|

Are you planning to buy a home? If so, you’re probably working on saving for your down payment. You should know there are options out there that can help. To understand what’s available so you can start finding tools and resources for your purchase, DM me.

#downpayments #firsttimehomebuyer #moveupbuyer #opportunity #housingmarket #househunting #newlisting #homeforsale #starterhome #dreamhome #keepingcurrentmatters

0 Comments

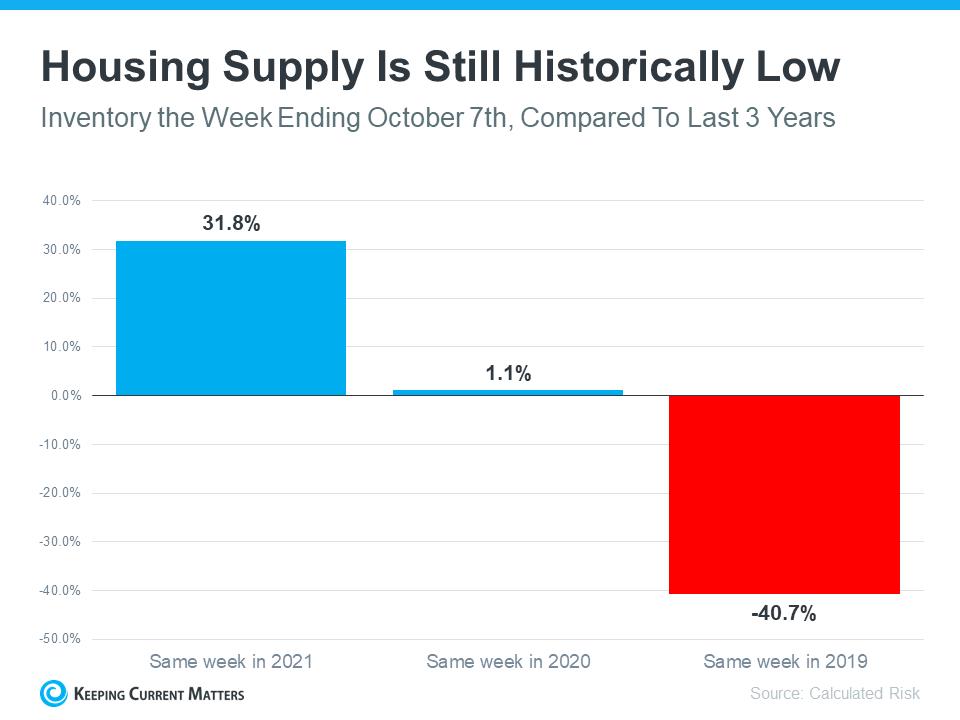

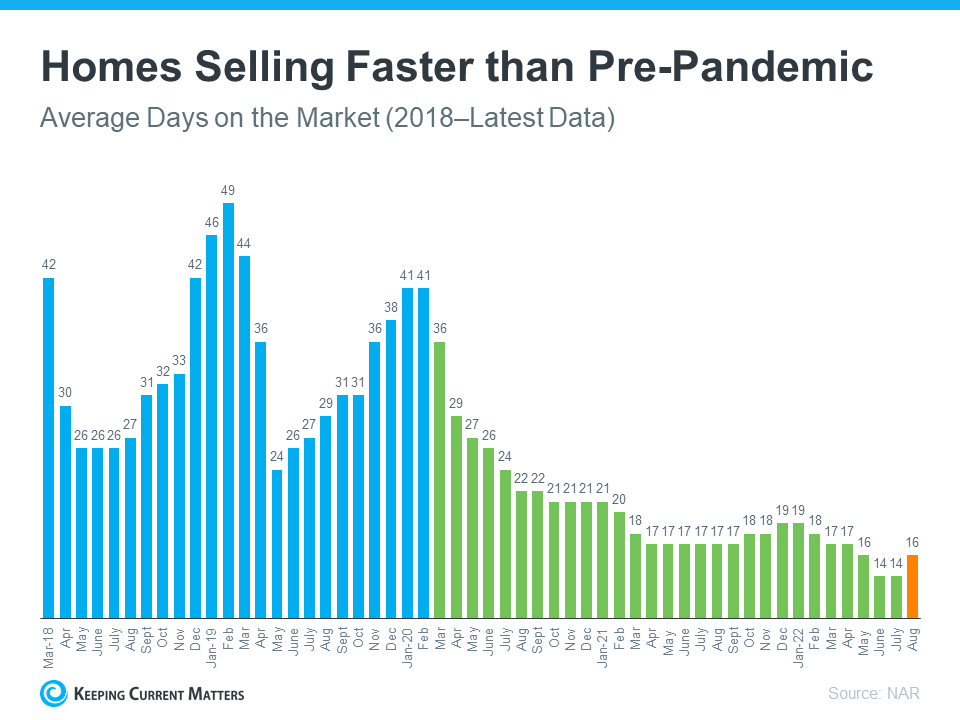

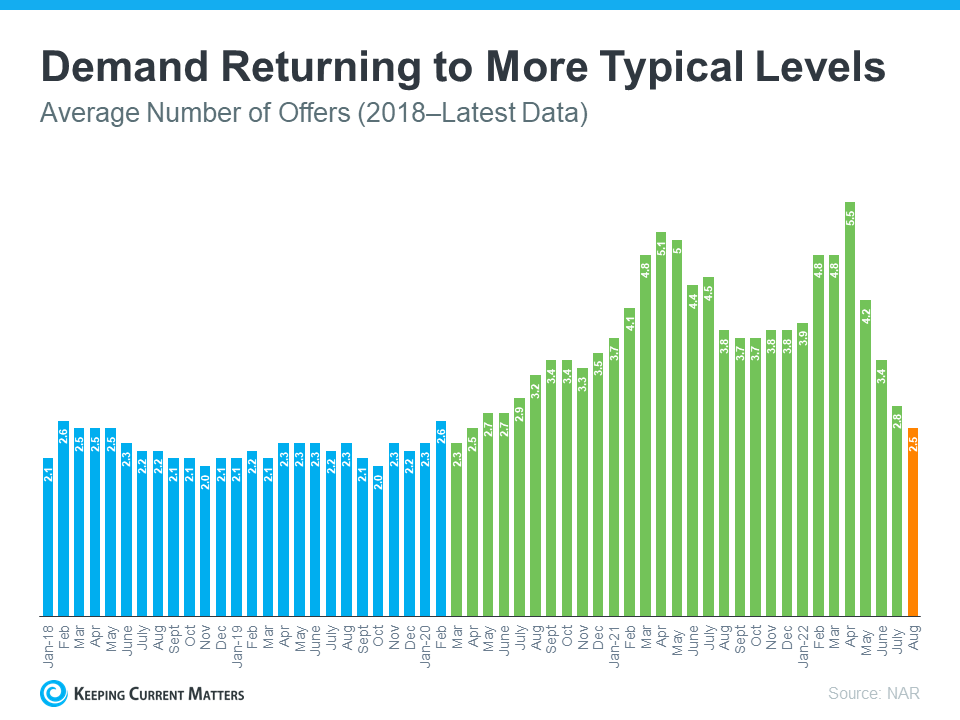

Does the latest news about the housing market have you questioning your plans to sell your house? If so, perspective is key. Here are some of the ways a trusted real estate professional can explain the shift that’s happening today and why it’s still a sellers’ market even during the cooldown. Fewer Homes for Sale than Pre-Pandemic While the supply of homes available for sale has increased this year compared to last, we’re still nowhere near what’s considered a balanced market. A recent article from Calculated Risk helps put this year’s increased inventory into context (see graph below): It shows supply this year has surpassed 2021 levels by over 30%. But the further back you look, the more you’ll understand the big picture. Compared to 2020, we’re just barely above the level of inventory we saw then. And if you go all the way back to 2019, the last normal year in real estate, we’re roughly 40% below the housing supply we had at that time. Why does this matter to you? When inventory is low, there is still demand for your house because there just aren’t enough homes available for sale. Homes Are Still Selling Faster Than More Normal Years And while homes aren’t selling as quickly as they did a few months ago, the average number of days on the market is still well below pre-pandemic norms – in large part because inventory is so low. The graph below uses data from the Realtors’ Confidence Index by the National Association of Realtors (NAR) to illustrate this trend: As the graph shows, the pre-pandemic numbers (shown in blue) are higher than the numbers we saw during the pandemic (shown in green). That’s because the average days on the market started to decrease as homes sold at record pace during the pandemic. Most recently, due to the cooldown in the housing market, the average days on the market have started to tick back up slightly (shown in orange) but are still far below the pre-pandemic norm. What does this mean for you? While it may not be as fast as it was a couple of months ago, homes are still selling much faster than they did in more normal, pre-pandemic years. And if you price it right, your home could still go under contract quickly. Buyer Demand Has Moderated and Is Now in Line with More Typical Years Buyer demand has softened this year in response to rising mortgage rates. But again, perspective is key. Getting 3-5 offers like sellers did during the pandemic isn’t the norm. The graph below uses data from NAR going back to 2018 to help tell the story of this shift over time (see graph below): Prior to the pandemic, it was typical for homes sold to see roughly 2-2.5 offers (shown in blue). As the market heated up during the pandemic, the average number of offers skyrocketed as record-low mortgage rates drove up demand (shown in green). But most recently, the number of offers on homes sold today (shown in orange) has started to return to pre-pandemic levels as the market cools from the frenzy.

What’s the takeaway for you? Buyer demand has moderated from the pandemic peak, but it hasn’t disappeared. The buyers are still out there, and if you price your house at current market value, you’ll still be able sell your house today. Bottom Line If you have questions about selling your house in today’s housing market, talk to a trusted real estate professional. An agent can help provide context around what’s happening now, so you’re up to date on what you can expect when you’re ready to move. SOURCE KCM #ForSellers #HousingMarketUpdates #Move-UpBuyers #Pricing $SellingMyths #RealBrokerLLC #StephenSimardRealtor The supply of homes for sale has been historically low over the past two years. But the growth we’ve seen this year means you may have more options to choose from compared to this time last year. DM me today if you’re ready to resume your housing search and explore the homes for sale in our area.

#newlistings #firsttimehomebuyer #opportunity #housingmarket #househunting #makememove #homegoals #houseshopping #housegoals #homeforsale #starterhome #dreamhome #keepingcurrentmatters If you’re looking to buy a home, you probably want to secure the lowest interest rate possible for your home loan. Over the last couple of years, that was easier to do as the housing market saw record-low mortgage rates, but this year rates have risen dramatically.

If you’re looking for ways to combat today’s higher rates and lock in the lowest one you can, here are a few factors to focus on. Since approval opportunities can vary, connect with a trusted lender for customized advice. Your Credit Score Credit scores can play a big role in your mortgage rate. Freddie Mac explains: “When you build and maintain strong credit, mortgage lenders have greater confidence when qualifying you for a mortgage because they see that you’ve paid back your loans as agreed and used your credit wisely. Strong credit also means your lender is more apt to approve you for a mortgage that has more favorable terms and a lower interest rate.” That’s why it’s important to maintain a good credit score. If you want to focus on improving your score, your trusted advisor can give you expert advice to help. Your Loan Type There are many types of loans, each offering different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says: “There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose.” When working with your real estate advisor, make sure you find out what’s available in your area and which types of loans you may qualify for. Your Loan Term Another factor to consider is the term of your loan. Just like with location and loan types, you have options. Freddie Mac says: “When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.” Depending on your situation, the length of your loan can also change your mortgage rate. Your Down Payment If you’re a current homeowner looking to sell and make a move, you can use the home equity you’ve built over time toward the down payment on your next home. The CFPB explains: “In general, a larger down payment means a lower interest rate, because lenders see a lower level of risk when you have more stake in the property. So if you can comfortably put 20 percent or more down, do it--you’ll usually get a lower interest rate.” To learn more, connect with a lender to find out the difference a higher down payment can make for your new mortgage. Bottom Line These are just few factors that can help determine your mortgage rate if you’re buying a home. The best thing you can do is have a team of professionals on your side. Connect with a local real estate professional and a trusted lender so you have the expert advice you need in each step of the process. SOURCE KCM #DownPayments #FirstTimeHomeBuyers #ForBuyers #InterestRates #Move-UpBuyers #RealBrokerLLC #StephenSimardRealtor While the inventory of homes for sale has increased compared to last year, it remains low. If you're still not finding a home that checks all your boxes, experts recommend expanding your search radius and looking at nearby locations to increase your pool of options. For more advice during your homebuying journey, DM me today.

#locationlocationlocation #firsttimehomebuyer #housingmarket #househunting #homegoals #houseshopping #housegoals #newlisting #starterhome #dreamhome #keepingcurrentmatters The housing market is rapidly changing from the peak frenzy it saw over the past two years. That means you probably have questions about what your best move is if you’re thinking of buying or selling this fall.

To help you make a confident decision, lean on the professionals for insights. Here are a few things experts are saying about the fall housing market. Expert Quotes for Fall Homebuyers A recent article from realtor.com: “This fall, a more moderate pace of home selling, more listings to choose from, and softening price growth will provide some breathing room for buyers searching for a home during what is typically the best time to buy a home.” Michael Lane, VP and General Manager, ShowingTime: “Buyers will continue to see less competition for homes and have more time to tour homes they like and consider their options.” Expert Quotes for Fall Sellers Selma Hepp, Interim Lead of the Office of the Chief Economist, CoreLogic: “. . . record equity continues to provide fuel for housing demand, particularly if households are relocating to more affordable areas.” Danielle Hale, Chief Economist, realtor.com: “For homeowners deciding whether to make a move this year, remember that listing prices – while lower than a few months ago – remain higher than in prior years, so you’re still likely to find opportunities to cash-in on record-high levels of equity, particularly if you’ve owned your home for a longer period of time.” Bottom Line Mortgage rates, home prices, and the supply of homes for sale are top of mind for buyers and sellers today. And if you want the latest information for your area, partner with a local real estate professional. SOURCE KCM #ForBuyers #ForSellers #HousingMarketUpdates #InterestRates #Pricing #RealBrokerLLC #StephenSimardRealtor If you’re a homeowner considering selling but aren’t sure if now is the right time, there’s good news. The latest survey of sellers in August found that 92% said they were pleased with the outcome of their home sale. If you’re thinking about selling your house, DM me to start the conversation today.

#sellyourhouse #moveuphome #realestate #homeownership #realestategoals #instarealtor #realestatetipsoftheday #realestatetipsandadvice #justsold #realestatemarket #realestateexperts #keepingcurrentmatters As you set out to buy a home, saving for a down payment is likely top of mind. But you may still have questions about the process, including how much to save and where to start.

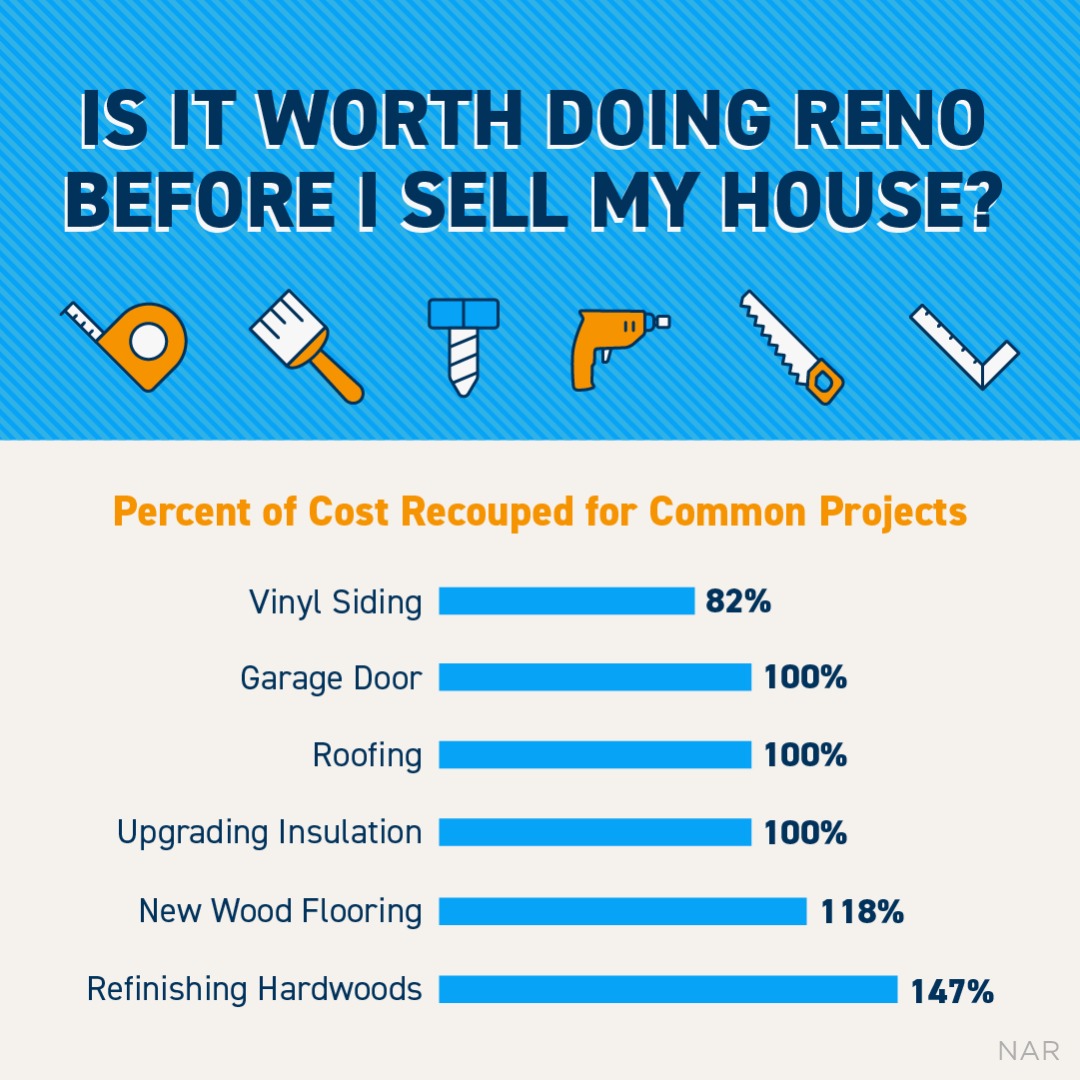

If that sounds like you, your down payment could be more in reach than you originally thought. Here’s why. The 20% Down Payment Myth If you believe you have to put 20% down on a home, you may have based your goal on a common misconception. Freddie Mac explains: “. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.” Unless it’s specified by your loan type or lender, it’s typically not required to put 20% down. According to the latest Profile of Home Buyers and Sellers from the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. There are even loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. This is good news for you because it means you could be closer to your homebuying dream than you realize. For more information, turn to a trusted lender. Down Payment Assistance Programs Can Be a Game Changer A professional will be able to show you other options that could help you get closer to your down payment goal. According to latest Homeownership Program Index from downpaymentresource.com, there are over 2,000 homebuyer assistance programs in the U.S., and the majority are intended to help with down payments. A recent article explains why programs like these are helpful: “These resources can immediately build your home buying power and help you take action sooner than you thought possible.” And if you’re wondering if you have to be a first-time buyer to qualify for these programs, that’s not always the case. According to an article from downpaymentresource.com: “It is a common misconception that homebuyer assistance is only available to first-time homebuyers, however, 38% of homebuyer assistance programs in Q1 2022 did not have a first-time homebuyer requirement.” There are also location and profession-based programs you could qualify for as well. Bottom Line Saving for your down payment is an important first step on your homebuying journey. Let’s connect today and make sure you have a trusted lender to help explore your options. SOURCE KCM #BuyingMyths #DownPayments #FirstTimeHomeBuyers #ForBuyers #Move-UpBuyers #StephenSimardRealtor #RealBrokerLLC #StephenSimardRealtor If you’re planning to sell, you want to make sure your house is attractive to the most buyers. But do you know where to focus your time and your money? A local real estate professional knows which updates are mission-critical, and which you can leave for the new homeowners. For expert advice on getting your house list-ready, DM me today.

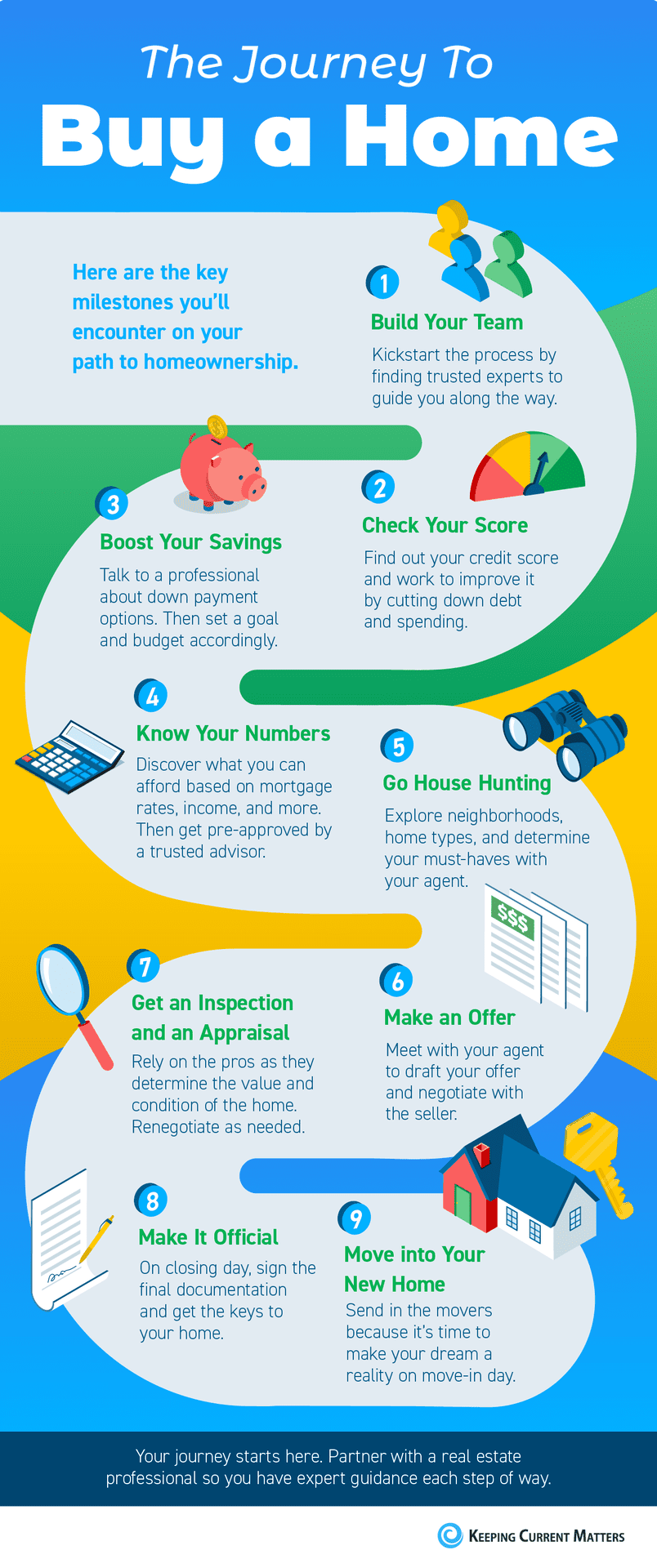

#sellyourhouse #moveuphome #dreamhome #realestate #homeownership #realestategoals #realestatetips #realestatelife #realestatenews #realestateagent #realestateexpert #realestatetipsandadvice #justsold #keepingcurrentmatters Some Highlights

#Buyers #FirstTimeHomeBuyers #Infographics #HomeBuying #StephenSimardRealtor #joinRealBrokerLLC |

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed