|

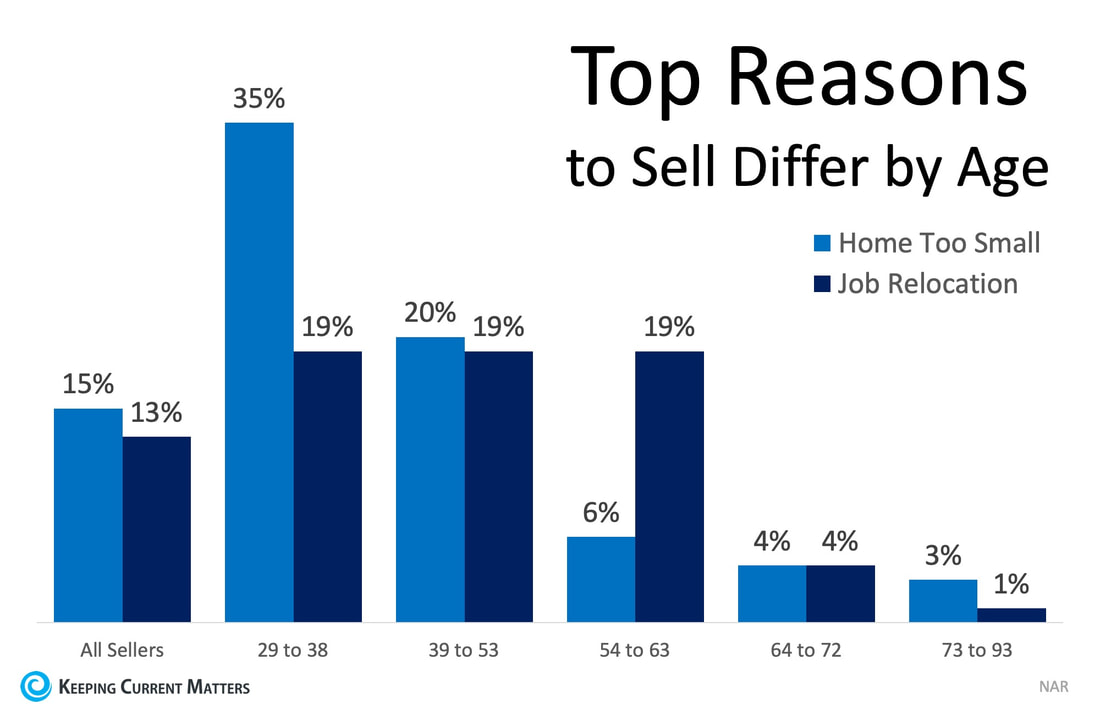

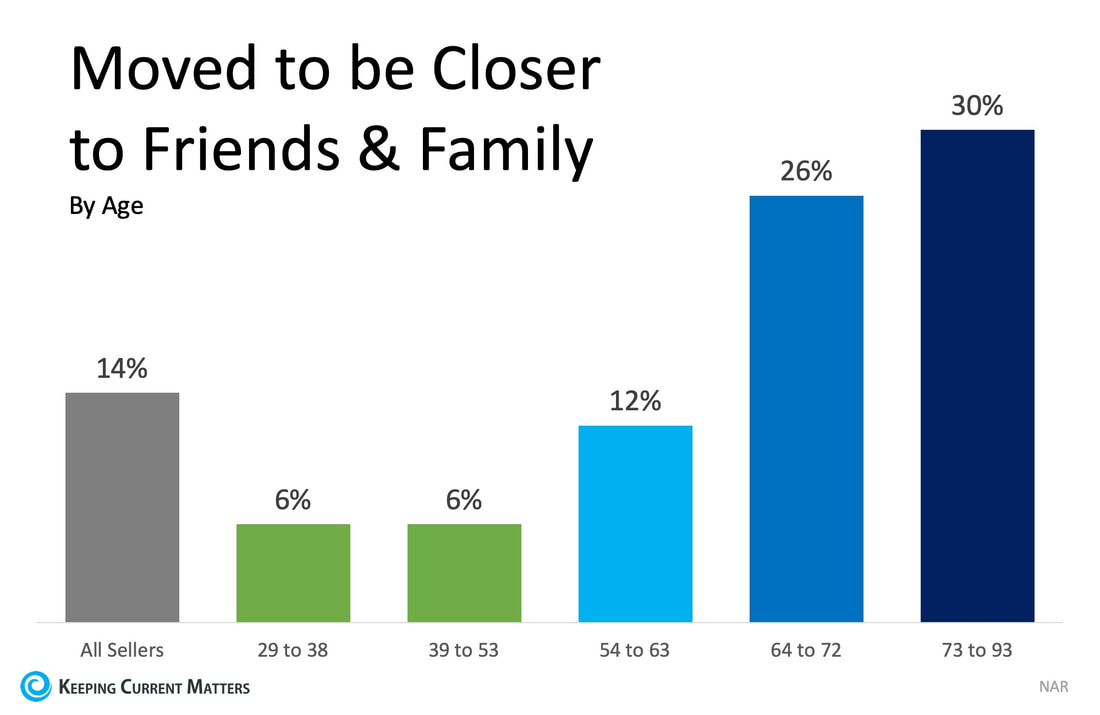

There are many reasons why a homeowner decides to sell their house and move. The latest Generational Trends Report from the National Association of Realtors asked recent home sellers to share their reason for moving. The younger the respondents, the more likely their top response centered around needing a larger home (ages 29 to 53). Relocating for a job was the top reason for those ages 54 to 63 and the second most popular response for those under 53. The chart below shows the breakdown for these two reasons. For homeowners over the age of 64, wanting to be closer to friends and family served as the top motivator to move. Downsizing to a smaller home or moving due to retirement came in as a close second and third. Have you outgrown your current house? Are you a homeowner who can relate to wanting to be closer to family and friends? Is your house becoming a burden to clean now that the kids have moved out?

Bottom Line Contact a local real estate professional who can help set you on the path to selling your current house and finding the home that fits your needs, today! Have you outgrown your current house? Are you a homeowner who can relate to wanting to be closer to family and friends? Is your house becoming a burden to clean now that the kids have moved out? Bottom LineContact a local real estate professional who can help set you on the path to selling your current house and finding the home that fits your needs, today SOURCE KCM #HousingMarket #Updates #SimardRealtyGroup #eXpRealty

0 Comments

For Sale in Southwick!

13 N Pond Rd, Southwick, MA Unique opportunity to build your dream home on North Pond! Enjoy epic views from this elevated .82 acre lot. Over 170 feet of shoreline frontage on North Pond (Congamond Lakes) can now be yours. Allows for water sports of all kinds as well as great fishing. View more info and photos here: https://13npondrd.thebestlisting.com/ #ForSale #SellingMA #Land #Southwick #SimardRealtyGroup #eXpRealty Some Highlights:

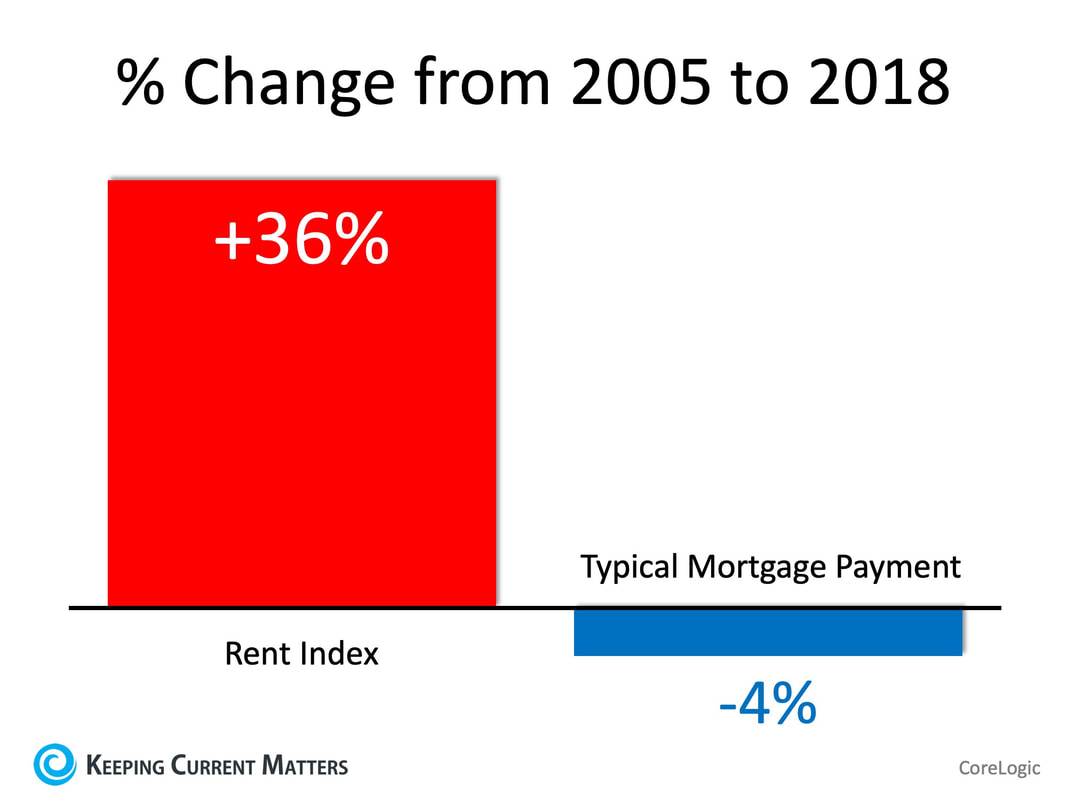

SOURCE KCM #HomeSalesReport #ForBuyersandSellers #SimardRealtyGroup #eXpRealty In a recent Insights Blog, CoreLogic reported that rent prices have skyrocketed since 2005. Meanwhile, the typical mortgage payment has actually decreased. “CoreLogic’s national rent index was up 36% in December 2018 compared with December 2005, while the typical mortgage payment was down 4% over that period.” Why the difference between the costs of renting versus owning?

It makes sense that rents have risen. However, how did mortgage payments decrease? CoreLogicexplained: “It’s mainly because mortgage rates back in December 2005 were significantly higher, averaging 6.3% for a fixed-rate 30-year loan, compared with 4.6% in December 2018. The national median sale price in December 2005 – $190,000 – was lower than the $220,305 median in December 2018, but because of higher mortgage rates in 2005 the typical monthly mortgage payment was slightly higher back then – $941 – compared with $904 in December 2018.” Additionally, a recent report by the National Association of Realtors (NAR) showed that purchasing a home requires less of your monthly paycheck. According to the Economists’ Outlook Blog, NAR’s February 2019 Housing Affordability Index showed that the “percentage of income needed” to pay the typical mortgage has decreased the last three months.

Bottom Line What does this all mean to the current housing market? We think First American said it best in a post last week: “The mortgage rate-driven affordability surge has arrived just in time… Rising affordability has already benefited home buyers and, if the lower rate environment persists, we’re in for a great spring home-buying season.” SOURCE KCM #ForBuyers #ForSellers #HousingMarketUpdates #SimardRealtyGroup #joineXpRealty According to a new survey from Move.com, the wave of first-time homebuyers hitting the market this summer has resulted in an interesting statistic. Nearly 60% of buyers searching for a home this spring are willing to consider buying a fixer-upper, with 95% believing that the projects needed will increase their new home’s value!

Realtor.com’s Chief Economist, Danielle Hale, pointed to low-inventory at the entry-level price range for the increase in willingness to renovate. “The combination of rising home prices and limited entry-level homes for sale is prompting many home shoppers to consider homes that need renovating. Replete with inspiration at their fingertips – like Pinterest, Instagram, and various home renovation TV shows – some home shoppers are comfortable tackling home renovation jobs to find a home that balances their needs with their budget.” Just over half of all respondents who said they would be willing to buy a home in need of some TLC, would also spend more $20,000 to make the home fit their needs. The most common ‘expected’ renovation is a kitchen remodel which can run anywhere from $22,000 for a minor remodel to $66,000 for a major remodel. This isn’t a new trend by any means. According to the Joint Center for Housing Studies at Harvard University,home improvement project spending reached a new high in 2018. “Americans spent $336.9 billion on remodeling projects, up 7.4% from the $313.6 billion a year earlier.” Home renovation television shows have given many buyers hope that they could renovate a home they can afford into their dream home! Bottom Line If you are one of the many Americans considering buying a home this spring, meet with a local real estate professional who can help you find a house with the potential to be your dream home! SOURCE KCM #Demographics #ForBuyers #ForSellers #SimardRealtyGroup #eXpRealty Some Highlights:

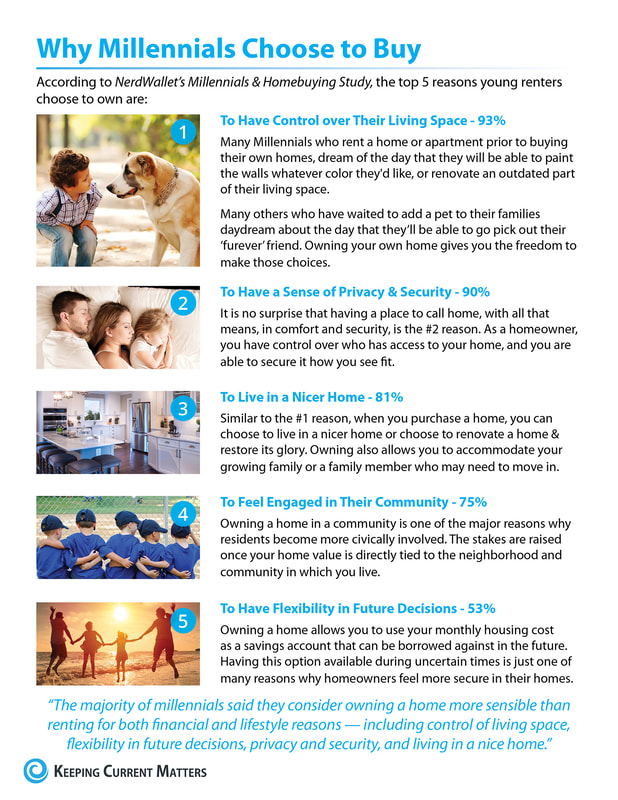

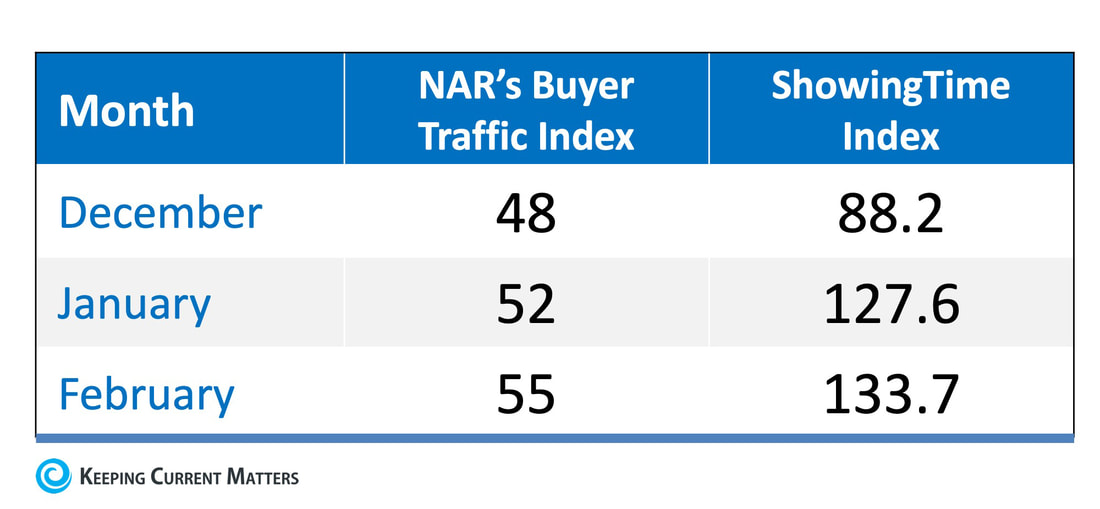

SOURCE KCM #Infographics #Millennials #Buyers #SimardRealtyGroup #eXpRealty Last fall, some predicted that the 2019 residential real estate market would be a disaster. There was even belief we might experience a housing crash like the one that occurred during the last decade. However, according to two separate reports*, buyer demand dramatically increased over the last three months, leading into this spring buyers’ market (the March data is not yet available). Both the ShowingTime Showing Index and the National Association of REALTORS Buyer Traffic Index show that buyer demand has increased in each of the last three months Why the increase in demand? Increased buying power.

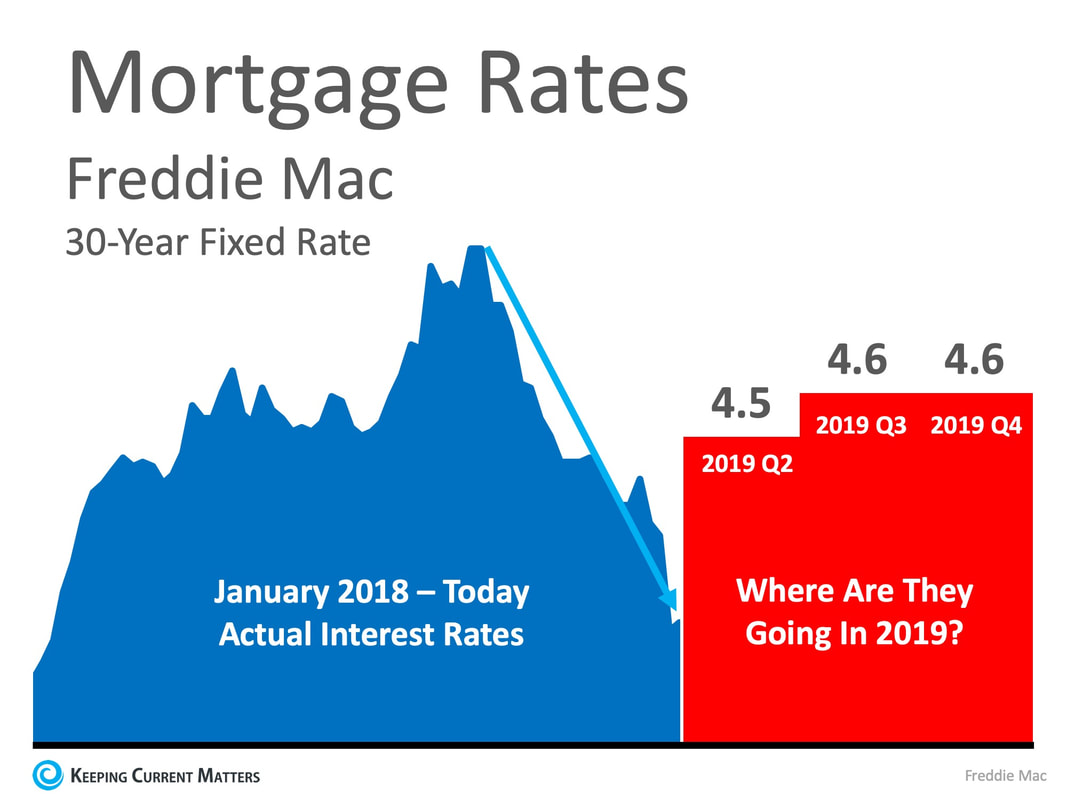

According to the National Association of Realtors’ Economists’ Outlook Blog, purchasing a home has become more affordable, which has led to increased demand. “Due to the combination of falling home prices and mortgage rates, the income needed to make an affordable mortgage payment (mortgage no more than 25% of income) on a median-priced home with 10% down payment and 30-year fixed rate mortgage decreased from $60,425 in June 2018 to $53,783 as of February 2019, and the difference of $6,642 represents a gain in buying power because one can afford a home purchase at a lower level of income.” Bottom Line It appears the spring buyers’ market is going to be much stronger than many had projected. Whether you are selling or buying, this is important news. SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #eXpRealty Interest rates for a 30-year fixed rate mortgage have been on the decline since November, now reaching lows last seen in January 2018. According to Freddie Mac’s latest Primary Mortgage Market Survey, rates came in at 4.12% last week! This is great news for anyone who is planning on buying a home this spring! Freddie Mac had this to say, “Mortgage interest rates have been steadily declining since the start of 2019. These lower mortgage interest rates combined with a strong labor market should attract prospective homebuyers this spring and could help the housing sector regain its momentum later in the year.” To put the low rates in perspective, the average for 2018 was 4.6%! The chart below shows the recent drop, and also shows where the experts at Freddie Mac believe rates will be by the end of 2019. Bottom Line

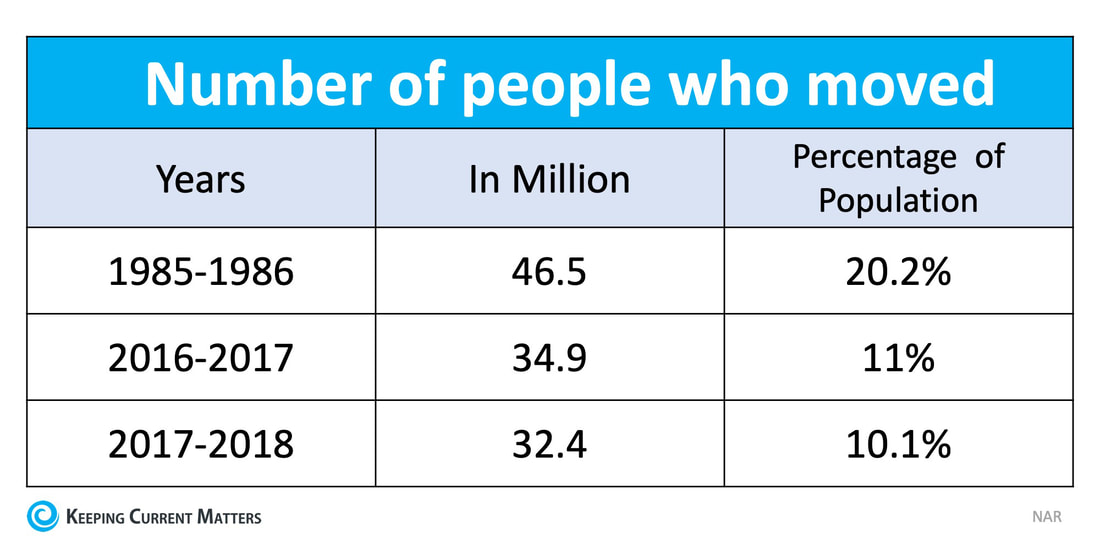

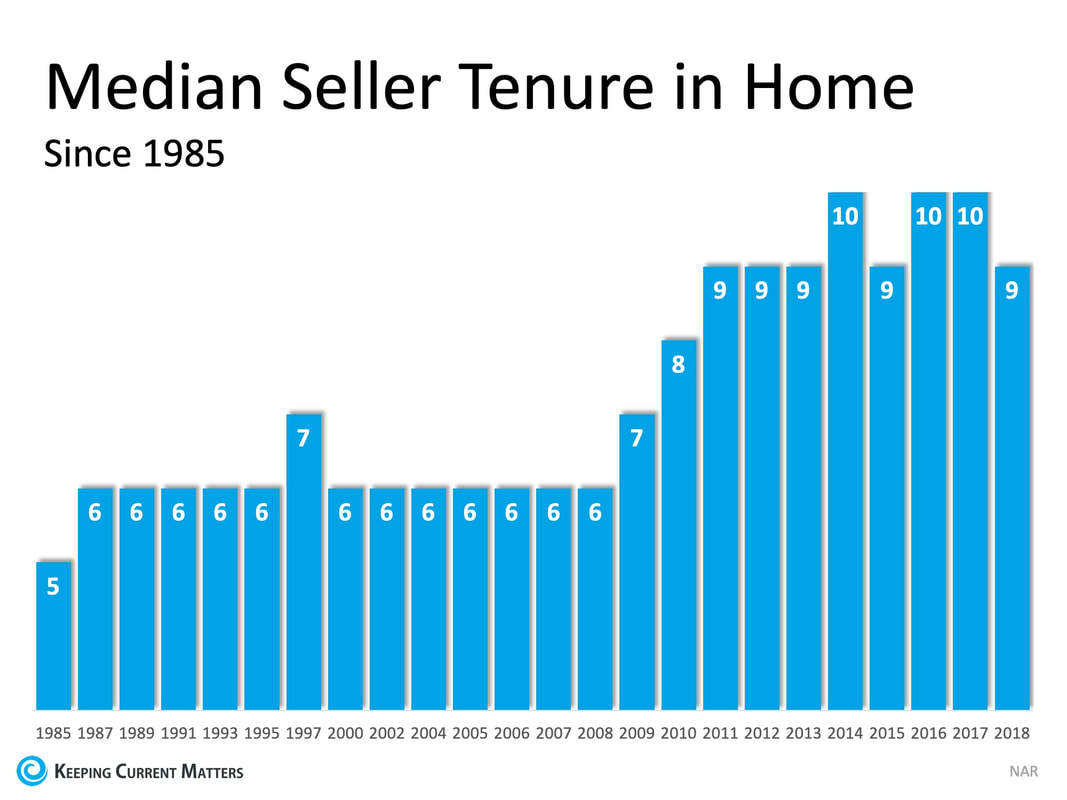

If you plan on buying a home this year, meet with a local real estate professional who can help you start your home search to ensure you can lock in these historically low rates today! SOURCE KCM #HousingMarketUpdate #Sellers #Buyers #SimardRealtyGroup #eXpRealty Every month, the National Association of Realtors (NAR) releases their Seller Traffic Index as a part of their Realtors Confidence Index. In the latest release, NAR reported that homeowners have been reluctant to sell their houses. This is reflected when broken down by state. Only 11 states have a stable level of seller traffic compared to the remainder of the country, which came in with a weak rating. As we can see in the following table, the number of people who moved last year is half of what the rate was in the 1980s. This does not come as a surprise, as tenure length (the number of years someone owns a home before moving again) among existing homeowners has increased. It has risen from an average of 6 years from 1985 to 2008, up to 9.5 years over the last few years. This is shown in the graph below: As we can see, there is a pent-up seller demand!

What led to this change in behavior? Falling prices during the housing crisis led to many homeowners having negative equity in their home, meaning they owed more on their mortgage than the home was worth. Others were able to secure a low interest rate on their mortgage and have not been quick to obtain a new mortgage with a higher rate. Will this trend continue? Recently NAR reported that “69% of people believe now is a good time to sell a home.” With a strong economy, low interest rates, and wages continuing to rise, some homeowners will be ready to put their house on the market and move up to the home of their dreams! Bottom Line There is a great opportunity for sellers to take advantage of the current real estate market before new inventory comes to market. If you are considering selling your house or would like to know your options, contact a local real estate professional today who can help you to understand the possibilities available to you! SOURCE KCM #InterestRates #MoveUpBuyers #SimardRealtyGroup #eXpRealty If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in the real estate market. Ask yourself the following three questions to help determine if now is a good time for you to buy in today’s market. 1. Why am I buying a home in the first place? This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money. For example, a study by realtor.com found that “73% said buying in a good school district was “important” in their search.” This report supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. The actual reasons are:

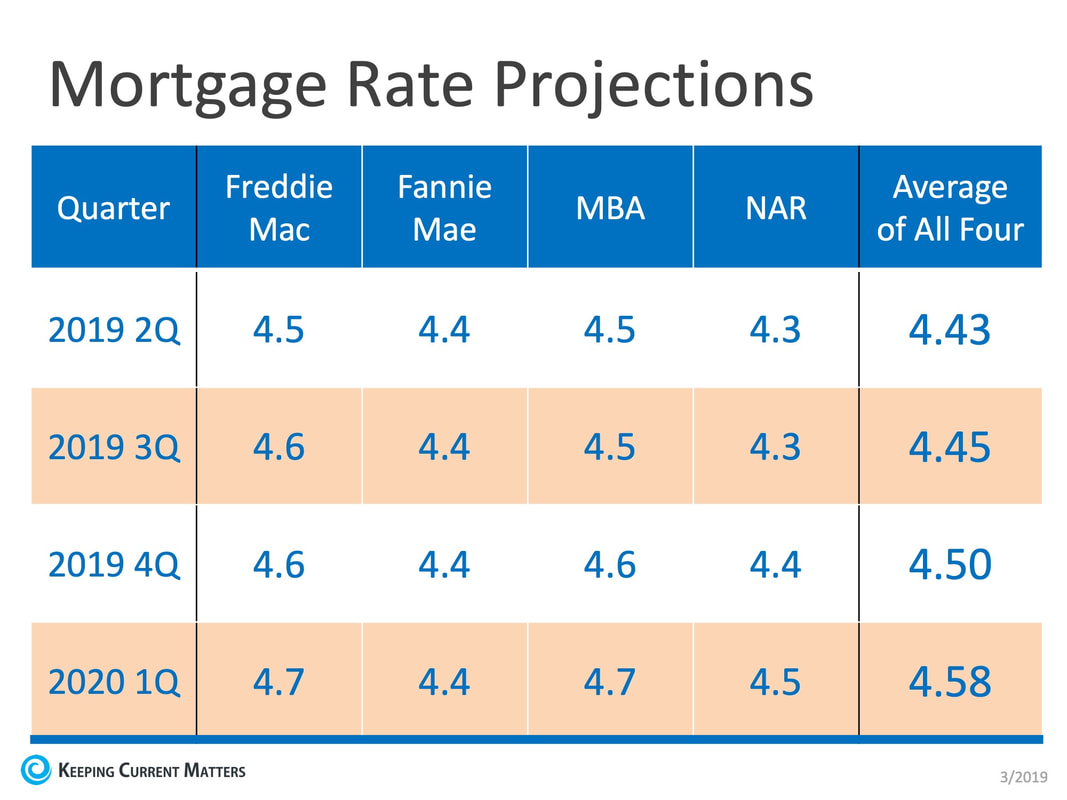

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not. 2. Where are home values headed? According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in February (the latest data available) was $249,500. This is up 3.6% from last year. The increase also marks the 84th consecutive month with year-over-year gains. Looking at home prices year over year, CoreLogic is forecasting an increase of 4.6%. In other words, a home that costs you $250,000 today will cost you an additional $11,500 if you wait until next year to buy it. What does that mean to you? Simply put, with prices increasing, it may cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy. 3. Where are mortgage interest rates headed? A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates. Freddie Mac, Fannie Mae, the Mortgage Bankers Association and NAR have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below: Bottom LineOnly you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #eXpRealty |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed