|

Experts agree the housing market is set to bloom this spring. Let's connect to make sure you're ready to buy or sell this season.

#TopGranbyRealtor #StephenSimard #RealBrokerLLC #GranbyRealEstate #GranbyConnecticut #FindyourGranbyhome #Newhomesforsale #SimardRealtyGroup #Granbyhomesforsale #JoinRealBrokerLLC #Simsburyhomes

0 Comments

Since the birth of our nation, homeownership has always been considered a major piece of the American Dream. As Frederick Peters reports in Forbes:

“The idea of a place of one’s own drives the American story. We became a nation out of a desire to slip the bonds of Europe, which was still in many respects a collection of feudal societies. Old rich families, or the church, owned all the land and, with few exceptions, everyone else was a tenant. The magic of America lay not only in its sense of opportunity, but also in the belief that life could in every way be shaped by the individual. People traveled here not just for religious freedom, but because in America anything seemed possible.” Additionally, a research paper released just prior to the shelter-in-place orders issued last year concludes: “Homeownership is undeniably the cornerstone of the American Dream, and is inseparable from our national ethos that, through hard work, every American should have opportunities for prosperity and success. It is the stability and wealth creation that homeownership provides that represents the primary mechanism through which many American families are able to achieve upward socioeconomic mobility and greater opportunities for their children.” Has the past year changed the American view on homeownership? Definitely not. A survey of prospective homebuyers released by realtor.com last week reveals that becoming a homeowner is still the main reason this year’s first-time homebuyers want to purchase a home. When asked why they want to buy, three of the top four responses center on the financial benefits of owning a home. The top four reasons for buying are:

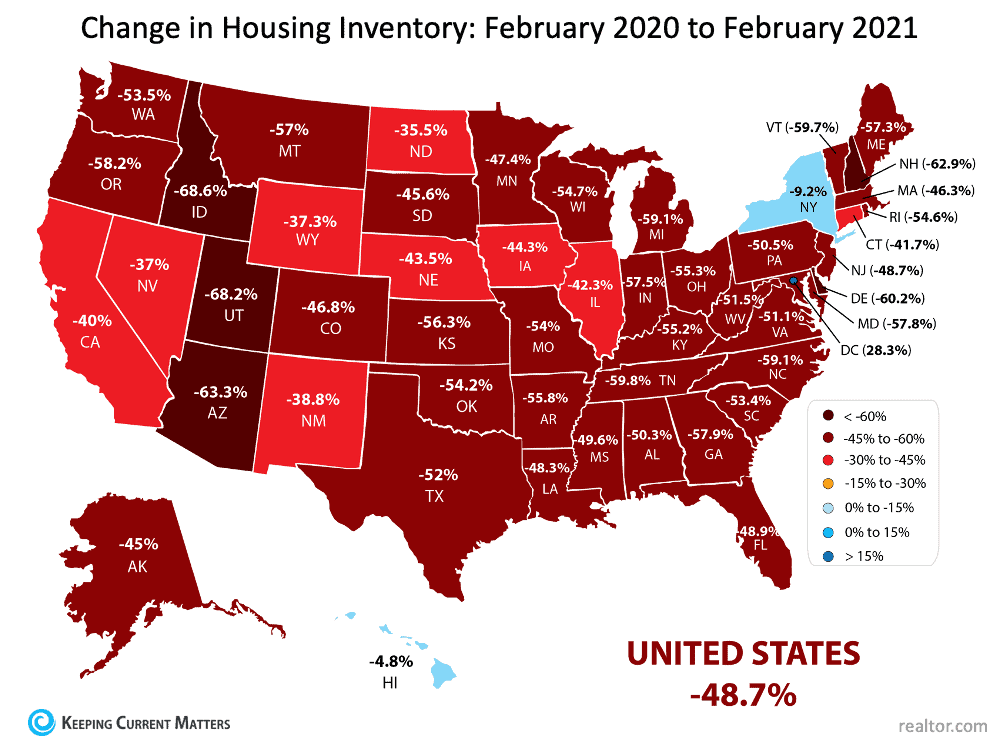

Millennials believe most strongly in homeownership. The survey also reports that 62% of millennials say a desire to be a homeowner is the main reason they’re buying a home. This contradicts the thinking of some experts who had believed millennials were going to be the first “renter generation” in our nation’s history. While reporting on the survey, George Ratiu, Senior Economist at realtor.com, said: “Americans, even millennials who many thought would never buy, have a strong preference for homeownership for the same reasons many generations before them have — to invest in a place of their own and in their communities, and to build a solid financial foundation for themselves and their families.” Odeta Kushi, Deputy Chief Economist for First American, also addresses millennial homeownership: “Millennials have delayed marriage and having children in favor of investing in education, pushing marriage and family formation to their early-to-mid thirties, compared with previous generations, who primarily made these lifestyle choices in their twenties…Delayed lifestyle choices delay the desire for homeownership.” Kushi goes on to explain: “As more millennials get married and form families, millennials remain poised to transform the housing market. In fact, the housing market is already experiencing the earliest gusts of the tailwind.” Bottom Line As it always has been and very likely always will be, homeownership continues to be a major component in every generation’s pursuit of the American Dream. SOURCE KCM #BuyingMyths #Millennials #Demographics #SimardRealtyGroup With housing inventory at a historic low, there has never been a better time to sell your house. Eager homebuyers are on the hunt for a house like yours, so DM me about getting ready to sell this spring.

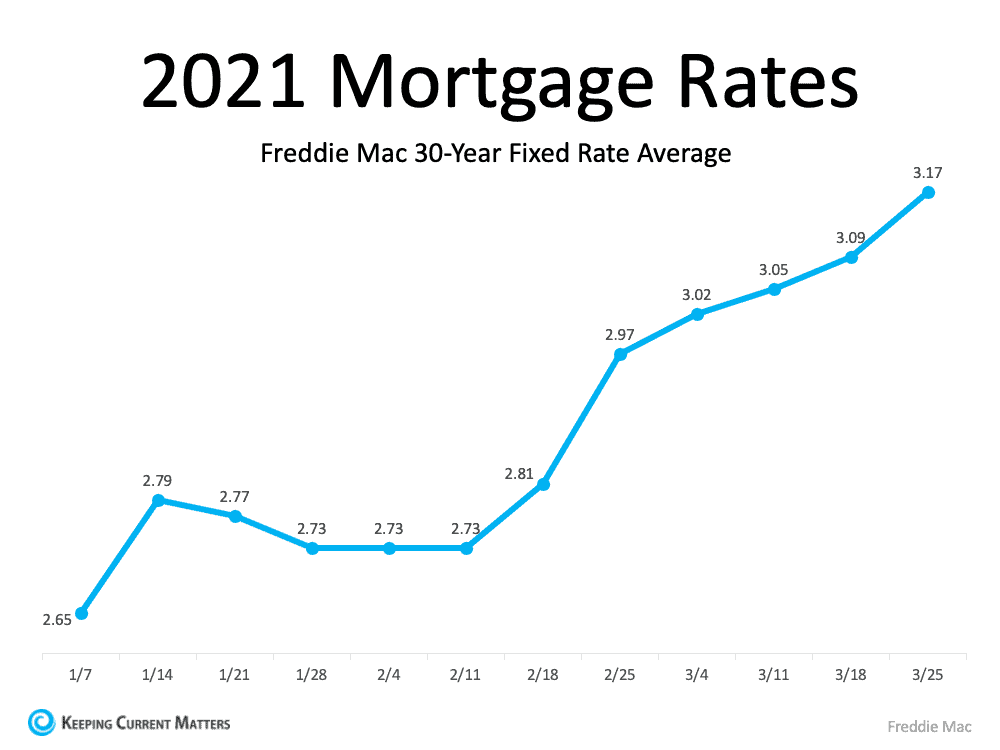

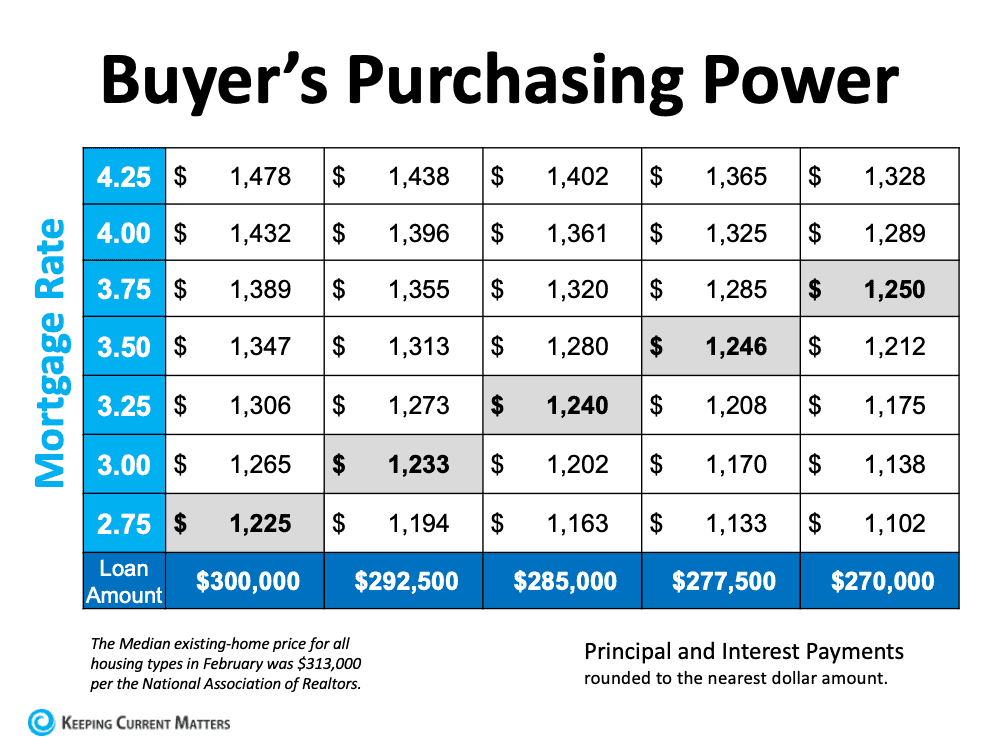

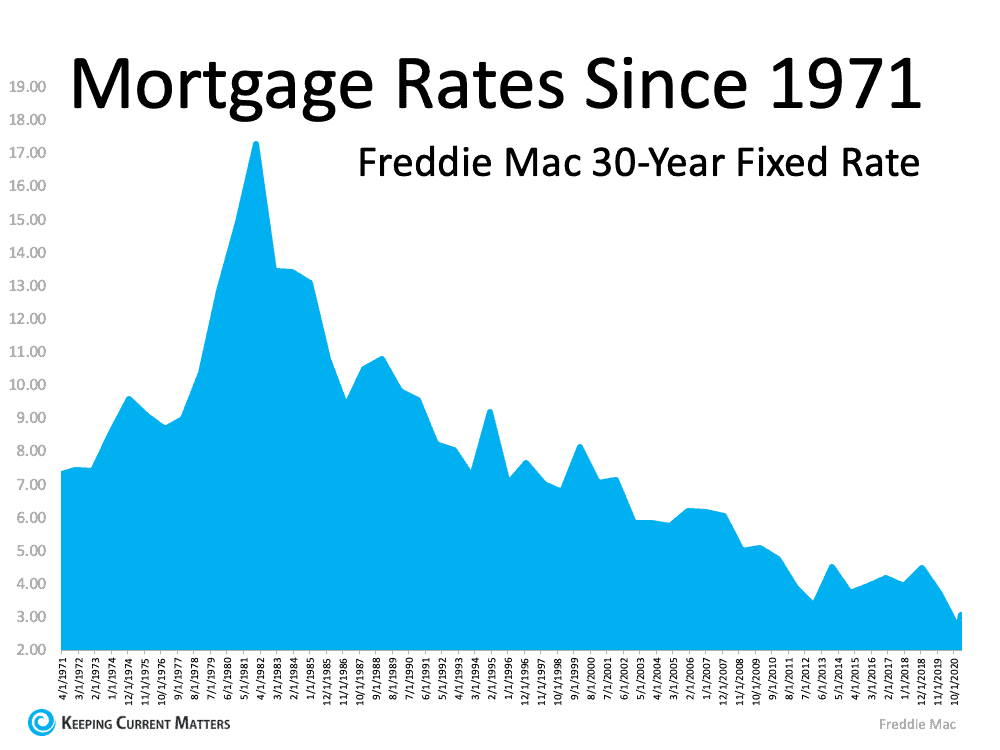

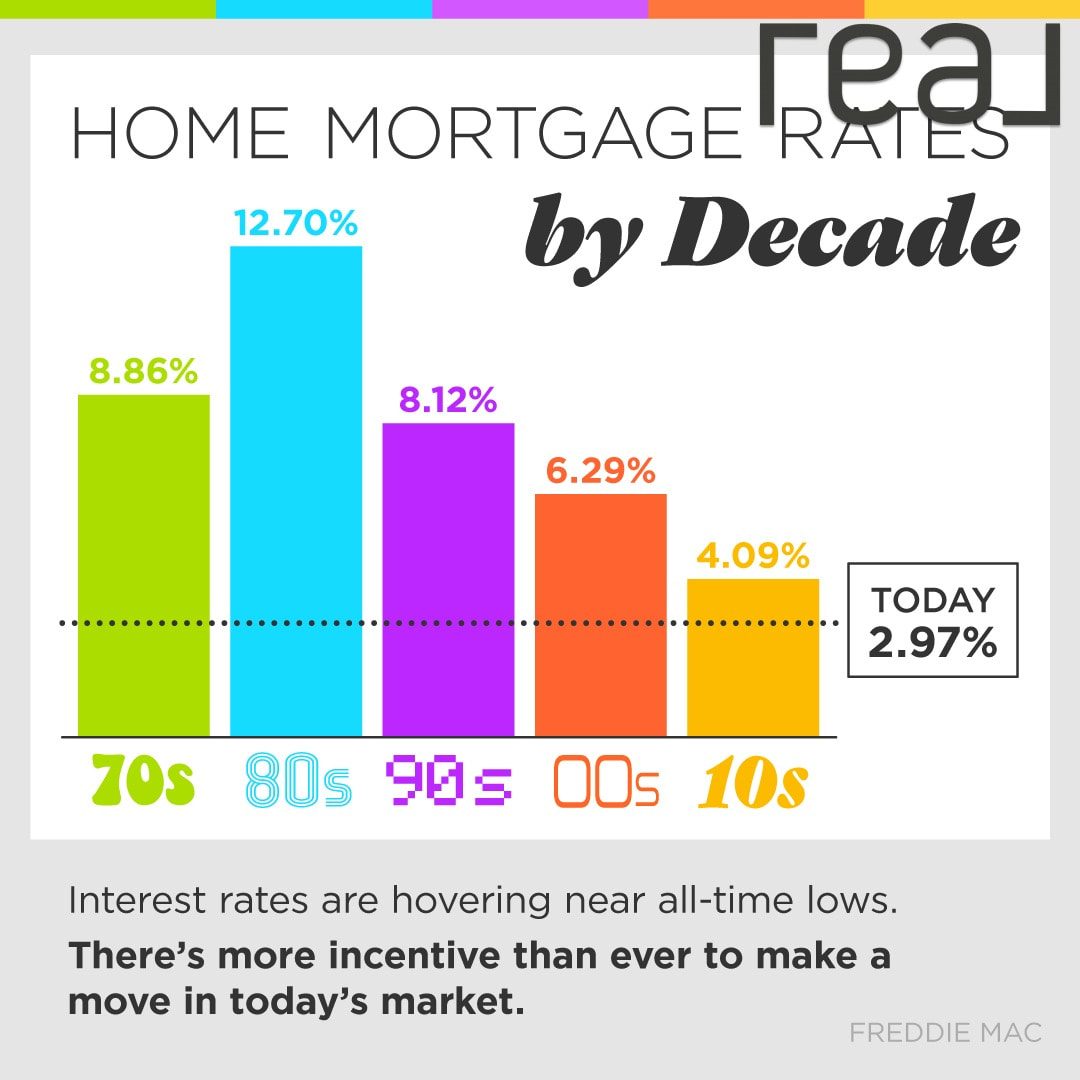

#housinginventory #sellyourhouse #homeinventory #moveuphome #dreamhome #realestate #homeownership #realestategoals #realestatetips #realestatelife #realestatenews #realestatetipsandadvice #justsold #keepingcurrentmatters Mortgage rates are on the rise this year, but they’re still incredibly low compared to the historic average. However, anytime there’s a change in the mortgage rate, it affects what you can afford to borrow when you’re buying a home. As Sam Khater, Chief Economist at Freddie Mac, shares: “Since January, mortgage rates have increased half a percentage point from historic lows and home prices have risen, leaving potential homebuyers with less purchasing power.” (See graph below): When buying a home, it’s important to determine a monthly budget so you can plan for and understand what you can afford. However, when you need to stick to your budget, even a small increase in the mortgage rate can make a big difference. According to the National Association of Realtors (NAR), today, the median existing-home price is $313,000. Using $300,000 as a simple number close to the median price, here’s an example of how a change in mortgage rate impacts your monthly principal and interest payments on a home. If, for example, you’re getting ready to buy a home and know your budget allows for a monthly payment of $1200-1250 (marked in gray on the table above), every time the mortgage rate increases, the loan amount has to decrease to keep your monthly cost in range. This means you may have to look for lower-priced homes as mortgage rates go up if you want to be able to maintain your budget.

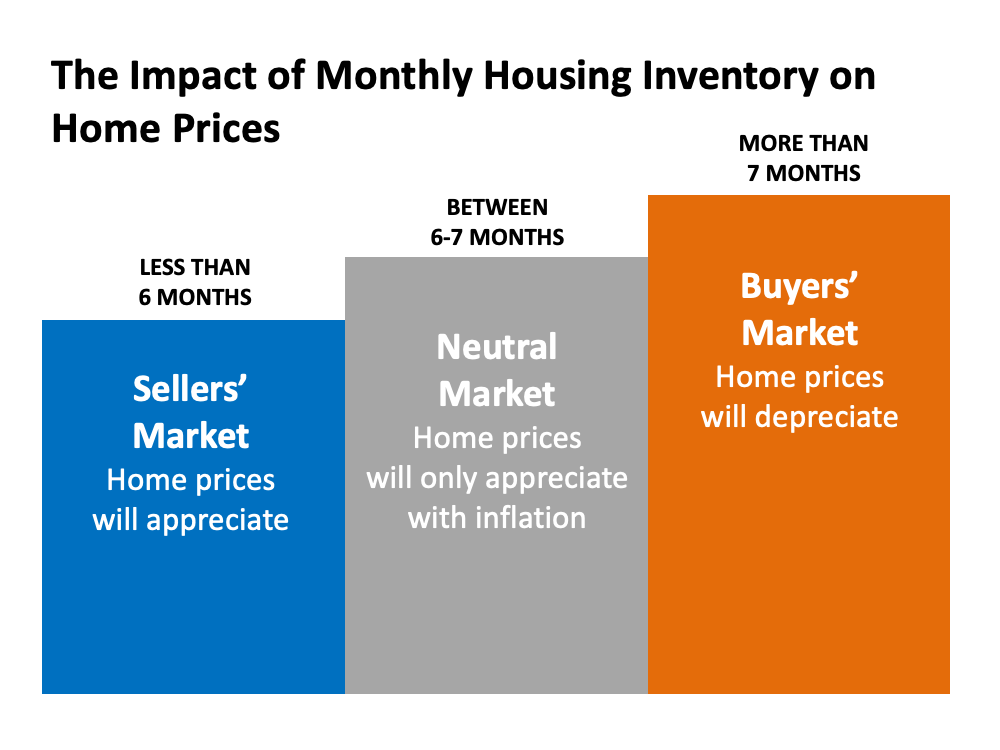

In essence, it’s ideal to close on a home loan when mortgage rates are low, so you can afford to borrow more money. This gives you more purchasing power when you buy a home. Mark Fleming, Chief Economist at First American, explains: “Monthly payments have remained manageable despite soaring home prices because of low mortgage rates. In fact, monthly payments remain below the $1,250 to $1,260 range that we saw in both fall 2018 and spring 2019, but they are on track to hit that level this spring. Although they remain low, mortgage rates have begun to increase and are expected to rise further later in the year, thus affordability will test buyer demand in the months ahead and likely help slow the pace of price growth.” Today’s mortgage rates are still very low, but experts project they’ll continue to rise modestly this year. As a result, every moment counts for homebuyers who want to secure the lowest mortgage rate they can in order to be able to afford the home of their dreams. Bottom Line Thanks to low mortgage rates, the spring housing market’s in bloom for buyers – but these favorable conditions may not last for long. Contact your local real estate professional today to start the homebuying process while your purchasing power is still holding strong. SOURCE KCM #Pricing #InterestRates #ForBuyers #SimardRealtyGroup #RealBrokerLLC If you’ve given even a casual thought to selling your house in the near future, this is the time to really think seriously about making a move. Here’s why this season is the ultimate sellers’ market and the optimal time to make sure your house is available for buyers who are looking for homes to purchase. The latest Existing Home Sales Report from The National Association of Realtors (NAR) shows the inventory of houses for sale is still astonishingly low, sitting at just a 2-month supply at the current sales pace. Historically, a 6-month supply is necessary for a ‘normal’ or ‘neutral’ market in which there are enough homes available for active buyers (See graph below): When the supply of houses for sale is as low as it is right now, it’s much harder for buyers to find homes to purchase. As a result, competition among purchasers rises and more bidding wars take place, making it essential for buyers to submit very attractive offers.

As this happens, home prices rise and sellers are in the best position to negotiate deals that meet their ideal terms. If you put your house on the market while so few homes are available to buy, it will likely get a lot of attention from hopeful buyers. Today, there are many buyers who are ready, willing, and able to purchase a home. Low mortgage rates and a year filled with unique changes have prompted buyers to think differently about where they live – and they’re taking action. The supply of homes for sale is not keeping up with this high demand, making now the optimal time to sell your house. Bottom Line Home prices are appreciating in today’s sellers’ market. Making your home available over the coming weeks will give you the most exposure to buyers who will actively compete against each other to purchase it. SOURCE KCM #SellersMarket #Pricing #SellersMarket #SimardRealtyGroup A #realestateagent is a lifelong asset in some of the biggest financial and life decisions you’ll make. They’re a trusted advisor who uses their knowledge and expertise about the housing market to give you confidence and power in the decisions you make. DM me so I can help you achieve your real estate goals this spring.

#expertanswers #powerfuldecisions #confidentdecisions #realestate #homeownership #homebuying #realestatelife #realestatenews #realestateagency #realestateadvice #realestateexperts #instarealestate #realestatetipsandadvice #keepingcurrentmatters Some Highlights

SOURCE KCM #BuyingMyths #ForSellers #Pricing #SimardRealtyGroup #joinRealBrokerLLC Right now, the housing market is full of outstanding opportunities for both buyers and sellers. Whether you’re thinking of buying your first home, moving up to a bigger one, or selling so you can downsize this spring, there are perks today that are powering big moves for people across the country. Here are the top two to keep on the radar this season. The Biggest Perk for Buyers: Low Mortgage Rates Today’s most compelling buyer incentive is low mortgage interest rates. The 30-year fixed-rate is now averaging just over 3%. While that’s slightly higher than the record-lows from 2020 and earlier this year, it’s still way lower than historic norms, making purchasing a home an ongoing perk for hopeful buyers (See graph below): This is a huge advantage for buyers and helps to make owning a home attainable for more households – and there’s good reason to strive for homeownership. The latest Homeowner Equity Report from CoreLogic shows how homeowners saw major gains in their net worth last year, all thanks to owning a home. Frank Martell, President and CEO of CoreLogic, explains: “Positive factors like record-low interest rates and a booming housing market encouraged many families to enter homeownership. This growing bank of personal wealth that homeownership affords was noticed by many but in particular for first-time buyers who want a piece of the cake. As a result, we may see more of those currently renting start to enter the market in the near future.” Low mortgage rates are a plus for buyers right now, but experts forecast we’ll see them continue to rise as the year goes on. If you’re ready to purchase a home, it’s wise to get started on the process soon so you can secure today’s comparatively low rate. The Biggest Perk for Sellers: Low Inventory Today, there are simply not enough houses on the market for the number of buyers looking to purchase them, and it’s creating a serious sellers’ market. According to Danielle Hale, Chief Economist at realtor.com: The lack of houses for sale continues to challenge the market, and with low mortgage rates fueling buyer demand, homes are hard for buyers to find today. According to the latest Realtors Confidence Index Survey by the National Association of Realtors (NAR), the average house is now receiving 4.1 offers and is on the market for only 20 days.

Buyers are clearly eager to purchase, and because of the shortage of inventory available, they’re often entering bidding wars. This is one of the factors keeping home prices strong and giving sellers leverage in the negotiation process. Homeowners who are in a position to sell shouldn’t wait to make their move. There’s a light at the end of the tunnel for today’s inventory shortage, so listing this spring will get your house on the market when conditions are most favorable. With low inventory and high buyer demand, homeowners can potentially earn a greater profit on their houses and sell them quickly in the fast-paced spring market. Bottom Line Whether you’re thinking about buying or selling a home, there are major perks available in today’s housing market. Contact a trusted real estate professional today to discuss how these favorable conditions play to your advantage in your local area. SOURCE KCM #ForBuyers #InterestRates #HousingMarketUpdate #SimardRealtyGroup Today’s mortgage interest rates are hovering near all-time lows. If you’re thinking about buying a home, this is the perfect time to lock in a low rate that will give you a bigger budget to find your dream home. DM me to start the homebuying process today.

#mortgagerates #homeaffordability #expertanswers #purchasingpower #buyingpower #realestate #homebuying #realestategoals #realestatenews #realestateagency #realestateadvice #instarealestate #realestatetipsandadvice #keepingcurrentmatters For generations, the homebuying process never really changed. The seller would try to estimate the market value of the home and tack on a little extra to give themselves some negotiating room. That figure would become the listing price of the house. Buyers would then try to determine how much less than the full price they could offer and still get the home. The asking price was generally the ceiling of the negotiation. The actual sales price would almost always be somewhat lower than the list price. It was unthinkable to pay more than what the seller was asking.

Today is different. The record-low supply of homes for sale coupled with very strong buyer demand is leading to a rise in bidding wars on many homes. Because of this, homes today often sell for more than the list price. In some cases, they sell for a lot more. According to the Home Buyers and Sellers Generational Trends report just released by the National Association of Realtors (NAR), 45% of buyers paid full price or more. You may need to change the way you look at the asking price of a home. In this market, you likely can’t shop for a home with the old-school mentality of refusing to pay full price or more for a house. Because of the shortage of inventory of houses for sale, many homes are actually being offered in an auction-like atmosphere in which the highest bidder wins the home. In an actual auction, the seller of an item agrees to take the highest bid, and many sellers set a reserve price on the item they’re selling. A reserve price is the minimum amount a seller will accept as the winning bid. When navigating a competitive housing market, think of the list price of the house as the reserve price at an auction. It’s the minimum the seller will accept in many cases. Today, the asking price is often becoming the floor of the negotiation rather than the ceiling. Therefore, if you really love a home, know that it may ultimately sell for more than the sellers are asking. So, as you’re navigating the homebuying process, make sure you know your budget, know what you can afford, and work with a trusted advisor who can help you make all the right moves as you buy a home. Bottom Line Someone who’s more familiar with the housing market of the past than that of today may think offering more for a home than the listing price is foolish. However, frequent and competitive bidding wars are creating an auction-like atmosphere in many real estate transactions. For the best advice on how to make a competitive offer on a home, reach out to a local real estate professional who’s an expert in your local market. SOURCE KCM #BuyingMyths #HousingMarket #Pricing #SimardRealtyGroup #RealBrokerLLC |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed