|

Some Highlights:

SOURCE KCM #Buyers #Sellers #RealEstateAgent #SimardRealtyGroup #JoinExpRealty

0 Comments

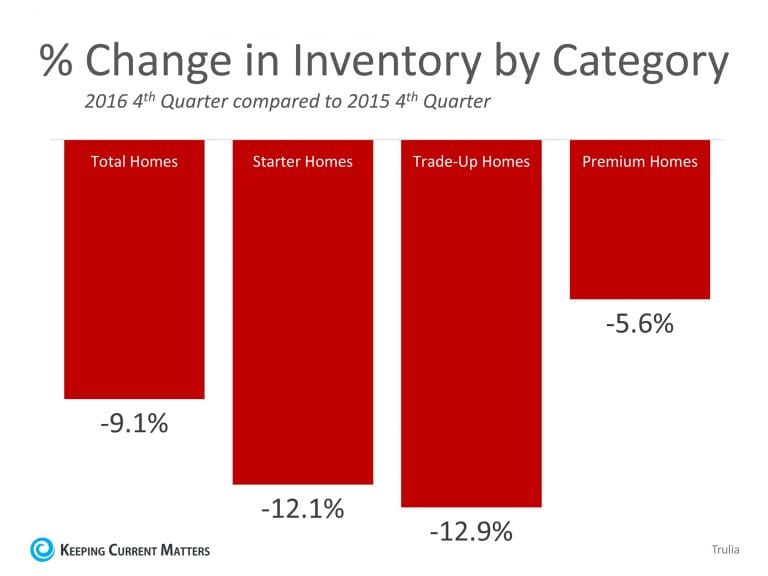

As we are about to bring in the New Year, families across the country will be deciding if this is the year that they will sell their current house and move into their dream home. Many will decide that it is smarter to wait until the spring “buyer’s market” to list their house. In the past, that might have made sense. However, this winter is not like recent years. The recent jump in mortgage rates has forced buyers off the fence and into the market, resulting in incredibly strong demand RIGHT NOW!! At the same time, inventory levels of homes for sale have dropped dramatically as compared to this time last year. Here is a chart showing the decrease in inventory levels by category: Bottom Line

Demand for your home is very strong right now while your competition (other homes for sale) is at a historically low level. If you are thinking of selling in 2017, now may be the time. SOURCE KCM #Selling #ForSellers #2017 #JoinExpRealty #SimardRealtyGroup When it comes to buying a home, whether you are a rookie homebuyer or have gone through the process many times, having a local real estate expert who is well versed in the neighborhood you are looking to move into, as well as the trends of that area, should be your goal.

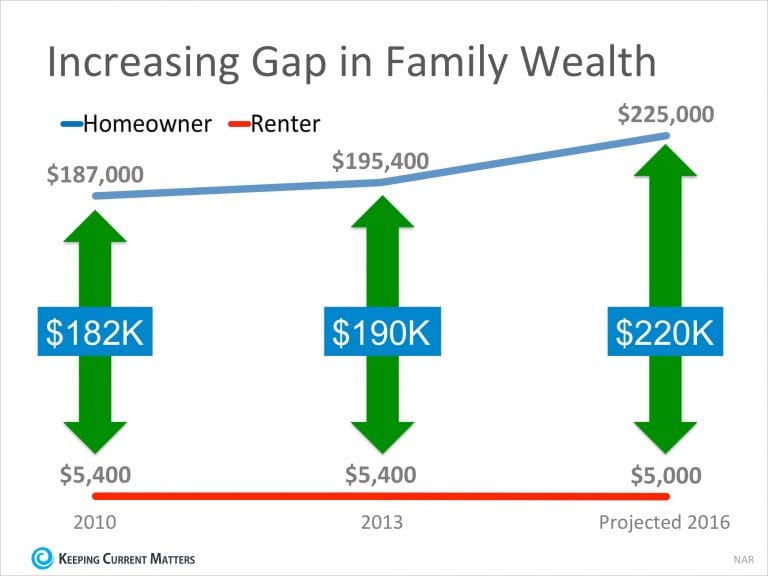

One great example of an agent who is in your corner and is always looking out for your best interests is one of the main characters on ABC’s Modern Family, Phil Dunphy. For those who aren’t familiar, the character Phil is a Realtor with a huge heart who always strives to do his best for his family and his clients. In one recent episode, Phil even shared the oath that he created and holds himself accountable to: "On my honor, I promise to aid in man's quest for shelter, to recognize I'm not just in the business of houses -- I'm in the business of dreams in the shape of houses. To disclose all illegal additions, shoddy construction, murders, and ghosts. And to put my clients' needs before my own." While this might seem silly, and it was definitely written with humor in mind, the themes of helping someone achieve the American Dream and putting a client's needs above your own are not to be taken lightly. Bottom Line When you make the decision to enter the housing market, as either a buyer or a seller, make sure you look for an agent who exemplifies these values and will help you through every step of the process. SOURCE KCM #ForBuyer #ForSellers #RealEstateAgent #ExpRealty #SimardRealtyGroup Every three years, the Federal Reserve conducts a Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner’s net worth is 36 times greater than that of a renter ($194,500 vs. $5,400). In a Forbes article, the National Association of Realtors’ (NAR) Chief EconomistLawrence Yun predicts that by the end of 2016, the net worth gap will widen even further to 45 times greater. The graph below demonstrates the results of the last two Federal Reserve studies and Yun’s prediction: Put Your Housing Cost to Work for You

As we’ve said before, simply put, homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you are contributing to your net worth. Every time you pay your rent, you are contributing to your landlord’s net worth. The latest National Housing Pulse Survey from NAR reveals that 85% of consumers believe that purchasing a home is a good financial decision. Yun comments: “Though there will always be discussion about whether to buy or rent, or whether the stock market offers a bigger return than real estate, the reality is that homeowners steadily build wealth. The simplest math shouldn’t be overlooked.” Bottom Line If you are interested in finding out if you could put your housing cost to work for you by purchasing a home, meet with a real estate professional in your area who can guide you through the process. Source KCM #Buyers #Renters #JoinExpRealty #SimardRealtyGroup Some Highlights:

Source KCM #HousingMarketUpdate #JoinExpRealty #SimardRealtyGroup You may have heard that the Federal Reserve raised rates last week… But what does that mean if you are looking to buy a home in the near future?

Many in the housing industry have predicted that the Federal Open Market Committee (FOMC), the policy-making arm of the Federal Reserve, would vote to raise the federal fund's target rate at their December meeting. For only the second time in a decade, this is exactly what happened. There were many factors that contributed to the 0.25 point increase (from 0.50 to 0.75), but many are pointing to the latest jobs report and low unemployment rate (4.6%) as the main reason. Tim Manni, Mortgage Expert at Nerd Wallet, had this to say, “Homebuyers shouldn’t be particularly concerned with [last week’s] Fed move. Even with rates hovering over 4 percent, they’re still historically low. Most market observers are expecting a gradual rise in home loan rates in the near term, anticipating mortgage rates to stay under 5 percent through 2017.” Bottom Line Only time will tell what the long-term impact of the rate hike will be, but in the short term, there should be no reason for alarm. SOURCE KCM #InterestRates #Buyer #ExpRealty #SimardRealtyGroup According to a recent analysis by CoreLogic, Millennial renters (aged 20-34) who have student loan debt also have higher credit scores than those who do not have student loans.

This may come as a surprise, as there is so much talk about student loans burdening Millennials and holding them back from many milestones that previous generations have been able to achieve (i.e. homeownership, investing for retirement). CoreLogic used the information provided on rental applications and the applicants’ credit history from credit bureaus to determine if there was a correlation between student loan debt and credit scores. The analysis concluded that: “Student loan debt did not prevent millennials from access to credit even though it may delay their homebuying decisions.” In fact, those with a higher amount of debt actually had higher credit scores. “Renters with student loan debt have higher average credit scores than those without; and those with higher debt amounts have higher average credit scores than those with lower student loan debt amounts.” Bottom Line Millennials are on pace to become the most educated generation in our nation’s history, with that comes a pretty big bill for education. But there is a light at the end of the tunnel: “Despite the fact that student loan debt has grown into the nation’s second largest consumer debt, following mortgage, and has created a significant financial burden for millennials, it does not appear to prevent millennials from accessing credit.” SOURCE KCM #Millenials #Buyers #JoinExpRealty #SimardRealtyGroup There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity. Are you ready to put your housing cost to work for you? Christina Boyle, Senior Vice President and Head of Single-Family Sales & Relationship Management at Freddie Mac, explains another benefit of securing a mortgage vs. paying rent: “With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.” Bottom Line This holiday season, why not give yourself the gift of homeownership? Lock in your housing costs for the next 30 years and guarantee you are the one building wealth. SOURCE KCM #ForBuyers #RentorBuy #ExpRealty #SimardRealtyGroup |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed