|

Your children have finally moved out and you and your spouse now live alone in a four-bedroom colonial (or a similar type of house). You have two choices to make:

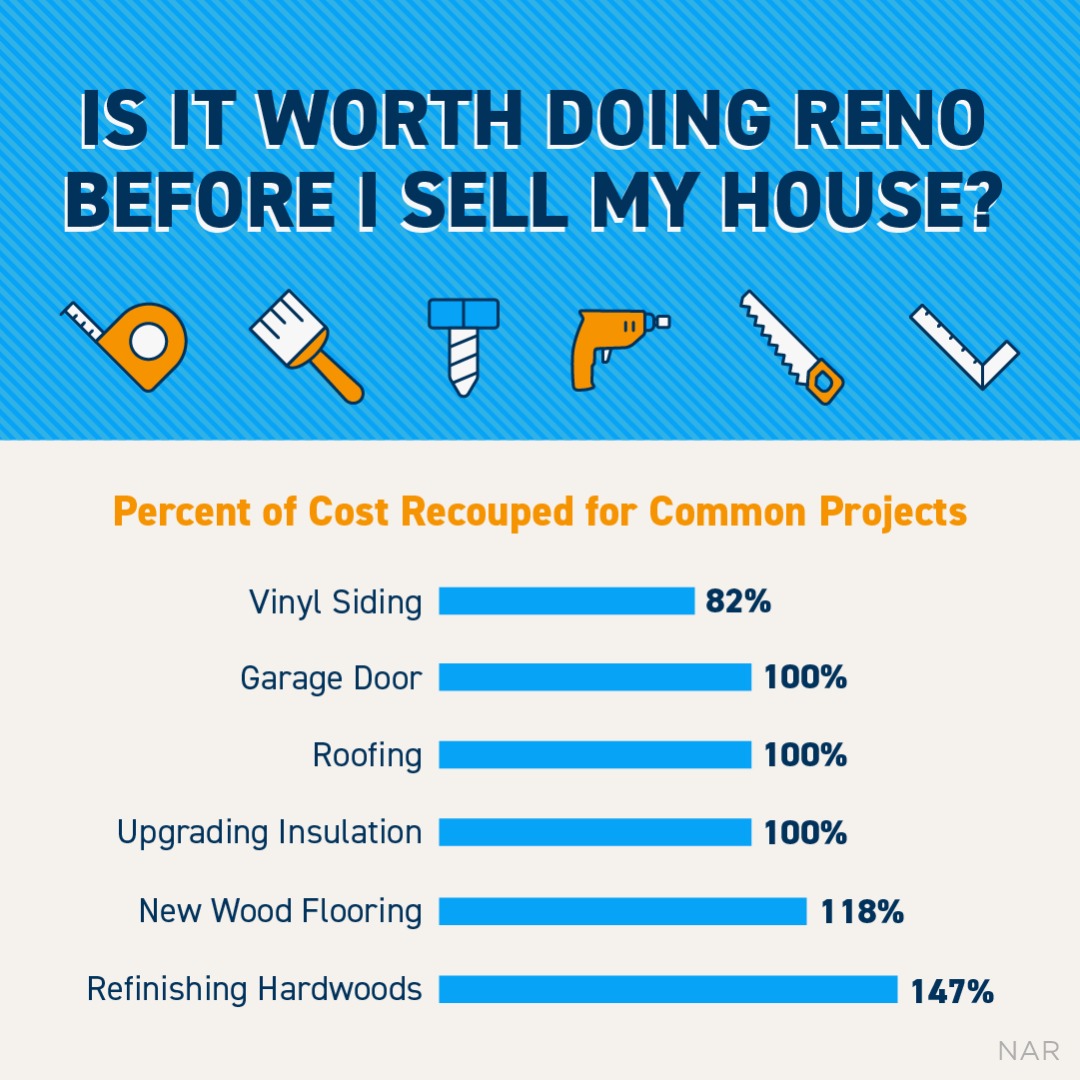

Based on the record of dollars spent on remodeling and renovations, it appears that many homeowners are deciding on number one. But, is that the best long-term solution? If you currently live in a 3-4-bedroom home, you probably bought it at a time when your children were the major consideration in determining family housing needs. Along with a large home, you more than likely also considered school district, the size of the property and the makeup of other families living in the neighborhood (example: you wanted a block with other kids your children could play with and a backyard large enough to accommodate that). Remodeling your home to meet your current needs might mean combining two bedrooms to make one beautiful master suite and changing another bedroom into the massive walk-in closet you always wanted. However, if you live in a neighborhood that historically attracts young families, you may be dramatically undermining the value of your house by cutting down the number of bedrooms and making it less desirable to the typical family moving onto your block. And, according to a recent study, you will recoup only 64.4% of a remodeling project’s investment dollars if you sell in the future. Your home is probably at its highest value as it stands right now. Instead of remodeling your house, it may make better financial sense to sell your current home and purchase a home that was built specifically to meet your current lifestyle and desires. In many cases, this well-designed home will give you exactly what you want in less square footage (read less real estate taxes!) than your current home. Bottom Line If you are living in a house that no longer fits your needs, at least consider checking out other homes in your area that would meet your lifestyle needs before taking on the cost and hassle of remodeling your current house. SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #ExpRealty

0 Comments

According to Black Knight Financial Service’s Mortgage Monitor Report, 1.5 million Americans have purchased a home with down payments under than 10% over the last 12 months. This is great news for buyers as this marks a 7-year high.

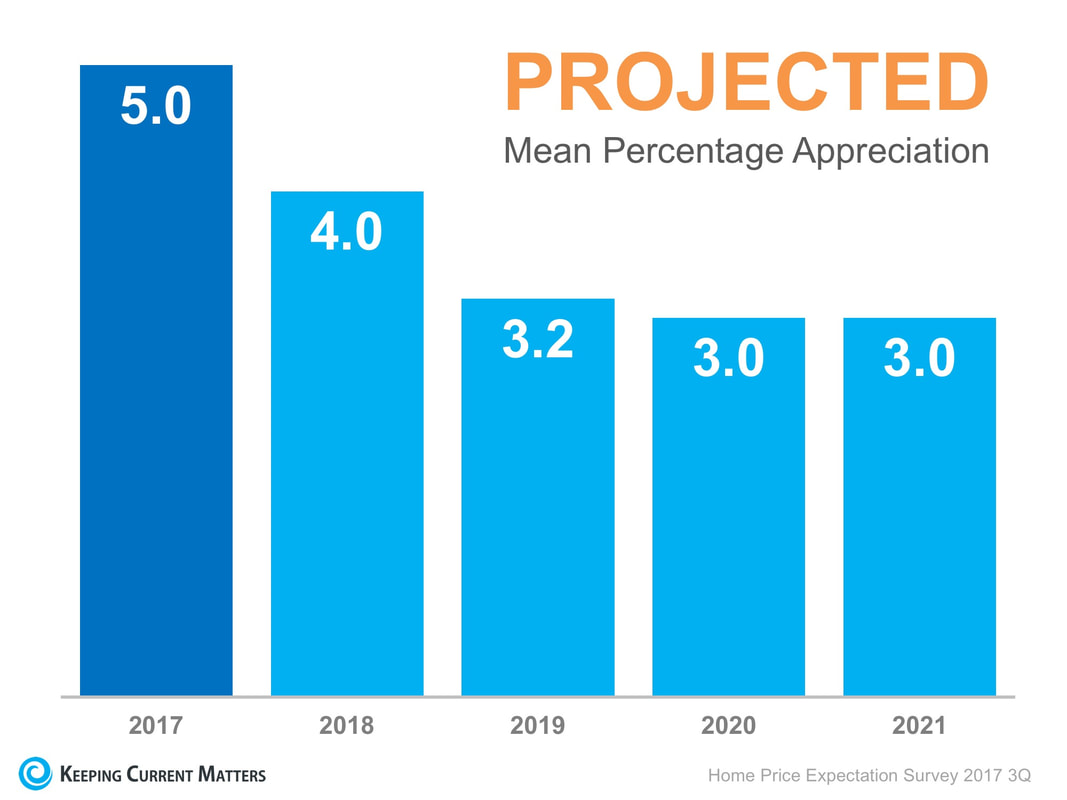

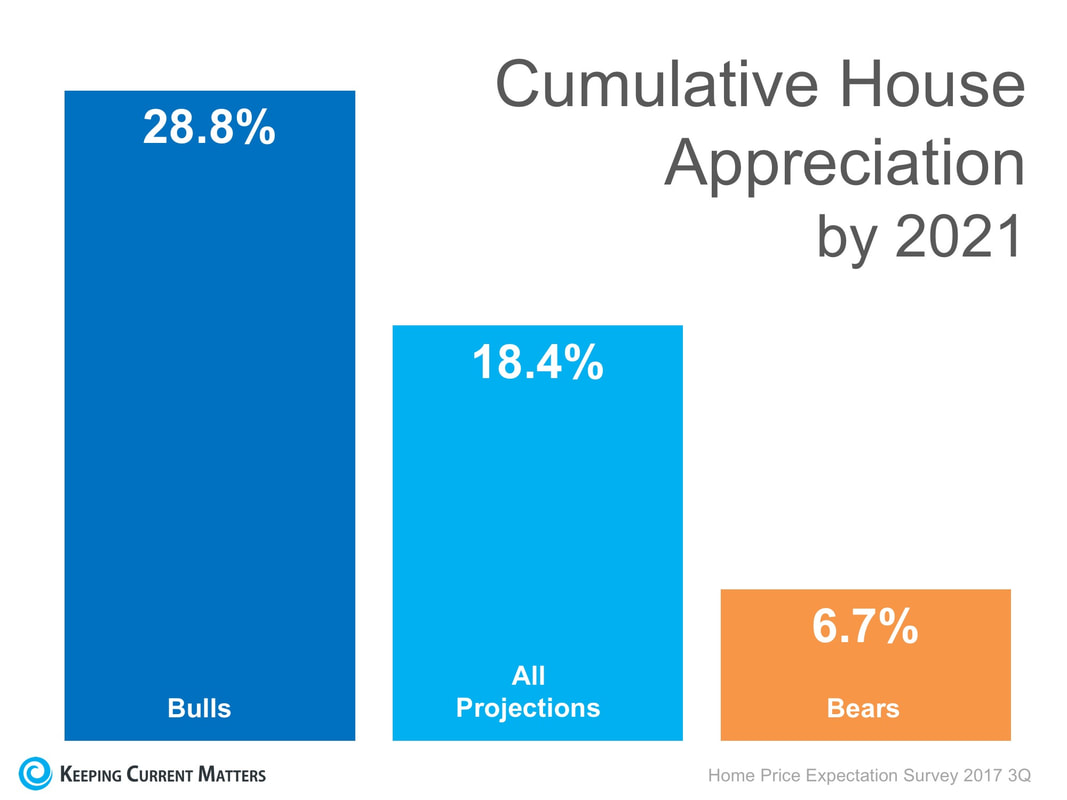

Many mortgage programs offered by agencies like Freddie Mac and Fannie Mae allow buyers to put down as low as 3% to purchase their dream homes. The strength of the housing market has aided buyers who used low-down-payment programs to buy. As a recent CNBC article points out, “Defaults on recent low down payment loans, so far, are slow, but that is as much a factor of the good credit quality as it is the strength of the housing market. Home prices are rising incredibly fast, meaning those borrowers are gaining equity in their homes quickly.” Low down payments aren’t just great for first-time homebuyers. These programs have allowed homeowners who want to capitalize on the equity they have in their homes to use the profit from their sale to pay off high-interest credit cards, fund education or even start a business. According to a new Census Report, the Annual Survey of Entrepreneurs, home equity was used to start 7.3% of all businesses in the United States, which equates to over 284,000! The industries that saw the most growth from home equity are accommodation & food services, manufacturing and, retail trade. Bottom Line Gone are the days of ‘20% down or no mortgage.’ What could you build with the equity in your house? Meet with a real estate professional who can evaluate your ability to achieve your dreams today! SOURCE KCM #DownPayments #Buyers #Sellers #SimardRealtyGroup #JoinExpRealty Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts, and investment & market strategists about where they believe prices are headed over the next five years. They then average the projections of all 100+ experts into a single number. The results of their latest survey: Home values will appreciate by 5.0% over the course of 2017, 4.0% in 2018, 3.2% in 2019, 3.0% in 2020, and 3.0% in 2021. That means the average annual appreciation will be 3.64% over the next 5 years. The prediction for cumulative appreciation increased from 17.8% to 18.4% by 2021. The experts making up the most bearish quartile of the survey are projecting a cumulative appreciation of 6.7%. Bottom LineIndividual opinions make headlines. We believe this survey is a fairer depiction of future values.

SOURCE KCM #ForBuyers #Pricing #SimardRealtyGroup #JoinExpRealty Congrats to our sellers for putting this amazing home Under Contract! 🎉🎉🎉 Looking forward to a successful closing! 👍👍👍

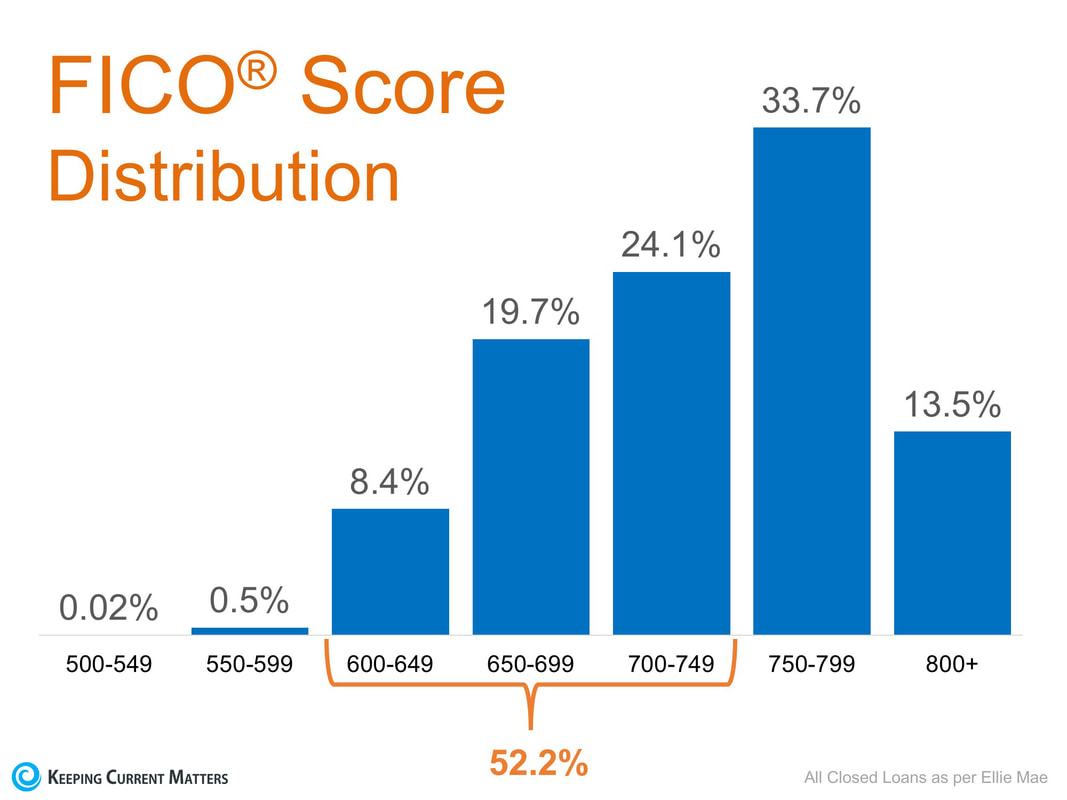

COME SEE THIS GORGEOUS MOVE IN READY HOME SET IN THE HEART OF WINDSOR CENTER. THIS IS THE ONE! UPDATED AND SUN FILLED, THE HOME BOASTS SOARING CEILINGS, REFINISHED HARDWOOD FLOORS, CROWN MOLDING, FIREPLACE, NEW WINDOWS, AND GENEROUS SIZED ROOMS. View full property info here:http://6remingtonroad.thebestlisting.com/ #UnderContract #Windsor #SimardRealtyGroup #JoinExpRealty The results of countless studies have shown that potential home buyers, and even current homeowners, have an inflated view of what is really required to qualify for a mortgage in today’s market. One such study by the Wharton School of Business at the University of Pennsylvania revealed that many millennials have not yet considered purchasing homes simply because they don’t believe they can qualify for a mortgage. A recent article about millennials by Realtor.com explained that: “About 72% of aspiring millennial buyers said they’re waiting because they can’t afford to buy…” The article also explained that 29% of millennials believe their credit scores are too low to buy. The problem here is the fact that they think they will be denied a mortgage is keeping them from even attempting to apply. Ellie Mae’s Vice President Jonas Moe encouraged buyers to know their options before assuming that they won’t qualify for a mortgage: “Many potential home buyers are ‘disqualifying’ themselves. You don’t need a 750 FICO® Score and a 20% down payment to buy.” So, what credit score is necessary? Below is a breakdown of the FICO® Score distribution of all closed (approved) loans in July from Ellie Mae’s latest Origination Report. Over 52% of all approved loans had a FICO® Score under 750. Many potential home buyers believe that they need a score over 780 to qualify.

Bottom LineIf owning a home of your own has always been your dream and you are ready and willing to buy, or if you are a homeowner who wants to move up, find out if you are able to! Meet with a local real estate professional who can help you determine if your dreams can become a reality sooner than you thought! SOURCE KCM #Buyers #Loan #SimardRealtyGroup #ExpRealty Some Highlights:

SOURCE KCM #ForSellers #ForBuyers #Pricing #SimardRealtyGroup #ExpRealty One of the main reasons why For Sale By Owners (FSBOs) don’t use a real estate agent is because they believe they will save the commission an agent charges for getting their house on the market and selling it. A new study by Collateral Analytics, however, reveals that FSBOs don’t actually save anything, and in some cases may be costing themselves more, by not listing with an agent.

In the study, they analyzed home sales in a variety of markets in 2016 and the first half of 2017. The data showed that: “FSBOs tend to sell for lower prices than comparable home sales, and in many casesbelow the average differential represented by the prevailing commission rate.”(emphasis added) Why would FSBOs net less money than if they used an agent? The study makes several suggestions:

Three conclusions from the study:

Bottom Line If you are thinking of selling, FSBOing may end up costing you money instead of saving you money. SOURCE KCM #FSBO #ForSellers #RealEstateAdvice #SimardRealtyGroup #ExpRealty Does your current house fit your needs? Does it seem like everyone else is moving up and moving on to more luxurious surroundings? Are you wondering what it would take to start living your dream life? Market conditions around the country have presented an opportunity like no other for those who are looking to make the jump to a premium or luxury home. The National Association of Realtors reports that national inventory levels are now at a 4.3-month supply. A normal market, where prices appreciate with inflation, has 6-7-months inventory. The national market has echoed the conditions felt in the starter and trade-up markets as inventory has declined year-over-year for 25 consecutive months. The chart below shows the relationship between the inventory of homes for sale and prices According to Trulia’s latest Inventory Report, the inventory of homes for sale in the two lower priced markets has dropped by double digit percentages over the last 12 months (16% for starter and 13% for trade-up homes). While the inventory of homes in the premium home category has dropped by only 4%.

This has created a seller’s market in the lower-priced markets, as 54% of homes were on the market for less than a month in the last Realtors Confidence Index, and a buyer’s market in the luxury market, where homes were on the market for an average of 160 days according to the Institute for Luxury Home Marketing. Bottom Line If you are even thinking of listing your home and moving up to a luxury home, now is the time to meet with a local real estate professional to evaluate your ability to do so. Homeowners across the country are upgrading their homes, why can’t you? Your dream home is waiting! SOURCE KCM #ForBuyers #ForSellers #SimardRealtyGroup #JoinExpRealty We previously informed you about a study conducted by TransUnion titled, “The Bubble, the Burst and Now – What Happened to the Consumer?” The study revealed that 1.5 million homeowners who were negatively impacted by the housing crisis could re-enter the housing market between 2016-2019. Recently, HousingWire analyzed data from the US Bankruptcy Courts and revealed that 6 million Americans will have their bankruptcies disappear off their credit reports over the next five years and that this could “possibly send a flood of more homebuyers into the housing market.” The chart below shows the total number of bankruptcies filed by year in the US over the last 10 years. The light blue bars represent over 3.3 million people who have already waited the 7 years necessary for their reports to no longer include their bankruptcies. How would this “send a flood of more homebuyers into the housing market”?As the article mentioned, in 2010 the number of chapter 7 bankruptcies increased to nearly 1.14 million. Now, 7 years later, they will begin to fade from credit histories, enabling prospective buyers to become homeowners again once their credit scores improve.

As we can see from both reports, the homeownership rate has the opportunity to increase drastically over the next few years with all of these boomerang buyers returning to the market. Bottom Line If your family was negatively impacted by the housing bust, here is the light at the end of the tunnel! You may be able to purchase your dream home faster than you think! SOURCE KCM #ForBuyers #HousingMarketUpdates #SimardRealtyGroup #JoinExpRealty Looking to take your Real Estate career to the next level? Eclipse your past production with a career at eXp Realty.

Service the client better, make more, keep more, build residual income, stock options, and top notch support. Let's talk. |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed