunities, along with the home purchase, drive the economy in a major way. The National Association of Realtors (NAR) recently shared a report that notes the full economic impact of home sales. This report summarizes: “The total economic impact of real estate related industries on the state economy, as well as the expenditures that result from a single home sale, including aspects like home construction costs, real estate brokerage, mortgage lending and title insurance.” Here’s the breakdown of how the average home sale boosts the economy As noted above in the circle on the right, the impact is almost double when you purchase new construction, given the sheer number of workers it requires to design, build, equip, and finalize the sale of the home. The NAHB paints a clear picture of these roles: “The NAHB model shows that job creation through housing is broad-based. Building new homes and apartments generates jobs in industries that produce lumber, concrete, lighting fixtures, heating equipment and other products that go into a home remodeling project. Other jobs are generated in the process of transporting, storing and selling these products. Additional jobs are generated for professionals such as architects, engineers, real estate agents, lawyers and accountants who provide services to home builders, home buyers and remodelers.” The same NAR report also breaks down the average economic impact by state: On an emotional level, what’s most important for today’s consumers to feel confident about is the safety component that goes into the process. Mitigating the risk of essential personnel at this moment in time is more crucial than ever as we all aim to reduce the spread of the coronavirus. Fortunately, the NAHB has put immense effort into a plan that prioritizes the health and safety of home builders and contractors:

“This is why NAHB and construction industry partners have developed a Coronavirus Preparedness and Response Plan specifically tailored to construction job sites. The plan is customizable and covers areas that include manager and worker responsibilities, job site protective measures, cleaning and disinfecting, responding to exposure incidents, and OSHA record-keeping requirements.” Bottom Line Buying a home is a substantial economic driver today, and when new construction picks back up again, it will be an even stronger recovery force throughout the country. If you’re in a position to buy a home this year, you can have a significant impact on your local neighborhoods and safely make the move you’ve been waiting for. It’s a win-win. SOURCE KCM #Economy #RealEstate #HousingMarketUpdates #SimardRealtyGrou[ #eXprealty

0 Comments

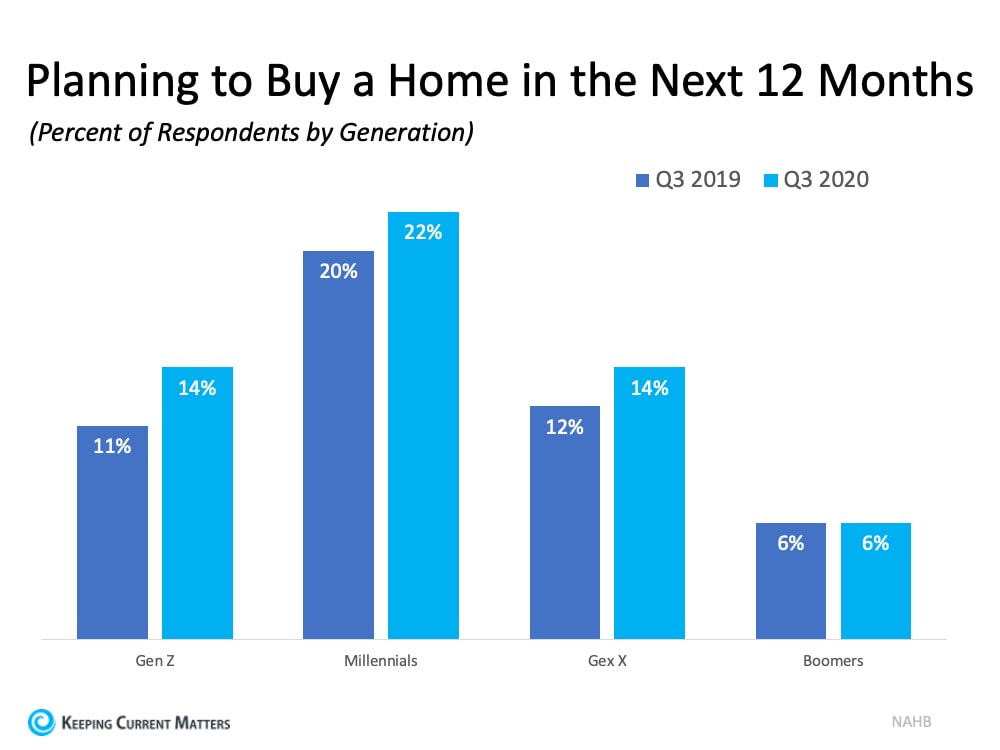

We’re all entitled to our piece of the American Dream, and homeownership is a huge part of that for most people. Millennials make up the most substantial part of the homebuying population, and regardless of generation, it can be a complicated process to jump into. If you feel ready to take the next step in homeownership, DM me so we can talk about your goals.

#millennials #millennialhomebuyer #realestate #timetobuyahome #homeownership #homebuying #realestategoals #firsttimehomebuyer #opportunity #housingmarket #househunting #makememove #realestateexpert #realestateagency #realestateadvice #realestateblog #realestatemarket #realestateexperts #instarealestate #instarealtor #realestatetipsoftheday #realestatetipsandadvice #keepingcurrentmatters Through all the volatility in the economy right now, some have put their search for a home on hold, yet others have not. According to ShowingTime, the real estate industry’s leading showing management technology provider, buyers have started to reappear over the last several weeks. In the latest report, they revealed: “The March ShowingTime Showing Index® recorded the first nationwide drop in showing traffic in eight months as communities responded to COVID-19. Early April data show signs of an upswing, however.” Why would people be setting appointments to look at prospective homes when the process of purchasing a home has become more difficult with shelter-in-place orders throughout the country? Here are three reasons for this uptick in activity: 1. Some people need to move. Whether because of a death in the family, a new birth, divorce, financial hardship, or a job transfer, some families need to make a move as quickly as possible. 2. Real estate agents across the country have become very innovative, utilizing technology that allows purchasers to virtually:

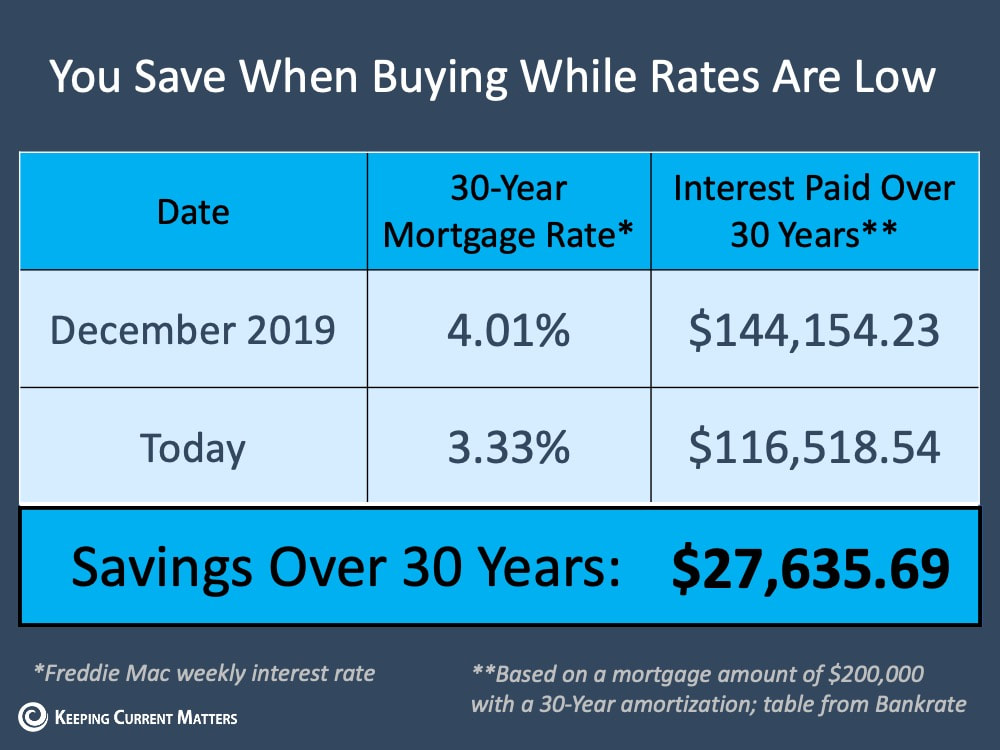

All of this can happen within the required safety protocols, so real estate professionals are continuing to help families make important moves. 3. Buyers understand that mortgage rates are a key component when determining their monthly mortgage payments. Mortgage interest rates are very close to all-time lows and afford today’s purchaser the opportunity to save tens of thousands of dollars over the lifetime of the loan. Looking closely at the third reason, we can see that there’s a big difference between purchasing a house last December and purchasing one now (see chart below) Bottom LineMany families have decided not to postpone their plans to purchase a home, even in these difficult times. If you need to make a move, reach out to a local real estate professional today so you have a trusted advisor to safely and professionally guide you through the process.

SOURCE KCM #ForBuyers #HousingMarketUpdates #SimardRealtyGroup #eXpRealty With the release of the latest Economic Pulse Flash Survey from the National Association of Realtors (NAR), results show that people selling their houses today are holding strong on price. According to the most recent data, 74% of real estate agents noted that sellers are not dropping listing prices to attract more buyers.

Lawrence Yun, Chief Economist at NAR, noted: “The housing market faced an inventory shortage before the pandemic. Given that there are even fewer new listings during the pandemic, home sellers are taking a calm approach and appear unwilling to lower prices to attract buyers during the temporary disruptions to the economy.” This inventory shortage, which spread widely throughout the housing market going into today’s economic slowdown, created an environment where there were not enough homes for sale for those who wanted to buy them. With that backdrop setting the stage, Yun also notes: “With the current quarantine recommendations in place, fewer sellers are listing homes, which will limit buyer choices.” So, with buyer choices already limited going into this season, and more sellers removing listings today, if you’ve been thinking about listing your house, it’s a great time to do so. Many others in your neighborhood may be waiting to make a move or removing their listings, so staying on the market – or jumping into it – could work to your advantage. Buyers today are serious ones, and with prices holding steady in this low-inventory market, you can feel confident about selling today. Embracing the process virtually, where available, could help your house hit the top of an eager buyer’s list. While your neighbors miss out on this opportunistic time, you don’t have to. Bottom Line If buyer choices are limited in your neighborhood, selling now may help your listing rise to the top of the pool. Reach out to a local real estate professional today to make sure you have the expert help you need to succeed in the selling process. SOURCE KCM #Pricing #SellingYourHome #HomeSellers #SimardRealtyGroup #eXpRealty A big challenge facing the housing industry is determining what impact the current pandemic may have on home values. Some buyers are hoping for major price reductions because the health crisis is straining the economy.

The price of any item, however, is determined by supply and demand, which is how many items are available in relation to how many consumers want to buy that item. In residential real estate, the measurement used to decipher that ratio is called months supply of inventory. A normal market would have 6-7 months of inventory. Anything over seven months would be considered a buyers’ market, with downward pressure on prices. Anything under six months would indicate a sellers’ market, which would put upward pressure on prices. Going into March of this year, the supply stood at three months – a strong seller’s market. While buyer demand has decreased rather dramatically during the pandemic, the number of homes on the market has also decreased. The recently released Existing Home Sales Report from the National Association of Realtors (NAR) revealed we currently have 3.4 months of inventory. This means homes should maintain their value during the pandemic. This information is consistent with the research completed by John Burns Real Estate Consulting, which recently reported: “Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices).” What are the experts saying?Here’s a look at what some experts recently reported on the matter: Ivy Zelman, President, Zelman & Associates “Supported by our analysis of home price dynamics through cycles and other periods of economic and housing disruption, we expect home price appreciation to decelerate from current levels in 2020, though easily remain in positive territory year over year given the beneficial factors of record-low inventories & a historically-low interest rate environment.” Freddie Mac “The fiscal stimulus provided by the CARES Act will mute the impact that the economic shock has on house prices. Additionally, forbearance and foreclosure mitigation programs will limit the fire sale contagion effect on house prices. We forecast house prices to fall 0.5 percentage points over the next four quarters. Two forces prevent a collapse in house prices. First, as we indicated in our earlier research report, U.S. housing markets face a large supply deficit. Second, population growth and pent up household formations provide a tailwind to housing demand. Price growth accelerates back towards a long-run trend of between 2 and 3% per year.” Mark Fleming, Chief Economist, First American “The housing supply remains at historically low levels, so house price growth is likely to slow, but it’s unlikely to go negative.” Bottom Line Even though the economy has been placed on pause, it appears home prices will remain steady throughout the pandemic. SOURCE KCM #ForSellers #HousingMarketUpdated #SimardRealtyGroup #joineXpRealty Some Highlights

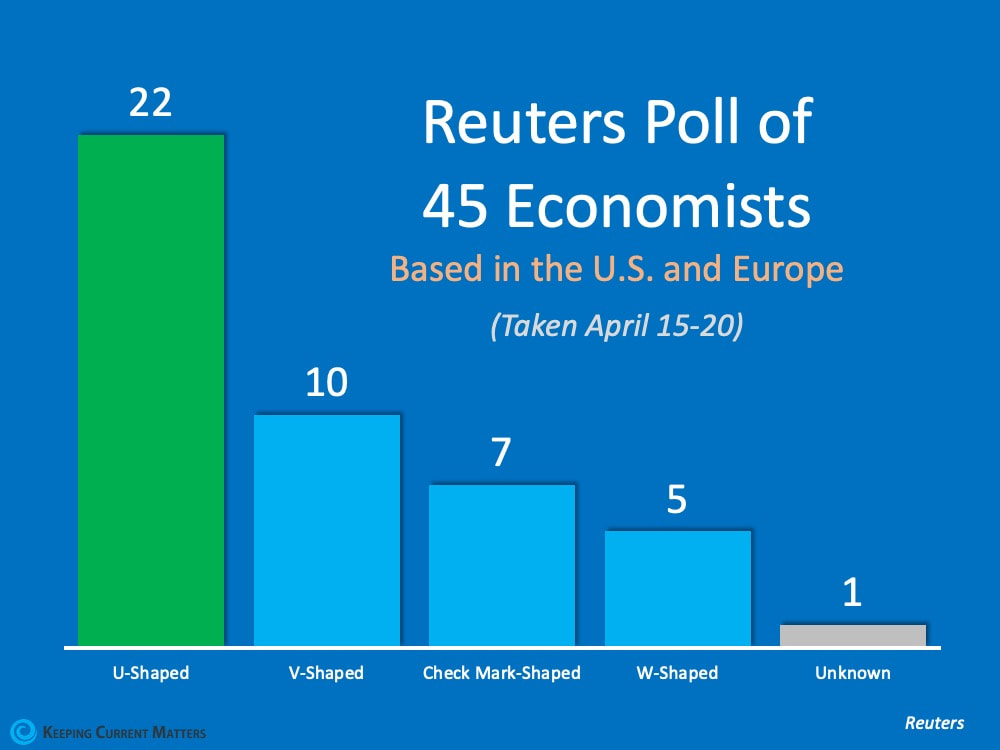

SOURCE KCM #ForSellers #HousingMarketUpdate #SimardRealtyGroup #joineXpRealty Earlier this week, we discussed how most projections from financial institutions are calling for a quick V-shaped recovery from this economic downturn, and there’s research on previous post-pandemic recoveries to support that expectation. In addition, we noted how there are some in the business community who believe we may instead be headed for a U-shaped recovery, where the return to previous levels of economic success won’t occur until the middle of next year. Yesterday, Reuters released a poll of U.S. and European economists which revealed that most surveyed are now leaning more toward a U-shaped recovery. Here are the results of that poll: Why the disparity in thinking among different groups of economic experts?

The current situation makes it extremely difficult to project the future of the economy. Analysts normally look at economic data and compare it to previous slowdowns to create their projections. This situation, however, is anything but normal. Today, analysts must incorporate data from three different sciences into their recovery equation: 1. Business Science – How has the economy rebounded from similar slowdowns in the past? 2. Health Science – When will COVID-19 be under control? Will there be another flareup of the virus this fall? 3. Social Science – After businesses are fully operational, how long will it take American consumers to return to normal consumption patterns? (Ex: going to the movies, attending a sporting event, or flying). The challenge of accurately combining the three sciences into a single projection has created uncertainty, and it has led to a wide range of opinions on the timing of the recovery. Bottom Line Right now, the vast majority of economists and analysts believe a full recovery will take anywhere from 6-18 months. No one truly knows the exact timetable, but it will be coming. SOURCE KCM #ForBuyers #ForSellers #HousingMarketUpdate #SimardRealtyGroup #joineXpRealty In a recent survey by realtor.com, people thinking about selling their homes indicated they’re generally willing to allow their agent and some potential buyers inside if done under the right conditions. They’re less comfortable, however, hosting an open house. This is understandable, given the health concerns associated with social contact these days. The question is, if you need to sell your house now, what virtual practices should you use to make sure you, your family, and potential buyers stay safe in the process?

In today’s rapidly changing market, it’s more important than ever to make sure you have a digital game plan and an effective online marketing strategy when selling your house. One of the ways your agent can help with this is to make sure your listing photos and virtual tours stand out from the crowd, truly giving buyers a detailed and thorough view of your home. So, if you’re ready to move forward, virtual practices may help you win big when you’re ready to sell. While abiding by state and local regulations is a top priority, a real estate agent can help make your sale happen. Agents know exactly what today’s buyers need, and how to put the necessary digital steps in place. For example, according to the same survey, when asked to select what technology would be most helpful when deciding on a new home, here’s what today’s homebuyers said, in order of preference:

After leveraging technology, if you have serious buyers who still want to see your house in person, keep in mind that according to the National Association of Realtors (NAR), there are ways to proceed safely. Here are a few of the guidelines, understanding that the top priority should always be to obey state and local restrictions first:

Getting comfortable with your agent – a true trusted advisor – taking these steps under the new safety standards might be your best plan. This is especially important if you’re in a position where you need to sell your house sooner rather than later. Nate Johnson, CMO at realtor.com ® notes: “As real estate agents and consumers seek out ways to safely complete these transactions, we believe that technology will become an even more imperative part of how we search for, buy and sell homes moving forward.” It sounds like some of these new practices might be here to stay. Bottom Line In a new era of life, things are shifting quickly, and virtual strategies for sellers may be a great option. Opening your doors up to digital approaches may be game-changing when it comes to selling your house. As always, a trusted real estate professional can help you safely and effectively navigate through all that’s new when it comes to making your next move. SOURCE KCM #ForSellers #SellYourHouse #StagingByYourSelf #DIYPhotoShoot #SimardRealtyGroup #eXpRealty

History shows that a recession does not equal a housing crisis. Let's connect to talk about what's happening in our market and how it impacts your goals this year.

Connecticut Top Granby Realtor & Five Star Award Winner Charisma and a true passion serving clients has helped me build a reputation as a trusted, results driven realtor. Aligning my business with one of the most innovative real estate companies, eXp Realty, allows me to offer a tech driven, memorable real estate experience. I specialize in all facets of Real Estate & can be counted to help my buyers score a great home. “Friendly, knowledgeable, enthusiastic and a hard-worker. He knows the area well and provides helpful recommendations on how to best sell your home. He is also well versed at negotiation when helping to purchase a house. We would definitely recommend him to anyone and will use him again in the future.” Jill, Granby CT." Selling? My system will sell you home for the most money. I'm a multi million dollar producing Realtor consistently named a 5 Star Agent by Connecticut Magazine for customer satisfaction and production. Let's get started. #TopGranbyRealtor #StephenSimard #ExpRealty #GranbyRealEstate #GranbyConnecticut #FindyourGranbyhome #Newhomesforsale #SimardRealtyGroup #Granbyhomesforsale #JoinExpRealty #Simsburyhomes Many American businesses have been put on hold as the country deals with the worst pandemic in over one hundred years. As the states are deciding on the best strategy to slowly and safely reopen, the big question is: how long will it take the economy to fully recover? Let’s look at the possibilities. Here are the three types of recoveries that follow most economic slowdowns (the definitions are from the financial glossary at Market Business News):

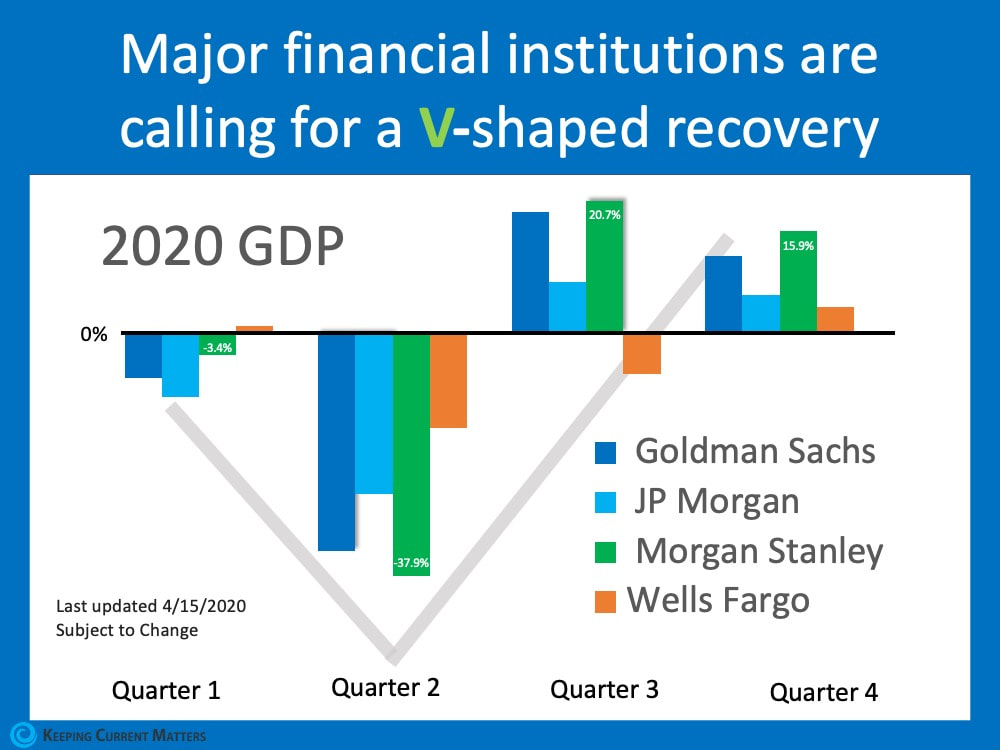

No one can answer this question with one hundred percent certainty. However, most top financial services firms are calling for a V-shaped recovery. Goldman Sachs, Morgan Stanley, Wells Fargo Securities, and JP Morgan have all recently come out with projections that call for GDP to take a deep dive in the first half of the year but have a strong comeback in the second half. Is there any research on recovery following a pandemic?There have been two extensive studies done that look at how an economy has recovered from a pandemic in the past. Here are the conclusions they reached:

1. John Burns Consulting: “Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.” 2. Harvard Business Review: “It’s worth looking back at history to place the potential impact path of Covid-19 empirically. In fact, V-shapes monopolize the empirical landscape of prior shocks, including epidemics such as SARS, the 1968 H3N2 (“Hong Kong”) flu, 1958 H2N2 (“Asian”) flu, and 1918 Spanish flu.” The research says we should experience a V-shaped recovery. Does everyone agree it will be a ‘V’? No. Some are concerned that, even when businesses are fully operational, the American public may be reluctant to jump right back in. As Market Business News explains: “In a typical V-shaped recovery, there is a huge shift in economic activity after the downturn and the trough. Growing consumer demand and spending drive the massive shift in economic activity.” If consumer demand and spending do not come back as quickly as most expect it will, we may be heading for a U-shaped recovery. In a message last Thursday, Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank, agrees with other analysts who are expecting a resurgence in the economy later this year: “We’re forecasting real economic growth of 30% for the U.S. in the 4th quarter of this year and 6.1% in 2021.” His projection, however, calls for a U-shaped recovery based on concerns that consumers may not rush back in: “After the steep plunge and bottoming out, a ‘U-shaped’ recovery should begin as consumer confidence slowly returns.” Bottom Line The research indicates the recovery will be V-shaped, and most analysts agree. However, no one knows for sure how quickly Americans will get back to “normal” life. We will have to wait and see as the situation unfolds. SOURCE KCM #ForSellers #ForBuyers #HousingMarketUpdates #SimardRealtyGroup |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed