|

Virtual house hunting is a go-to in today’s real estate process. If you’re planning to buy, shopping online helps you narrow down the homes you really want to see in person. And if you’re selling your house, showcasing its best qualities brings in more attention from potential buyers. DM me to learn more about the best ways we can work together to boost your internet strategy in the real estate process.

#onlinelistings #homeshopping #buyingahome #sellingyourhouse #realestate #homeownership #realestategoals #realestatetips #realestatelife #realestateexpert #realestateagency #realestatemarket #realestateexperts #realestatetipsoftheday #keepingcurrentmatters

0 Comments

Some Highlights

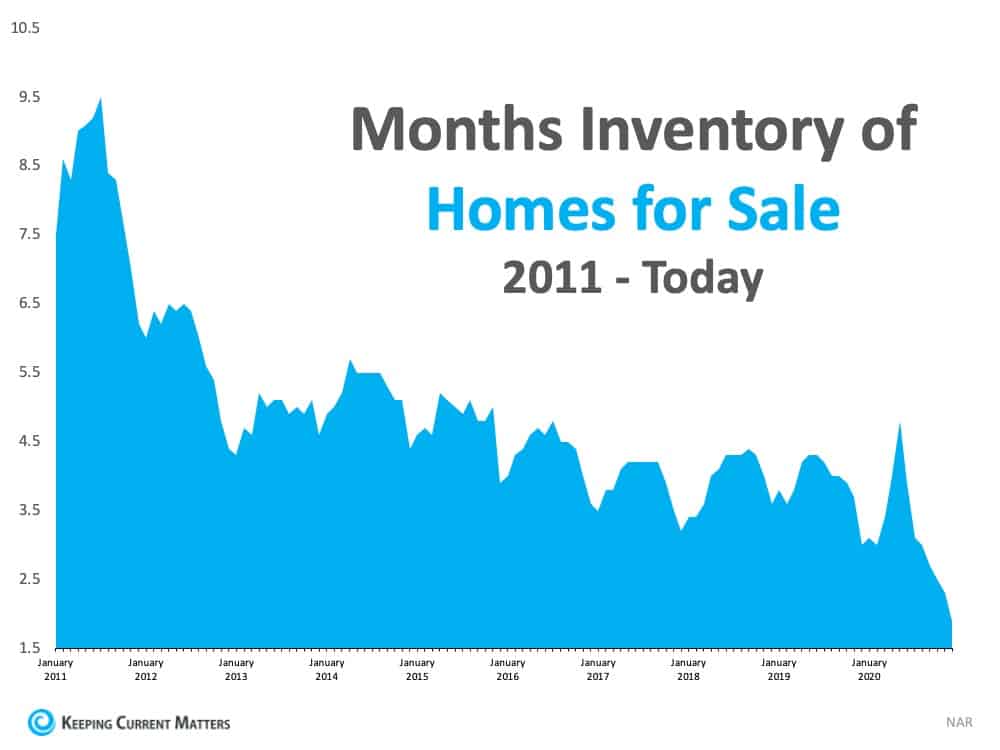

SOURCE KCM #ForSellers #Infographics #MoveUpBuyers #SimardRealtyGroup The real estate market is expected to do very well in 2021, with mortgage rates that are hovering at historic lows and forecasted by experts to remain favorable throughout the year. One challenge to the housing industry, however, is the lack of homes available for sale today. Last week, the National Association of Realtors (NAR) released their Existing Home Sales Report, which shows that the inventory of homes for sale is currently at an all-time low. The report explains: “Total housing inventory at the end of December totaled 1.07 million units, down 16.4% from November and down 23% from one year ago (1.39 million). Unsold inventory sits at an all-time low 1.9-month supply at the current sales pace, down from 2.3 months in November and down from the 3.0-month figure recorded in December 2019. NAR first began tracking the single-family home supply in 1982.” (See graph below): What Does This Mean for You?

If You’re a Buyer: Be patient during your home search. It may take time to find a home you love. Once you do, however, be ready to move forward quickly. Get pre-approved for a mortgage, be prepared to make a competitive offer from the start, and know that a shortage in inventory could mean you’ll enter a bidding war. Calculate just how far you’re willing to go to secure a home and lean on your real estate professional as an expert guide along the way. The good news is, more inventory is likely headed to the market soon, Lawrence Yun, Chief Economist at NAR, notes: “To their credit, homebuilders and construction companies have increased efforts to build, with housing starts hitting an annual rate of near 1.7 million in December, with more focus on single-family homes…However, it will take vigorous new home construction in 2021 and in 2022 to adequately furnish the market to properly meet the demand.” If You’re a Seller :Realize that, in some ways, you’re in the driver’s seat. When there’s a shortage of an item at the same time there’s a strong demand for it, the seller is in a good position to negotiate the best possible terms. Whether it’s the price, moving date, possible repairs, or anything else, you’ll be able to request more from a potential purchaser at a time like this – especially if you have multiple interested buyers. Don’t be unreasonable, but understand you probably have the upper hand. Bottom Line The housing market will remain strong throughout 2021. Know what that means for you, whether you’re buying, selling, or doing both. SOURCE KCM #InterestRates #HousingMarketUpdate #SimardRealtyGroup #eXpRealty

Ready to buy a home this year? Let's connect to separate reality from reality TV and make sure your experience is smooth and successful.

#TopGranbyRealtor #StephenSimard #ExpRealty #GranbyRealEstate #GranbyConnecticut #FindyourGranbyhome #Newhomesforsale #SimardRealtyGroup #Granbyhomesforsale #JoinExpRealty #Simsburyhomes According to the latest report from Black Knight, Inc., a well-respected provider of data and analytics for mortgage companies, 6.48 million households have entered a forbearance plan as a result of financial concerns brought on by the COVID-19 pandemic. Here’s where these homeowners stand right now:

This shows that of the almost 3.72 million homeowners who have left the program, only 116,000 (2%) exited while they were still behind on their payments. There are still 2.77 million borrowers in a forbearance program. No one knows for sure how many of those will become foreclosures. There are, however, three major reasons why most experts believe there will not be a tsunami of foreclosures as we saw during the housing crash over a decade ago:

Will there be foreclosures coming to the market? Yes. There are hundreds of thousands of foreclosures in this country each year. People experience economic hardships, and in some cases, are not able to meet their mortgage obligations. Here’s the breakdown of new foreclosures over the last three years, prior to the pandemic:

Through the first three quarters of 2020 (the latest data available), there were only 114,780 new foreclosures. If 10% of those currently in forbearance go to foreclosure, 275,000 foreclosures would be added to the market in 2021. That would be an average year as the numbers above show. What happens if the number is more than 10%? If we do experience a higher foreclosure rate from those in forbearance, most experts believe the current housing market will easily absorb the excess inventory. We entered 2020 with 1,210,000 single-family homes available for purchase. At the time, that was low and problematic. The market was experiencing high buyer demand, and we needed more houses to meet that demand. We’re now entering 2021 with 320,000 fewer homes for sale, while buyer demand remains extremely strong. This means the housing market has the capacity to soak up a lot of inventory. Bottom Line There will be more foreclosures entering the market later this year, especially compared to the record-low numbers in 2020. However, the market will be able to handle the increase as buyer demand remains strong. SOURCE KCM #DistressedProperties #HousingMarketUpdates #SimardRealtyGroup More people are finding out that working from home may not be just a necessity during the pandemic, but a long-term opportunity once it’s over. This opens a lot of doors to find a home that’s more affordable or more appealing to your needs and interests. If you’re considering making a move this year, DM me to explore your options.

#workfromhome #opportunity #remotework #timetomove #realestate #homeownership #realestatelife #realestatenews #realestateagent #realestatemarket #realestateexperts #realestateagents #instarealestate #instarealtor #keepingcurrentmatters If you’re planning to buy a home, an appraisal is an important step in the process. It’s a professional evaluation of the market value of the home you’d like to buy. In most cases, an appraisal is ordered by the lender to confirm or verify the value of the home prior to lending a buyer money for the purchase. It’s also a different step in the process from a home inspection, which assesses the condition of the home before you finalize the transaction. Here’s the breakdown of each one and why they’re both important when buying a home.

Home AppraisalThe National Association of Realtors (NAR) explains: “A home purchase is typically the largest investment someone will make. Protect yourself by getting your investment appraised! An appraiser will observe the property, analyze the data, and report their findings to their client. For the typical home purchase transaction, the lender usually orders the appraisal to assist in the lender’s decision to provide funds for a mortgage.” When you apply for a mortgage, an unbiased appraisal (which is required by the lender) is the best way to confirm the value of the home based on the sale price. Regardless of what you’re willing to pay for a house, if you’ll be using a mortgage to fund your purchase, the appraisal will help make sure the bank doesn’t loan you more than what the home is worth. This is especially critical in today’s sellers’ market where low inventory is driving an increase in bidding wars, which can push home prices upward. When sellers are in a strong position like this, they tend to believe they can set whatever price they want for their house under the assumption that competing buyers will be willing to pay more. However, the lender will only allow the buyer to borrow based on the value of the home. This is what helps keep home prices in check. If there’s ever any confusion or discrepancy between the appraisal and the sale price, your trusted real estate professional will help you navigate any additional negotiations in the buying process. Home Inspection Here’s the key difference between an appraisal and an inspection. MSN explains: “In simplest terms, a home appraisal determines the value of a home, while a home inspection determines the condition of a home.” The home inspection is a way to determine the current state, safety, and condition of the home before you finalize the sale. If anything is questionable in the inspection process – like the age of the roof, the state of the HVAC system, or just about anything else – you as a buyer have the option to discuss and negotiate any potential issues or repairs with the seller before the transaction is final. Your real estate agent is a key expert to help you through this part of the process. Bottom Line The appraisal and the inspection are critical steps when buying a home, and you don’t need to manage them by yourself. Reach out to a local real estate professional today so you have the expert guidance you need to navigate through the entire homebuying process. SOURCE KCM #BuyingMyths #HomeInspection #Appraisal #FirstTimeHomeBuyers #SimardRealtyGroup Ready to take advantage of today’s low mortgage rates to buy your next home? DM me to get the process started. I’ll help you navigate the digital steps you need to know to stay healthy and safe along the way in our local market.

#virtualhomebuying #realestatepro #realestate #homeownership #homebuying #realestatetips #realestatelife #realestatenews #realestateagent #realestateexpert #realestateadvice #realestatemarket #realestatetipsoftheday #realestatetipsandadvice #keepingcurrentmatters As we look back over the past year, we’ve certainly lived through one of the most stressful periods in recent history. After spending so much more time at home throughout the health crisis, some are wondering if they should move to improve their mental health and well-being. This is no surprise since the U.S. Census Bureau reported an increase in the percentage of adults with symptoms of anxiety and depression in a recent Household Pulse Survey.

There’s logic behind the idea that making a move could improve someone’s quality of life. When people change their scenery, they often feel happier. Catherine Hartley, an Assistant Professor at New York University’s Department of Psychology and co-author of a study on how new experiences impact happiness, mentioned: “Our results suggest that people feel happier when they have more variety in their daily routines—when they go to novel places and have a wider array of experiences.” If you’re looking for a new experience, planning a move into a new home may be something you’ve started to consider more carefully. If so, you’re not alone. The 2020 Annual National Movers Study by United Van Lines shows: “For customers who cited COVID-19 as an influence on their move in 2020, the top reasons associated with COVID-19 were concerns for personal and family health and wellbeing (60%); desires to be closer to family (59%); 57% moved due to changes in employment status or work arrangement (including the ability to work remotely); and 53% desired a lifestyle change or improvement of quality of life.” So, if you’re thinking of moving this year to help boost your happiness factor, here are a few questions to ask yourself as you make your decision. How’s the Weather? Is the weather something that’s important to you? Does it have a tendency to impact your mood? The World Population Review shares: “What states have the best weather? When evaluating each state for temperature, rain, and sun, some states stand out. Although climate and weather preferences are personal and subjective, some criteria are considered to make up the best weather, according to Current Results:

“Better weather” can mean different things to different people – some prefer the heat, others cooler temperatures, and some want to experience all four seasons. Think about what makes you feel happiest if you’re looking for a new location. Should I Choose the City, Suburbs, or Country? With the COVID-19 pandemic, some people are deciding to move to lower-density areas. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), mentions: “The third quarter Home Building Geography Index (HBGI) reveals that a suburban shift for consumer home buying preferences in the wake of the COVID-19 pandemic is accelerating as telecommuting is providing consumers more flexibility to live further out within large metros or even to relocate to more affordable, smaller metro areas.” Can you work from home? Are you open to a longer commute in the future? If so, a move to the suburbs or even a quieter rural area may be a win for you. Or, if you’ve always dreamed of life in the city, now may be your chance to move into town. Bottom Line As we look beyond the trials of the pandemic, many are hoping for a new beginning, and that may mean moving. Contact a local real estate advisor today to talk about your new goals and options in today’s market. SOURCE KCM #FirstTimeHomeBuyer #ForSellers #Moving #SimardRealtyGroup Some Highlights

SOURCE KCM #BuyingMyths #DownPayments #Infographics #SimardRealtyGroup |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed