|

THE WALEK FARMS PROPERTY YOU'VE BEEN WAITING FOR! FANTASTIC CUL-DE-SAC LOCATION, LOW MAINTAINENCE, JUST MOVE RIGHT IN! INSIDE YOU'LL FIND AN UPDATED MOVE-IN CONDITION HOME WITH A KITCHEN OPEN TO THE LIVING ROOM, GRANITE COUNTER TOPS, AND HARDWOOD FLOORS. MASTER BEDROOM WITH HUGE WALK-IN CLOSET.

View full property info here: http://14walekfarmsroad.thebestlisting.com/ #PriceReduced #Manchester #SellingCT #SimardRealtyGroup

0 Comments

Some Highlights:

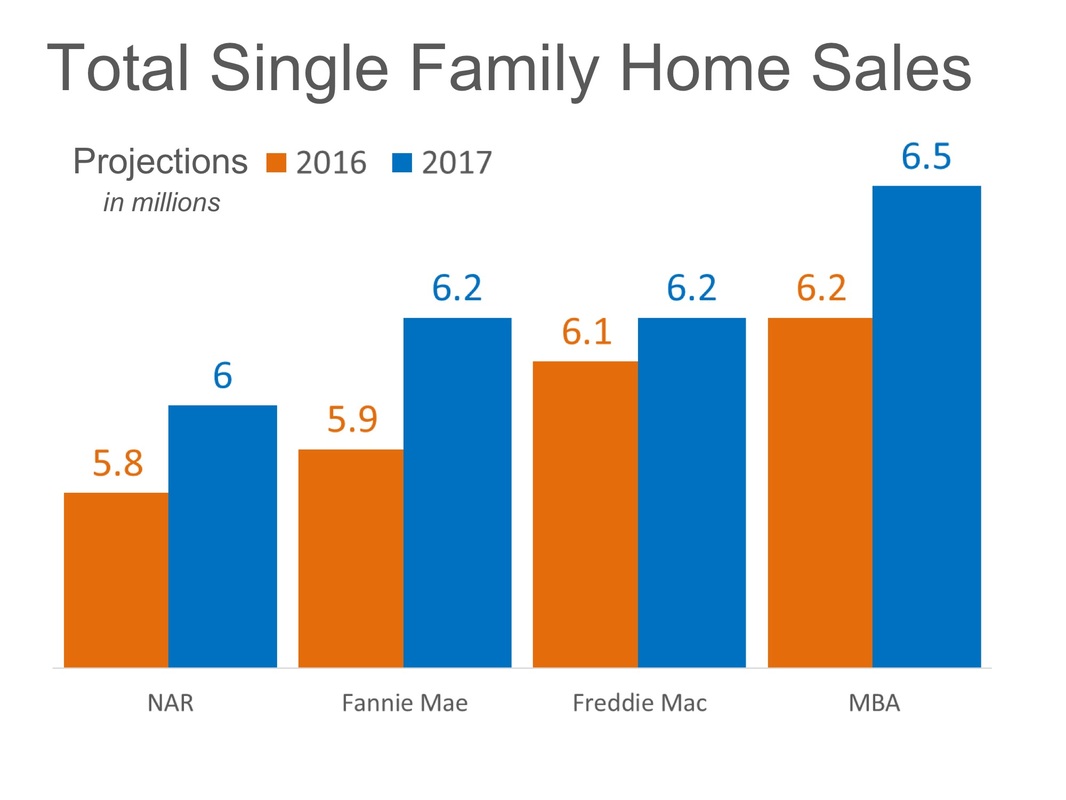

SOURCE KCM #HomeSalesInventory #RealEstateNews #SimardRealtyGroup The National Association of Realtors, The Mortgage Bankers’ Association, Freddie Mac andFannie Mae are all projecting that home sales will increase in 2017. Here is a chart showing what each entity is projecting in sales for this year and the next. As we can see, each is projecting sizable increases in home sales next year. If you have considered selling your house recently, now may be the time to put it on the market.

SOURCE KCM #HomeSales #SellingCT #SimardRealtyGroup Whether or not you’ve ever seen an episode of Modern Family, or know who Phil Dunphy’s character is, the concept of knowing that you have someone in your corner who is looking out for your best interests is something we all want.

When it comes to buying a home, whether you are a rookie homebuyer or have gone through the process many times, having a local real estate expert who is well versed in the neighborhood you are looking to move into, and the trends of the area, should be your goal. For those who aren’t familiar, the character Phil Dunphy is a Realtor with a huge heart who always strives to do the best for his family and his clients. In one recent episode, Phil even shared the oath that he created and holds himself to: "On my honor, I promise to aid in man's quest for shelter, to recognize I'm not just in the business of houses -- I'm in the business of dreams in the shape of houses. To disclose all illegal additions, shoddy construction, murders, and ghosts. And to put my clients' needs before my own." While this might seem silly, and it was definitely written with humor in mind, the themes of helping someone achieve the American Dream and putting a client's needs above your own are not to be taken lightly. Bottom Line When you make the decision to enter the housing market, as either a buyer or a seller, make sure you look for an agent who exemplifies these values and will help you through every step of the process. SOURCE KCM #Realtor #Agent #RealEstate #SimardRealtyGroup According to the latest Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, the U.S. housing market has continued to move deeper into buy territory, supporting the belief that housing markets across the country remain a sound investment.

The BH&J Index is a quarterly report that attempts to answer the question: In today’s housing market, is it better to rent or buy a home? The index examines the entire US housing market and then isolates 23 major cities for comparison. The researchers “measure the relationship between purchasing property and building wealth through a buildup in equity versus renting a comparable property and investing in a portfolio of stocks and bonds.” Ken Johnson, Ph.D., Real Estate Economist & Professor at Florida Atlantic University, and one of the index’s authors explains that: “Housing prices, in general, continue to slow and when considered in light of the recent trends in the Buy vs. Rent Index signal that ownership remains an excellent investment for the majority of Americans.” While 15 of the 23 metropolitan markets examined moved further into buy territory since last quarter, Dallas, Denver, and Houston are three of the major cities that are currently deep into rent territory. In these three markets, it is estimated that renting will top homeownership 7 out of 10 times. Eli Beracha, Ph.D., Assistant Professor in the T&S Hollo School of Real Estate at FIU,believes that, in these three markets, the “strong odds in favor of renting to create more wealth should begin to have an impact on the demand for home ownership and from that, impact property prices in these areas.” Simply put, home prices in these areas will begin to return to more normal levels once residents realize that renting may be a better choice, therefore bringing home affordability back as well. Bottom Line The majority of the country is strongly in buy territory. Buying a home makes sense socially and financially. Rents are predicted to increase substantially in the next year. Protect yourself from rising rents by locking in your housing cost with a mortgage payment now. SOURCE KCM #USHousingMarket #ForBuyers #SimardRealtyGroup Coming Soon!

44 Wolcott Ave West Springfield MA at $215,000. 4 beds 1.5 bath Just move in! This home has been updated, freshly painted, and has a newer roof.Text or call Stephen at 860-919-0991 to schedule a showing. #ComingSoon #SellingMA #SimardRealtyGroup It’s that time of year; the seasons are changing and with them come thoughts of the upcoming holidays, family get-togethers, and planning for a new year. Those who are on the fence about whether or not now is the right time to buy don’t have to look much further to find four great reasons to consider buying a home now, instead of waiting.

1. Prices Will Continue to Rise CoreLogic’s latest Home Price Index reports that home prices have appreciated by 6% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 5.4% over the next year. The Home Price Expectation Survey polls a distinguished panel of over 100 economists, investment strategists, and housing market analysts. Their most recent report projects home values to appreciate by more than 3.5% a year for the next 5 years. The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense. 2. Mortgage Interest Rates Remain at Historic Lows Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have remained at or below 3.5% for 13 consecutive weeks. The Mortgage Bankers Association, Freddie Mac & the National Association of Realtors are in unison, projecting that rates will increase by this time next year. Any increase in rates will impact YOUR monthly mortgage payment. A year from now, the percentage of your income that you spend on housing will increase substantially if you choose to wait. 3. Either Way You Are Paying a Mortgage Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage - either your mortgage or your landlord’s. As a paper from the Joint Center for Housing Studies at Harvard University explains: “Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.” 4. It’s Time to Move on with Your Life The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise. But what if they weren’t? Would you wait? Look at the actual reason you are buying and decide whether it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer or you just want to have control over renovations, maybe now is the time to buy. If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings. SOURCE KCM #HomeBuyers #FallRealEstateMarket #SimardRealtyGroup Some Highlights:

SOURCE KCM #ForeClosure #HousingMarketUpdate #InfoGraphics #SimardRealtyGroup Whenever there is talk about an improving housing market, some begin to show concern that we may be headed toward another housing bubble that will be followed by a crash similar to the one we saw last decade.

Here are five data points that show the housing market will continue to recover, and that a new housing crisis is not about to take shape. 1) Mortgage availability is increasing, but is nowhere near the levels we saw in 2004-2006. A buyer’s chances of being approved for a mortgage have increased over the last three years; That’s good news for the market. This is not a precursor to another challenge, as many experts maintain that it is still too difficult for many buyers to attain house financing. As Jonathan Smoke, the Chief Economist of realtor.com, recently explained: “The havoc during the last cycle was the result…of speculation fueled by loose credit. That’s the exact opposite of what we have today.” 2) The Housing Affordability Index, which measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home, based on the most recent price and income data. The current index shows that it is more affordable to buy a home today than at any other time between 1990 and 2008. With median incomes finally beginning to rise, houses should continue to remain affordable and housing demand should remain strong. 3) Home prices are well within historic norms. Prices have increased substantially over the last several years; However, those increases followed the housing crash of 2008 and national prices are still not back to 2006 levels. If there were no bubble (and subsequent bust), today’s prices would actually be lower than if they were measured by historic appreciation levels from 1987-1999. 4) Demand for housing, as measured by new household formations, is growing. The Urban Land Institute projects that 5.95 million new households will be formed over the next three years. Even if the homeownership rate drops to 60%, that would be over 3.5 million new homeowners entering the market. 5) New home starts are finally beginning to increase. This helps eliminate the number one challenge in the industry – lack of inventory. And it does so in two ways:

This means that there will be an increase in both new construction and existing home inventories. Agents: Join us later on today for our free webinar at 2PM ET/1PM CT as we give you the tools and understanding you’ll need to calm your clients’ doubts and position yourself as a market expert. Reserve your seat today for “5 Graphs that Prove the Housing Market is Strong and Will Continue to Surge.” SOURCE KCM #RealEstateMarket #Buyers #Sellers #SimardRealtyGroup Are you looking for the perfect country retreat? Look no further, this is it! Amazing setting with so many possibilities. The special property consists of just over 35 acres, a post and beam cape cod style home with 2,600 sq ft of living space, 4 working fireplaces including a beehive oven, a stone patio area, 2 new chimneys, an over-sized 2 car garage, original wide board flooring, exposed beams, family room with cathedral ceiling, and the charm of many original period details. Outside there are many stone walls, mature plantings and perennials, a small spring fed pond, and possible building lot.

View full info: http://48robertsvilleroad.thebestlisting.com/ #PriceReduced #Barkhamstead #SellingCT #SimardRealtyGroup |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed