|

Life is the most interesting thing that will ever happen to you. Celebrate every day to the fullest. Wishing you and your family a safe, healthy, and prosperous new year! Hello 2021!

#2021 #HappyNewYear #SimardRealtyGroup

0 Comments

There are many benefits to working with a real estate professional when selling your house. During challenging times, like what we face today, it becomes even more important to have an expert you trust to help guide you through the process. If you’re considering selling on your own, known in the industry as a For Sale By Owner (FSBO), it’s critical to consider the following items.

1. Your Safety Is a Priority Your safety should always come first, and that’s more crucial than ever given the current health situation in our country. When you FSBO, it is incredibly difficult to control entry into your home. A real estate professional will have the proper protocols in place to protect not only your belongings but your health and well-being too. From regulating the number of people in your home at one time to ensuring proper sanitization during and after a showing, and even facilitating virtual tours, real estate professionals are equipped to follow the latest industry standards recommended by the National Association of Realtors (NAR) to help protect you and your potential buyers. 2. A Powerful Online Strategy Is a Must to Attract a Buyer Recent studies from NAR have shown that, even before COVID-19, the first step 43% of all buyers took when looking for a home was to search online. Throughout the process, that number jumps to 97%. Today, those numbers have grown exponentially. Most real estate agents have developed a strong Internet and social media strategy to promote the sale of your house. 3. There Are Too Many Negotiations Here are just a few of the people you’ll need to negotiate with if you decide to FSBO:

As part of their training, agents are taught how to negotiate every aspect of the real estate transaction and how to mediate the emotions felt by buyers looking to make what is probably the largest purchase of their lives. 4. You Won’t Know if Your Purchaser Is Qualified for a Mortgage Having a buyer who wants to purchase your house is the first step. Making sure they can afford to buy it is just as important. As a FSBO, it’s almost impossible to be involved in the mortgage process of your buyer. A real estate professional is trained to ask the appropriate questions and, in most cases, will be intimately aware of the progress being made toward a purchaser’s mortgage commitment. You need someone who’s working with lenders every day to guarantee your buyer makes it to the closing table. 5. FSBOing Is Becoming More Difficult from a Legal Standpoint The documentation involved in the selling process is growing dramatically as more and more disclosures and regulations become mandatory. In an increasingly litigious society, the agent acts as a third-party to help the seller avoid legal jeopardy. This is one of the major reasons why the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years. 6. You Net More Money When Using an Agent Many homeowners think they’ll save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent’s commission. The seller and buyer can’t both save on the commission. A study by Collateral Analytics revealed that FSBOs don’t actually save anything by forgoing the help of an agent. In some cases, the seller may even net less money from the sale. The study found the difference in price between a FSBO and an agent-listed home was an average of 6%. One of the main reasons for the price difference is effective exposure: “Properties listed with a broker that is a member of the local MLS will be listed online with all other participating broker websites, marketing the home to a much larger buyer population. And those MLS properties generally offer compensation to agents who represent buyers, incentivizing them to show and sell the property and again potentially enlarging the buyer pool.” The more buyers that view a home, the greater the chance a bidding war will take place, potentially driving the price higher, too. Bottom Line Listing on your own leaves you to manage the entire transaction by yourself. Why do that when you can hire an agent and still net the same amount of money? Before you decide to take on the challenge of selling your house alone, reach out to a local real estate professional to discuss your options. SOURCE KCM #FSBO #SellingMyths #Pricing #SimardRealtyGroup #StephenSimard

This holiday season may be the perfect time to sell your house. Let's connect to discuss how today's buyer demand is presenting the greatest opportunities for sellers.

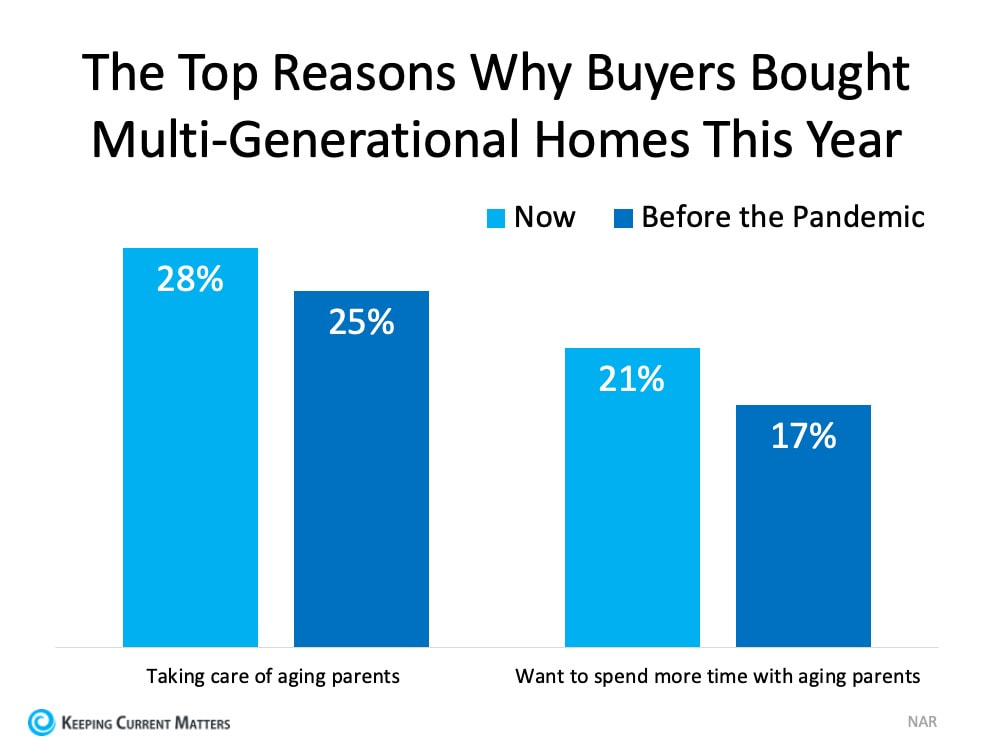

Connecticut Top Granby Realtor & Five Star Award Winner Charisma and a true passion serving clients has helped me build a reputation as a trusted, results driven realtor. Aligning my business with one of the most innovative real estate companies, eXp Realty, allows me to offer a tech driven, memorable real estate experience. I specialize in all facets of Real Estate & can be counted to help my buyers score a great home. “Friendly, knowledgeable, enthusiastic and a hard-worker. He knows the area well and provides helpful recommendations on how to best sell your home. He is also well versed at negotiation when helping to purchase a house. We would definitely recommend him to anyone and will use him again in the future.” Jill, Granby CT." Selling? My system will sell you home for the most money. I'm a multi million dollar producing Realtor consistently named a 5 Star Agent by Connecticut Magazine for customer satisfaction and production. Let's get started. #TopGranbyRealtor #StephenSimard #ExpRealty #GranbyRealEstate #GranbyConnecticut #FindyourGranbyhome #Newhomesforsale #SimardRealtyGroup #Granbyhomesforsale #JoinExpRealty #Simsburyhomes This year challenged us to reprioritize everything – from the way we use our time to where we work, how we socialize and gather together, and our needs at home. For many, this also meant making decisions about how to best support and engage with our extended families, near and far. In some cases, we weren’t able to see our relatives and loved ones who were living in senior facilities. In others, maybe older children moved back home. Jessica Lautz, Vice President of Demographics and Behavioral Insights for the National Association of Realtors (NAR), says: “A lot of families have an aging senior relative who was living independently or in senior care and wanted to move them into their home.” These changes led more homebuyers to invest in multi-generational homes to accommodate more long-term plans. A multi-generational home, according to the 2020 Profile of Home Buyers and Sellers from NAR, is a home that has adult siblings, adult children over the age of 18, parents, and/or grandparents in the household. A recent study from NAR shows that since the health crisis began, there’s been an increase in purchasing trends for homes that cater to this dynamic: “Buyers who purchased after March were more likely to purchase a multi-generational home at 15% compared to 11% who purchased before April.” There are many reasons for this uptick in preference toward multi-generational homes. The graph below shows the top two reasons and how they’ve increased this year: Bottom LineMore homeowners are making arrangements to accommodate their loved ones so they can safely take care of them at home. If you’re in a similar situation, contact a local real estate professional so you can learn more about your local options and maybe even have your whole family under one roof by early next year.

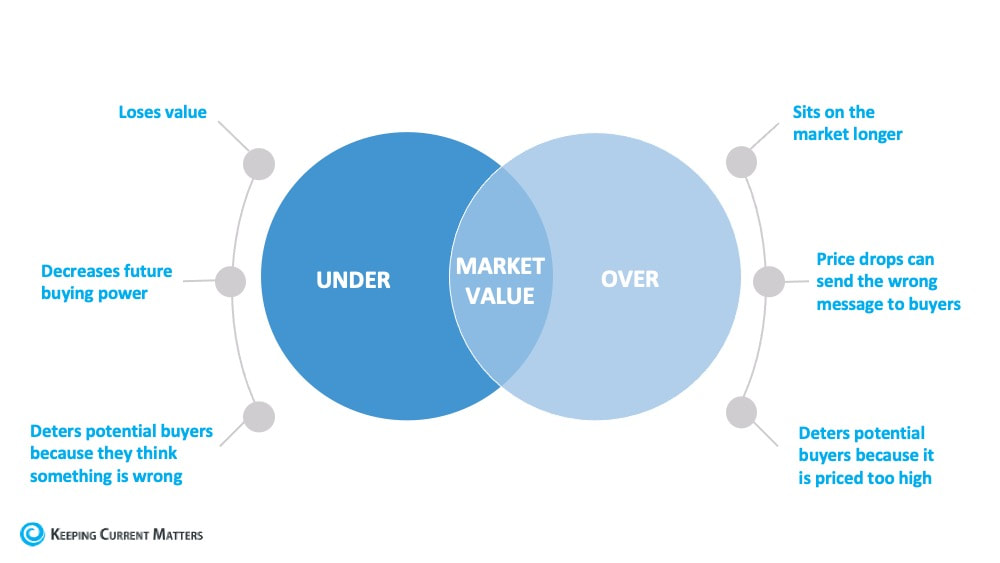

SOURCE KCM #Demographics #ForBuyers #MoveUpBuyers #SimardRealtyGroup Even in today’s sellers’ market, setting the right price for your house is one of the most valuable things you can do. According to the U.S. Economic Outlook by the National Association of Realtors (NAR), existing home prices nationwide are forecasted to increase by 4.5% in 2021. This means experts anticipate home values will continue climbing next year. Danielle Hale, Chief Economist for realtor.com, notes: “We expect price gains to ease somewhat in 2021 and end 5.7% above 2020 levels, decelerating steadily through the spring and summer, and then gradually reaccelerating toward the end of the year.” How to Price Your House When it comes to setting the right price for your house, the goal is to increase visibility and drive more buyers your way. Instead of trying to win the negotiation with one buyer, you should price your house so that demand is maximized and more buyers want to take a look. As a seller in today’s market, you might be thinking about pricing your house on the high end while so many of today’s buyers are searching harder than ever just to find a home to purchase. But here’s the thing – a high price tag does not mean you’re going to cash in big on the sale. It’s actually more likely to deter buyers. Right now, even when there are so few houses for sale, your house is more likely to sit on the market longer or require a price drop that can send buyers running if it isn’t priced just right from the very beginning. It’s important to make sure your house is priced correctly by working with a trusted real estate professional throughout the process. When you price it competitively from the start, you won’t be negotiating with one buyer. Instead, you’ll likely have multiple buyers competing for the house, potentially increasing the final sale price.

The key is to make sure your house is priced to sell immediately. This way, it will be seen by the greatest number of buyers. More than one of them may be interested, and it will be more likely to sell at a competitive price. Bottom LineReach out to a local real estate professional to price your house correctly from the start so you can maximize your exposure and your return. SOURCE KCM #ForSellers #Pricing #SellingMyths #SimardRealtyGroup Whatever is beautiful. Whatever is meaningful. Whatever brings you happiness. May it be yours this holiday season and throughout the coming year. Wishing you all a Merry and Safe Christmas!

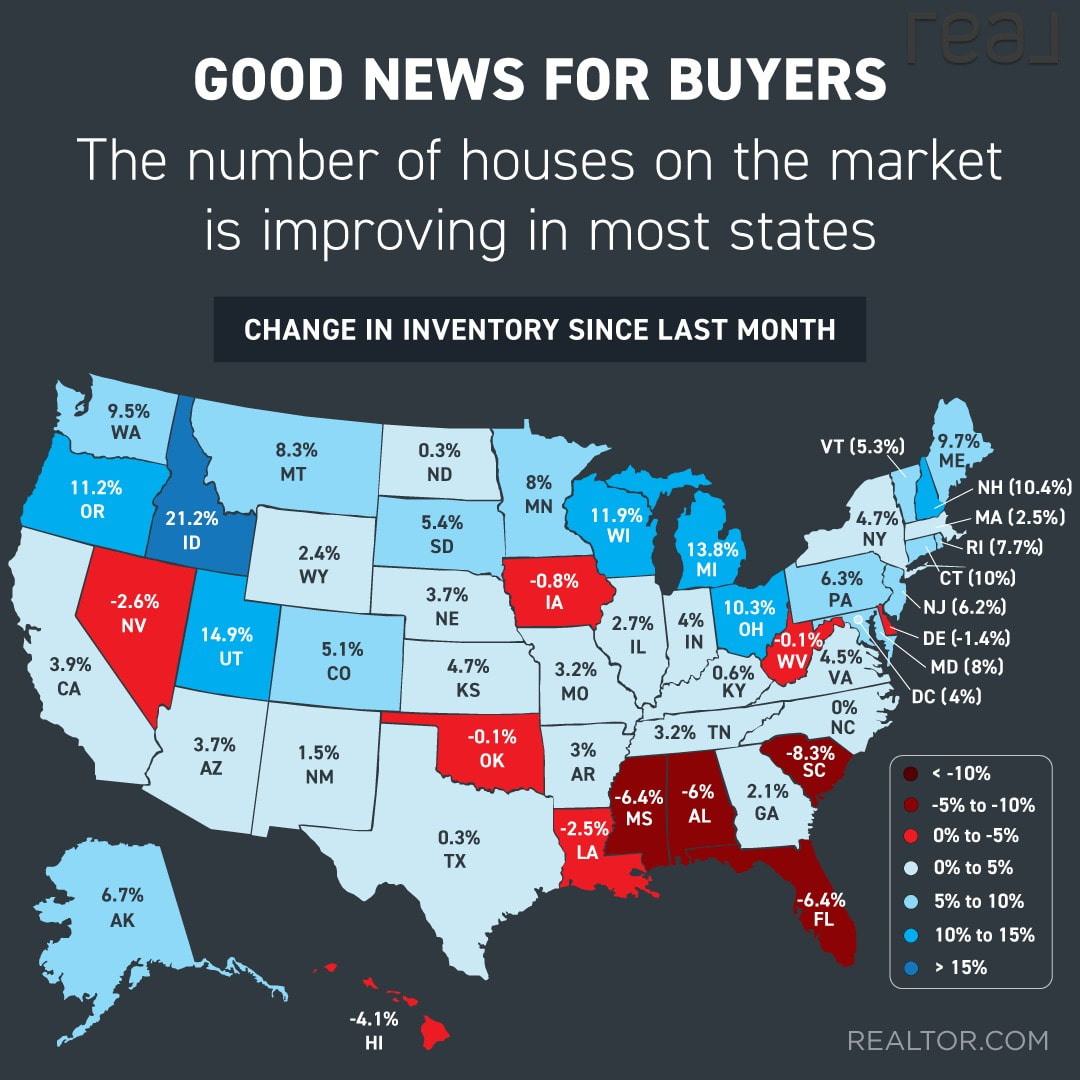

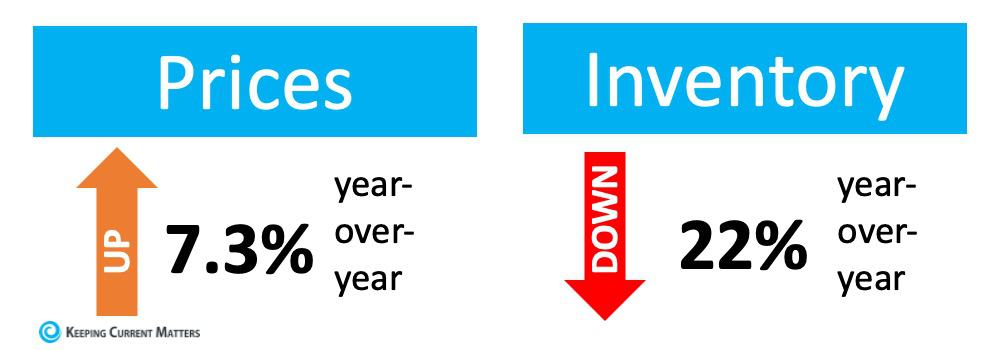

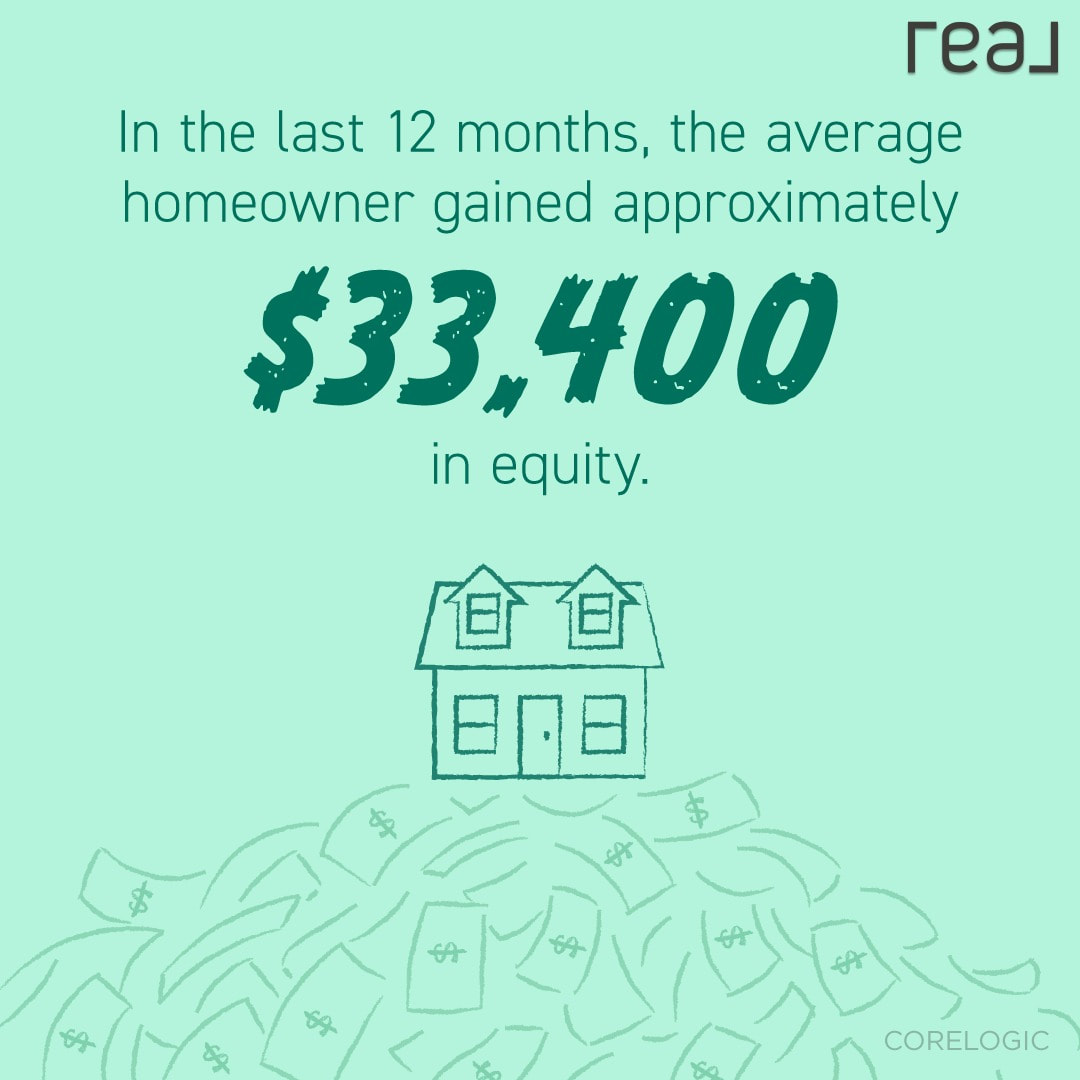

It may seem hard to imagine that the home you’re in today – whether it’s your starter home or just one you’ve fallen in love with along the way – might not be your forever home. Many needs have changed in 2020, and it’s okay to admit if your house no longer fits your lifestyle. If you’re now working remotely, facilitating virtual school, trying to exercise at home, or simply just spending more time in your own four walls, you may be bursting at the seams in your current house. According to the latest Home Price Insights from CoreLogic, prices have appreciated 7.3% year-over-year. At the same time, the National Association of Realtors (NAR) reports that inventory has dropped 22% from one year ago. These two statistics are directly related to one another. As inventory has decreased and demand has increased, prices have been driven up.

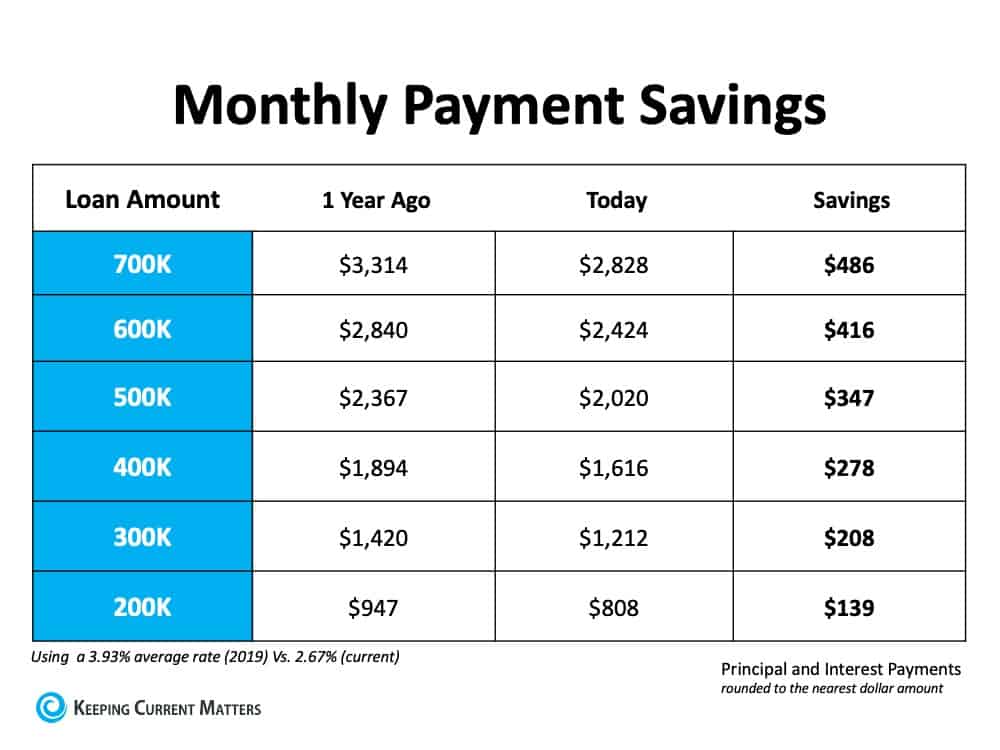

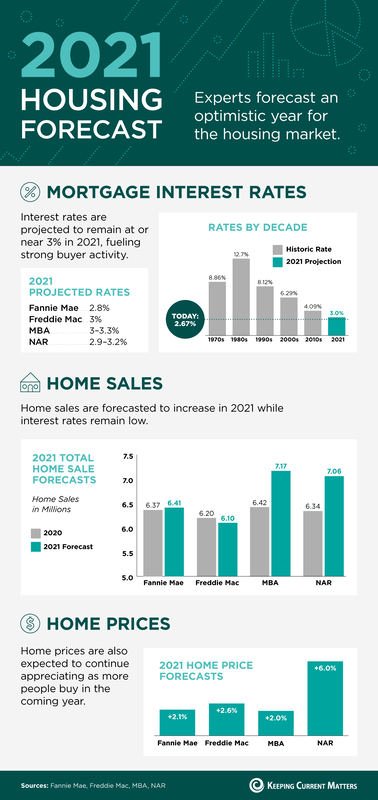

This is great news if you own a home and you’re thinking about selling. The equity in your house has likely risen as prices have increased. Even better is the fact that there’s a large pool of buyers out there searching for the American dream, and your home may be high on their wish list. Bottom Line If you think you’ve outgrown your current home, reach out to a real estate professional to discuss local market conditions and determine if now is the best time for you to sell. SOURCE KCM #Pricing #HousingMarketUpdate #ForSellers #SimardRealtyGroup Over the past year, mortgage rates have fallen more than a full percentage point, hitting a new historic low 15 times. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits. Here’s a look at three of them. 1. Move-up or Downsize: One option is to consider moving into a new home, putting the equity you’ve likely gained in your current house toward a down payment on a new one that better meets your needs – something that’s truly a perfect fit, especially if your lifestyle has changed this year. 2. Become a First-Time Homebuyer: There are many financial and non-financial benefits to owning a home, and the most important thing is to first decide when the time is right for you. You have to determine that on your own, but know that now is a great time to buy if you’re considering it. Just take a look at the cost of renting vs. buying. 3. Refinance: If you already own a home, you may decide you’re going to refinance. It’s one way to lock in a lower monthly payment and save more over time. However, it also means paying upfront closing costs, too. If you want to take this route, you have to answer the question: Should I refinance my home? Why 2020 Was a Great Year for Homeownership Last year, the average mortgage rate was 3.93% (substantially higher than it is today). If you waited for a better time to make a move, market conditions have improved significantly. Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home. The chart below shows how much you would save per month based on today’s rates compared to what you would have paid if you purchased a home exactly one year ago, depending on how much you finance: Bottom LineIf you’ve been waiting since last year to make your move into homeownership or to find a house that better meets your needs, today’s low mortgage rates may be just what you need to get the process going. Reach out to a local real estate professional to discuss how you may benefit from the current rates.

SOURCE KCM #RentVSBuy #HousingMarketUpdate #InterestRates #SimardRealtyGroup #eXpRealty Once you’ve found the right home and applied for a mortgage, there are some key things to keep in mind before you close. You’re undoubtedly excited about the opportunity to decorate your new place, but before you make any large purchases, move your money around, or make any major life changes, consult your lender – someone who is qualified to tell you how your financial decisions may impact your home loan.

Below is a list of things you shouldn’t do after applying for a mortgage. They’re all important to know – or simply just good reminders – for the process. 1. Don’t Deposit Cash into Your Bank Accounts Before Speaking with Your Bank or Lender. Lenders need to source your money, and cash is not easily traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer. 2. Don’t Make Any Large Purchases Like a New Car or Furniture for Your New Home. New debt comes with new monthly obligations. New obligations create new qualifications. People with new debt have higher debt-to-income ratios. Higher ratios make for riskier loans, and then sometimes qualified borrowers no longer qualify. 3. Don’t Co-Sign Other Loans for Anyone. When you co-sign, you’re obligated. With that obligation comes higher ratios as well. Even if you promise you won’t be the one making the payments, your lender will have to count the payments against you. 4. Don’t Change Bank Accounts. Remember, lenders need to source and track your assets. That task is significantly easier when there’s consistency among your accounts. Before you transfer any money, speak with your loan officer. 5. Don’t Apply for New Credit. It doesn’t matter whether it’s a new credit card or a new car. When you have your credit report run by organizations in multiple financial channels (mortgage, credit card, auto, etc.), your FICO® score will be impacted. Lower credit scores can determine your interest rate and maybe even your eligibility for approval. 6. Don’t Close Any Credit Accounts. Many buyers believe having less available credit makes them less risky and more likely to be approved. Wrong. A major component of your score is your length and depth of credit history (as opposed to just your payment history) and your total usage of credit as a percentage of available credit. Closing accounts has a negative impact on both of those determinants of your score. Bottom Line Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved. If your job or employment status has changed recently, share that with your lender as well. The best plan is to fully disclose and discuss your intentions with your loan officer before you do anything financial in nature. SOURCE KCM #BuyingMyths #InterestRates #MoveUpBuyers #SimardRealtyGroup Some Highlights

SOURCE KCM #HousingMarketUpdate #Pricing #Infographics #SimardRealtyGroup |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed